Three VCs on how they are changing India's deeptech landscape

Endiya Partners on the importance of celebrating small wins; Arali Ventures on spotting early opportunities; MFV Partners on enabling startups with proprietary tech

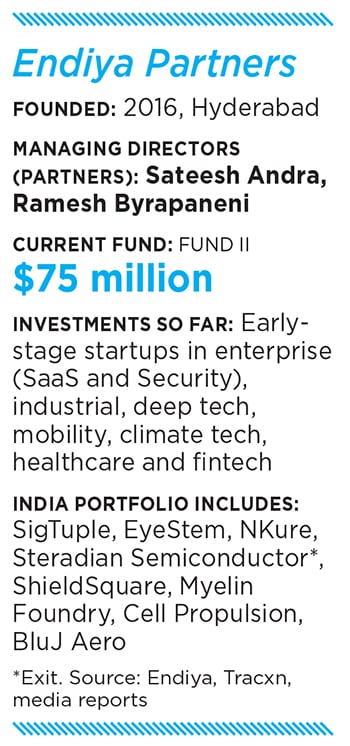

The firm manages about $100 million investments with a strong portfolio of startups

I think we all kind of tend to forget that (deep tech) is a marathon, right? This is going to take us 10-20 years," says Sateesh Andra, managing director at Endiya Partners. “But then you need to register small wins along the way to keep the energy levels going, to keep the belief and the conviction."

And everyone in the ecosystem needs to be patient and continue to believe, and make investments and celebrate the victories along the way, he says.

Currently, Endiya is investing from its second fund. And overall, the firm manages about $100 million investments with a strong portfolio of startups not only in deeptech, but also software products, sustainability, environment tech and so on.

Currently, Endiya is investing from its second fund. And overall, the firm manages about $100 million investments with a strong portfolio of startups not only in deeptech, but also software products, sustainability, environment tech and so on.

The partners see themselves as thematic investors, and “on average, for every dollar we’ve invested, our companies, cumulatively, have raised close to $30 from other investors", Andra says.

Eventually, some product startups from India will go global, but many more will go regional as well, he says. “I think the time has come," he says.

Unlike in software services, for example, and some other sectors, talent in deeptech comes at a premium, and the idea of “fail cheap, fail fast" isn’t so relevant for deeptech companies, Andra says. This is because there is a certain upfront cost necessary to building such technologies and products.

That said, with the changing landscape worldwide and in India, multiple factors are coming together—from geopolitical shifts, to growing local awareness about the importance of lab-to-market commercialisation—that will support the rise of some strong tech companies from India over the next decade, he says.

Also read: Why Pi Ventures likes to be one of the first investors in a startup

(From left) Rajiv Raghunandan and Arun Raghavan, managing partners, Arali Ventures

(From left) Rajiv Raghunandan and Arun Raghavan, managing partners, Arali Ventures

The Bengaluru-based firm has identified interesting deeptech companies and invested early

A run Raghavan and Rajiv Raghunandan, senior tech executives-turned-founding partners at Arali Ventures, don’t necessarily see themselves as deeptech VCs, but along their journey, they’ve found such startups in which they saw potential earlier than many others.

A run Raghavan and Rajiv Raghunandan, senior tech executives-turned-founding partners at Arali Ventures, don’t necessarily see themselves as deeptech VCs, but along their journey, they’ve found such startups in which they saw potential earlier than many others.

Wingman, a software products company, got acquired fairly early. Think of their software as an AI whisperer into the ears of sales agents. CynLr is one of the most sophisticated robotics companies to come out of India so far, with their AI and computer vision guided camera for industrial robots.

In the broader tech landscape in India, the real inflection point will happen when Indian companies will start developing fundamental “infrastructure level" technologies, Raghavan says. This is something that applies to Indian deeptech companies as well. For example, a space propulsion engine developer in India would be making innovative tweaks based on an existing original invention that was probably developed in the US. A computer vision venture will likely use existing pieces of hardware and develop a sophisticated design to pull them together.

There’s tremendous opportunity there, but we need to go deeper, in parallel. Raghavan offers the software analogy: Traditionally we’ve been very good as a country in all things application software—today, a $250 billion industry, including IT services and global capability centres. “But anything that’s at a more infra level, anything that’s more at a tooling level is something that we don’t have a lot of experience in," he says. That’s something that he thinks will develop as a startup ecosystem in India over the next four or five years.

“Can we think of a Snowflake emerging from India in the next 10 years?" For example. “It’s a critical aspect. If you’re able to do that, the ability for you to become a large company is very easy."

Karthee Madasamy, Founding partner, MFV Partners

Karthee Madasamy, Founding partner, MFV Partners

The venture capital firm has invested in companies working in areas ranging from software IP and mathematical models to hardware components and mechanical products

MFV Partners is an early-stage deep tech fund, based in the US, but one which also invests in other markets including India. “The way we define deep tech is companies that have proprietary tech, which is hard for others to replicate," says Karthee Madasamy, a founding partner at the VC firm.

MFV Partners is an early-stage deep tech fund, based in the US, but one which also invests in other markets including India. “The way we define deep tech is companies that have proprietary tech, which is hard for others to replicate," says Karthee Madasamy, a founding partner at the VC firm.

And that unique tech is what becomes the main competitive advantage for that startup. With that in mind, MFV has invested in ventures working in areas ranging from software IP and mathematical models, all the way to hardware components and mechanical products.

“Including full-stack solutions like robotics, and satellite systems," says Madasamy, who started his career with a degree in electrical engineering, and prior to MFV helped Qualcomm Ventures expand into Israel and India.

Madasamy says he’s been looking India’s startup ecosystem from 2006, and deeptech today is at a time similar where software was two decades ago, about to take off, he says. “There are more experiments being done, and being done well," he says.

And the existence of a strong, growing local market across sectors also augurs well for deep tech in India – manufacturing, pharmaceuticals, logistics and so on. So, while such ventures will continue to look at the US as their most important market, there will also be growing interest within India in their tech, he says.

Specifically, “definitely robotics is a big theme for us, whether it is a full system or specific platforms within," he says. Other strong themes, which are emerging in India as well are energy electrification as a theme, tech for health care and life sciences, and computing, including AI and quantum solutions.

First Published: Oct 30, 2023, 17:24

Subscribe Now