How WeWork's Adam Neumann failed up

The last 80 days have seen an implosion unlike any other in the history of startups. As the scope of the WeWork disaster comes into focus, the question on everyone's mind is how its founder and chief

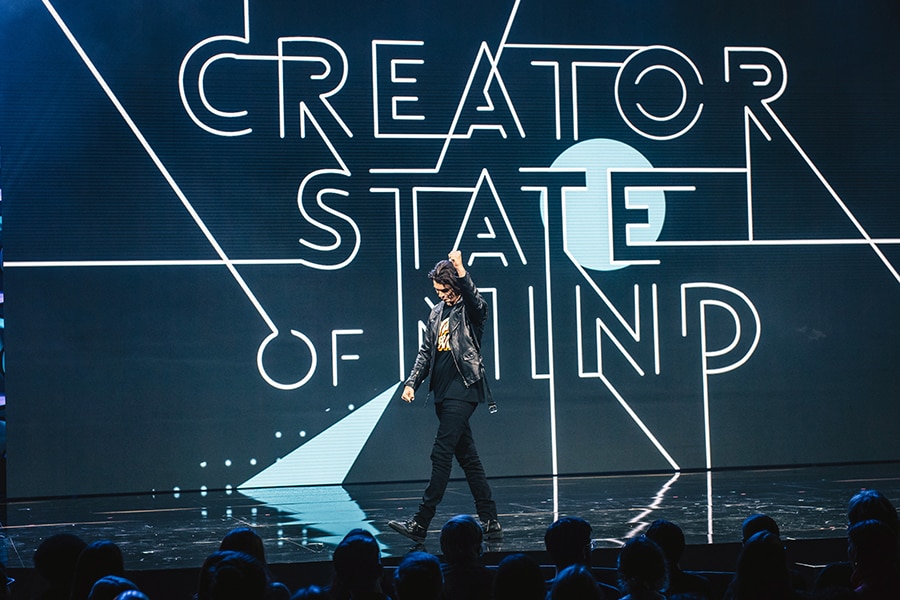

Adam Neumann, WeWork’s co-founder and former chief executive, onstage at the company"s "2018 Creator Awards" at Madison Square Garden in New York on Jan. 17, 2018. After it failed to sell its stock to the public last month, throwing its funding plans into disarray, the company was bailed out on Tuesday, Oct. 29, 2019, by SoftBank, its largest outside investor. (Cole Wilson/The New York Times)[br]Adam Neumann stood on the 57th floor of the Woolworth Building, the neo-Gothic skyscraper that was once the tallest in the world. It was late on a Friday night in 2013, and the WeWork founder and chief executive had just made a move to add the top 30 floors to his rapidly expanding real estate dealings.

Adam Neumann, WeWork’s co-founder and former chief executive, onstage at the company"s "2018 Creator Awards" at Madison Square Garden in New York on Jan. 17, 2018. After it failed to sell its stock to the public last month, throwing its funding plans into disarray, the company was bailed out on Tuesday, Oct. 29, 2019, by SoftBank, its largest outside investor. (Cole Wilson/The New York Times)[br]Adam Neumann stood on the 57th floor of the Woolworth Building, the neo-Gothic skyscraper that was once the tallest in the world. It was late on a Friday night in 2013, and the WeWork founder and chief executive had just made a move to add the top 30 floors to his rapidly expanding real estate dealings.

Neumann and three employees had already enjoyed a few drinks when he decided to bring them to tour his latest coup. In the gutted-out space, they tossed beer bottles into empty elevator shafts, listening to them clink on the way down. Then, Neumann told them all to follow him out to the ledge. No guardrails. No enclosures. Just four inebriated startup executives teetering on the edge of death.

“I was up there with him on the top of the world, and he said, ‘Everything is going to be amazing,’” recalled Harrison Weber, WeWork’s editorial director at the time.

Then, Neumann picked up an old beer bottle — a remnant, apparently, from some previous bender. He asked the employees to drink the rank liquid. Everyone took a swig, except Weber. “It felt like a loyalty thing,” he said. “In that moment, I felt what a deeply persuasive person he is.”

The last 80 days have seen an implosion unlike any other in the history of startups. WeWork filed for an initial public offering with a prospectus that was quickly ridiculed for its incoherence investors learned of several red-flag financial arrangements by Neumann the company’s valuation plummeted Neumann was forced to resign and the IPO was withdrawn. Once estimated to be worth $47 billion, WeWork was reduced to $7 billion after a rescue by the Japanese giant SoftBank.

But WeWork’s astonishing downfall came with an even more astonishing exit package for Neumann: The 40-year-old could receive more than $1 billion after selling his shares to SoftBank and collecting a $185 million consulting fee. As the scope of the disaster comes into focus, the question on everyone’s mind — from his co-working customers to Wall Streeters to soon-to-be-laid-off WeWork employees — is how Neumann managed to fail up so spectacularly.

The answer has a lot to do with what Weber glimpsed atop the Woolworth Building — an inexplicably persuasive charisma and a taste for risk. But Neumann, who grew up in Israel, also had an uncanny ability to read people, from potential investors to reporters, gain their loyalty and then sell them on his vision of a “capitalist kibbutz” on a global scale. He benefited from a frenetic, nonstop energy, and silly as it may sound, there’s no question that Neumann’s good hair and looks helped his cause. At 6 feet 5, he had a physical presence that could dominate a room. (Through a spokeswoman, he declined to comment.)

Crucially, Neumann was selling to an eager audience at the right time: WeWork’s rebranding of the office as an expansion of one’s personality made sense to a generation of the intermittently employed. If you were inclined to believe his vision of a world where work and play bled into one, you might have grouped WeWork with other startups — like Uber and Lyft — that were unprofitable at the moment but would surely figure out the economics in time.

Neumann would talk eloquently about creating the first “physical social network,” a place where members could talk about jobs, family, love. “It was like, wait, you mean life. What you’re talking about is just regular life,” Weber said. But as Neumann framed things, it sounded revolutionary. As more people bought into his vision, WeWork’s value kept soaring. It may have never reached the stratosphere, though, if Neumann had not found the perfect benefactor: SoftBank’s chief executive, Masayoshi Son. Adam Neumann, WeWork’s co-founder and former chief executive. After it failed to sell its stock to the public last month, throwing its funding plans into disarray, the company was bailed out on Tuesday, Oct. 29, 2019, by SoftBank, its largest outside investor. (Nigel Buchanan/The New York Times)[br]Like Neumann, Son — known as Masa — quotes Yoda (“feel the force”), trusts his instincts and tries to think centuries into the future. At $100 billion, SoftBank’s Vision Fund is the world’s largest technology investment fund, flush with cash from Saudi Arabia and Abu Dhabi. Some of its gigantic bets, including one on Uber, have performed poorly, but Son has rejected the idea that he was putting too much money into an already overvalued startup cycle. “Those who are calling the current environment a ‘bubble’ and ‘dangerous’ are those who do not understand technology,” Son told Japan’s Nikkei news service in July.

Adam Neumann, WeWork’s co-founder and former chief executive. After it failed to sell its stock to the public last month, throwing its funding plans into disarray, the company was bailed out on Tuesday, Oct. 29, 2019, by SoftBank, its largest outside investor. (Nigel Buchanan/The New York Times)[br]Like Neumann, Son — known as Masa — quotes Yoda (“feel the force”), trusts his instincts and tries to think centuries into the future. At $100 billion, SoftBank’s Vision Fund is the world’s largest technology investment fund, flush with cash from Saudi Arabia and Abu Dhabi. Some of its gigantic bets, including one on Uber, have performed poorly, but Son has rejected the idea that he was putting too much money into an already overvalued startup cycle. “Those who are calling the current environment a ‘bubble’ and ‘dangerous’ are those who do not understand technology,” Son told Japan’s Nikkei news service in July.

Famously, in 2017, Neumann spent just 12 minutes walking Son around WeWork’s headquarters, prompting an investment of $4.4 billion. Afterward, an elated Neumann zoomed uptown in the back seat of his chauffeured white Maybach, blaring rap, with an iPad open to a rendering of the hasty digital spit-swear he’d just made with Son.

‘Crazier, faster, bigger’

To WeWork insiders who know Neumann — most of whom spoke on the condition of anonymity because of nondisclosure agreements signed with the company — the SoftBank deal changed things precipitously. They talk about WeWork as existing pre- and post-Masa. The investment transformed the startup from a mere unicorn into something with nearly unlimited ambition.

Even by the standards of brash startup founders, Neumann’s eccentricities became the stuff of legend. He could be earthy, walking around in bare feet at the office, and he organized debauched “summer camp” events for WeWork employees, which attendees described as a sort of Coachella-meets-“Wild Wild Country”-meets-nerdy-fraternity-party.

Neumann had a talent for imbuing “Animal House” antics with a larger meaning. In his view, WeWork didn’t simply sublease office space to workers it supplied them with kombucha, cold-brew coffee and an ecstatic sense of community. “They’re coming to us for energy, for culture,” Neumann would say.

He envisioned customers residing in WeLive apartment buildings that would drive down suicide rates because “no one ever feels alone.” He imagined a WeGrow school and an effort to shelter the world’s orphans. (“We want to solve this problem and give them a new family: the WeWork family.”) There was talk of a WeBank, WeSail, WeSleep and an airline.

Even if the business lines were widely derided, their grandiosity helped Neumann cast WeWork as a tech startup, so many of which are known to have nearly messianic mission statements.

For those who were intoxicated by this pitch, Neumann added a hefty dose of self-help spirituality that he picked up from his wife, Rebekah Paltrow Neumann, a cousin to Goop founder Gwyneth Paltrow, and a certified Jivamukti yogi. “My intention was never to find a way to make the most money,” Rebekah Paltrow Neumann said last year. “My intention when I met him was just, ‘How do we expand this good vibration to the planet?’”

One person who indisputably vibrated to Neumann’s frequency was Son. He and Neumann became acquainted in 2016 in India, during a gathering of startup luminaries with Prime Minister Narendra Modi.

On the surface, Son — who is one of Japan’s richest men but is often described as modest — and Neumann, who has said he wants to become the world’s first trillionaire and “president of the world,” couldn’t have been more different. In college, Son invented an electronic translator that he sold to the Sharp Corp. and later founded SoftBank as a software distributor. In his early days, Neumann struggled to get dubious ventures off the ground, including women’s shoes with collapsible high heels and Krawlers, knee pads for babies, with the slogan “Just because they don’t tell you, doesn’t mean they don’t hurt.”

But both men had been outsiders. Neumann’s parents divorced when he was 7, and he bounced from city to city — including a stint on a kibbutz, or communal settlement — before following his sister, Israeli model Adi Neumann, to New York. Son, the descendant of Korean grandparents, was born in a small town in Japan and felt the sting of discrimination before he moved to California as a teenager.

Like Neumann, Son was known to follow his gut and ignore the naysayers. In 2000, he made a $20 million early investment in the Chinese e-commerce venture Alibaba, now worth more than $100 billion, because he’d noticed a “sparkle” in the chief executive’s eyes.

If a founder asked the Vision Fund for $40 million, Son might ask, “What would you do with $400 million?”

“Masa has his own style and others might choke, but Adam would be like: ‘$400 million? How about $4 billion, and I can do this for you,’” said a senior executive with direct knowledge of the men’s interactions.

The two entrepreneurs became close, with Neumann joining Son for sushi in Tokyo and dinner at his 9-acre Bay Area home, the most expensive ever sold in California. Son would stop by Neumann’s Corte Madera, California, mansion, which featured a guitar-shaped living room.

Son’s decision to put billions into WeWork may have thrilled early investors and made the Vision Fund’s partners feel as if they had a piece of a world-changing startup, but the deal severed Neumann from any sense of reality. “You’ve got a guy who meets Adam for 10 minutes and cuts him a check for $4.4 billion, and it’s just insane,” the former executive said. “And he’s not told, ‘I need you to be the most careful steward of this capital.’ It’s like, ‘I need you to go crazier, faster, bigger and more.’”

An uncommon vision

Enabled by Son’s instructions to be “crazier,” Neumann dove into expanding WeWork around the world and pursuing his loftier goals. But his uncurbed ambitions — and the company’s growing losses — started to wear on employees and investors, said nearly a dozen people who know Neumann.

Last year, WeWork bought access to a Gulfstream G650 for $60 million, about the sum that the company was losing every two weeks. He installed an infrared sauna and a cold plunge pool in his Manhattan office. In a glaring conflict of interest, he made millions leasing buildings he partly owned back to WeWork. Indulging his penchant for mysticism, Neumann changed the company’s name to the We Company. Its IPO filing, which included at least 150 references to the word “community,” noted that Neumann had acted to trademark “We” and extract a $5.9 million payment from the company for the use of the pronoun. He later returned the fee.

Some employees found his behavior noxious. In a federal complaint filed Thursday, Medina Bardhi, a former chief of staff to Neumann, accused him of retaliating against her for becoming pregnant and derided her maternity leave as a “vacation” and “retirement.” (She also said she had to stop traveling with Neumann while pregnant because he liked to hotbox the company jet. A WeWork spokeswoman said the company would “vigorously defend itself” and had “zero tolerance for discrimination.”)

Over the years, many on Wall Street and in the business press have scoffed openly at WeWork’s business model last year, Vanity Fair questioned its “$20 billion house of cards.” And some came to wonder if Neumann had been wise to share, during a 2017 speech at Baruch College, a story from his first date with Rebekah. “She looked me straight in the eye and she said, ‘You, my friend, are full of” crap, Neumann recalled. “‘She then said, ‘Every single word that comes out of your mouth is fake.’”

No one disputes that Neumann had an uncommon vision. In nine years, WeWork grew from a single office to encompass more than 45 million square feet of real estate, with roughly 527,000 tenants — or “memberships” — in some 110 cities. WeWork became the single-largest private occupier of office space in London, New York and Washington. Its sleek quarters became synonymous with entrepreneurship in the gig economy and millennial hustle, complete with “Thank God It’s Monday!” T-shirts. Large corporations including IBM, Microsoft and Salesforce moved employees into WeWork spaces.

For a long time, Son protected Neumann. In mid-September, as the IPO effort was collapsing and Neumann was facing outside and board pressure to resign, Son invited him to sit at his table at the Langham Hotel in Pasadena, California, for a Vision Fund social gathering. John Legend would be playing. According to a person briefed on the conversations, SoftBank executives told Son that the optics of Neumann attending the event, much less joining him at the main table, would be awful.

Ultimately, Neumann did not appear and, pointedly, Son gave other attendees a stern reminder about the importance of profitability and strengthening corporate governance before a company attempts to go public.

Neumann resigned as chief executive Sept. 24. In an October conference call with Vision Fund investors, according to a person familiar with the discussion, Son apologized for putting so much faith in the founder. On Oct. 22, SoftBank bailed out WeWork, taking roughly an 80% stake in the company. The next day, the company’s new executive chairman — SoftBank’s chief operating officer, Marcelo Claure — held a town-hall meeting with employees.

“Are there going to be layoffs? Yes. How many? I don’t know,” he said, according to a transcript. “I’d like to put the Adam story behind us, the payout,” he added.

Whether Neumann was hailed as a visionary or denigrated as a huckster, he had always maintained a powerful hold on voting power within WeWork. At one point, his shares had been worth 20 votes each. To get control of his stake, SoftBank decided, it had to pay up.

“Adam is not going to have any role in the company, he’s not going to be in the board of directors, but I do plan to use some of his knowledge,” Claure told employees.

Some on Wall Street think WeWork still has a ways to fall. On Oct. 30, hedge fund manager Bill Ackman said publicly that the company’s value “has a pretty high probability of being a zero.” Other analysts say that WeWork does have a workable business model but that the model will most likely hew closer to the core idea of leasing office space, largely to long-term corporate clients — rather than, say, schools and orphanages — providing them with a cheery atmosphere and free Wi-Fi.

Neumann has been uncharacteristically quiet in recent weeks, dealing with legal and public relations matters as he shuttles among homes in Greenwich Village, Montauk and Westchester County. The man who promised that WeWork would “create a world where people make a life and not just a living” is in between jobs.

First Published: Nov 04, 2019, 11:35

Subscribe Now