UPI: The Imperative for a unified QR ecosystem

While UPI QRs are interoperable within the UPI ecosystem-across banks, prepaid issuers, apps and RuPay credit cards, they remain incompatible with other major payment networks like Visa and Mastercard

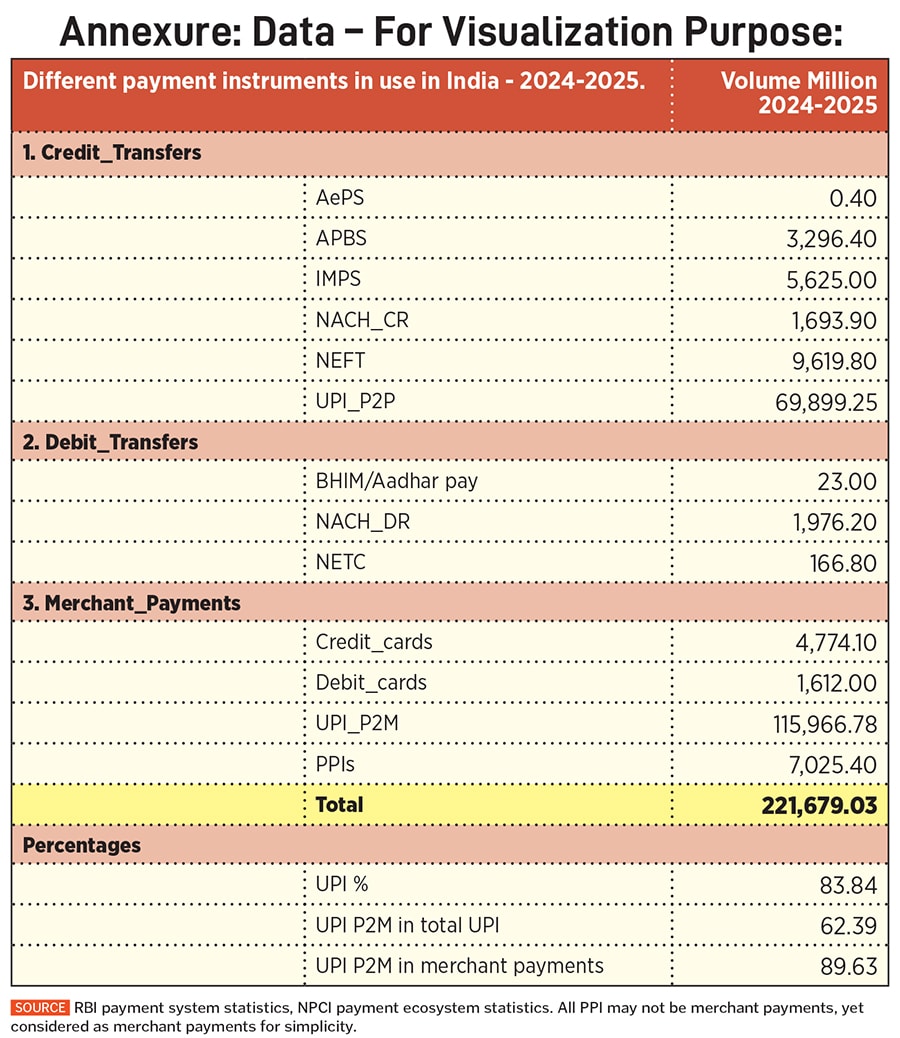

India"s digital payments revolution, led by the Unified Payments Interface (UPI), is a global success story. Since its launch in 2016, UPI has transformed transactions nationwide, handling 185 billion transactions in FY 2024–25—over 83 percent of all retail digital payments. Of this, over 62 percent accounted for person-to-merchant (P2M) payments, highlighting broad adoption. Even informal payments via person-to-person (P2P) UPI QR scans reinforce UPI’s dominance in the merchant payment space.

By FY 2024–25-end, UPI P2M accounted for 90 percent of formal merchant digital payments. Traditional instruments like credit cards (3.7 percent), debit cards (1.2 percent), and prepaid instruments (5.5 percent) lag far behind—and not all Prepaid Payment Instrument (PPI) transactions are merchant-related. This dramatic shift underscores the scale and structural impact of QR-based UPI acceptance.

However, beneath this success lies a critical challenge: the lack of true network-level interoperability. While UPI QRs are interoperable within the UPI ecosystem—across banks, prepaid issuers, and apps—they remain incompatible with other major payment networks like Visa and Mastercard. For example, a UPI QR code displayed by a roadside tea vendor cannot be scanned using a card app like Visa Tap-to-Pay. This means that if a UPI app faces downtime, neither a card-based app nor an alternative scheme can complete the transaction via the same QR code. However, it is important to note that RuPay credit cards can be linked to UPI, enabling card-based payments.

As of early 2025, India had approximately 658 million UPI QRs versus just 67.2 million Bharat QRs—the latter being the only fully interoperable format across all major payment networks. Bharat QR, developed jointly by NPCI, Visa, Mastercard, and Amex under the EMVCo global standard, allows any participating app (whether UPI- or card-based) to scan and process the payment, intelligently routing it via the customer"s preferred network. In contrast, UPI QR codes are tightly bound to the UPI infrastructure and cannot be scanned or interpreted by card-based apps, even though the hardware and software might support scanning.

Roughly 90 percent of the QR infrastructure is tethered to UPI. While this has enabled rapid merchant digitization through asset-lite infrastructure, it also creates concentration risk. Four apps—PhonePe, Google Pay, Paytm, and Amazon Pay—account for 96 percent of UPI volumes PhonePe and Google Pay alone handle over 83 percent. This fragility became evident during multiple UPI outages in 2025. In one incident, a major third-party application provider (TPAP) went offline for hours, crippling local commerce. When UPI fails, most QR codes become unusable. Card-based or non-UPI apps can"t scan them due to the lack of scheme-level interoperability. This overdependence on a single rail poses a systemic vulnerability.

The solution lies in enabling network-level QR interoperability at the acceptance level infrastructure: one QR code that can accept payments from any regulated network—UPI, Visa, Mastercard—routed intelligently via the payer’s chosen method. This is already standard practice in card-based POS terminals, which accept cards across networks such as VISA, MasterCard and Rupay without issue. QR acceptance should follow the same logic.

Global examples show what is possible. Singapore’s SGQR unifies wallets, cards, and bank apps. Brazil’s PIX, Thailand’s PromptPay, and Malaysia’s DuitNow integrate QR-based payments across networks, sometimes even across borders. India already has the necessary foundation in Bharat QR, but it remains underutilized.

India’s broader payment ecosystem has benefitted from such interoperability in the past. The National Financial Switch (NFS) enabled ATM interoperability, and RuPay’s success at POS terminals rests on shared infrastructure. The same needs to be adopted in the QR domain based on shared infrastructure principles.

The risks of inaction are high. As stated above, with 83 percent of digital payments running on one network, a single failure can disrupt the entire ecosystem. Moreover, the dominance of a few foreign-owned TPAPs raises further concerns about resilience, sovereignty, and governance. The longer this persists, the deeper the silos will become and will be harder to dismantle.

To mitigate systemic risks and ensure long-term inclusiveness, India must urgently mandate scheme-level QR interoperability. The Reserve Bank of India should revise its 2020 circular to require that all new QR codes—whether UPI or Bharat QR—be both readable and routable across all regulated payment networks. Existing UPI QR codes should be gradually migrated to a unified format aligned with global standards such as EMVCo, incorporating metadata to enable intelligent, network-agnostic routing. Alternatively, if the UPI QR format is considered superior, its structure must be enhanced to include EMV-compliant elements that facilitate full interoperability across payment schemes.

NPCI and the card networks must collaborate to define and implement this common standard. Acquirers and payment providers must update QR software, merchant standees, and compatible POS hardware. With its scale and resources, NPCI can subsidize or support this transition. Merchant onboarding must remain simple and affordable, preserving UPI’s low-cost appeal.

Resistance will emerge—from dominant players fearing disruption to banks concerned about compliance costs. Interoperable QR infrastructure is not a minor tweak it is a strategic safeguard for India"s digital payments future.

UPI has propelled India forward. Sustaining that momentum now requires broader, more resilient foundations. A truly interoperable QR ecosystem—one QR, any app, any scheme—is the logical and necessary next step. With decisive policy and collaborative execution, India can ensure its payments infrastructure remains robust, inclusive, and future-ready.

Balakrishnan, M., Post Doctoral Research Fellow, Centre for Digital Public Goods, Indian Institute of Management, Bangalore, India

Srinivasan, R., Chairperson Centre for Digital Public Goods, and Professor of Strategy, Indian Institute of Management, Bangalore, India

First Published: Jul 07, 2025, 14:19

Subscribe Now