To better understand the unprecedented power struggle currently playing out at Bombay House, the headquarters of the storied Tata group, it would be worthwhile to get one’s hands on the epilogue, written by Ratan Naval Tata, to RM Lala’s book The Creation of Wealth: The Tatas from the 19th to the 21st Century.

Ratan Tata writes that after his predecessor and uncle JRD Tata informed him in 1991 that he would be the next chairman of the group, Tata, who turns 79 in December, had told JRD that he would always look to the latter as someone he could turn to. “And although I said that and I meant it, I did have some concerns that Jeh [as JRD was fondly known] would be in the office every day, and he would interfere and that he would forget that he was no longer the chairman, that he would be irritable and render somewhat impotent the moves that I was hoping to make.”

But Tata admits that his initial apprehension with respect to JRD’s interference was unfounded. “He acted as a senior statesman. He was available for counselling, he was available for advice, he was available for guidance. He was my best advisor,” Tata says of his predecessor.

Later in the epilogue, Tata explains the “moves that he was hoping to make,” which he eventually made, to restructure the diversified group to become more competitive, to provide better returns to shareholders, and to be more nimble-footed. “Broadly, the plan was to critically look at various companies through a group mechanism, which in fact did not exist.”

Tata, who was chairman for two decades till 2012, employed some “welding mechanisms”: The creation of the Group Executive Office comprising executive directors of Tata Sons responsible for overseeing the performance of various group businesses, while respecting their autonomy to take decisions the creation of a unified brand with a common logo which would be used and displayed by all the companies a set of operating requirements governing the use of this common brand and a code of conduct to embody the group’s value system.

Tata is widely credited with solidifying the Tata group’s image as a symbol of India’s responsible capitalism, with businesses spread across the world, earning a collective turnover of over $103 billion. And to a large part, his decision to unify these diverse businesses under a single conglomerate structure, with commonality of purpose embodied through common personnel manning various group entities, can be said to have catalysed this success.

During his tenure in the corner office of Bombay House, Tata was the chairman of Tata Trusts, a clutch of philanthropic trusts that collectively own a majority 66 percent in Tata Sons, the chairman of Tata Sons, the flagship holding company of the group and the chairman of the various group operating companies in which Tata Sons was the main promoter shareholder. ![mg_90917_tata_two_280x210.jpg mg_90917_tata_two_280x210.jpg]() THE GENESIS

THE GENESIS

It is little surprise then that when Ratan Tata’s successor was perceived to be tinkering with the conglomerate structure which he had painstakingly put in place over two decades, it created unpleasant ripples.

When Tata passed the baton to the 50-year-old Cyrus Pallonji Mistry—who was given the reins of the business house after impressing a selection committee with his vision for the group—in December 2012, he would have perhaps hoped that the younger son of Pallonji Mistry, whose family owns 18.4 percent in Tata Sons, would think of Ratan Tata as a senior statesman and advisor. Much like Tata thought of JRD while enjoying a free hand to shape the group’s destiny.

Indeed, the pleasant visuals of Tata and Mistry making public appearances together seemed to suggest that that was the case.

When asked what his advice to Mistry was, Tata had remarked that he had asked his successor to “be his own man”. Mistry, significantly, was the first Tata Sons chairman who was not chairman of either or both of the two principal Tata Trusts—Sir Dorabji Tata Trust and Sir Ratan Tata Trust which, together, hold the majority of the controlling stake in Tata Sons.

But as it now appears, being his own man meant different things to Tata and Mistry.

Mistry was taking decisions that were being perceived as being an attempt to dismantle the conglomerate structure of the group and seemingly making Tata Sons and Tata Trusts less relevant. And that was unacceptable to the old guard.

On his part, various communications issued by Mistry suggest that he saw Tata, and the trusts that he continues to chair, as the kind of interference that Tata had hoped he wouldn’t face from JRD.

![mg_90929_tcs_280x210.jpg mg_90929_tcs_280x210.jpg]()

Mistry has defended his strategy of empowering group operating companies to a greater extent by saying that this would lead to more targeted, effective and quick decision-making, keeping in mind the realities in which different businesses operated as well as better corporate governance.

“Cyrus wanted Tata Sons to function as a kind of corporate centre and be a provider of support—mostly financial and strategic in nature—as and when needed by operating companies,” says a source close to Mistry. “His idea was to install people with domain expertise at the level of the group operating companies who would take decisions in the best interests of those entities.”

Sources in the Tata Sons board, however, read Mistry’s moves differently. “Ample indications were given to him that things were not as they should be. There were serious differences of views for some time on a variety of issues. In fact, there were differences on the outlook for the group as a whole—about keeping it cohesive,” a top Tata Sons source tells Forbes India.

He explains that in the structure which Ratan Tata put in place, Tata Sons was one binding shareholder, though its shareholding varies in group companies. Then there were the codes of governance, ethics, and a common management pool through the Tata Administrative Services. “There was a feeling that that was beginning to drift apart and the commonality was fading away.”

As an example of this apparent “fading away”, Tata Sons sources cite an instance in 2015 when the government came out with a defence contract for futuristic infantry combat vehicles. Tata group companies were found to be bidding with different external partners rather than together. This was despite the engineering expertise residing within the group which they feel could have been leveraged to bring a larger, and recurring, share of the Rs 60,000 crore contract to the conglomerate. “People were wondering why two Tata companies were competing rather than collaborating for the same contract,” the source says.

He adds: “I don’t know to what extent Cyrus accepted the fact that the trusts are the owners of Tata Sons. But they are the owners. They don’t behave like typical owners but surely they are very watchful [and ensure] that the activities of the group are not such that their own existence is in jeopardy. Remember, their activities are in philanthropy and not commercial [areas].”

![mg_90921_tata_motors_280x210.jpg mg_90921_tata_motors_280x210.jpg]()

Another sore point in the Tata-Mistry relationship has been the composition and role of Mistry’s core team—his Group Executive Council (GEC)—which was disbanded immediately after Mistry was suddenly replaced as Tata Sons chairman on October 24. Tata veterans and Tata Sons board members have had serious reservations against at least two GEC members who worked closely with Mistry — Nirmalya Kumar, who headed strategy, and Madhu Kannan, who was in charge of business development. While sources close to Mistry maintain that the former chairman was entitled to pick his own team and strongly refute that the GEC was any kind of alternate power centre, Tata Sons sources say there were some GEC members who were acting in contravention to Tata values and ethics.

“So much of the running of the group had been outsourced to two or three people in the GEC. They were intrusive in the affairs of group companies,” the Tata Sons official says.

Just as Tata Sons had issues with Kumar and Kannan, Mistry also seems to have had reservations about the role played by the managing trustee of Tata Trusts, R Venkataramanan. Among other things, Mistry has accused Venkat, as he is popularly known in the group, of pushing Tata Capital to extend a loan to C Sivasankaran that turned bad. A source close to Venkat, however, counters this by saying that the loan was extended to Sivasankaran’s Siva Group after following due process and securing adequate collateral.

It is this divergence of views that is at the core of the bruising—and very public—power struggle which has broken out at the House of Tata. It is a boardroom battle which also has far-reaching implications for Indian corporations at large. Contentious issues range from the level of information which should be shared with controlling shareholders to the role of independent directors (IDs).

GROWING TRUST DEFICIT

While the trust deficit between the two sides had been growing for the last couple of years, insiders say matters reached a tipping point earlier this year when it was felt that important business decisions were being taken without keeping Tata Sons and Tata Trusts in the loop.

Consequently, in a swift and unexpected move, the board of Tata Sons voted to replace Mistry as its chairman on October 24. The resolution to vote out Mistry, who has been a Tata Sons director since 2006, wasn’t explicitly mentioned in the agenda of the meeting. Rather, it was discussed as part of the residual items that merit the board’s attention at the end of every meeting. Sources close to Ratan Tata say that Mistry was offered the option of resigning and making a graceful exit, but he refused. However, those close to Mistry say he was asked to resign only minutes before the board meeting and that the scion of the construction major Shapoorji Pallonji Group chose to opt for a board vote instead. Six members of the board, including Ajay Piramal, Venu Srinivasan, Amit Chandra and Nitin Nohria, voted in favour of his removal, while two—Ishaat Hussain and Farida Khambata—abstained.

The developments that have unfolded since, especially at the level of the group operating companies, have led to the creation of two power centres within the conglomerate. Ratan Tata is back as the interim chairman of Tata Sons and will continue to be so till a selection committee identifies Mistry’s successor within four months. Mistry has dug in his heels to fight what he contends is the shabby treatment meted out to him. He has refused to step down as chairman and as a director on the boards of the various group operating companies. He also continues to be a director on the board of Tata Sons.

![mg_90923_ratan_tata_and_cyrus_mystry_280x210.jpg mg_90923_ratan_tata_and_cyrus_mystry_280x210.jpg]()

But Tata Sons and Tata Trusts, which appear determined to do whatever it takes to get Mistry out of Bombay House, have taken a series of measures to oust him. Mistry was replaced as chairman of Tata Consultancy Services (TCS) with Tata Sons’ finance director Hussain as chairman of Tata Steel with former State Bank of India chairman OP Bhatt and as chairman of Tata Global Beverages (TGBL) with another Tata group veteran Harish Bhat. Curiously, while Mistry has cried foul and questioned the validity of these board meetings and circular resolutions via which he has been removed as chairman, there has been no legal challenge from his side thus far.

Even as all this happened, IDs on the boards of some group companies have expressed their support for Mistry publicly. They include the IDs of Indian Hotels Company (IHCL), Tata Chemicals and Tata Motors who, in varying degrees, have articulated support for Mistry and the management of the companies on whose boards they sit. IDs of companies like IHCL have explicitly named Mistry, while those in companies like Tata Motors have simply referred to him as “chairman”.

Says Vibha Paul Rishi, a former top executive at Future Group who is an independent director on the IHCL and Tata Chemicals boards: “As far as we are concerned, we have done an evaluation of the chairman [Mistry]. As IDs, keeping in mind the interests of all stakeholders, there was nothing we saw to make us change our earlier evaluation.”

TRADING CHARGES

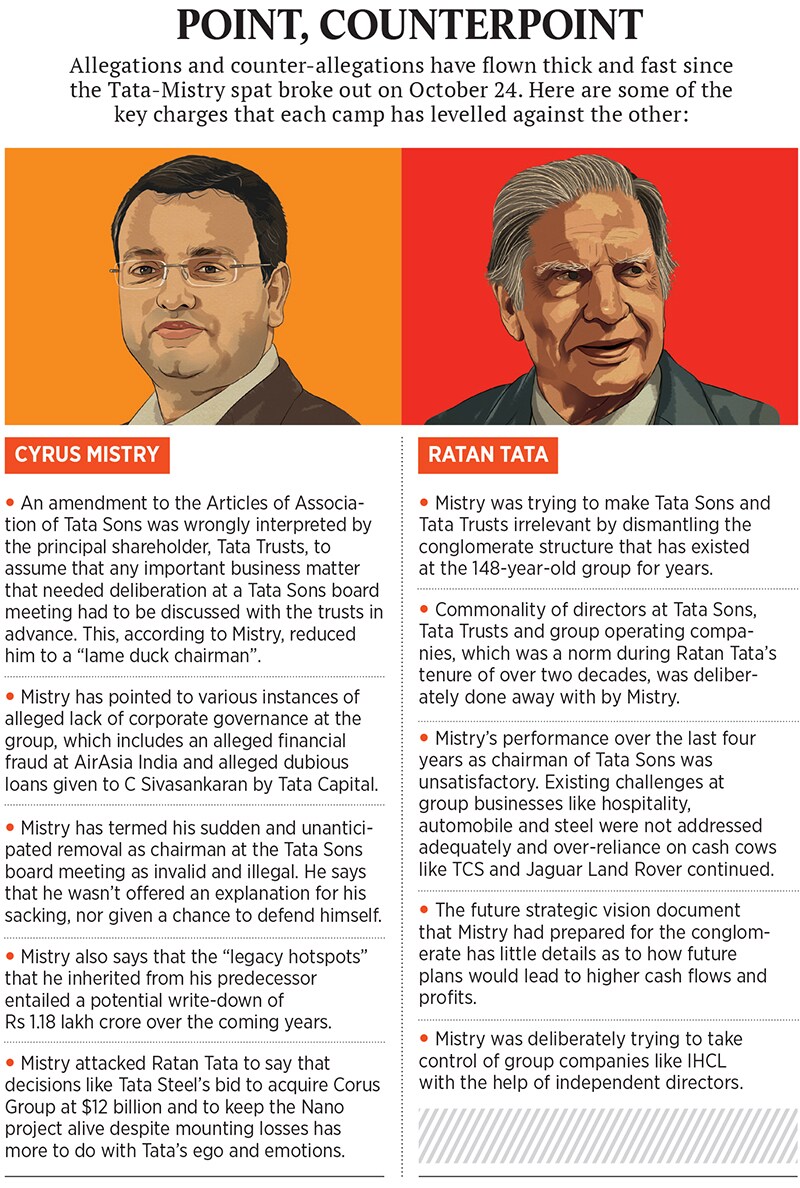

While technical manoeuvres to rid the group of Mistry are being put in place, allegations between the two camps have flown thick and fast and the war of words has escalated by the day.

It began on October 25 with a confidential letter written by Mistry to the board of Tata Sons and the trustees of Tata Trusts finding its way to the media. The missive, which has come to be known as Mistry’s “letter-bomb”, contains some serious allegations. Foremost among them was that Mistry was reduced to being a “lame duck chairman”, with no real authority to do what he wanted to do.

Mistry points to an amendment in the Articles of Association (AoA) of Tata Sons, brought about when he was taking over the job from Ratan Tata, which states that any important business matter that needs to be decided at the level of the Tata Sons board requires the affirmative vote of the Tata Trusts-nominated directors.

A source close to Mistry claims that this amendment was wrongly interpreted to assume that such matters would need to be discussed with the Tata Trusts representatives before they came up for discussion at the Tata Sons board.

He cites an example where Mistry had to meet Ratan Tata and NA Soonawala, also a trustee of Tata Trusts, separately for two to three hours to apprise them of the investment that Tata Teleservices was willing to make to secure spectrum at a government auction. “Mistry had to then repeat the same plan at a Tata Sons board meeting. This was slowing down decision-making and led to confusion regarding Mistry’s role as chairman.”

The Tata Sons source says Ratan Tata was never interested in seeking commercial details from Tata Sons. “He would restrict himself to broader issues like ethics and governance.”

Mistry sought to put in place a corporate governance framework that outlined the roles and responsibilities of various stakeholders within the Tata ecosystem, including Tata Sons, Tata Trusts and the group operating companies. This framework wasn’t implemented.

Sources in Tata Sons contend that, contrary to the Mistry camp’s claim that changes made to the AoA tied his hands, they, in fact, diluted the role of the trusts to give him a freer hand. Article 121 of Tata Sons’ AoA earlier said that certain important business matters like the adoption of a five-year strategy for the group’s future growth, which had to be ratified by the Tata Sons board, needed the affirmative vote of all the Trusts-nominated directors. An amendment, put in place in 2014, now makes it necessary for an affirmative vote from only a majority of the Trust nominees, and not all of them.

“There was a clear enough understanding when Cyrus took over about the relationship between Tata Trusts and Tata Sons. The AoA was amended and the role of the nominee directors of the Trusts emphasised. There was no ambiguity,” says the Tata Sons source.

Another contentious issue in the relationship between Tata Sons and Mistry, and perhaps the straw that broke the camel’s back, was Tata Power’s decision to acquire Welspun Energy’s renewable power assets for Rs 10,000 crore. Tata Sons sources claim that while the deal had already been signed by Tata Power on June 12, it was only brought up for discussion at the Tata Sons board meeting on June 30. “This was like a fait accompli for us at Tata Sons. Though we had reservations about the manner in which the deal had been signed before explaining the details to us, we decided to back it.”

However, the Mistry camp has a different view. Sources close to Mistry say the Tata Sons board was “adequately informed about the transaction from time to time” as Mistry did not want to run the risk of Tata Sons voting against the deal at a later stage. Moreover, as chairman emeritus of Tata Power, Ratan Tata would also have received board papers from the operating company outlining the details of the deal. There are several other charges and counter-charges which have been made, with Mistry’s letter and a Tata Sons nine-page response expressing dissatisfaction with his performance forming the basis of these claims. (See box, Point, Counterpoint.)

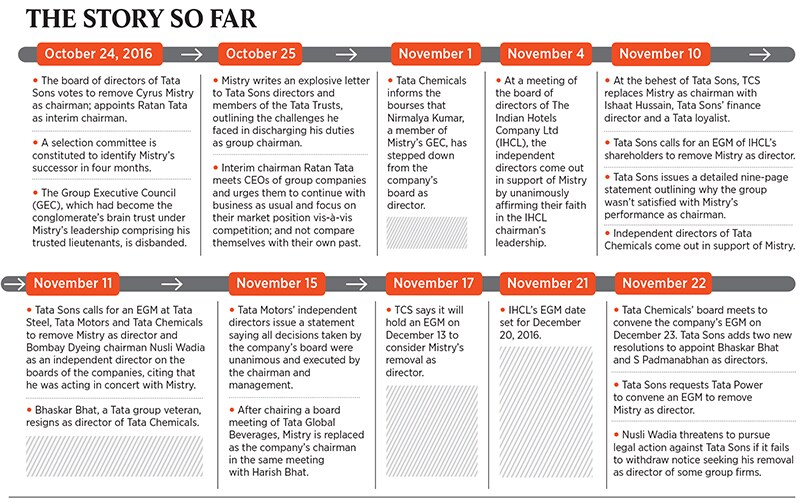

One of the key problems Tata Trusts and Tata Sons face is the group’s excessive reliance on software giant TCS for dividend income. Tata Sons, in its statement outlining the reasons for Mistry’s ouster, says Mistry did not “materially contribute” to TCS’s stellar performance.

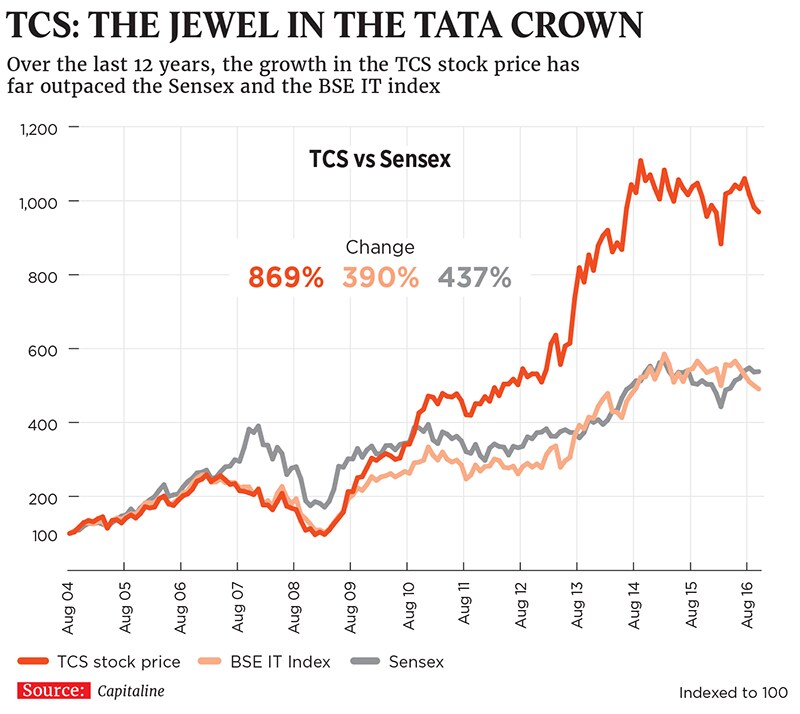

“Dividends received from all the other 40 companies (excluding TCS) have continuously declined from Rs 1,000 crore in 2013 to Rs 768 crore in 2015-16,” Tata Sons says, indicating that other companies, under Mistry’s leadership, didn’t do well enough. Mistry has refuted these charges in a subsequent statement. He says as chairman of TCS, he was actively involved in building global relationships with potential high-value clients “to reinforce the capabilities of TCS for organisations to co-innovate in the digital world”. Moreover, Mistry has contended that “legacy hotspots” like IHCL, Tata Motors’ passenger vehicles business and Tata Steel Europe were inherited by him. He has been trying to address these challenges through measures such as restructuring IHCL’s balance sheet and divestment of assets at Tata Steel Europe for more efficient use of capital.

The view that the group is overly dependent on the fortunes of TCS is also echoed by Tata Trusts.

Says VR Mehta, a trustee of Sir Dorabji Tata Trust: “TCS has an overwhelming share of the dividends coming to Tata Sons. This is dangerous. What happens if the IT sector witnesses challenges? Business patterns are changing.”![mg_90915_nusli_wadia_280x210.jpg mg_90915_nusli_wadia_280x210.jpg]() Tata Sons sees Nusli Wadia as a catalyst in garnering support for Mistry. He denies the charge even as the group attempts to remove him as independent director from three top companies

Tata Sons sees Nusli Wadia as a catalyst in garnering support for Mistry. He denies the charge even as the group attempts to remove him as independent director from three top companies

Image: Sameer Joshi / Fotocorp

THE WADIA FACTOR

Relationships, like business patterns, are also changing as the Tata-Mistry battle plays out. A key figure in this saga is Nusli Neville Wadia, 72, chairman of Bombay Dyeing and one-time close friend of Ratan Tata, who had helped the latter establish his authority in the early years of his chairmanship. Today, however, Wadia finds himself at the receiving end of a notice to eject him as independent director from the boards of three major Tata companies—Tata Steel, Tata Motors and Tata Chemicals. This is because Tata Sons sees Wadia as a catalyst in orchestrating support for Mistry on the boards of the group operating companies, a charge which Wadia vehemently denies.

Wadia, who was also known to be close to JRD, has countered Tata Sons by slapping a notice, asking it to withdraw resolutions moved by the latter seeking his ouster. He has alleged that the special notices seeking his removal were defamatory in nature and asked Tata Sons to furnish evidence that he has been “acting in concert” with Mistry. He has threatened legal action if Tata Sons fails to withdraw the notices.

“By issuing such a letter, it is evident that you have embarked on a personal vendetta against me for discharging my duties as an independent director,” Wadia says in his notice to Tata Sons. “If I was galvanising the independent directors, then you are implying that all the other independent directors of Tata Steel failed to perform their fiduciary duties… and were looking for direction only from me.”

Wadia has also questioned why Tata Sons was not seeking the removal of other IDs who have expressed support for Mistry.

Denying any personal vendetta or attempt at defamation against Wadia, Tata Sons has responded by saying that legally or otherwise, it, as a shareholder, is not required to “provide any reasons” while seeking his removal as director.![mg_90925_tata_group_companies_280x210.jpg mg_90925_tata_group_companies_280x210.jpg]() RAMIFICATIONS FOR INDIA INC

RAMIFICATIONS FOR INDIA INC

L’affaire Mistry has wider ramifications for Corporate India as a whole, much beyond the immediate implications on the House of Tata. Legal experts and corporate lawyers argue that the role of IDs and the manner of their removal are key issues which have been thrown up by the Tata-Mistry tussle.

Says noted corporate lawyer HP Ranina: “Independent directors should not be puppets on a string at the hands of the principal shareholder. They must act on the basis of their own judgement. I think this issue has thrown up the need for Sebi and the government to amend the laws to protect the independence of such directors.”

Ranina, who emphasises that he has never met Mistry, argues that section 169 of the Companies Act of 2013, which provides for removal of directors, should be amended to explicitly call upon those seeking the removal to provide a detailed reasoning why this is necessary. On IDs, he points out that while the Act has a detailed code of conduct for such IDs, the procedure for removal is the same as that for other directors. “I do think that since independent directors are eminent people, their unexplained removal may lead to loss of reputation. This must be addressed.”

Tata Sons, on its part, has contended that Mistry was trying to gain control of group operating companies like IHCL through IDs. “He has cleverly ensured over these years that he would be the only Tata Sons representative on the board of IHCL in order to frustrate Tata Sons’ ability to exercise influence and control on IHCL,” a Tata Sons statement says.

JN Gupta, a former Sebi executive director and founder of proxy advisory firm Stakeholders Empowerment Services, feels that opposition cannot be the only measure of independence. “The directors should not take sides. Let the battle of the individuals be fought outside the board.”

But reality is often different. For now, the IDs find themselves in the eye of the storm raging in the boardrooms of the various operating companies. Says Rishi: “I won’t say I haven’t thought about stepping down, but I haven’t made up my mind. I certainly don’t want to serve in a hostile environment. It is very, very sad.”

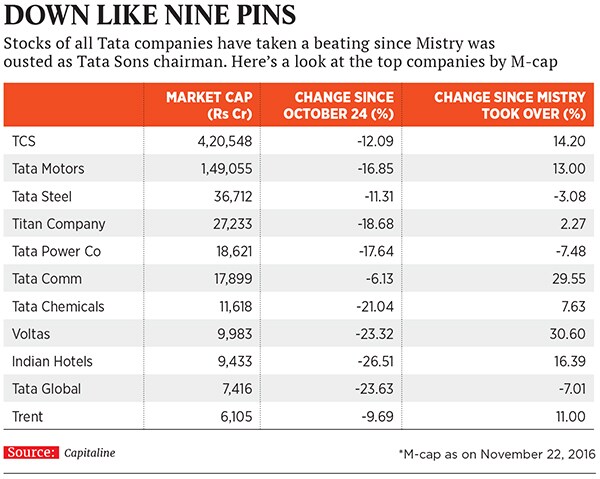

The wealth of Tata group shareholders—both large and small —has clearly been collateral damage in this battle. Ever since Mistry was ousted, key Tata stocks have seen a decline in valuations (see chart Down Like Nine Pins) and the markets have expectedly been rattled.

Says the CEO of a leading financial services group: “For the first time in the Tata group’s history, a full-blown fight is emerging in front of our eyes. The Tata brand will survive but the institution is getting weaker.” He, however, adds that the markets may have now begun to factor in the problem. “Tata group stocks are unlikely to be too affected by current developments. Most group stocks have overcome previous crises. Investors are likely to stay in the long term wherever valuations are attractive.”

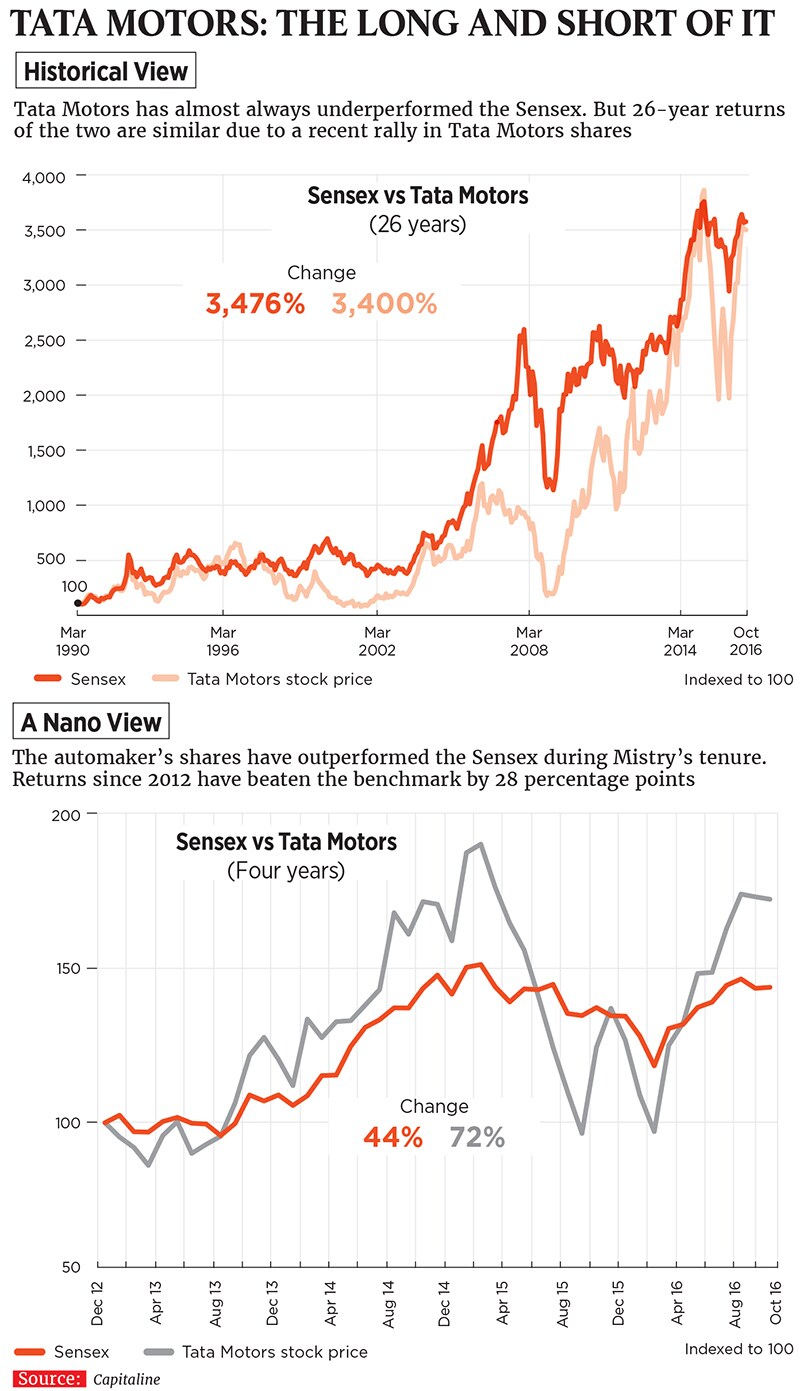

OVER TO SHAREHOLDERS

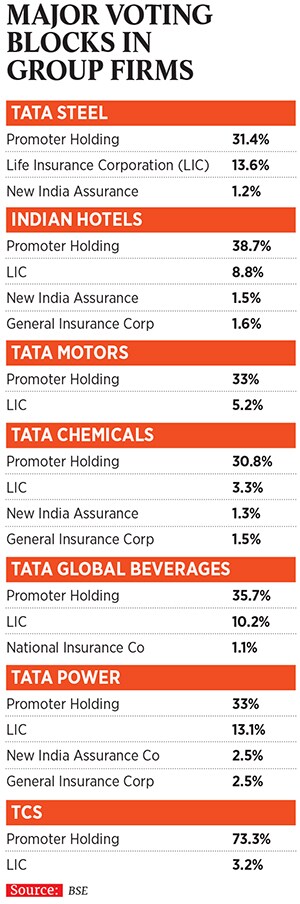

While a board can choose to replace its chairman at a company, the decision of removing someone as a director lies with the shareholders. Tata Sons as the principal promoter shareholder of the group operating companies has called for extraordinary general meetings (EGMs) at IHCL, TCS, Tata Steel, Tata Chemicals, Tata Power and Tata Motors where resolutions to remove Mistry and Wadia will be put to vote. It is expected that at companies like TCS, where the promoters led by Tata Sons hold as much as 73.3 percent, removing Mistry will be an easier task compared to removing him from a company like IHCL. There the promoters hold 38.7 percent and Mistry’s leadership has been endorsed by the IDs who have the fiduciary duty of protecting the rights of minority shareholders.

![mg_90927_tata_investor_280x210.jpg mg_90927_tata_investor_280x210.jpg]()

The EGMs will be held from mid-December, where a key role will be played by public financial institutions like the Life Insurance Corporation of India (LIC) which holds significant stakes across various Tata companies. Currently, LIC is keeping its cards close to its chest even as both Tata and Mistry have been actively lobbying for support with investors. Attempts to get LIC’s views did not elicit a response.

The key question shareholders will have to answer is whether their vote at the EGMs will be a referendum on Mistry’s performance as chairman or the vision the principal shareholder—Tata Sons—has for the future of the House of Tata.

Mistry continues to sit on the Tata Sons board as a director though there is no agreement whereby he is guaranteed a board seat by virtue of his family’s stake.

The question, therefore, is: Will Tata Sons also move to eject Mistry from its board?

Says Mehta: “It will probably come to that. Tata Sons may have to remove him from the board.”

Questions are still being asked about why Tata Sons replaced him as chairman at such short notice without giving him a chance to explain himself. Points out Mehta: “I don’t think that would have worked out well.” Tata Sons sources add that if Mistry wasn’t removed swiftly, he would have had the benefit of incumbency and time to prepare himself against the move. Hence, the element of surprise was essential.

THE ROAD AHEAD

Irrespective of who they may support, most Tata-watchers agree that the continuing battle at Bombay House is doing serious damage to the reputation of the 148-year-old House of Tata, known to place a premium on governance, ethics and humane treatment of its employees. Tata Sons could argue that this is a bitter-yet-necessary pill to swallow in the interest of restoring order at the business house.

One way of ensuring greater cohesion between Tata Trusts, Tata Sons and the operating companies is to go back to the earlier practice of having some common directors across these entities. Towards this end, one of the first things Ratan Tata has done as interim chairman is to induct TCS managing director N Chandrasekaran and Jaguar Land Rover CEO Ralf Speth on the board of Tata Sons. Alongside, Srinivasan, chairman and managing director of TVS Motor, who is a director on the Tata Sons board, has been inducted as a trustee on the Sir Dorabji Tata Trust. This is reminiscent of the times when, during Ratan Tata’s chairmanship, there were names like RK Krishna Kumar, Soonawala and Ishaat Hussain who sat on various group company boards and Tata Sons.

“The next chairman of Tata Sons should ideally also be on the Tata Trusts,” says a senior Tata Sons source. Mehta says this structure is one way of enabling smoother and coherent decision-making since there will be alignment between the objectives of all the entities.

Sections of India Inc feel that the current imbroglio could, perhaps, have been averted if there was a clear and codified relationship between the chairman of Tata Sons, Tata Trusts and the operating companies. For instance, there were no clear deliverables and milestones identified for Mistry on which his performance could have been judged. In his defence, Mistry has cited that the nomination and remuneration committee of the Tata Sons board had lauded his performance as recently as in June 2016.

Says industrialist and Marico chairman Harsh Mariwala: “There should have been clearly identified deliverables for Cyrus and written agreements on what he can and cannot do, and which matters need to specifically be referred to Tata Trusts. Also, a dispute resolution mechanism should have been constituted to iron out potential differences.”

Addressing these issues will be critical, not just to secure the future of the Tata group but also if it wants to attract a top-class professional to take charge as the next chairman of Tata Sons. Names doing the rounds as possible contenders include such internationally known corporate heavyweights as former Unilever Chief Operating Officer Harish Manwani and insiders like Chandrasekaran of TCS and Noel Tata of Trent.

In Lala’s book, Ratan Tata says that he often had differences with JRD. “But he [JRD] allowed those differences to exist. We agreed to disagree very often. But most of the time we were on the same path, maybe the route to the end might have been different.” Given that both Tata and Mistry have said they have the best interests of the Tata group at heart, these words would, perhaps, resonate with both.

Disagreements aren’t undesirable by themselves. But it is the lack of trust that makes them the starting points of serious conflict.

However, despite the discord, there continue to be murmurs of a possible rapprochement between the two sides, particularly after an uneventful board meeting of Tata Power, where Mistry’s chairmanship was not contested.

VR Mehta too does not entirely rule out a middle path. “These [rapprochement] efforts, if they are made, will always remain subterranean until the peace smoke is visible.” He says this will necessarily involve a full package where the settlement will include multiple points and will have to be agreed upon by both sides. “One part could also be to allow him to remain director on the company boards till his term expires.”

But for now, all eyes continue to be on the EGMs where Mistry and Wadia are also expected to make their points to shareholders.

Interestingly, it isn’t as if the mutual respect between the two camps has been completely eroded.

“There are many good qualities in Cyrus—he is well-mannered, soft-spoken and hard-working. This made it [the removal] a very sad business,” concedes the Tata Sons official. “But you could say the trust fell away.”

(With inputs from Samar Srivastava, Salil Panchal and Pravin Palande)

(For ongoing coverage of the Tata-Mistry story, log on to www.forbesindia.com)

THE GENESIS

THE GENESIS

Tata Sons sees Nusli Wadia as a catalyst in garnering support for Mistry. He denies the charge even as the group attempts to remove him as independent director from three top companies

Tata Sons sees Nusli Wadia as a catalyst in garnering support for Mistry. He denies the charge even as the group attempts to remove him as independent director from three top companies RAMIFICATIONS FOR INDIA INC

RAMIFICATIONS FOR INDIA INC