By Jeff Thomson, CMA, CSCA, CAE, President and CEO, IMA

By Jeff Thomson, CMA, CSCA, CAE, President and CEO, IMA

Technological advancements are disrupting industries and displacing jobs at an unprecedented rate. From cashier-less machines at grocery stores to automated touch-screen kiosks that allow fast-food customers to create their own meals, and the self-check-in machines at airports, an increasing reliance on automation appears to pose a threat to the workforce. This is true across industries with jobs that are highly repetitive or mechanical including clerical and professional services positions.

A report by FICCI, NASSCOM and Ernst & Young India titled, "Future of jobs in India: A 2022 perspective" suggests that approximately 20% of jobs in banking and finance sector will be impacted by technology in 2022. Finance and accounting professionals performing routine and repetitive tasks and processes—starting with auditing, transaction processing, and financial accounting—may be replaced by AI, bots, and software which can do the job faster, more accurately, and more cost-efficient.

Considering these trends, what does the future hold for those just about to enter the profession or those who have spent years pursuing a career in finance and accounting?

As the leading resource for developing, certifying, connecting, and supporting the world’s best accountants and financial professionals in business, IMA® (Institute of Management Accountants) conducts independent research to identify trends and issues affecting the profession. For years, IMA has advocated that management accountants expand their skill sets to elevate the profession. Far from needing to be feared as a destroyer of the management accounting profession, technology has the potential to free the finance function or the CFO team to bring more value to their organization.

How?

As Big Data continues to mature, finance professionals will have vast amounts of data at their disposal that can be exploited to create insights, foresights and ultimately value for their organizations. With their more routine tasks outsourced to AI and robotics, management accountants will have more time to focus on higher-level analytics. But first, finance professionals need to adapt new skills and become “future-proof.” They need to acquire knowledge of data extraction tools for mining structured and unstructured data. While they do not need the full expertise of data scientists, they do need to gain a more comprehensive understanding of data to derive greater insights and enable more effective decision-making. This will require upskilling in advanced data analytics, data mining, modelling, visualization, story-telling and strategy management skills.

Below, a young professional shares her first-hand experience on how technology and automation is changing the field of accounting. Additionally, she shares how the CMA® (Certified Management Accountant), IMA’s certification for accountants and financial professionals in business, helped her deal with these technological changes.

“A couple of years back, accountants were considered manual bookkeepers. We rigorously maintained our books in the double accounting format. Now we are more looked at as analyzers of numbers rather than just keeping them in the right place. With the introduction of new bots and software in the world of accounting, we now spend more time analyzing the numbers that the bot gives us and present our analysis to management. Being a CMA has helped me adapt to changes in the world of accounting. Starting with the CMA curriculum, it has given me the skills to help me stay relevant and updated in this era of changing and evolving technology," said Charu Solanki, CMA, Senior Analyst, Goldman Sachs.

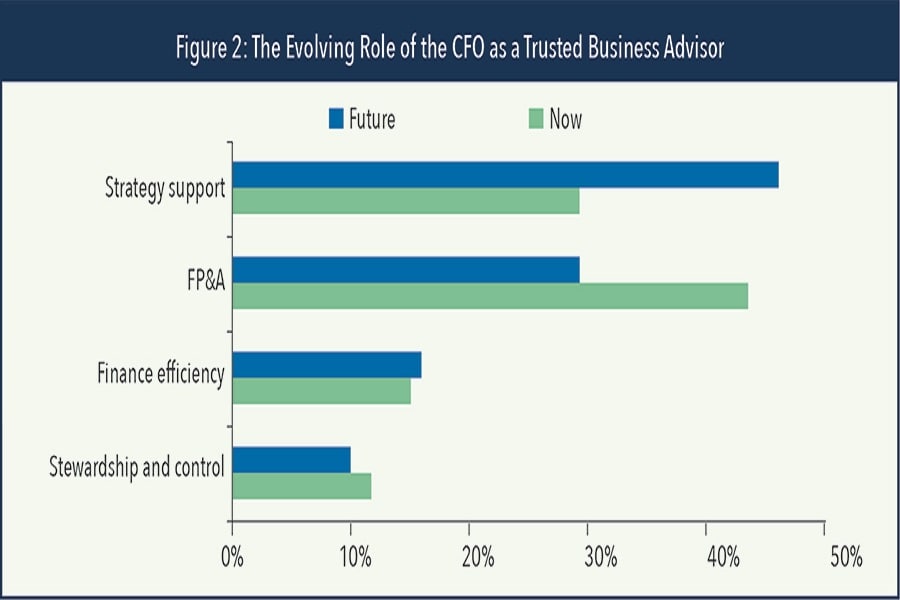

Charu Solanki, CMA, Senior Analyst, Goldman Sachs[br]Over the past several decades, IMA has published numerous research studies documenting the evolution of the role of the management accountant from being that of record keeper and “compliance cop” to that of being a strategic business partner. What we found time and again, was that the potential to provide strategic insights to senior management has been hampered by the need to focus on lower-value-added activities, including transaction processing. Below is a table from a study conducted jointly by IMA and ACCA involving senior finance professionals, called “The Changing Role of the CFO,” which clearly indicates the desire to spend more time on strategy support and less on financial planning and analysis (FP&A).

What competencies does a finance professional need to stay relevant in the digital age?

For finance professionals to carve a niche for themselves, competencies in accounting and finance, though important, now need to be complemented with skills like leadership, business strategy, operations and technical know-how. They need to go beyond their traditional roles and become trusted business advisors. The CMA program’s focus on planning, analysis, and decision support aligns closely with the skills management accounting and finance professionals need now and will need in the future.

The purpose of the CMA program is not solely to put individuals ahead of the competition, but also enhance skills in financial planning, risk management, and strategic management of businesses. Expertise in areas like data analytics, data science, business intelligence, and the exposure to new technologies and their integration at work helps CMAs become equipped to adapt to technologies including AI. To learn more about the CMA® (Certified Management Accountant), please visit this link.

Jeff Thomson, CMA, CSCA, CAE, is the president and CEO at IMA, the association of accountants and financial professionals in business.

Disclaimer: The pages slugged ‘Brand Connect’ are equivalent to advertisements and are not written and produced by Forbes India journalists.

First Published: Jun 07, 2019, 03:25

Subscribe Now- Home /

- Brand-connect /

- Futureproofing-the-cfo-team