Driving India to a $5 trillion economy through quality and entrepreneurship

Dynamic business owners and venture capitalists share their insights and vision for India's enterprise ecosystem

Despite the twin headwinds of inflation and softening demand, India has been heralded by some as a sweet spot in the global economy.

Despite the twin headwinds of inflation and softening demand, India has been heralded by some as a sweet spot in the global economy.

The country’s GDP for FY2022/23 surpassed expectations, coming in at estimated 7.2% , and it has retained its position as one of the world’s fastest-growing economies, according to the World Bank .

In our India’s Growth Drivers series, we’ve partnered with Barclays Private Clients to explore the key catalysts behind this impressive growth story. And we explore the $5 trillion economic projection currently in India’s sights .

In the first of three panel discussions, we invited leading business owners and venture capitalists to discuss the role of quality and entrepreneurship in shaping the country’s future.

Mohandas Pai is a prolific investor, and the Chairman of Aarin Capital and Manipal Global Education, making him well-qualified to comment on current conditions: “In 1991, India’s GDP was USD275 billion now, in 2023, it is USD2.34 trillion," he explained. “This translates into an 8.2% growth, year after year for 32 years, in dollar terms. This is not an indication of a slowdown."

While the number of start-ups and funded companies is rapidly growing, Mr Pai was quick to remind panellists that it’s quality rather than quantity that investors need to focus on. “Many young entrepreneurs have never built companies before and are learning on the job," he noted. “They understand technology but when it"s their first time managing an enterprise, they may feel overly optimistic with the funding they receive, leading them to make bad decisions. In that sense, the system has to mature."

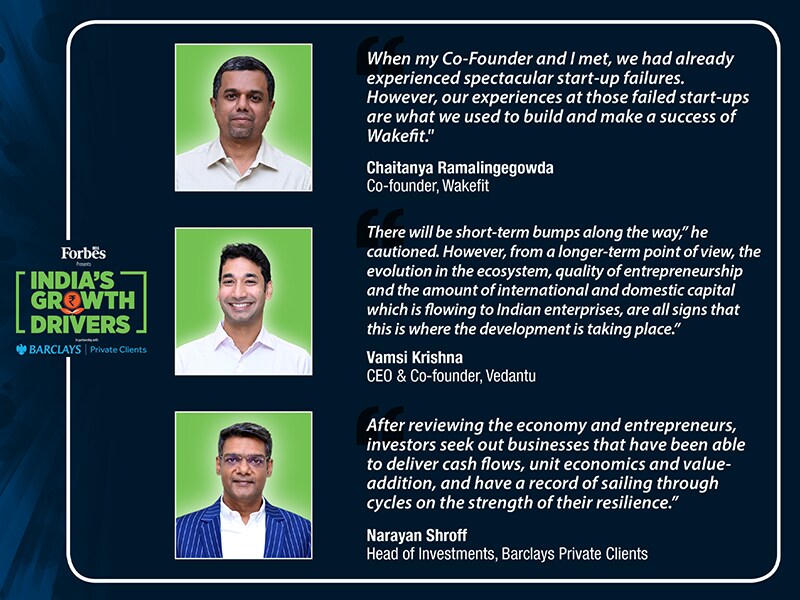

Against that backdrop, Narayan Shroff, the Mumbai-based Head of Investments at Barclays Private Clients, reflected on the international investors sizing up India: “After reviewing the economy and entrepreneurs, investors seek out businesses that have been able to deliver cash flows, unit economics and value-addition, and [have] a record of sailing through cycles on the strength of their resilience," he observed.

For Mr Shroff, India’s recent domestic strengths point towards a bright future. In his opinion, entrepreneurial culture when combined with high quality, comes with three core benefits: an increase in the flow of capital, a reduction in the cost of capital and reduced risk premium. All of which are good news for India’s story.

Bright times ahead?

For seasoned founder, Vamsi Krishna, the CEO & Co-Founder of Vedantu, the outlook for investors and entrepreneurs looks promising. Having started his entrepreneurial journey almost two decades ago, he observed that the quality of entrepreneurship, and the high standards of the business ecosystem, have changed considerably.

“(For business owners and investors) There will be short-term bumps along the way," he cautioned. “However, from a longer-term point of view, the evolution in the ecosystem, quality of entrepreneurship and the amount of international and domestic capital which is flowing to Indian enterprises, are all signs that this is where the development is taking place," he explained.

The value of hard-earned experience

Having been involved in start-ups for over a decade, Gaurav Singh Kushwaha, Founder & CEO, Bluestone.com, has worked through both good and bad times. In his opinion, it’s important to remember that growth is rarely without friction, and so-called ‘funding winters’ - ie: periods of heightened caution and constrained spending – are part-and-parcel of the journey.

In his words: “We have seen multiple cycles over the past decade, and this is not the first time there has been a funding winter. The down-phases help separate good enterprises from the weak ones and that’s important too."

Newer entrants to the start-up universe, like Chaitanya Ramalingegowda, Co-Founder of Wakefit, understands the value of learning from mistakes. As the owner of India’s largest furniture factory that has disrupted the market, he knows what it takes to bounce back from a setback.

“When my Co-Founder and I met, we had already experienced spectacular start-up failures. However, our experiences at those failed start-ups are what we used to build and make a success of Wakefit," reflected Ramalingegowda.

He went on to explain how Wakefit leverages technology to enhance product quality: “If you consider technology very narrowly, in the sense of using IT systems, then we are an IT-enabled business. But if you think more broadly about how we use technology to enhance material science-driven sleep and ergonomics in our products, then we are a tech-first company."

Adopting a client-first mindset

For wellbeing entrepreneur Arvind Varchaswi, client experience is key. As Managing Director of Sri Sri Tattva, he thinks investors would do well to explore a firm’s client strategy, as much as their balance sheet.

“One thing that Sri Sri Tattva has always championed is quality," he stated. “And to begin a global brand, we believe it’s our responsibility to ensure that the value of quality resonates with India too."

While he agreed that a business has to keep unit-economics and return-on-investment on its radar, it must also ensure that it is sufficiently customer centric. He concluded that quality and profitability can go hand-in-hand.

In summary

As the panel session progressed, it became clear that technology was front-and-centre of everyone’s mind when thinking about growth strategies.

On the flip side, the panellists also shared their pain-points and discussed some of the potential solutions. These included government policy support, a simpler indirect tax regime, better digital infrastructure, staff up-skilling and better management of macro-economic indicators like inflation, interest and liquidity.

Nevertheless, there was a consensus that India is well-placed to power ahead with its growth story. And the two most influential catalysts look set to be quality of domestic businesses, and a well-embedded entrepreneurial culture.

Watch the full discussion at www.forbesindia.com/india-growth-drivers

The pages slugged ‘Brand Connect’ are equivalent to advertisements and are not written and produced by Forbes India journalists.

First Published: Jul 13, 2023, 16:13

Subscribe Now