Primex Finance to replace centralized prime brokerages

Think De-Centralised Finance, Think Primex Finance

Over the centuries, finance has developed into a highly diversified industry with a wide range of products for everyone, and, to protect that money, traditional finance is highly layered and controlled, often segmenting the global market into national jurisdictions and centralized markets (think NYSE or EuroNext). The crypto world ripped away the regulations, the insularity, the segmentation, and the oligarchic capture to build a truly global, decentralized, and laissez-faire market.

Problems with Traditional Finance

Centralized power in institutions can lead to inefficiencies and inaccuracies, such as the overrating of risk-worthiness of CDOs before the 2007-8 financial crisis. Centralization always means points of failure become more dangerous, too. Moreover, regulators from one jurisdiction may enact stricter regulations or pursue enforcement more zealously, leading to price divergence in mismatched economic environments.

When money and power come into the equation, regulatory violations may be weakly enforced or simply ignored, conferring unfair advantages at the expense of true market value. Furthermore, smaller players may not even be able to enter markets, such as some derivatives products reserved solely for big trading desks.

The layering of the traditional financial system (brokers, clearinghouses, exchanges, and other entities) precludes individuals from directly interacting on exchanges. Even worse, if an individual finds himself or herself on the wrong side of a government, assets can easily be seized because the individual does not have control over their own assets. This applies to centralized crypto exchanges (CEXes), too, where the exchange essentially holds crypto on their balance sheet and user transactions are simply netted off against each other.

Finally, due to layering and lack of direct access, in some markets oligopolies have arisen that exploit their positions by charging significant fees for access to markets. Neo Brokers are changing this, but the issue still remains and is worse in some markets.

Can DeFi Solve Any of This?

Traditional finance has its shortcomings, but can decentralized finance (DeFi) solve them? Do we even need to solve them?

DeFi promises to relocate power into the masses, decentralizing the markets and democratizing access across all borders. Because anyone with an internet connection can participate, regardless of citizenship or location or ideology or anything else, DeFi delivers a truly global market.

Decentralized exchanges (DEXes) also permit direct asset ownership stored on a globally-distributed network, eviscerating governments’ and middlemen’s ability to seize assets. Direct access and ownership means prime brokerages become simply unnecessary.

Furthermore, DeFi is an infrastructure. It is more like the email protocol than an email provider. When one provider (e.g., Gmail) fails, the email protocol still functions and other email providers are not affected. Absent a fatal coding flaw in the smart contract, the entire blockchain would have to fail to take down a DeFi platform.

Due to the absence of brokers and significantly less regulatory enforcement abilities, DeFi also means markets are driven by economic incentives rather than political meddling, ideological considerations, or even social conditions. This reality, coupled with direct ownership, means trust is not nearly as important: economic logic drives behavior and execution is always based on computing logic, no human-based trust needed.

DeFi’s Problems

DeFi is not a panacea. There are drawbacks. One major drawback is that prime brokerages provide some very useful services, such as margin trading and automated trade execution. The former is simply undercollateralized lending for trading purposes, but DeFi’s anonymity disincentivizes lenders from participating. The volatility of crypto markets means risk profiles can change very quickly. Conversely, many margin traders (the borrowers) want to maintain DeFi’s promise of anonymity and thus reject traditional KYC.

For trades to be automated (such as a limit order or stop loss), something must trigger the transaction. For prime brokerages and CEXes, their own backend systems trigger the trades. On the blockchain, another mechanism is required.

Another major drawback is the fragmentation of DEXes. The DeFi space is not as fragmented and captured as traditional finance or CEXes, but some DEXes do not play well with others and margin capital, if even possible, tends to be restricted to the lending DEX’s platform.

Then, DeFi adoption is hindered by complexity in security and poor user interface design, alienating the uninitiated. The DeFi developer community is immersed in IT and computer science all day and may not realize the uneasiness of the general public in trusting their money to esoteric systems.

A Solution for DeFi Margin Trading and Automated Trading

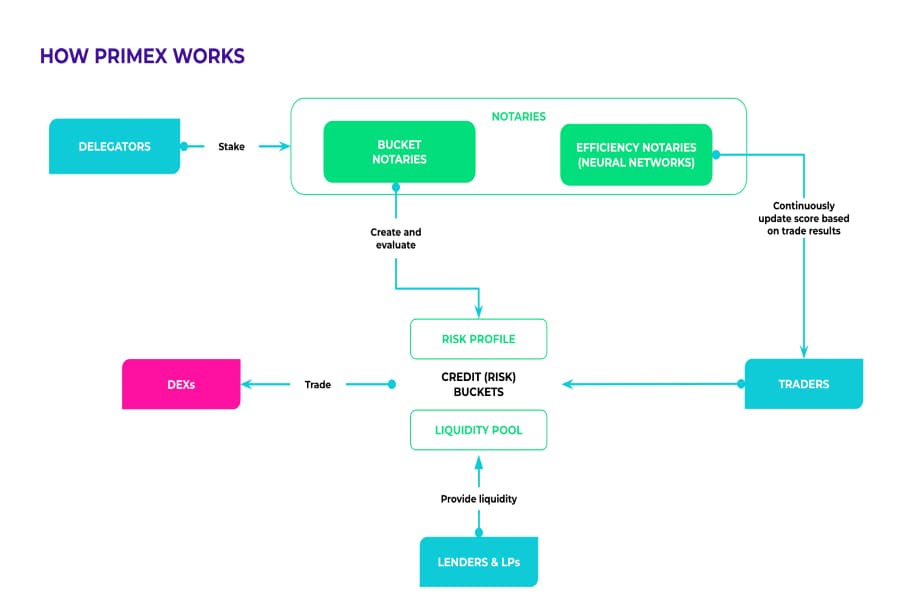

Primex solves these primary issues with various components.

Margin trading is enabled through a system of liquidity pools (Primex credit buckets) with variable and continuously-updated risk profiles. Credit buckets can even restrict traders based on their scores, which are based on past and current profitability (no KYC necessary), and overly risky positions are automatically liquidated. Purely economic incentives drive participant behavior, enabling zero trust. Moreover, Primex Keeper nodes enable automated trading, bringing the other major missing prime brokerage service into the DeFi space.

Primex also enables interoperability between different DEXes, giving traders the freedom to take their borrowed capital anywhere in the DeFi space. This completes the erasure of borders that DeFi initially set out to accomplish. And Primex does it in an easy-to-understand interface that does not intimidate the general public. DeFi’s Future

DeFi’s Future

The world continues to march towards a decentralized, borderless, distributed financial system that is digitally native and a true democratization of financial markets. Traditional financial institutions have their place and will remain for a long time to come, but DeFi will continue to advance and become mainstream. Primex’s solutions for margin lending, risk management, DEX-agnosticism, and automated trading will play a central role in bringing about that mainstreaming.

The pages slugged ‘Brand Connect’ are equivalent to advertisements and are not written and produced by Forbes India journalists.

First Published: Apr 06, 2022, 17:05

Subscribe Now