Game, tech, match! Indian sports teams are going high-tech

As sports leagues and their fans grow in volume in India, companies are using technology to enhance player performance and fan engagement

Tech companies provide solutions for the sports industry and help players analyse their performance using pitch sensors and videos

Tech companies provide solutions for the sports industry and help players analyse their performance using pitch sensors and videos

Image: Luke Macgregor/Bloomberg Via Getty Images[br]

Days before the 2019 ICC Cricket World Cup began in May, media reports said the Indian cricket team had signed a deal with StatSports, a Northern Ireland-based performance tracking and analysis company. It produces a small device that sits between the shoulder blades on an athlete’s back, worn in a vest under the jersey. The device measures metrics such as distance covered, speed, acceleration, deceleration, and dynamic stress load. It allows the coach and support staff to analyse and record data about the players’ movements and manage their workload.

Team India was the first high-profile client from the world of cricket for StatSports, whose clientele includes the United States women’s football team, which recently won the Fifa Women’s World Cup, English football clubs Liverpool (UEFA Champions League winners), Manchester United, and Arsenal, and the Irish rugby team.

StatSports had been in conversation with the Board of Control for Cricket in India (BCCI) for about a year before the deal was signed, says Sean O’Connor, its co-founder and COO. “We have a couple of guys on the ground in India, which is a growing base for us and we are looking to ramp things up there quite substantially.” During this time, the company gave the Indian team a demo of the product, and invited India’s under-19 coach Rahul Dravid to visit Arsenal Football Club’s academy to meet the staff and understand how the technology can best be utilised.

The BCCI-StatSports partnership is one of the many new deals being struck in India’s growing sports technology space. Not only are athletes, teams and organisations turning towards technology to improve themselves, but tech companies are also providing solutions for the sports industry, both domestic and international.

Indian IT majors such as Infosys, HCL and Wipro are being hired by global sports giants for data analytics and tech solutions. Last August, HCL had revamped the website and mobile app of English football giant Manchester United, while this June it became Cricket Australia’s official digital technology partner. Infosys is big in the world of tennis, having partnered with the Association of Tennis Professionals (ATP) in 2015, the Australian Open in 2018, and the French Open in 2019.

Sports technology is predicted to be a $10 billion market globally by 2024, according to industry estimates. Although it is in its infancy in India, significant strides have been made over the last three to four years. According to industry tracker SportsTechX, more than 63 percent of the 360 operational sports tech companies in India were founded since 2015.

***** World No 1 Novak Djokovic. Infosys has partnered with ATP, the Australian Open and French Open for fan engagement and player stats

World No 1 Novak Djokovic. Infosys has partnered with ATP, the Australian Open and French Open for fan engagement and player stats

Image: Julian Finney/Getty Images[br]The sports tech ecosystem can broadly be divided into three sectors: Athlete tracking and performance measurement, fan engagement and media, and sports management. India does not have a lot of companies working in athlete tracking and performance, but there are some in the space of bat technology, motion tracking, video analysis, and training platforms.

For example, Pitch Vision is a cricket training platform for players, coaches, academies and enthusiasts that helps them analyse their performance using pitch sensors and video. “The idea was to build a system that gives all the information a player needs to analyse their game and minimise the cost,” says Ubaid Shaikh, digital director of Pitch Vision, which is based in the UK but manufactures its products in India. “We came up with different product types: A basic one was a camera for the footage and tools to analyse the videos. You can also go for a smarter solution, like sensors in the pitch.”

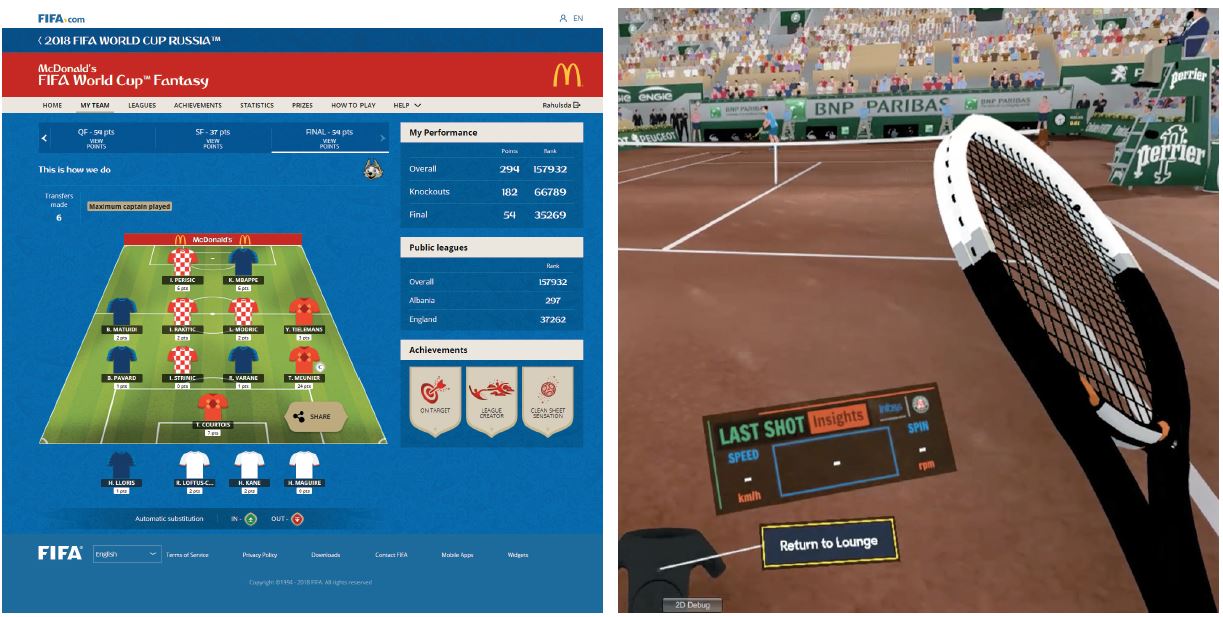

Fan engagement is by far the most popular sector in India. “It includes everything from data analytics, ways to analyse game patterns, showing trends using virtual reality and augmented reality, and providing an immersive experience to fans,” says Pravin Rao, COO of Infosys. In 2017, the company launched Second Screen, a new feature for fans that provides player performance insights within seconds of a point being played.

During the 2019 French Open, Infosys claimed that over 10 million fans engaged with its four digital engagement platforms—the Infosys Match Centre, Stats+, Social Heatmap and Slam Leaderboards—on the tournament’s official website. The company says nearly 100,000 fans experienced the Infosys Virtual Reality Zone at various ATP tournaments. Infosys in 2017 also created PlayerZone, which is the official digital platform for over 2,000 tennis players and their entourage on the ATP Tour. It is used to enter tournaments, find doubles partners, track scores and schedules, get travel advisories, request hotels, contact tournament organisers, understand prize money, taxes, and pension, among other services.

“We believe that sport provides a fantastic opportunity to showcase all the technology developments and disruptions that are happening,” says Rao. Explaining why Infosys has only worked in tennis so far, he adds, “Tennis is the most popular individual sport, with more than a billion fans and it is played all year round. Any association with such a game gives you a leg-up from a branding perspective.”

A sub-sector of fan engagement is the world of fantasy sports, where the number of operators in India has increased from around 10 in 2016 to more than 70 at present, according to a report by the Indian Federation of Sports Gaming. The number of users in India has grown from 2 million in June 2016 to over 50 million in February 2019, the report adds, due, in some measure, to the growing number of sports leagues in the country. StatSports, a Northern Ireland-based performance tracking and analysis company, signed a deal with BCCI in 2019

StatSports, a Northern Ireland-based performance tracking and analysis company, signed a deal with BCCI in 2019

Image: Getty Images[br]Many Indian sports companies also provide solutions for media, both traditional and digital, which are, again, aimed at fans. This includes live score widgets and apps, streaming platforms, websites, and social media engagement. One of the biggest Indian companies in this space is Sportz Interactive, founded in 2002. “Back then, if Sachin Tendulkar was batting, just getting to know his score was difficult,” says Arvind Iyengar, CEO of Mumbai-based Sportz Interactive. “Going one level deeper into the number of boundaries and sixes he hit was the next stage. Today, it’s about how many cover drives Kohli hit, how many boundaries were hit off an outside edge, how many of those were in the first 10 balls of the innings.”

Sportz Interactive is a B2B company that works with publishers, broadcasters and technology companies to power their sports solutions. “Today, our vision is to revolutionise fan experience by providing data, visualisation of data with automated infographics, building fantasy games, creating websites and apps, working with OTT partners, and managing social media. We’ve gone from capturing sports data to envisioning it in a number of different ways and building products around it to make the fan experience better,” adds Iyengar.

Many Indian companies also function in the sports management sector, which includes tech solutions that help organise tournaments, leagues, teams and venues. “To help you organise a tournament, you have various technologies like a games management system, which includes athlete registration, accreditation, catering, inventory management and transportation,” says Sujit Panigrahi, founder and CEO of Sequoia Fitness and Sports Technology, which was founded in 2010 in New Delhi. “There is timing, scoring and results [TSR], networking, telecommunications, venue technology—what you see on the ground like scoreboards. In India you have smaller versions of all of these systems.” The company developed the Khelo India Fitness app for the government, and runs a sports education and fitness assessment programme for schools and private companies across India.

***** The number of operators in fantasy sports in India has increased from around 10 in 2016 to over 70 now[br]While sports technology was more of a luxury in India five years ago, teams and organisations are increasingly adopting it now. Cricket is fairly ahead of the game in this regard, with Indian Premier League (IPL) teams known to be data- and tech-driven, whether it is for auction strategies or analysing the game. Today, sports such as football and kabaddi are also catching up.

The number of operators in fantasy sports in India has increased from around 10 in 2016 to over 70 now[br]While sports technology was more of a luxury in India five years ago, teams and organisations are increasingly adopting it now. Cricket is fairly ahead of the game in this regard, with Indian Premier League (IPL) teams known to be data- and tech-driven, whether it is for auction strategies or analysing the game. Today, sports such as football and kabaddi are also catching up.

“Earlier, our clients were more concerned about whether they could go through a season without too many barriers, both operationally, logistically and commercially,” says Chiraag Paul, founder and CEO of Proem Sports Analytics, which is based in Singapore and Bengaluru. “The importance of using data to interact with fans and sponsors, and taking them seriously, has actually occurred over the last couple of years. It was not a lack of understanding it’s just circumstances that took India a bit longer to understand the importance of data.”

The sports tech ecosystem in India, and Asia as a whole, is still not as advanced as those in countries such as the US, the UK and Australia. However, Paul believes that it’s not about catching up but about solving problems that are unique to regions. “The reason why the guys in North America have to be that quick or advanced is because sport and entertainment in that continent evolve that quickly in terms of viewership. Technology and other parameters catch up. In Asia, it’s more about getting people to understand the various sports we are playing and focusing on grassroots. The problems that we are solving are being solved at the speed at which they need to be solved.”

Nikhil Punde, founder of Pune-based SparUp Sports Technology, which is into athlete performance management, concurs that the focus in India should be on ensuring that the technology available at the elite level of sports trickles down to the youth and grassroots. “At the elite level, there are a lot of high-performance centres coming up in India, which have tie-ups with the top leagues in the country,” he says. “But at the youth level we are still five to eight years away from the kind of things that are happening in the US or the UK. The first step is to make the process more structured, and then slowly bring in more technology as required. Right now, at least there is a realisation in Indian sports that we need to collect data and analyse it.”

One of the other challenges that the Indian sports tech industry faces is monetisation. Venture capital (VC) money hasn’t trickled into the sector as much as some others because the gestation period for commercialisation is much longer. Most of the Indian sports leagues hold tournaments that last for a few weeks. Therefore, to build something for these leagues and expect a business to survive while operating just for six to eight weeks is a hard sell.

However, that’s starting to get fixed with more and more leagues popping up. The sports gaming and fantasy sports industry has also provided a shot in the arm. This April, Dream11 became the first gaming company in the country to make it to the unicorn club, after being valued at more than $1 billion.

“I think sports tech is at the cusp of something big and it’s already starting to grow like crazy,” says Iyengar. “We have been fortunate to grow from 70 to 450 employees in the last five years. That’s on the back of a greater demand. Similarly, if you look at newer spaces like fantasy gaming, you are seeing companies getting VC funding and commanding high valuation. Investor interest is there because you are starting to see more and more consumers getting active in the space.”

What’s exciting about India is that the sports community is willing to take risks by starting leagues at national, state and district levels. Since the IPL started in 2008, 14 other professional national sports leagues have sprouted in India.

The backbone of sports technology is sports itself. If the sport grows, everything around it grows along with it.

First Published: Sep 07, 2019, 06:40

Subscribe Now