Budget 2018: High on hope

From banking to aerospace, every sector is buoyant with expectations from the upcoming Budget. As February 1 looms, hope springs eternal

Illustration: Chaitanya Dinesh Surpur

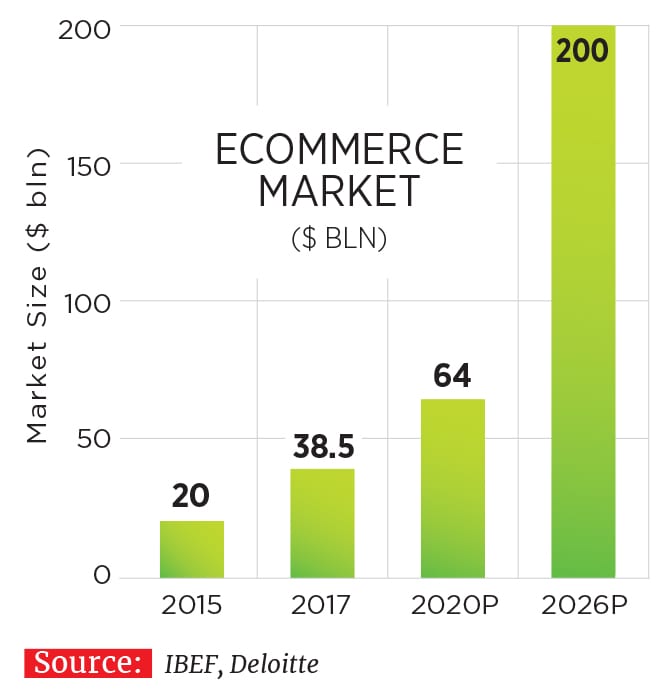

1. ECOMMERCE

The size of the Indian ecommerce market is estimated to touch $40 billion in 2018. Good policy and fiscal support, especially around GST, can catalyse growth in the sector.

Challenges

&bull Large number of consumers, especially in rural areas, cannot access digital transactions.

&bull Logistics account for 2-10 percent of the cost of ecommerce.

&bull FDI policy for sector is still evolving.

&bull There are grey areas around characterisation of ecommerce transactions for tax treatment, especially for foreign players.

&bull GST has resulted in additional compliance requirements.

&bull Working capital has been choked due to additional GST on stock transfers.

&bull The Composition Scheme—wherein taxpayers can get rid of tedious formalities and pay GST at a fixed rate of turnover—is not available for ecommerce transactions.

&bull There is lack of clarity on tax treatment of cash-back schemes, gift coupons and vouchers.

&bull While the law mandates passing on benefits that businesses accrue from GST to end-consumers (anti-profiteering), there is no clarity on the methodology to be followed. Expectations from Budget 2018

Expectations from Budget 2018

&bull Incentivise cashless transactions.

&bull Reduce logistical costs by slashing GST on tyres.

&bull Incentivise technology and sourcing agreements between kirana stores and foreign ecommerce players.

&bull Bring clarity on how ecommerce transactions should be treated under GST.

2. RETAIL

The Indian market provides a good opportunity for the retail sector to flourish, with robust demand, increasing investments and innovation in financing. Adoption of digital technology and ecommerce is the way forward for the sector. Challenges

Challenges

&bull Lack of proper infrastructure and an under-developed supply chain have resulted in inefficiencies and higher costs. Coupled with rising real estate rates, this has hit profitability.

&bull Demonetisation has impacted sales and footfalls.

&bull Though GST has been positive, ambiguity remains on transitional credit for existing stock and anti-profiteering rules.

&bull Multiple changes in GST rates have made transitions difficult and, in some cases, resulted in higher prices.

&bull There is a dearth of skilled workers at the management and operational levels.

&bull Despite several relaxations in FDI policy, multiple regulatory bodies are slowing decisions.

&bull Kirana store owners perceive foreign players as a threat to their livelihood. Deep discounting by e-tailers has bred insecurity among them.

Expectations from Budget 2018

&bull Focus on developing infrastructure and the rural sector.

&bull Reduction of GST rates for consumer goods and clarifications on transitional credit and anti-profiteering can help reduce prices.

&bull Budget 2018 should relax conditions for income-tax incentives related to employment generation in the sector.

&bull Government could sponsor training programmes or incentivise training initiatives of private players to take on the challenge of inadequate skilled manpower.

&bull Clarifications on open issues and measures for ease of doing business, including those related to return-filing timelines, their revisions and relaxation of non-compliance penalties would be welcome.

&bull Technology and sourcing collaboration agreements between small players and foreign investors must be created to promote trust and avoid oligarchy.

&bull Simplification of compliance procedures under GST and scaling up of IT infrastructure to ease compliance.

3. AVIATION

Domestic airline passengers in India stood at around 104 million in FY17, up by 22 percent from the previous fiscal. This fast growth in passenger traffic is increasing the pressure on existing airports.

Challenges

&bull Most of India’s 40 largest airports are likely to exceed their capacity within a decade Mumbai and Chennai are fast approaching saturation.

&bull There is no roadmap for safety enhancement, airport capacity expansion or improving the quality

of services at airports run by the Airports Authority of India.

Expectations from Budget 2018

&bull Consider tripling airport capacity within 15 years at a cost of ₹3 lakh crore.

&bull Reduce VAT on aviation turbine fuel to 1 percent.

&bull Enable private sector to operate and maintain airports in tier-II and tier-III cities and develop underserved airstrips and airports.

&bull Set up skill development centres for technical and service staff so that they can play their roles to perfection.

&bull Set up centres to develop skilled personnel for aerospace manufacturing.

&bull Promote energy-efficient airports.

&bull Expand e-visa initiatives to more countries.

&bull Bring airport operations and maintenance under public private participation (PPP).

&bull Finalise guidelines for use of drones for civil purposes.

4. AEROSPACE & DEFENCE

At around $55.9 billion in 2016, India’s military spending is the fifth largest in the world and the country is also the world’s biggest arms importer. Challenges

Challenges

&bull Only 15 percent of India’s military equipment is state-of-the-art 50 percent is obsolete.

&bull Procurement procedures of the defence ministry are time consuming.

&bull Lack of cutting-edge manufacturing facilities is responsible for India’s large defence imports.

&bull Offset credit can be claimed by foreign defence companies only for equity investments in joint ventures and not for portfolio investments.

Expectations from Budget 2018

&bull Consider 100 percent FDI under the automatic route to encourage global participation from original equipment manufacturers and to expedite technology transfers.

&bull Bring tax exemption for private players that enter into transfer of technology agreements with foreign companies.

&bull There should be development of relevant skillsets and tax rationalisation to retain maintenance, repair and operations activities.

&bull Weighted tax deduction for R&D spends, which will be phased out after March 31, 2020, should be extended by five years.

&bull The 15 percent tax deduction for investment in new plant or machinery, which was available for all sectors until March 31, 2017, should be extended for aerospace and defence. &bull Procurement costs should be slashed through exemptions or by lowering GST.

&bull Procurement costs should be slashed through exemptions or by lowering GST.

&bull Government can accord ‘infrastructure’ status to the defence sector for claiming various benefits, such as tax holidays.

5. HEALTH CARE

India can achieve its health care goals by tapping digital and other modern technologies, through targeted budget allocations, that will make surveillance, monitoring and various health care programmes feasible.

Challenges

&bull In 2017-18, government spending on health care was a dismal 1 percent of GDP, compared with 7-12 percent in many developing countries.

&bull Malnutrition, air pollution, contaminated water and lack of sanitation remain some of the leading risk factors.

&bull The National Nutrition Mission needs more funds.

&bull Health care has to be made more affordable and equitable with price controls on medical devices.

&bull Penetration of health insurance schemes remains low.

Expectations from Budget 2018

&bull Health care services should continue to be exempt from taxes under GST.

&bull High taxes (12-18 percent) levied on inputs such as consumables and medical equipment must be reduced.

&bull The government must enhance the limit of non-taxable medical reimbursement to at least ₹50,000.

&bull For taxation, pro-rata deduction of single premium paid in a year should be allowed over the term of a medical insurance policy.

&bull Deductions on health insurance under section 80D may be enhanced to ₹40,000 for individuals and ₹50,000 for senior citizens.

&bull Tax exemption on preventive health checkup under section 80D should be raised to ₹20,000 from the current ₹5,000.

&bull Weighted deduction available under section 35AD to a taxpayer engaged in building and operating a hospital must be restored to 150 percent (currently 100 percent) to reduce cost burden on patients.

&bull Liberalise provisions of section 35AD to include new hospitals with less than 100 beds.

6. LIFE SCIENCES

The government’s proactive policies have helped domestic private pharma companies build scale, with Indian generic firms recognised the world over as critical partners for providing safe and low-cost medications.

Challenges

&bull Local innovation is discouraged.

&bull There must be more government focus on chronic diseases such as diabetes and cardiovascular ailments, including tax incentives for patients.

&bull Promote cutting edge R&D to help Indian players transition from pure-play generic companies to branded pharma firms.

&bull Financial and non-financial incentives are needed to increase Indian companies’ presence in the manufacture of active pharmaceutical ingredients.

Expectations from Budget 2018

&bull Concessional tax rates for patent royalties received from overseas.

&bull Concessional tax rate on royalty must be extended to include know-how, copyrights and trademarks.

&bull Tax deductions for expenditures incurred on marketing and protection of patents.

&bull Concessional tax for successors of mergers and demergers or inheritors of inventions.

&bull Expenses in connection with payment to doctors should be available for tax deduction.

7. PUBLIC FINANCE

It is hoped that Budget 2018 will focus on fiscal consolidation, while releasing adequate resources for accelerating growth.

Challenges

&bull The government has to reduce its fiscal deficit to 3 percent of GDP and revenue deficit to 1.6 percent of GDP from the prevailing 3.2 percent and 1.9 percent, respectively. Expectations from Budget 2018

Expectations from Budget 2018

&bull A fiscal council to monitor progress of rule-based fiscal policy should be established.

&bull The Budget should mandate tax authorities to progress with the recommendations of the Tax Administration Reforms Commission, which suggests changes in structure, improvement in taxpayers’ service, enhanced use of information and communication technology, exchange of information with other agencies, revenue forecasting, predictive analysis and research for tax governance.

&bull The Budget should focus on generating resources and improving governance through strategic disinvestments, starting with Air India.

8. CONSUMER AND INDUSTRIAL PRODUCTS

A tax-payer friendly, transparent GST regime and incentives to promote infrastructure and the rural sector will provide an impetus to the overall growth.

Challenges

&bull Consumer products companies have been impacted by GST with supplies remaining muted in recent months.

&bull Consumer demand has not been picking up at the desired pace.

&bull Consumer Price Index-based inflation rose to a 15-month high in November 2017.

&bull Manufacturing companies have

been hit by a slowdown in capital goods demand.

Expectations from Budget 2018

&bull Measures to pass on benefits of GST to consumers will boost demand.

&bull Strengthen agricultural supply chain to manage price fluctuations.

&bull Law curbing anti-profiteering.

&bull Articulate a better PPP framework to increase investment flow to infrastructure projects.

&bull Improve efficacy of GST implementation to reduce supply chain costs.

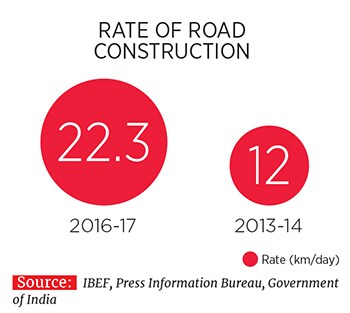

9. TRANSPORT SECTOR

The transport sector is an important contributor to India’s growth. It is important to focus on regional airline connectivity, promote electric vehicles, enhance last mile connectivity and address skill gaps in the sector.

Challenges

&bull The central government plans to build 83,677 kilometres of roads over five years by spending ₹7 lakh crore, the bulk of which will have to be borne by the government.

&bull Most Indian cities are not equipped to provide sustainable transportation options leading to growth of motor vehicles and the inability to popularise electric vehicles.  Expectations from Budget 2018

Expectations from Budget 2018

&bull Infrastructure companies would like revenue to be taxed during the operation and maintenance period and not during the construction period.

&bull Scale-up high-speed train network.

&bull A large commitment by Indian Railways for development of stations.

&bull Public listing of Ircon, IRFC and IRCTC to unlock value for Indian Railways.

&bull Measures to develop a seamless payment infrastructure in ports and integrate payment infrastructure at tolls and fuel retail outlets.

&bull Eliminate differential tax treatment for shipping industry.

&bull In urban transport, promote sustainable financing via dedicated funds.

&bull National Urban Transport Fund must be created at the national level and state governments should be encouraged to generate additional funding.

&bull Take adequate measures to meet target of 100 percent vehicle electrification by 2030.

10. ENERGY & RESOURCES

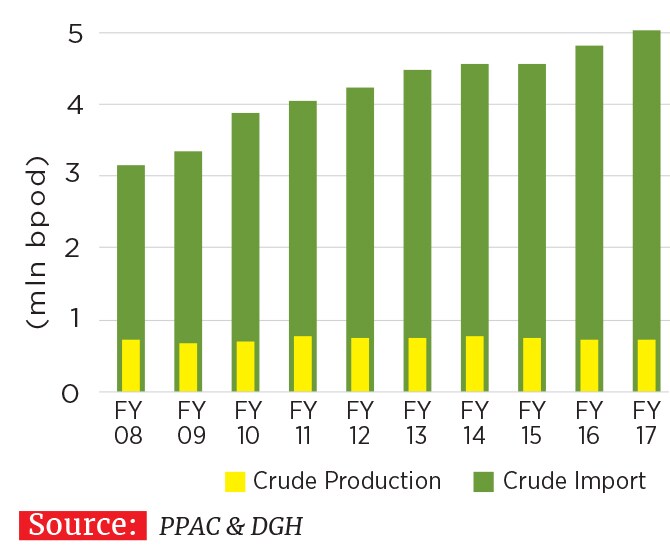

India is the world’s third largest consumer of crude oil and petroleum products and the second largest refiner in Asia. The fortunes of this sector are strongly linked to the development of infrastructure.

Challenges

&bull Mining sector carries the risk of non-productive mines where companies invest huge capital.

&bull Slow economic growth and reduced demand have affected the sector.

&bull Given the PM’s vision of reducing import dependence for energy needs, there must be more private players in oil and gas exploration. Expectations from Budget 2018

Expectations from Budget 2018

&bull The promised reduction of corporate tax rate from 30 percent to 25 percent announced in Budget 2015 is yet to be applied to all sectors.

&bull Abolish Minimum Alternative Tax (MAT): While the I-T Act has moved from profit-linked incentives to investment-linked incentives, its benefits can be enjoyed only if MAT provisions are done away with.

&bull Consolidation of tax returns for infrastructure and energy companies.

11. OIL & GAS

According to BP Energy Outlook 2016, India’s energy consumption is projected to grow at 4.2 percent per annum up to 2035, faster than all major economies in the world. With the continued dependence on fuel imports, ensuring energy security is crucial to sustain the country’s growth momentum. Challenges

Challenges

&bull The government has embarked on a mission of ‘24x7 power for all’ by March 2019.

&bull The MAT rate of 20 percent of book profit for exploration and production (E&P) is a significant deterrent for overall investment.

Expectations from Budget 2018

&bull The government should consider reducing MAT rate for E&P operations.

&bull Petroleum products should be brought under GST to enable free flow of credit and avoid cascading of taxes.

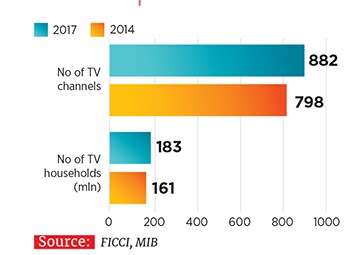

12. MEDIA AND ENTERTAINMENT

The media and entertainment market in India was estimated at $20.5 billion in 2016. The country is the second largest television market globally and its film industry churns out the largest number of movies in the world annually. Challenges

Challenges

&bull Benefits of carrying forward tax losses during consolidation is not available to the broadcasting sector.

&bull The sector cannot claim benefits of the safe harbour provisions, which internet companies, for instance, use to protect themselves from copyright infringement cases.

&bull Broadcasting is capital intensive and requires financing at a lower cost and the segment has not been granted infrastructure status.

&bull India has a screen density of 6 per million people which is significantly lower than the US (126 per million) and China (30 per million).

&bull The requirements to obtain a cinema licence were drafted in 1952 and have not been updated. About 15-20 approvals are needed.

Expectations from Budget 2018

Expectations from Budget 2018

&bull The government should consider treating broadcasting as an industrial undertaking.

&bull A single-window clearance mechanism should be introduced

for setting up screens.

&bull Tax holidays for new multiplexes or for conversion of single screen to multiplexes.

&bull Even with GST, local authorities levy tax on movie tickets. This should be discontinued or a corresponding reduction in GST should be provided.

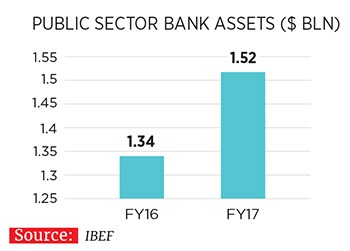

13. BANKING & INSURANCE

The financial services sector needs structural incentives to provide solutions for raising capital and refinancing credit. Challenges

Challenges

&bull Income of banks from most sources is subject to TDS. This creates a huge volume of TDS certificates.

&bull Units located in International Financial Service Centres (IFSC) are provided with a MAT rate of 9 percent this is not globally competitive (Dubai 0 percent, Malaysia 3 percent).

&bull Costs of private health care have risen but section 80D allows a maximum deduction of just ₹25,000 for qualified medical insurance expenses.

Expectation from Budget 2018

&bull NBFCs must be treated at a par with banks for tax provisions.

&bull Provide blanket TDS exemption for payments to banks.

&bull Abolish MAT for units in IFSCs and increase tax holidays.

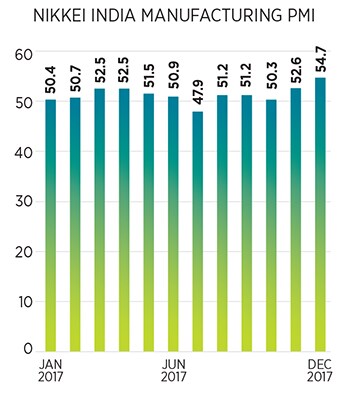

14. MANUFACTURING

The manufacturing sector is estimated to touch $1 trillion by 2025 accounting for about 25-30 percent of the GDP, providing 90 million jobs. With its geographic advantage and huge labour pool, India can be a global manufacturing hub. Challenges

Challenges

&bull Stronger consumerism in the domestic market and sustained availability of high-skilled, low-cost manpower is needed.

&bull Disputes relating to indirect tax incentives promised to MNCs in India by state governments have

not been resolved.

Expectations from Budget 2018

&bull Relaxation in tax compliance and fast track settlement of long-pending tax cases.

&bull Matters decided by courts or tribunals in favour of taxpayers should be implemented by lower authorities without delay.

&bull Reducing MAT rate

First Published: Jan 26, 2018, 07:17

Subscribe Now