I built a BPO company in the past, I built a marketing solutions company. I built FreeCharge, which I exited (sold to Snapdeal for $400 million in 2015). Every single company was a lesson.

For example, time value for money is an interesting concept that doesn’t exist for most Indians. Every single American, no matter who they were, their first job was an hourly salary—whether they mowed lawns or did the job of a waiter... You walk up to anybody over there, they have this intuitive math, even at a million-dollar salary, for what is their salary per hour. In India, you ask anyone what their salary per hour is, and they have no clue. And, therefore, Indians do an extraordinary amount of… let’s call it time wasting. People who make ₹10,000 an hour, spend an hour trying to save ₹500 on a flight ticket.

The second thing. When I visited China for the first time after my exit from FreeCharge, every meeting I went to had more women than men. And this especially in product tech companies... And then I realised that the data was quite bleak for India, that female participation in labour was extremely low. I realised that our per capita income cannot grow with one gender working.

If one gender drives the income of a household, it becomes a certain type... By the way it creates this unique dynamic that divorce rates are lower in economies where females have lower financial independence...

![]()

Q ...which is not necessarily a good thing.

We can have a longer discussion on that topic. But let’s stick to this insight.

I am a firm believer that the country will not get to prosperity with one gender contributing alone. That’s my single line answer to all the things that we are going to talk about. It creates a very high concentration of financial services. As the core thing was, this is a male gender-driven household, so ARPU (average revenue per user)-wise, consumption is low on other things except financial services.

So, 35 to 40 percent of India’s market cap or PAT (profit after tax) in public markets is financial services. Men can live with four brands, three websites, and one barber, right? So, anyway, what I’m coming to is financial services becomes quite a concentrated thing.

The other thing is India’s per capita income. We are at $2,800, but if you remove the top 35 to 40 million consumers, the per capita income drops maybe to $600 to $800. Yet every tech company was building for hundreds of millions of customers for one reason only—because all the global guys love to come to India because India is a large MAU (monthly active users) farm for them.

Indian founders took that implied understanding that this is also good for them. But you cannot serve consumers a quick commerce when the income is not high enough for them to have discretionary spends, right? So, we realised that we need to focus on a segment of customers, and their life is materially different than everybody else’s, and they need different things.

By the way, that 30 million number is an interesting one, because that same number replicates in people who pay taxes, people who have cars. I was shocked, but Bollywood revenues are concentrated in just 5 to 6 million customers. Let’s take UPI. We talk about UPI, this 400 million customer thing, but the number of customers that drives the bulk of the transactions is actually 50 to 60 million—the same households. More interestingly, most of the 50 to 60 million customers have a credit card.

We observed that credit card customers do multiple-x more transactions on UPI than an average UPI customer because they have the money. If you look at bank deposits, the same 40 million would be controlling 80 percent of all deposits. Look at mutual fund AUM (assets under management), 90 percent would be the 30 million. Another thing is, all these financial products are very gendered. So maybe 90 percent of all credit card spends are male. Same thing for loans, and so on and so forth.

Another thing I realised in internet companies as a phenomenon is that frequency is the biggest driver of all revenue and profit pools. Let me ask you a question. I am asking you to delete five apps on your phone. How are you going to select?

Q. I’ll see which are the least-used ones.

Perfect. So, frequency is the thing that will make you keep or delete an app. But some apps are so frequent you can’t even think about them being down for five minutes. So, you’ll see all internet revenue and profit pools concentrate on frequency. And anybody who loses frequency loses everything. We noticed that many businesses in India never thought of frequency, because they could rent the frequency.

Internet is the only business where you have to create your own frequency. Warna koi nai aane wala.

Another thing I noticed is that India is a low-trust nation. It is still evolving as a developing nation. Our institutions are not strong enough to create a high-trust network yet. You see the emergence of super apps, superstars and super conglomerates in low-trust nations. Tata can do anything from salt to cars to jewellery to whatever they want, and people will buy it.

When you combine all of this, you realise that that is how you need to think about building businesses. Familiarity causes trust in low-trust nations, which also explains brands like Cred investing in brand advertising upfront.

Q. Doesn’t that also apply to funding a startup founder, such as yourself, who has done a successful exit? It is easier for them to get funded.

Hundred percent. Actually, funding is a little bit like an arranged marriage. You want to improve the odds of success, as a parent. You are better off marrying your daughter to an IITian versus a non-IITian. From an LTV perspective, lifetime value perspective, you are better off. This person has demonstrated extraordinary excellence to compete and win. IIT is just one manifestation of that. You may also want to fund athletes. You may want to fund anybody who has achieved extraordinary success with extraordinary difficulty. Because entrepreneurship is, unfortunately, extremely hard in India, specifically hard because we don’t respect our status. How many risk takers-based extraordinary movies have you seen in India?

Q. Guru was an exception.

Yes, that’s one. If you go to the US, every entrepreneur’s journey has been documented with great details. We have no stories captured. And, therefore, there is an extraordinary amount of mockery around entrepreneurs, because we don’t like risk-takers. We don’t see people crowding around houses of entrepreneurs.

Q. Hasn’t that changed, to an extent? People like you or the Flipkart people are celebrities.

Yeah, but as a nation… How many people are trying to become an actor, an influencer versus an entrepreneur? How do we move towards prosperity is by having a significantly high amount of risk-taking. That’s not happening yet. In fact, anybody who takes risks is generously mocked for some failure which impacts so many more people to not take risk. Unless you develop a thick skin.

I had complete bankruptcy in my family when I was 14-15. I had to start working as a delivery boy, data entry operator, do odd jobs. I had no shame left, because I did everything. I could not speak English properly till I was 22-23. So, you now you have no shame because you been mocked for not being able to speak English properly, mocked for not having clothes, not having shoes. I’ve seen the worst.

Moving back to VC investing, they look for the slope of success, competitive ability, understanding, insight, the ability to lead. Leadership is followership, right? If you moved out of this company, can you take 10 people who will come for you from anywhere?

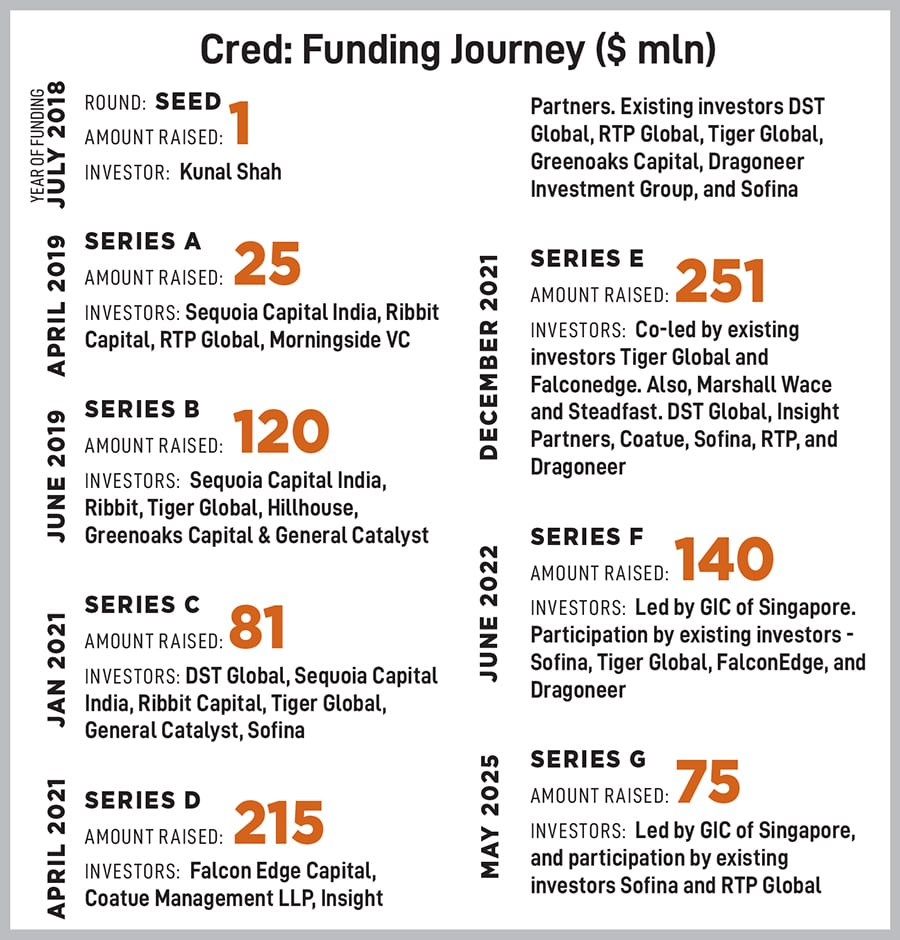

Cred would not have been possible if I could not have raised a large round. We did not monetise the company for the first two-and-a half to three years. This is only possible if you have the pedigree to say, “Trust me, I’m doing the right thing for building distribution first and then monetisation."

![]()

Q. How do you feel about the Snapdeal deal? Since that deal, Kunal Bahl and Kunal Shah have taken different directions. Your stock has grown and grown.

We all get lucky in many things that we do. Kunal Bahl is an extraordinary person. It is about making choices. I don’t like building businesses where there is no evidence of a large revenue or profit pool. I go hit a dart on a dart board that is so big, kuch toh nikal ke aayega.

Let me give you two data points: 2 percent of India’s market cap is tech the US’s is 27 percent. Secondly, 35 to 40 percent of India’s market cap is financial services. When you combine both of these insights, would you believe there’ll be five, $50 billion companies? So, I am operating with that order of success.

There are two types of entrepreneurs. People who have unfortunately dealt with headwinds and people who have dealt with tailwinds. I like to operate with tailwinds and go for large markets.

Q. What caused your family’s bankruptcy?

My dad was the seventh kid in a joint family of seven sons and an engineering graduate. He built his own pharma distribution business. By the time the family had completely split, because we had lots of illnesses in the family, so family wealth was completely depleted... in that he built a business with the little capital he had. It did not do well. We had to move to a chawl for, like, 100 square feet in Mumbai in Lohar Chawl.

When I was 15-16, I did everything to make money. But I’ve also realised that a lot of success comes from only trauma. I’m here because maybe thousands of people have believed in me and helped me in some ways. I can’t thank them. And today, I also pay it forward in investing. I don’t have mutual fund stocks. I invest in startups only.

I remember when I was a delivery boy, I would move around on a Honda and deliver stuff. And sometimes I would not have enough fuel. So I would go to the fuel pump and say, “Yaar yeh paanch rupay ka daal do, servicing mein ja raha hai." The guy would notice that I did not have money, and he would put in a little extra. I can’t thank the guy, but I think if you can just pay it forward, fulfilling dreams of many more people, I think it’s a good life lived.

Q. Speaking about tailwinds that you go for, does that mean that within the risk-taking format you still bet on things that are a bit less risky?

Hundred percent. Entrepreneurship is not glory it’s about judgement, about getting it right. And getting it right is about going for fertile categories, working with high-quality team members. A lot of times, entrepreneurship gets into the category of glory, which is problematic. Tailwinds are about judgement, so that you get extraordinary returns, but not by playing the odds of luck. I’m going for four tailwinds: Tech, financial services, focusing on 30 to 40 million consumers, I am having this best of the times where AI is there, UPI is there, digital DPI platforms are there. I’m leveraging all of these tailwinds.

Q. Are Indian startups creating good stuff, or only doing lifestyle things and quick commerce? I’ll put this in the context of what you said a couple of weeks ago that India does not have a culture of excellence.

See the thing is, excellence is a culture, right? You have to demonstrate return of capital. Talking about the early stage of our ecosystem, we have probably the highest number of unicorns compared to many other countries. We have created so many tech ecosystems, so much capital has moved. We need to give great returns to some of these investments, because investors are not going to come back if you cannot give them good returns.

The other thing that causes some of this stuff is more capital coming and getting deployed. Investors come for the returns we create for them, the trust we create for them, right? If they have to worry about their money, that doesn’t create trust. We have to start thinking about those things as well. See, the internet made information accessible through the air. Someone like me who did not have the best of education can learn anything.

![]()

Q. Apparently, AI has made you 10 times more efficient.

I would say it has made me 10 times more curious. My value-add to Cred is judgement.

Q. Not ideas?

Judgement is ideas, right? You generate ideas, but you should have judgement that will work. That’s my role... to take judgement calls on many, many things, on product choices and so on and so forth. And that is better fuelled through curiosity.

For example, I was curious about how Tata has created so much trust compared to any other conglomerate? Earlier, I had to meet and interview people to find the answer. And read some books here and there. Now I can get a detailed report by using ChatGPT. Which makes my job significantly easier.

Q. Why is this answer important to you?

Because, should we be trustworthy? Absolutely yes. Otherwise, Cred has no future, right? Because the default setting of a new Indian startup is that people will say, “Are yeh toh data chori karta hai." And we are constantly judging the younger founders because we can judge them. Sometimes I believe that we don’t have entrepreneurship stories because there’d be so many flaws in those stories.

Q. Those are the more interesting stories.

Yeah, but unfortunately, we don’t have tolerance for those things as society. If you look at any startup founder, look at their Twitter, it is filled with mockery, filled with judgement. Many founders have pinged me, “How do you deal with this?" I said, “Welcome to the entrepreneurship journey."

Q. How do you deal with it? On social media, you often say things that can easily trigger a debate.

I wish they did. As a society, we don’t debate anything anymore.

![]()

Q. Like when you said India has no culture of excellence?

If people debated that and gave me 10 examples, I’ll delete that post. Social media has this unique ability of destroying nuance. It was a five-minute monologue about what India needs to do, and we captured that line.

Q. So this mockery and negativity that we are talking about, Cred has faced quite a bit of that.

Every company faces it.

Q. Probably the expectations from you were higher?

Every company that raises money faces it. Every company that goes public faces it. Every entrepreneur that takes risks faces it from different quarters.

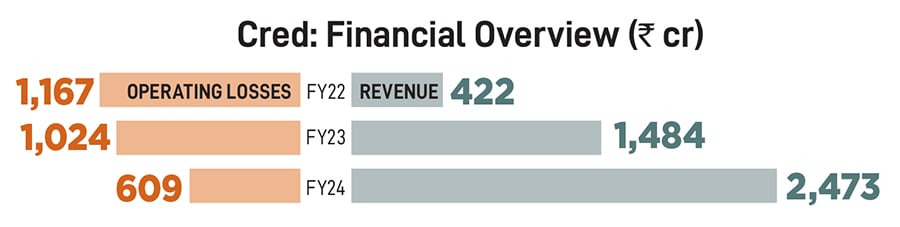

Q. People kept saying that Cred has raised a billion dollars. But where are the revenues? But now, of course, you are showing how it has to be monetised, and you’ve started several revenue streams. So where is Cred really going?

Cred is going exactly where we had planned it to be. All of the stuff that we’re doing is something that we have spoken about consistently. Our simple principles were, we need to be in the business that rewards good financial behaviours consistently.

![]()

Q. And it’s not just about the money, it’s about behaviour.

Exactly. Consistency of that behaviour. And then we wanted to create that loop, to create more cross-sell opportunities that existing products, that banks have, because if you build the right cohort, you build the right kind of behaviour segment, it makes sense. For example, does it make sense to sell car insurance to somebody with good credit score because they are likely to be less fraudulent? Yes. Therefore, we’ve done well in our car insurance business, also, which is one year old.

You cannot have a bad relationship with credit. You need to have a good relationship with credit. That’s our core motivation. Now what has happened is, we have managed to appeal to a segment of customers who trust us. Today, I would say 35 to 40 percent of all credit card bill payments go through Cred and people rely on us to remind them.

Q. You guys earn per transaction?

We make money every time a bank cross-sells a loan on our platform or sells an insurance on our platform... we make a commission out of that.

Q. Do you worry about valuation?

No. I’ll tell you why. Valuation is a point-in-time view to life... But let’s say valuation also can drop when there is a liquidity squeeze, bank loan interest has gone 2x… Valuation and other things matter when you are looking at just vanity. Because, again, in India we worship people with a certain kind of valuation. I think what needs to be measured is whether the business is doing consistently okay. Is it driving value? Is it innovating? Is it doing things.

Q. I ask this because recent reports say that in the round you are supposed to be raising, you know about $75 million, your valuation has apparently dropped by 45 percent...

It is very interesting. What causes a private company’s valuation to drop? We are not a public-listed company, correct? So, it is a choice one has to make for themselves. And for me, these are great choices to make, because which company is able to raise capital right now? Very few.

Just two important data for you. We have never raised money by going outside. All the rounds have been raised by internal investors, which means we speak to them. Valuation is a function of what people are willing to give at that point of time. I have reached a point in life where I am really optimising for the long term. I’m not a young founder anymore, which means I am optimising for what will create extraordinary long-term value. What we have done, though, in every round, is that we have barely any dilution.