Razorpay's early-mover advantage paid off. Can it defend its lead against compet

Razorpay co-founder Harshil Mathur identified an early niche in India's online payments market, enabling small businesses to grow. Now competitors are hot on his heels

Harshil Mathur knew the odds were stacked against him and his college pal Shashank Kumar when they pitched a new online payment gateway for small businesses to suited-up bankers a decade ago. Mathur, then 23, had a mechanical engineering degree, a fondness for T-shirts and no experience in finance. “Initially, we felt like we were not being taken seriously," says Razorpay’s chief executive.

The pair were turned down by nearly 100 banks all were wary about partnering with an unknown fintech in a field with stringent security protocols. They finally got a break when banking giant HDFC agreed to roll out their gateway—but the co-founders had to come up with a security deposit of ₹2.5 million, roughly $40,000 at the time. They didn’t have that kind of cash, having stumped up ₹1 million to launch the company, so Kumar’s grandfather chipped in part of his life savings. “Everything was a challenge in the beginning," reflects Mathur.

Over the next decade, they hustled, beefing up online payment options for customers and adding merchant-friendly services such as international and real-time payments, digital banking and lending services and point-of-sale machines for in-store purchases to the mix. To round it out, they bought eight companies—all but one in India—spanning a payroll-management firm, an AI-powered fraud detection platform and a digital invoice company.

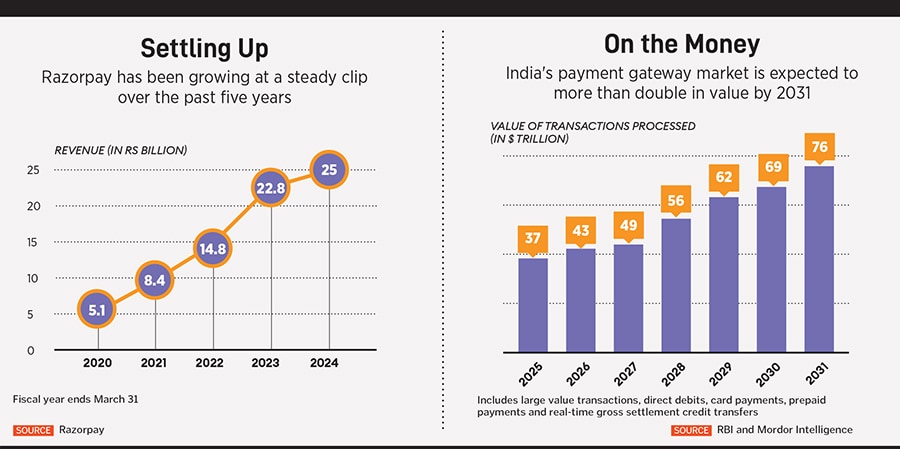

Those efforts paid off. Today Bengaluru-based Razorpay operates one of India’s largest payment gateways by revenue and transaction volume and counts 86 of the country’s top 100 unicorns by value among its customers. Sales in the year ended March 2024 climbed nearly 10 percent to ₹25 billion ($300 million) as total payments volume hit ₹15 billion, up from ₹12.6 billion a year earlier.

Razorpay’s last funding round in 2021, which brought total funds raised to nearly $742 million, valued the Delaware-registered company at $7.5 billion. (They chose the US to be closer to the bulk of their investors.) As per recently disclosed information about their stakes, both Mathur, who featured in the 30 Under 30 Asia list in 2021, and Kumar are billionaires with a net worth of about $1 billion each.

Shashank Kumar, co-founder and managing director of RazorpayImage: Courtesy Razorpay

Now, as more competitors charge into their fiefdom, including global payments giants PayPal and PayU and domestic players such as Bengaluru-based PhonePe and Cashfree Payments, they’re readying for a massive scale-up. In the next five years, they want to more than triple the number of end users to a billion and sales to ₹84 billion. “Growth trumps everything," declares Mathur.

Part of that plan is getting a significant chunk of India’s burgeoning payments market, where the value of total transactions processed is projected to more than double to $76 trillion in fiscal 2031 from an estimated $37 trillion this year, according to Hyderabad-based market advisory firm Mordor Intelligence. “This is a reachable goal given the kind of products…and focus that we have, and the pace at which the digital economy is growing," says Kumar, Razorpay’s managing director.

Razorpay gets more than 70 percent of its revenue from payment-processing fees charged to merchants in India, which average around 1.75 percent per transaction, depending on the payment method used (such as credit or debit card, digital wallet, cardless payment or bank transfer). That compares with around 1.75 percent to 2.5 percent per transaction charged by rivals, according to industry data.

While over 70 percent of its 5 million clients—the bulk are startups and small businesses—use two or more products, the company is leaning into new sales with fresh offerings like R.A.Y. (Razorpay Assistant for You), an on-demand AI “concierge" that can generate intelligent insights for payments customers.

Razorpay’s net profit was up nearly five-fold to ₹340 million in fiscal 2024 from ₹73 million a year earlier, powered by double-digit growth (24 percent) in its payment gateway business. Banking and lending aren’t yet in the black, but are growing at a much faster rate, with Mathur anticipating that “as the payments business scales, it will fund the other businesses, which will eventually become profitable".

To boost its top line, the company is pressing ahead with its ambitions for Southeast Asia, estimating that, by 2030, the region will account for 15 percent of total revenue. Its first stop was Malaysia, where Razorpay acquired Kuala Lumpur-based payments company Curlec for $20 million in 2022.

More recently, in March, it set up an office in Singapore that focuses on real-time payments and cross-border transactions—which make up a third of online payments by Singapore businesses, Razorpay estimates. It projects the city-state’s ecommerce market will double to $40 billion by 2028 from $20 billion in 2025. “We want to grow with them," says Mathur, adding that the company plans to enter the Philippines, Thailand, Indonesia and Vietnam in the next four years.

Still, staying ahead of competition is far from assured, cautions Ramita Sen, lead technology analyst at Mordor Intelligence, by email. “All these [industry] players are providing robust, scalable and secure payment solutions tailored to meet diverse merchant requirements."

Mathur and Kumar first met at the Indian Institute of Technology Roorkee, where the undergrads founded a coding club together. After he graduated in 2013, Mathur was working as a field engineer with a global energy company in Dubai when he got a call from Kumar, then a Microsoft software engineer living in the US, who pitched the idea of building a crowdfunding platform for social causes.

They began to work on the project in their spare time, and soon came to realise a big problem that small online businesses faced: Making and processing digital payments. They pivoted to building a secure payments platform for startups, which positioned Razorpay to grow alongside its clients such as food-delivery company Zomato and multiplex operator PVR Inox (previously PVR Cinemas).

Small companies remain at the heart of their business, Mathur insists. In 2020, when the Reserve Bank of India capped deposit withdrawals at troubled lender Yes Bank for two weeks to prevent a run on deposits, about 30 percent of Razorpay’s merchant funds were locked in. “We could either do settlements for the top ten largest customers or for 20,000 small customers," recalls Mathur. They chose the latter: “We literally took a call in the middle of the night to support the small businesses because they needed the money more."

As Razorpay presses ahead, investors are looking for sustained momentum. “Think of this as a 50-lap race," says Ishaan Mittal, managing director of VC firm Peak XV Partners (formerly Sequoia Capital India), which participated in four funding rounds. “They have done their first five or seven laps," he says, “but there are a lot more laps to be run."

Mathur says he’s preparing Razorpay to go public in the next two to three years, with plans to move its headquarters to Bengaluru, where the co-founders currently reside. That’s no mean feat: It needs to obtain regulatory clearances in India while capital gains taxes in the US could cost as much as $300 million. “A small price to pay," he avers. “This is our home market."

First Published: Jul 08, 2025, 11:14

Subscribe Now