Paytm moderates Buy Now, Pay Later lending, but overall impact marginal

The demand for big-ticket lending, onboarding of new lending partners will be watched closely. Analysts forecast a path towards profitability by FY26

The payments and financial services company, Paytm, under parent One 97 Communications, continues to ride into slightly unchartered territory as it has rejigged its lending portfolio more towards merchant loans and high-ticket personal loans, after exiting the highly dissected buy now pay later (BNPL) lending segment.

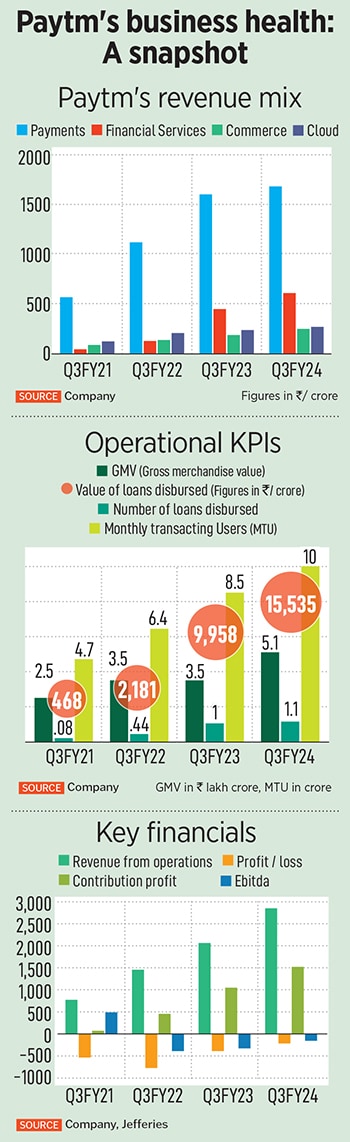

While some of the financial optics from its Q3FY24 earnings announced last week are positive–ebitda losses continued to narrow as contributing profit outpaced operating costs and GMV levels improved–there are elements of its lending book that will depend on credit behaviour of customers as they move towards buying higher-size ticket loans with Paytm’s lending partners.

Paytm does its lending activity through tie-ups with banks or non-banking financial companies (NBFCs). The unknown piece here is the acceptance and clearance of Paytm’s new lending partners in coming quarters, which will be watched by the regulator and investors both.

Paytm has had a chequered history in terms of regulations and clearances in the recent past. In October 2023, the Reserve Bank of India (RBI) had imposed a penalty of Rs5.39 crore on Paytm, for non-compliance with the central bank’s e-KYC provisions. In March 2022, the RBI barred Paytm Payments Bank from onboarding new customers due to “certain material supervisory concerns observed in the bank" The Paytm Payments Bank is hopeful that these restrictions will get lifted by March this year.

“Certain future clearances and licenses to be sought from the RBI and new platform partners which they will onboard for the high ticket loans will be watched very closely," a senior executive at a payment-focussed fintech firm told Forbes India, on condition of anonymity.

As Paytm has chosen to pull out of its postpaid small-ticket BNPL lending activity, it has impacted the overall disbursement of loans of the quarter gone by. The total number of loans disbursed by Paytm in the December-ended quarter fell to 1.14 crore loans from 1.32 crore loans in the previous sequential September 2023 -ended quarter.

In the same period, the number of personal loans grew 5.4 percent to 2.53 lakh and its value rose 13.5 percent to Rs4,460 crore. Merchant loans slid 3.2 percent to 1.78 lakh while its value rose 9.2 percent to Rs3,579 crore.

But analysts say disbursements under Paytm postpaid moderated on expected lines and 4QFY24 will have full impact.

But analysts say disbursements under Paytm postpaid moderated on expected lines and 4QFY24 will have full impact.

“The use cases in Paytm postpaid are coming down and will continue to come down in 4Q and 1QFY25, post which the business is expected to stabilise, though according to Paytm it is too early to predict as of now. The business impact from Paytm postpaid on P&L and the overall lending business is very marginal," says Nitin Aggarwal, head BFSI (institutional equities) at Motilal Oswal Financial Services. This is because the profitability of the BNPL loans is relatively lower than the other loans.

Aggarwal estimates a 25 percent compound annual growth rate (CAGR) in disbursements over the coming years, led by continued traction in personal loans and merchant loan segments. The growth in disbursements was forecasted to be much higher in previous years, but has moderated since.

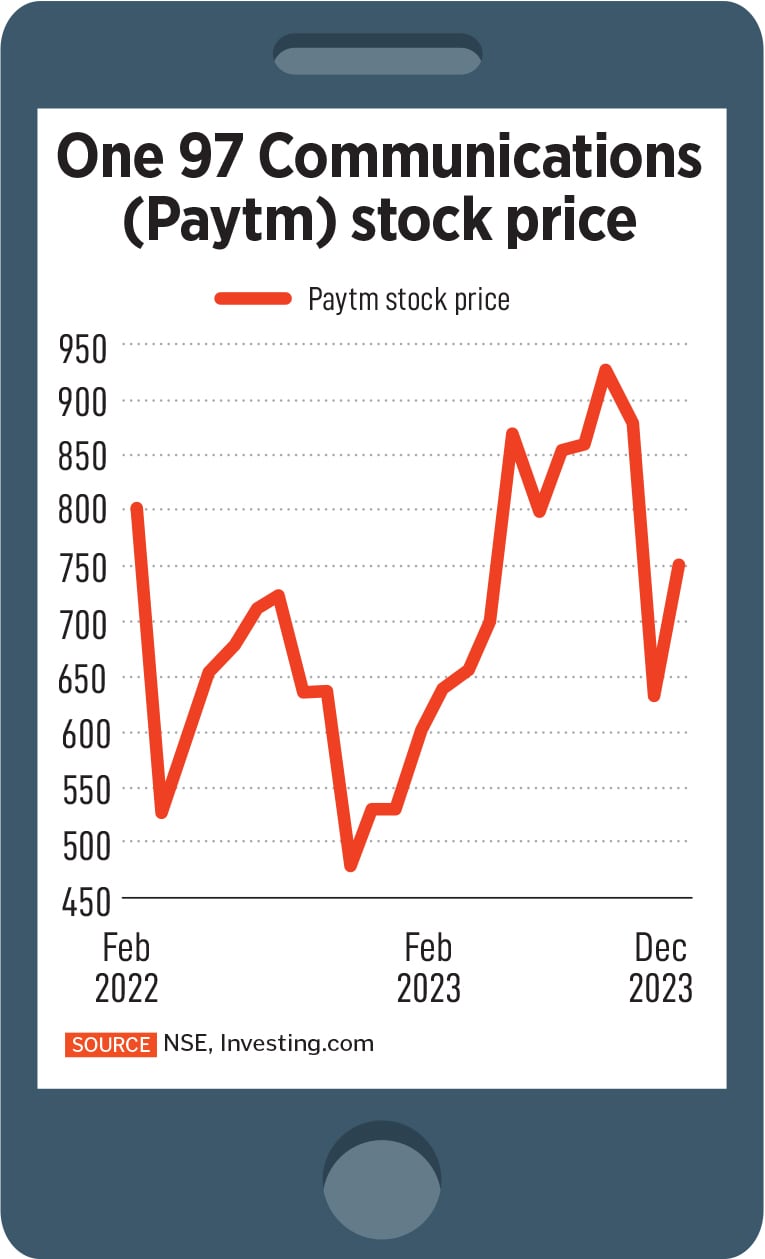

This moderation in the financial services business growth appears to have been factored into the Paytm stock price. Paytm has continued to slide from the listing price of Rs1,951 on November 18, 2021 at the National Stock Exchange (NSE), but seen buying at lower levels, gaining 38 percent in the past one year, from Rs543 levels to Rs751.5 on January 23.

Aggarwal has a buy rating on the stock with a 20x FY28E ebitda, valuing it at Rs975 which corresponds to a 4.2 times FY26E P/ sales. He expects Paytm to turn profitable by FY26.

On Wednesday (January 24), Japanese investor Softbank has sold another two percent stake in One 97 Communications, its biggest listed investment in India, bringing the level down to around five percent, data at the stock exchanges showed.

On the flip side, the demand for high-ticket loans has been healthy. Paytm’s president and group CFO Madhur Deora told analysts, “High-ticket loans have shown significant growth in the last month and a half, we now have two crore white-list users from our partners. The business has disbursed Rs 490 crore worth of loans already.

Paytm will further focus on cross-selling these products, because almost over 60 percent of its all-new loan disbursals every month go to existing loan customers, with various lenders.

This will be one more area of focus for Paytm, in coming quarters. It remains to be seen how much confidence Paytm has in ramping up overall disbursements. The company, being a technology company, will continue to leverage on the knowledge of the lending partners.

The RBI Governor Shaktikanta Das has made it slightly easier for fintech firms and some NBFCs by clarifying that the actions of the central bank were preemptive and not a crackdown on such lending. In November last year, the RBI had announced a 25 percent rise in the risk weight on consumer credit exposure for commercial banks and non-banking finance companies (NBFCs).

Specific to Paytm, Jefferies analyst Jayant Kharote, in a report to clients, says that “while key risks are slower, ramp-up of lending business and intense competition, strong execution could trigger earnings upside and re-rating with an over 34 percent upside in 2024E." Kharote has reiterated a ‘buy’ for the Paytm stock with a Rs1,050 price target in the note.

In December 2023, media had reported that One 97 Communications had fired over 1,000 employees across multiple divisions, to lower employee costs, possibly in the three months to December. Employee costs (excluding ESOPs) for Paytm rose for the three-months ending December 2023 to Rs809 crore, compared to Rs584 crore for the corresponding period, a year earlier.

In December 2023, media had reported that One 97 Communications had fired over 1,000 employees across multiple divisions, to lower employee costs, possibly in the three months to December. Employee costs (excluding ESOPs) for Paytm rose for the three-months ending December 2023 to Rs809 crore, compared to Rs584 crore for the corresponding period, a year earlier.

“[The] management hinted at moderation in new sales force addition as pace of device deployment stabilises around 1.1 to 1.2 million quarterly (versus 1.4 million in 3Q24)," Kharote says in the report.

Jefferies estimates an around 23 percent topline CAGR over FY24-26E, led by robust growth in payments & financial services (both at +24 percent CAGR). It also expects contribution margins to expand (around 170 bps) on better revenue mix from credit business and better payments margins. Kharote also forecasts Paytm to turn profitable in 2HFY25E with EPS of around Rs3 in FY25E, expanding to around Rs18 in FY26E, in the report.

First Published: Jan 24, 2024, 13:22

Subscribe Now