Critics say Bitcoin may go $0 this time, three signals suggest otherwise

Rumors about Bitcoin (BTC) losing its value are going around, but certain indicators like on-chain data show that buy-in at the current time could prove to be beneficial

Image: Shutterstock

Image: Shutterstock

For the past few months, Bitcoin has been seeing a steady decline in value, hitting a new 2022 low of $17,600 in June. The current bear market has proven tough for investors to deal with.Many experts are predicting the demise of the King coin with the ‘Bitcoin is dead’ predictions rife again, but the latest indicators and signals may prove these predictions a hoax call.

Regular BTC users have quite a few indicators and on-chain metrics at hand to determine whether BTC is in a buy zone, and it"s time to take a closer look at them. Let us look at what these metrics suggest now and if 2021 was Bitcoin"s last epic moment.

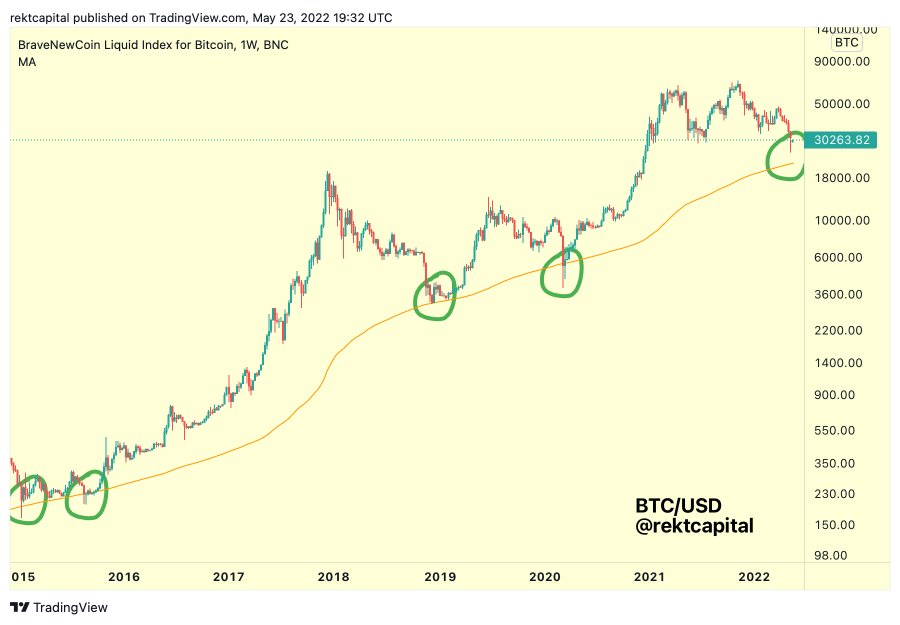

Some Bitcoin traders only purchase 200-week moving average (MA) bounces, and this has historically worked as a strong level of support, as illustrated in the chart below from market analyst Rekt Capital. The lows established in prior bear markets have occurred in locations near the 200-MA, which has effectively served as a major support level, as represented by the green circles.

Source: Twitter | Rekt Capital

BTC is trading right above its 200-week moving average right now, after briefly falling below the measure during the June 14 sell-off. While the valuation could drop again, if history proves anything, then the drop will probably not be further than this level, and it won"t be long-lasting. Along with the 200-week moving average, there are also many price levels from Bitcoin"s past that should now serve as support if the valuation continues to drop.

The last time Bitcoin traded below $24,000 was in December 2020, when $21,900 served as a support level from which Bitcoin bounced before it rallied to $41,000. The last metric used by regular users of Bitcoin is the market-value-to-realised-value ratio (MVRV), which is currently at 0.969 and implies that BTC is reaching a phase ideal for buy-ins. MVRV is simply any asset"s market capitalisation divided by its realised capitalisation.

Looking at Bitcoin"s MVRV performance, it has spent most of the time during the last four years above a value of one, except for two brief periods that coincided with unfavourable market conditions.

If we go through all this data thoroughly, it may suggest that Bitcoin"s valuation still has a chance of witnessing further drop, but if the past is anything to go by, then predictions are that the worst phase is already over.

The writer is the founder at yMedia. He ventured into crypto in 2013 and is an ETH maximalist. Twitter: @bhardwajshash

First Published: Jun 20, 2022, 14:42

Subscribe Now