Tech Mahindra: Vineet Nayyar's winning bet forges ahead

Vineet Nayyar gambled that by taking over a discredited rival, he could put Tech Mahindra into the Big 5 of India's IT industry. This year, it alone makes the list

When Tech Mahindra took over scandal-ridden Satyam Computer Services in 2009, the naysayers were numerous. Satyam’s founder, B Ramalinga Raju, had perpetrated the largest fraud in Indian corporate history by fudging accounts to the tune of $1 billion. Tech Mahindra’s entire annual revenue was just shy of $1 billion. And Satyam had 40,000 employees, thousands more than Tech Mahindra.

Vineet Nayyar, the vice chairman and managing director, knew very well what he was up against—a minefield of legal and regulatory issues, sagging employee morale and customers who were ready to walk out. “Taking over Satyam was an act of madness, an act of desperation,” he says today, sitting in his office in New Delhi. “We had to repair an institution that was completely destroyed in many ways. It was an institution that was built on a lie.”

Tech Mahindra, however, needed Satyam. It was too dependent on one industry—96 percent of its revenue came from telecom customers. Satyam brought with it customers in banking, health care and retail. So Tech Mahindra, of India’s famed Mahindra & Mahindra stable, took a 43 percent stake for $585 million and completed the merger with a share swap in 2013.

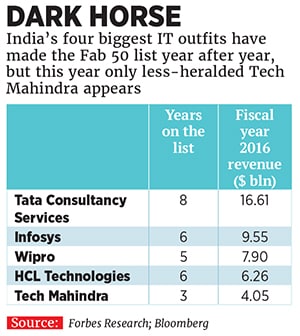

Fast forward and Tech Mahindra is now the fifth-largest IT services company in India, with more than 100,000 employees, $4.05 billion in revenue and $477 million in net profit for the year ended March 31. All five of these IT companies have made the Fab 50 multiple times, but this year, only Tech Mahindra cracks the list. “The Satyam takeover looked like a gamble,” says Ashish Chopra, an analyst at Mumbai’s Motilal Oswal (which does not have an investment-banking relationship with the company). “But you have to give it to them. They managed to get the house in order, and now they are doing very well in the non-telecom business as well. It speaks to the management’s acumen in winning new business.”

Since Satyam, Tech Mahindra has made more acquisitions: Indian telecom-software company Comviva for mobile money and payment solutions, Lightbridge Communications in the US for network-engineering services, Italian auto designer Pininfarina for automotive and industrial design, and France’s Sofgen for banking and wealth-management offerings.

The latest purchase was in June—Bio Agency, a digital company in the UK. And it’s now looking to buy Target Group, also from the UK, to boost automation in the lending, investment and insurance segments. “We are not Infosys, we are not Wipro,” explains Nayyar. “We are a Johnny-come-lately. So we run a bit harder. We are a hungry lot, and we are arrogant enough to believe that with the right tenacity, we can take a broken piece and make it work.”

But integrating acquisitions such as Lightbridge and Sofgen has hit margins. Tech Mahindra had to digest the currency impact and cope with a radical revamp of its business mix. The $240 million Lightbridge deal in 2014 involved taking on a company with four separate businesses and operations across 50 countries. “Lightbridge has caused more pain than gain thus far,” says Chopra. “But in another quarter, the right-sizing should be complete.”

It has already discontinued many of Lightbridge’s low-profit businesses, such as civil work. “We are on the path to making it work. I don’t see any huge impediment that’ll slow down our momentum,” says Nayyar, who took home a $27 million paycheque this year (including stock options that were cashed in), one of the largest in corporate India.

Nayyar is now 77 and served in an executive post until August of last year, when he became non-executive vice chairman playing a strategic and mentoring role. He brings the experience of many worlds to Tech Mahindra. A former bureaucrat with the Indian Administrative Service, he started as a district magistrate and then worked in the agriculture department in the northern state of Haryana. Then came stints at the World Bank heading the energy, infrastructure and finance portfolios for East Asia and the Pacific. In 1986, he became the founding chairman of the Gas Authority of India, where he oversaw the construction of one of the largest gas pipelines in Asia.

His IT avatar began in his late 50s when he became managing director of IT heavyweight HCL and also co-founded HCL Perot Systems. (Nayyar is not to be confused with Vineet Nayar, who worked at HCL and later was vice chairman and CEO of HCL Technologies.) He joined Tech Mahindra almost a decade later in 2005, when it had revenue of just $210 million. Observers say that with his ability to keep his head above water, he has steered the company through many a crisis.CP Gurnani, the company’s 57-year-old CEO and managing director, recalls when a Satyam customer filed a lawsuit in Texas claiming $1 billion in damages. All hell broke loose. “But [Nayyar] was Mr Calm,” he says. “Even in the worst of situations he brings in a level of maturity and warns us about the short bends in the road ahead.”

The customer finally settled for $70 million. Analysts say Nayyar and Gurnani—two decades apart in age—represent a unique partnership. While they’ve expanded their lineup of services, they’ve also tapped Tech Mahindra’s legacy strength in telecom. It’s the leader in this field, beating the likes of Infosys, Wipro and Tata Consultancy Services.

Tech Mahindra started in 1986 as a joint venture between British Telecom and Mahindra & Mahindra. For nearly two decades, Mahindra British Telecom (as it was known) relied on its British Telecom account. Then it reeled in other telecom customers, notably AT&T and Vodafone. Telecom providers still make up half of its revenue, but there are more customers across multiple regions.

The company’s other main focus is on digital solutions, which comprise more than a fifth of its revenue. This is expected to go to 70 percent in the next few years. In line with this it has identified 13 sectors where digitisation and automation are key mantras. Tech Mahindra has also hired a chief digital officer from US software giant Oracle.

The trend toward more automation means more business for Tech Mahindra, but it also promises huge changes for its own sector. India’s IT services industry is projected to lose 640,000 low-skilled jobs to automation in the next five years. High-skilled jobs would be added. (Tech Mahindra wouldn’t quantify the exact impact for the company.) “This is a reinvention,” says Nayyar. “It’s suicidal in some ways, but it’s imperative that we do this. If we don’t push, we’ll become irrelevant.”

That’s why the company is expanding its play in Artificial Intelligence, robotics and machine-to-machine communication. Gurnani calls the digital transformation the company’s biggest challenge. “We have to move from being an IT provider to a DT [digital, design and data transformation] provider. There’s not a boardroom in this world where the impact of the digital economy is not being discussed.”

At Tech Mahindra, examples of digitisation are rife across several sectors. When one of its customers—a global property insurer—faces a hailstorm, it sends out drones to take pictures and come up with an assessment. In another instance, Tech Mahindra works with aircraft manufacturer Bombardier to study an airplane while it’s flying, providing real-time data management, fault notification and diagnostics.

But however newfangled the technology gets, Tech Mahindra relies on good old customer service to keep the business humming. As Nayyar puts it: “In our business, the work isn’t done until the customer is fully satisfied. My obsession is such that we’ll go multiple miles to ensure that the customer is satisfied even when our work has been done and the payment is done. We never lose a customer.”

First Published: Sep 26, 2016, 07:20

Subscribe Now