RBI: The tough regulator

In the last two to three years, it has sent a clear signal that no financial institution will be spared in the case of governance lapses and non-compliance. A build-up in SME lending and fresh concern

Dealing with an edgy or aggressive financial regulator is never a great thought. And one might be tempted to label the Reserve Bank of India (RBI) that, considering the rap on the knuckles it has been giving some of India’s largest banks, non-banking financial institutions (NBFCs) and fintechs in the past 12 to 36 months.

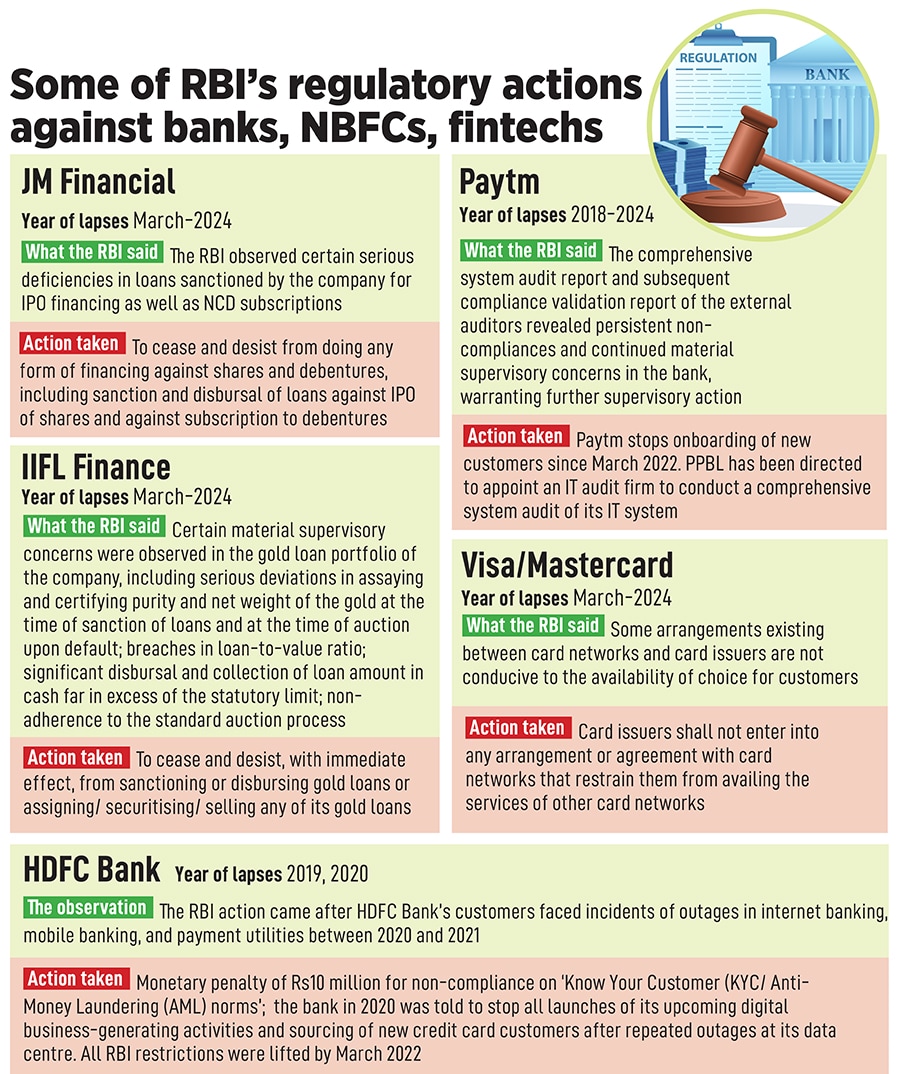

Not many have been spared: The list includes the largest private sector lender HDFC Bank to large NBFC lenders Bajaj Finance, IIFL Finance, JM Financial, payments bank Paytm Payments Bank (PPBL) and credit card issuers Visa and Mastercard (see table). At a broad level, the RBI has been concerned about nipping bad practices at the earliest instance—be it poor governance or risk management concerns evergreening of loans, non-compliance and supervisory concerns, and even gaps in the functioning of technology platforms.

RBI Governor Shaktikanta Das—who, like previous governors YV Reddy and Duvvuri Subbarao, has an IAS background—has faced some backlash from the fintech community for his actions, fearing that all were under the scanner after the action against Paytm. Earlier this month, though, speaking to a television channel, Das was clear about why action was necessary against the payments bank.

Paytm’s concerns had started in 2018 and escalated two years ago in March 2022, when the RBI stopped it from onboarding new customers and asked it to carry out a comprehensive system audit. These restrictions continue to be in force, the RBI said in February. Last year, the RBI fined Paytm Payments Bank Rs5.4 crore for breach of KYC guidelines. India’s Financial Intelligence Unit has fined PPBL a further Rs5.49 crore for violating rules under money laundering norms.

“Paytm is a scenario of arrogance [of its leadership] of the highest order being clamped down by the regulator. It had been given multiple warnings over the past five to six years. Arrogance of that level cannot be tolerated. Fintechs have to realise that they are dealing in a regulated sector," says a CEO of a foreign investment bank, on condition of anonymity.

This is what Das is clearly signalling. “The RBI action was against a regulated entity, which is a payments bank," he had told the TV channel. The RBI governor said, unfortunately, a narrative was being built that RBI was against fintech companies. “Fintech companies are not regulated by the RBI unless they are NBFC lenders. Fintechs are free to grow," Das clarified in the March interview.

Fintechs in India operate as a third-party service—a payments aggregator or financial lender of mainly unsecured loans and distributor of other financial products. But the responsibility of governance and ensuring regulation rests with the regulated entity, which in these cases, are banks and NBFCs.

Following the RBI action, Paytm parent firm One97 Communications (OCL), had no option but to continue to lower its dependency on PPBL, considering that it has been barred from acquiring new customers since March 2022. OCL now partners with Axis Bank, HDFC Bank, the State Bank of India and Yes Bank for its secure settlement of transactions with merchants.

PPBL runs the risk of losing its licence soon. But Paytm, this week, has been granted a third-party application provider licence by the NPCI, which means that customers and merchants can keep using the Paytm app to make payments through the tie-up with other banks. OCL shares were down 35 percent to Rs420 at the BSE on March 20, in the year-to-date, but have gained 20 percent since March 13.

IIFL is another player which has been pulled up by the RBI (since the order on March 4) to stop sanctioning or disbursing gold loans or securitising/selling any of its gold loans. The RBI has raised material supervisory concerns—after an inspection last year—in IIFL’s gold loan portfolio.

These included serious deviations in assaying and certifying purity and net weight of the gold at the time of sanction of loans and at the time of auction upon default breaches in loan-to-value (LTV) ratio and significant disbursal and collection of loan amount in cash [against gold] is far in excess of the statutory limit. The LTV for gold loans is 75 percent.

IIFL Managing Director Nirmal Jain has said that there are “no ethical issues at play and it is just an operational issue". IIFL’s gold loans form 32 percent—or Rs24,692 crore of its total loan AUM of Rs77,444 crore as of Q3FY24.

Muthoot Finance is the largest NBFC in the gold segment with a portfolio of Rs69,221 crore, while Manappuram Finance’s portfolio is of Rs20,809 crore.

From March 1, the IIFL Finance stock is down 46 percent to Rs336.4 at the BSE. Fitch Ratings has put IIFL Finance’s "B+" long-term issuer default rating (IDR) and medium-term note (MTN) programme rating on Rating Watch Negative (RWN), after the RBI action.

The RWN reflects downside risk to IIFL Finance"s franchise, profitability and overall risk profile if regulatory restrictions on new gold-backed lending are prolonged, it said.

Also listen: Paytm saga: Can ex-SEBI chief"s panel help matters?

The source at the foreign investment bank warns that SME lending is a business which has never been consistent and not an easy segment to lend to. “It should be monitored better. People are not fully analysing cash flows… it is somewhat like microfinance where the same customer is being targeted by three lenders." he tells Forbes India.

The RBI has introduced a measure to help borrowers. Lenders will now provide their borrowers a key fact statement (KFS) containing important information regarding a loan agreement, including the all-in cost of the loan, in simple and easy terms to understand format.

He adds that the microfinance sector tends to throw up “some problems" every two to three years.

A latest on-the-ground assessment from ‘channel checks’ on the microfinance sector in north Indian states of Punjab and Haryana suggests “consistent stress on recoveries as well as fresh disbursements in these states" due to the ongoing unrest caused by regional campaigns like the Karja Mukti Morcha, etc. This has led to a higher focus on collections among lenders, with more staff being deployed for the same, InCred Equities says in a March 19 report.

The outstanding MFI assets under management between banks, NBFCs and NBFC-MFIs in Punjab and Haryana stood at Rs59 billion each as of December 2023-end, which is cumulatively around 3 percent of the total AUM.

“Top lenders in these states are seeing the potential for demand to grow, but they would like to tread with caution. We believe the regional unrest will die down after the forthcoming general elections and probably post good monsoon," InCred analysts Jignesh Shial, Meghna Luthra and Rishabh Joghani say in their analysis.

Fintechs continue to be clearly rattled by the regulator’s actions surrounding Paytm. “All fintechs are under scrutiny, even as we seek more clarification of how to do things," says an entrepreneur-promoter of a fintech lending firm, declining to be named. “If there is non-compliance which is glaring, fintechs are bound to come under stress."

With fintech innovation evolving faster than regulation, there will also be a need for “young blood" in the RBI. The entrepreneur also seeks more “open forums" from the regulator. “The communication from the RBI is issue-based," he adds. CNBC-TV18 has reported that the RBI held 202 meetings with fintech companies in the past six months (till February-end), through in-person meetings, conferences and events.

A banking expert with a consultancy firm, however, says an aggressive RBI cracking the whip was not a good signal for foreign investors. “You do not want them to become risk-averse while expanding their presence in India," he tells Forbes India.

All the experts Forbes India spoke with indicated that, currently, India’s lending ecosystem is robust, the credit cost to balance sheets is low and the retail lending demand is good, being still under-leveraged, despite concerns over aggressive unsecured lending. Das, unlike immediate predecessors, economists Urjit Patel and Raghuram Rajan earlier, has surprised most by working proactively with the ruling government and helping the economy emerge through the post-pandemic period, relatively unscathed.

Das is clearly not on a witch-hunt. All he wants to ensure is that a mini-crisis does not brew and that RBI can control it before a bubble bursts.

First Published: Mar 21, 2024, 12:05

Subscribe Now