How India is taking UPI global

As UPI takes its first steps in going international Forbes India takes a look at what that entails

An Indian tourist in Singapore can now seamlessly pay via UPI for a coffee purchased or even a television. The National Payments Corporation of India (NPCI) International has tied up with Singapore’s PayNow and transferring money on the PayNow Virtual Payment Address (VPA) will be similar to domestic transfer on UPI. All a traveller would have to do is scan the QR code, enter his or her PIN and have the money debited via their app from their bank account.

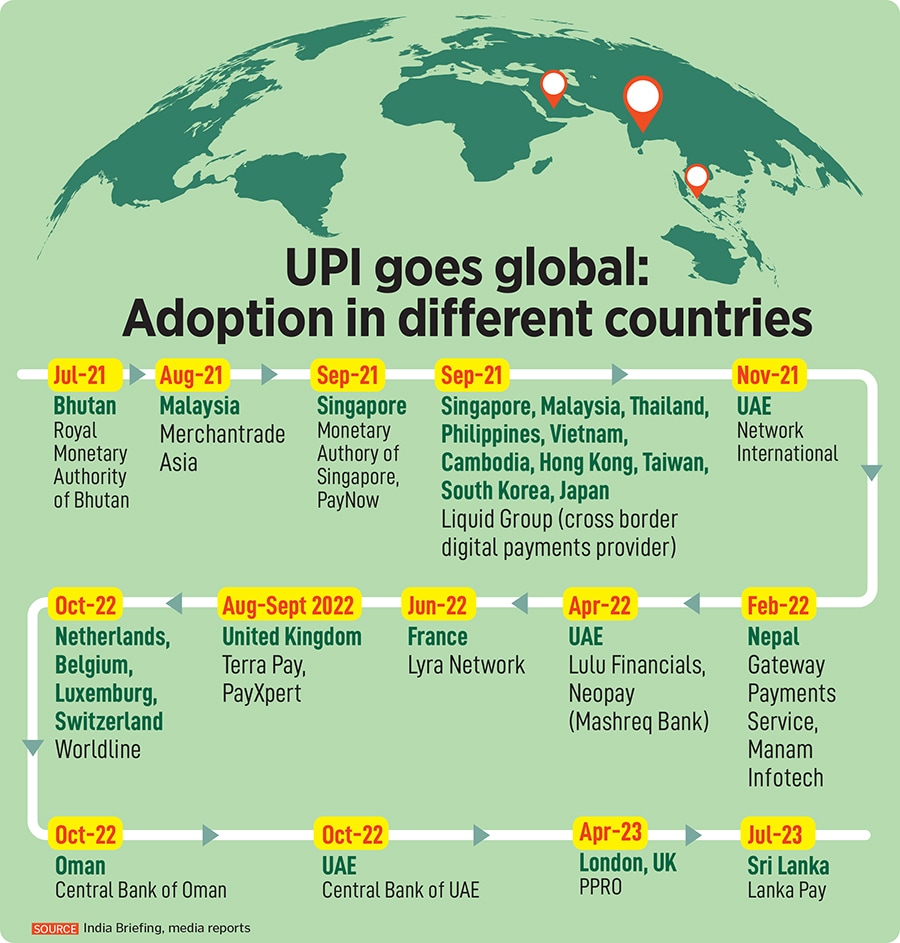

The move to accept payments in Singapore and other countries like Bhutan and Nepal is significant not only due to their economic links with India but also on account of the fact that UPI is being increasingly seen as a peer-to-global payment network. (It still has a long way to go before it gets there though). Global payment networks are divided into three categories. There is Visa and Mastercard, accepted worldwide but with a dominant presence in north America and Europe and the China-based closed loop networks Alipay and WeChat Pay. And UPI.

“There was a time before the pandemic when we were asked to take a look at the strides China had made in the payments space. That is no longer the case as UPI is mentioned in its own right," says Parag Rao, country head, payments business, HDFC Bank.

Since its launch in April 2016 UPI has become the dominant payment system in India. The Reserve Bank of India’s observation in its June 2023 bulletin—based on PwC data—that the Unified Payments Interface (UPI) is expected to account for 90 percent share of retail digital transactions volume in the next five years, up from 75.6 percent in FY23, is proof of the domination that it commands over the system.

In volume terms, UPI has grown 59.2 percent year-on-year to Rs 9.33 billion in June 2023 and 45.5 percent in value terms to Rs 14,75,464 crore, from a year ago. This has only expanded to Rs 9.96 billion in volume terms and Rs 15,33,536.44 crore in value terms, for July.

In setting up UPI abroad the NPCI has followed a two-step approach. “When we go outside [India], there are two key areas of focus. One is building interoperability with India and that means two things—creating opportunities for travellers from India when they go to international markets, giving them the option to scan their UPI apps and make UPI payments," says Ritesh Shukla, CEO, NPCI International.

"The other part (step two) that is more long term, is helping other countries create UPI-like ecosystems. We prefer to work with central banks or central bank authorised entities and create a relevant proposition which includes not only technology but also the business know-how," Shukla adds.

The way an international UPI transaction works is like this. There would be an acquiring bank in Singapore. The payment would be routed via the domestic payment pipe (in this case PayNow). The system would then be designed to talk to the Indian system UPI and it would then get routed to the Indian bank via the UPI network and then to the customer’s account, explains Rao of HDFC Bank. The settlement of the transaction would happen in the reverse order.

The way an international UPI transaction works is like this. There would be an acquiring bank in Singapore. The payment would be routed via the domestic payment pipe (in this case PayNow). The system would then be designed to talk to the Indian system UPI and it would then get routed to the Indian bank via the UPI network and then to the customer’s account, explains Rao of HDFC Bank. The settlement of the transaction would happen in the reverse order.

While NPCI International has signed agreements with a host of countries—Nepal, Bhutan, Singapore, UAE, France, Oman to name a few—there is still no data on the number of transactions that flow through as a result of this, either through money being sent back to India or Indians scanning QR codes for local payments in those countries.

Shukla points to the fact that once a critical mass is reached these transactions could see a hockey-stick like growth curve. Still, the refusal to share numbers points to a tacit acknowledgment of the fact that there is still some way to go in UPI usage outside of India.

Shukla points to the fact that once a critical mass is reached these transactions could see a hockey-stick like growth curve. Still, the refusal to share numbers points to a tacit acknowledgment of the fact that there is still some way to go in UPI usage outside of India.

In July Prashanth Aditya Susrala was on a business trip to Dubai. This was a few days after the announcement of UPIs linking with the Instant Payment Platform of UAE. At the airport and at the shops that he visited he found no buzz of such a service available. He says this is significant as there is a large Indian population in Dubai and the uptake should have been instant. Shukla of NPCI International acknowledges this and says that there will be a lot more marketing efforts over the next few months. Susrala also tried (and failed) to use UPI in Nepal earlier. “The QR infrastructure outside India is not well developed and while in India it is interoperable that is not the scenario in some of the countries outside India," says Rahul Jain, CFO at NTT Data Payment Services India.

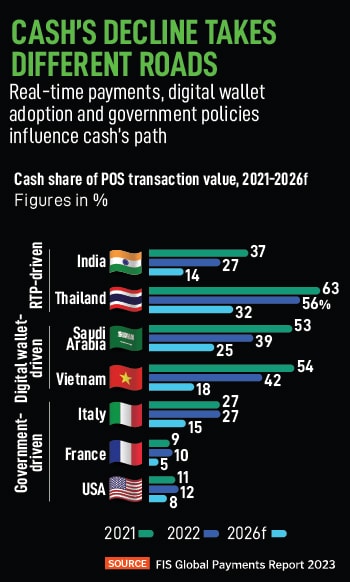

Acceptance in India also took a few years to play out—between 2016 and 2019. Digital payments are not likely to slow down any time soon. There are clear signs too that the usage of cash in the Indian economy is starting to slow down (see infographic).

The Indian digital payments market is expected to touch 411 billion transactions in FY27, from 103 billion in FY23, PwC said in a May 2023 report, with the industry expanding steadily in the last five years at a CAGR of 50 percent transaction, volume-wise and 60 percent transaction, value-wise respectively.

Another issue is that while Indians abroad may prefer to use UPI for low-ticket transactions like restaurant meals or tour tickets, high-value transactions may still happen through credit cards. “This is true even in India as people like to utilise free credit for 45 days so there is no gainsaying the fact that for a big-ticket item it makes sense to leverage the credit card," says Raj Khosla, founder of MyMoneyMantra.

Lastly, there is the issue of the merchant discount rate. How will merchants accepting payments be charged abroad? Unlike India, NPCI International is clear that there will be a fee charged abroad. What that fee settles at remains to be seen. It needs to be low enough to get merchants to steer customers away from card payments and still needs to make a business-use case for banks. Ultimately success or failure would depend on pricing and marketing. On both those fronts the story is still to play out.

First Published: Aug 11, 2023, 15:22

Subscribe Now