Learning to live with disruption

Today's companies will only survive if they learn to live with disruption

Image: Shutterstock

Technology is moving fast and disruption is becoming the new normal for all industries: digitalization has transformed the way we do business and entire sectors (e.g. music) 3D-printing is changing manufacturing industries the blockchain is about to disrupt financial services big data and the internet of things enable new or better products, services and processes in almost all areas of business. It is difficult to identify an industry that will not be strongly impacted (not to say disrupted) by the advances of artificial intelligence.

Today’s companies will only survive if they learn to live with disruption.

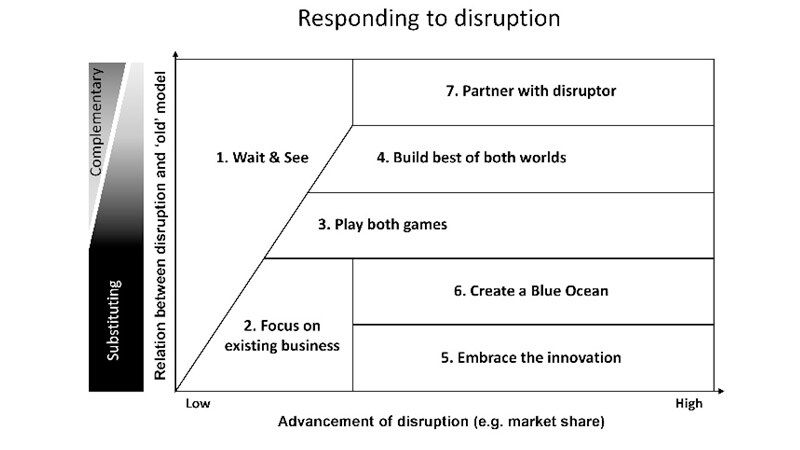

When facing a potential disruption, companies have the following strategic options:

WAIT & SEE

Doing nothing but monitoring the disruption should always be considered as an option because ex ante it is impossible to know whether a newly launched business model or innovation will actually become a disruption. An innovation can trigger market growth by attracting non-consumers to the market or increasing consumption by existing customers. An example is the introduction of white-label bottled water by supermarkets, like Carrefour in the 1980s. Established brands, such as Evian could have considered the 30-50% cheaper water, occupying massive shelve space as a threat. But actually they profited from its introduction, because supermarkets helped moving bottled-water consumption to mainstream from being considered a waste of good money by the average consumer.

A wait & see approach is recommended when there is reasonable doubt about the future superiority of the disruption, particularly if there is a possibility to ‘join the party’ later at limited extra cost. However, even if doing nothing is the best option at a given point in time, the company should closely follow the development of the potential disruption and consider preparing one of the following alternatives.

FOCUS ON EXISTING BUSINESS

If it is possible to enhance the current product, service or business model sufficiently to maintain an advantage over the disruption, a company should focus on their existing business. Nespresso’s response to the eco-friendly, cheaper coffee capsules sold in supermarkets is a good example. Nespresso strengthened their customer relationship management and increased its focus on superior customer experience in advertising, but also in distribution (direct and store delivery). Additionally, they set up capsule-recycling points to become more competitive in terms of environmental sustainability.

This option can become a trap if the incumbent company focuses on product enhancements only. With the (disruptive) innovation becoming better over time, it is likely that at some point it will be good enough for a majority of customers. At this point the incumbent will lose market share and eventually go out of business, succumbing to what is called the innovator’s dilemma.

PLAY BOTH GAMES

Is the disruptive innovation expected to conquer a significant part of the market? Are there synergies between the ‘old’ business and disruptive innovation? Then, play both games. A company can do so either by acquiring the disruptor or by copying its business model and value proposition in addition to keeping its ‘old business’. The new or acquired entity should be integrated with the existing business if the synergies (by far) exceed the risk of conflict between the two business models / entities.

A good example of this strategy is the launch of the low-cost airline German wings (now Eurowings) by Lufthansa as well as online banks launched by large retail banks, such as ING direct by ING or Boursorama by Société Générale. Even if cannibalization is a common issue when playing both games, remember: If there are cannibals in the jungle, make sure they are part of your family!

BUILD ‘BEST-OF-BOTH WORLDS

Incumbents can profit from disruptive innovation by combining some of the innovation’s characteristics with the strengths of their existing value proposition. This ‘best-of-both-worlds’ approach leads to superior value propositions which can only be offered by the incumbent. Hybrid cars are a perfect example for this option for responding to disruptive innovation. ‘Best-of-both worlds’ can also be the result of an acquisition, such as for example the integration of Viv’s artificial intelligence capabilities in Samsung’s technology.

EMBRACE THE INNOVATION

In some instances, the disruptive innovation is simply superior to the existing way of doing business. In this case the incumbent should adopt the innovation and scale up using its existing resources and capabilities. The classic example of this strategic option is the brokerage firm Charles Schwab that changed its business model to e-trading when it realized the superiority of the technology used by a small competitor. Embracing the innovation can also entail the acquisition of the (potential) disruptor, as in the case of the acquisition of Connor (producing 3.5-inch drives) by Seagate (market leader in 5.25-inch drives).

CREATE A BLUE OCEAN

Alternatively, incumbents can decide to focus on a completely new combination of product characteristics and thus create a new market (segment). The introduction of Swatch by Swiss watchmakers, which were disrupted by Asian competitors such as Seiko offering watches with additional functionalities at lower cost is a text-book example of a Blue Ocean Strategy. Companies that exit the disrupted market and use their existing resources and capabilities to create new markets (e.g. Nokia) are a more extreme form of the same type of response.

PARTNER WITH THE DISRUPTOR

Partnering with the disruptor can be the best option if the value propositions, the resources or capabilities of the disruptor and the incumbent are complementary to some extent. . This approach is only recommended if both partners need each other to succeed – otherwise the risk of one partner crowding out the other player in the medium-term is substantial. An example of such a partnership is the cooperation between the mobile operator Telenor and Facebook. Even if Facebook messenger and WhatsApp disrupt the messaging business of network operators, these applications drive mobile internet uptake and generate data traffic. Furthermore, Facebook needs mobile network operators for providing access to its content and advertisements. As shown in the diagram, the choice between all the strategic options depends on the advancement of the disruption and on the relation between the disruption and the existing business / value proposition. This relation can be complementary in addition to being substituting: on the one extreme, the disruption completely substitutes the ‘old’ business model or value propositions on the other extreme, there is a certain complementarity between the ‘old’ business and the disruption, either in terms of resources and capabilities or in terms of the value proposition (partially complementary products). Last but not least, the incumbent’s capabilities and resources determine which of the seven strategic options for dealing with disruption are feasible for a specific company.

As shown in the diagram, the choice between all the strategic options depends on the advancement of the disruption and on the relation between the disruption and the existing business / value proposition. This relation can be complementary in addition to being substituting: on the one extreme, the disruption completely substitutes the ‘old’ business model or value propositions on the other extreme, there is a certain complementarity between the ‘old’ business and the disruption, either in terms of resources and capabilities or in terms of the value proposition (partially complementary products). Last but not least, the incumbent’s capabilities and resources determine which of the seven strategic options for dealing with disruption are feasible for a specific company.

This article has been written by Karin Kollenz-Quetard, Professor of Strategy, EDHEC Business School, with research support from Pierre-Olivier Bligny. It is based on executive education & consulting work as well as the research by many outstanding scholars of innovation, namely C. Charitou, C. Christensen, N. Furr, J.S. Gans, C. Markides, G. Moore and D. Snow.

First Published: Nov 20, 2017, 09:14

Subscribe Now