The central bank has, this year, hiked the minimum amount of capital which banks and non-banking financial companies (NBFCs) need to hold in relation to a loan. In 2022, the RBI introduced measures to curtail credit lending by non-banks through prepaid cards and digital wallet products.

The clear signal to lenders is that there is a need to be aware of the risks and they need to have the ability to safeguard themselves and the lending ecosystem from the rising concerns of unsecured retail loans.

Lending is a business that needs discipline. “The weakness of a lending business is that there is a long tail of risk and earnings. A financial lending company gives money but it comes back anywhere between 6-12 months or even 24-36 months later," the promoter of a top fintech firm said, declining to be named. “Prudence is not often being maintained."

The RBI got concerned because it was propelling unwarranted consumerism without guardrails. This raises concerns because, more often than not, people tend to uptrade when they buy on immediate credit.

![]() Some alarm bells have started to ring, getting founders of fintech firms to tweak their business models and diversify into more secured forms of lending. It has also raised the compelling debate of whether pure BNPL has a positive role to play in India’s lending ecosystem.

Some alarm bells have started to ring, getting founders of fintech firms to tweak their business models and diversify into more secured forms of lending. It has also raised the compelling debate of whether pure BNPL has a positive role to play in India’s lending ecosystem.

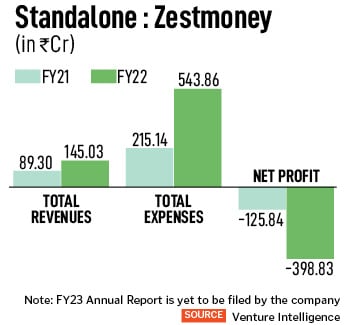

Earlier this month, a Goldman Sachs-backed buy-now-pay-later focused (BNPL) fintech ZestMoney, after a series of attempts to revive its business under a new management, told employees at a townhall that it will shut down operations in 2024. In May this year, its founders Lizzie Chapman, Priya Sharma and Ashish Anantharaman announced their decision to step down from the firm, weeks after fintech PhonePe chose to call off its proposed acquisition of the company.

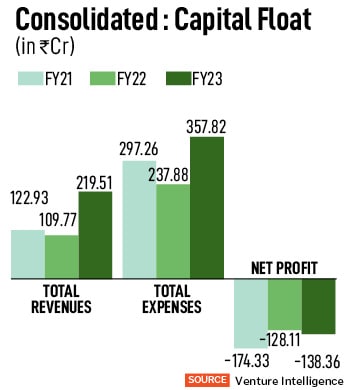

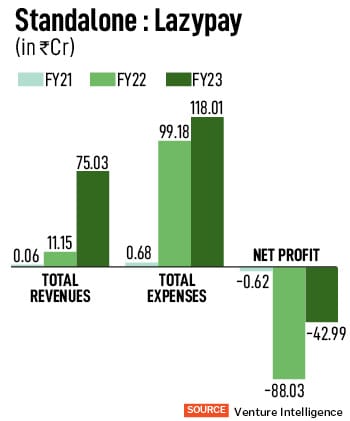

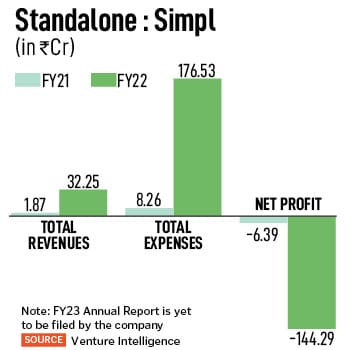

“ZestMoney turned into a fiasco because of its lack of capability to collect money it lent out. Defaults were far too high from the collection side and its losses mounted (see table). This reflected in the fact that it was lending to the wrong people, becoming a marred module which failed due diligence," a promoter of a top fintech firm said, declining to be named.

![]() In December, fintech giant Paytm, backed by Softbank, said it has “recalibrated the portfolio" of less than Rs 50,000 ticket loans—prominently the BNPL Postpaid loan product—and will now be a smaller part of its loan distribution business going forward. With Postpaid, users got credit of up to Rs 60,000 every month at 0 percent interest for up to 30 days, to make purchases, bill payments, recharges and bookings. Now Paytm says it will focus on expanding its offering to include higher ticket personal and merchant loans to lower risk and high credit-worthy customers.

In December, fintech giant Paytm, backed by Softbank, said it has “recalibrated the portfolio" of less than Rs 50,000 ticket loans—prominently the BNPL Postpaid loan product—and will now be a smaller part of its loan distribution business going forward. With Postpaid, users got credit of up to Rs 60,000 every month at 0 percent interest for up to 30 days, to make purchases, bill payments, recharges and bookings. Now Paytm says it will focus on expanding its offering to include higher ticket personal and merchant loans to lower risk and high credit-worthy customers.

NBFC giant Bajaj Finance had also told analysts in October that it was trimming 14 percent of the business in rural and 8 percent in urban—in small ticket lending—as a preventive measure, because “while they may be short term in nature, represent imprudence".

Successfully pivoted business models

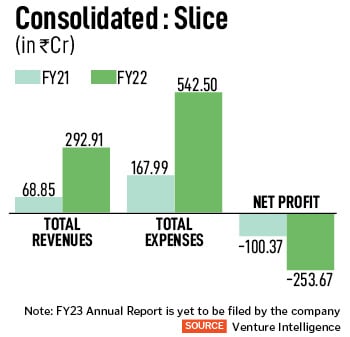

Much before the concerns, some fintechs had already pivoted their business models to meet changing circumstances and regulations. Take the case of fintech unicorn Slice, founded by former Flipkart staffer Rajan Bajaj in 2016 as a BNPL firm, called SlicePay then. After three years of running this model, by 2019, Bajaj realised that BNPL would just not work in India as India was already starting to move away from a high merchant discount rate and they were just not paying good enough fees to the BNPL provider for transactions completed. Unified Payments Interface (UPI) was also already starting to expand rapidly.

![]() Slice took an NBFC licence and—after steady funding from marquee investors—launched prepaid credit card products with SBM Bank (India), which became a hugely successful and rapidly expanding venture. But then the 2022 RBI guidelines came and pinched its growth prospects, forcing Slice to rethink its business model. Bajaj is now working on his dream to make Slice a bank through its ongoing merger with the loss-making North East Small Finance Bank (NE SFB).

Slice took an NBFC licence and—after steady funding from marquee investors—launched prepaid credit card products with SBM Bank (India), which became a hugely successful and rapidly expanding venture. But then the 2022 RBI guidelines came and pinched its growth prospects, forcing Slice to rethink its business model. Bajaj is now working on his dream to make Slice a bank through its ongoing merger with the loss-making North East Small Finance Bank (NE SFB).

Slice is backed by 82 investors, which include 64 institutional investors including Tiger Global, Insight Partners, Moore Ventures, Gunosy, Das Capital and Blume Ventures.

In the case of lending startup Moneytap, it was initially focussed on providing credit for middle-class consumers. After acquiring an NBFC licence, the brand, operating under the neo-banking parent Freo, has expanded multifold into a “diversified, digital banking platform within an app—which caters to three aspects: Spending, saving and borrowing", says Freo’s co-founder and CEO Kunal Varma.

“Lending is about creating long-term advantages in cost of capital and diversifying into various types of lending, such as asset-backed loans. We went down the path of offering other products to our customers, while better understanding their core needs. Freo"s business is to address the core financial needs of an Indian family (pay-save-borrow) within one ecosystem within one app," Varma told Forbes India.

![]() In its early days, Moneytap had experimented with the BNPL model and then transitioned from a lending business into a digital banking platform. “We understood early on that there were challenges in being just a lending business," Varma said, adding that product lines had to go beyond lending lines, which now include credit cards, savings and deposits accounts.

In its early days, Moneytap had experimented with the BNPL model and then transitioned from a lending business into a digital banking platform. “We understood early on that there were challenges in being just a lending business," Varma said, adding that product lines had to go beyond lending lines, which now include credit cards, savings and deposits accounts.

Freo plans to launch its credit on UPI feature soon and has already launched Freo co-branded credit cards with Yes Bank and RBL Bank on the Visa/Mastercard and Rupay platforms. “We are also partnering with Equitas SFB for savings and deposit products," he said. Freo plans to expand selling insurance and other savings and investments verticals in the coming months.

Freo has a quarter of a million customers in the credit cards vertical and overall two million customers across all its products. Varma declined to disclose Freo’s financial performance in FY23 and the revenue run rate or profitability.

Freo has raised near $50 million as of Series B funding in 2020. Varma says the company would look for capital opportunistically, having several years of runway.

BNPL required, but with guardrails

Digital payments in India continue to grow at a massive rate and is expected to grow four times by FY 2026–2027, PwC India has said in its 2023 Indian Payments Handbook. Demand for credit will also continue to grow and in this space embedded finance will remain one of the fastest growing segments in the fintech space.

![]() With the current regulatory restrictions in place—including the capping of the first loss default guarantee (FLDG) of the loan portfolio at just five percent—pure BNPL companies are unlikely to continue to lend rampantly. But there is no doubt that it still forms an essential form of credit.

With the current regulatory restrictions in place—including the capping of the first loss default guarantee (FLDG) of the loan portfolio at just five percent—pure BNPL companies are unlikely to continue to lend rampantly. But there is no doubt that it still forms an essential form of credit.

“BNPL is an essential form of credit. The recent guidelines have helped with guardrails to keep the lenders on prudent track in the underwriting process, which, somewhere was felt amiss and left to the loan service providers/platforms sourcing the transaction," says Saif Khan, chief growth officer at fintech firm PayNearby. “It is a welcome move and would make the BNPL portfolio more robust. Some process realignments would need to be done at both the LSP and the lender end, but eventually I believe this form of checkout credit is here to stay and grow both online and offline."

China and Australia have gone through similar BNPL cycles in recent times, seeing years of rapid growth followed by blowups and bankruptcies, often on the back of poor underwriting.

“There will be a need for loans and there is certainly a credit gap. There is no need to think whether BNPL firms should exist or not. Even the micro-finance ecosystem went through some rough cycles. Hopefully BNPL firms will come out stronger," says Bhavik Hathi, managing director of Alvarez & Marsal"s global transaction advisory group.

![]() “BNPL firms will need to stay disciplined. Promoters need to ascertain if they can hold back on growth it will be a growth verses profitability issue," Hathi said. In the current scenario then, banks and NBFCs will be circumspect in funding for these loans and entities in the next few quarters.

“BNPL firms will need to stay disciplined. Promoters need to ascertain if they can hold back on growth it will be a growth verses profitability issue," Hathi said. In the current scenario then, banks and NBFCs will be circumspect in funding for these loans and entities in the next few quarters.

Business models will depend on how fast companies want to grow and also on how much firms will diversify their lending book in the form of cross-selling of products, de-risking the model through different type of loans and generating more income to deal with low BNPL profitability.

Alvarez & Marsal’s Hathi forecasts that there will be some business model failures in this space. “There will be more failures not necessarily shutdowns but companies which could incur losses, or need a bailout, valuations may drop."

And another black swan event might warrant further RBI action.

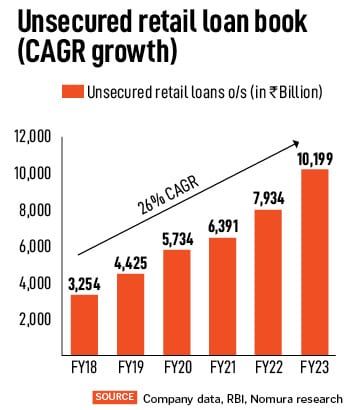

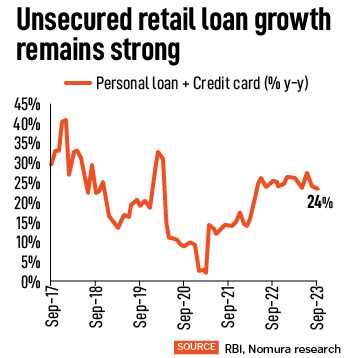

Nomura’s research shows that NBFCs have seen the sharpest increase in exposures to unsecured retail (see chart). Most of the NBFCs (excluding Bajaj Finance and the unlisted HDB Financial Services) have scaled up this segment, from near-zero to 7 percent to 22 percent of their portfolio in just over the past 18-24 months. In the past 18 months, around 25 to 30 percent of incremental growth for NBFCs came from unsecured retail, the Nomura report said.

Nomura’s research shows that NBFCs have seen the sharpest increase in exposures to unsecured retail (see chart). Most of the NBFCs (excluding Bajaj Finance and the unlisted HDB Financial Services) have scaled up this segment, from near-zero to 7 percent to 22 percent of their portfolio in just over the past 18-24 months. In the past 18 months, around 25 to 30 percent of incremental growth for NBFCs came from unsecured retail, the Nomura report said. Some alarm bells have started to ring, getting founders of fintech firms to tweak their business models and diversify into more secured forms of lending. It has also raised the compelling debate of whether pure BNPL has a positive role to play in India’s lending ecosystem.

Some alarm bells have started to ring, getting founders of fintech firms to tweak their business models and diversify into more secured forms of lending. It has also raised the compelling debate of whether pure BNPL has a positive role to play in India’s lending ecosystem. In December, fintech giant Paytm, backed by Softbank, said it has “recalibrated the portfolio" of less than Rs 50,000 ticket loans—prominently the BNPL Postpaid loan product—and will now be a smaller part of its loan distribution business going forward. With Postpaid, users got credit of up to Rs 60,000 every month at 0 percent interest for up to 30 days, to make purchases, bill payments, recharges and bookings. Now Paytm says it will focus on expanding its offering to include higher ticket personal and merchant loans to lower risk and high credit-worthy customers.

In December, fintech giant Paytm, backed by Softbank, said it has “recalibrated the portfolio" of less than Rs 50,000 ticket loans—prominently the BNPL Postpaid loan product—and will now be a smaller part of its loan distribution business going forward. With Postpaid, users got credit of up to Rs 60,000 every month at 0 percent interest for up to 30 days, to make purchases, bill payments, recharges and bookings. Now Paytm says it will focus on expanding its offering to include higher ticket personal and merchant loans to lower risk and high credit-worthy customers. Slice took an NBFC licence and—after steady funding from marquee investors—launched prepaid credit card products with SBM Bank (India), which became a hugely successful and rapidly expanding venture. But then the 2022 RBI guidelines came and pinched its growth prospects, forcing Slice to rethink its business model. Bajaj is now working on his dream to make Slice a bank through its

Slice took an NBFC licence and—after steady funding from marquee investors—launched prepaid credit card products with SBM Bank (India), which became a hugely successful and rapidly expanding venture. But then the 2022 RBI guidelines came and pinched its growth prospects, forcing Slice to rethink its business model. Bajaj is now working on his dream to make Slice a bank through its  In its early days, Moneytap had experimented with the BNPL model and then transitioned from a lending business into a digital banking platform. “We understood early on that there were challenges in being just a lending business," Varma said, adding that product lines had to go beyond lending lines, which now include credit cards, savings and deposits accounts.

In its early days, Moneytap had experimented with the BNPL model and then transitioned from a lending business into a digital banking platform. “We understood early on that there were challenges in being just a lending business," Varma said, adding that product lines had to go beyond lending lines, which now include credit cards, savings and deposits accounts. With the current regulatory restrictions in place—including the capping of the first loss default guarantee (FLDG) of the loan portfolio at just five percent—pure BNPL companies are unlikely to continue to lend rampantly. But there is no doubt that it still forms an essential form of credit.

With the current regulatory restrictions in place—including the capping of the first loss default guarantee (FLDG) of the loan portfolio at just five percent—pure BNPL companies are unlikely to continue to lend rampantly. But there is no doubt that it still forms an essential form of credit. “BNPL firms will need to stay disciplined. Promoters need to ascertain if they can hold back on growth it will be a growth verses profitability issue," Hathi said. In the current scenario then, banks and NBFCs will be circumspect in funding for these loans and entities in the next few quarters.

“BNPL firms will need to stay disciplined. Promoters need to ascertain if they can hold back on growth it will be a growth verses profitability issue," Hathi said. In the current scenario then, banks and NBFCs will be circumspect in funding for these loans and entities in the next few quarters.