How interest rates build narratives

They are like gravity in valuation. If the rates are nothing, valuation can be almost infinite. But if extremely high, it's a huge gravitational pull on value

Illustration: Chaitanya Dinesh Surpur [br]

Illustration: Chaitanya Dinesh Surpur [br] The first lesson we are taught in investing is to focus on the value of a company (which is largely a function of its cash flows) and not the price.

The first lesson we are taught in investing is to focus on the value of a company (which is largely a function of its cash flows) and not the price.

But what if price itself could create value? How? If the price is so high that the company can use it to create significant moats, it can possibly create value. The best examples of this are probably the leading tech companies in the US, where they continuously use their stock as currency to acquire smaller companies that could be potential future challengers.

And what causes prices to go much beyond the value of a company? There are a multitude of factors like flows, low float, star CEO, narratives, or recently even Reddit.

In this column, we will focus on one factor—interest rates and how they impact valuations.

Cost of Equity (CoE) is a function of risk premium and risk free rates. Risk premium is the extra return that we would want from any investment that promises but does not guarantee returns.

In India, apart from sovereign guarantee and ₹5 lakh in every fixed deposit, everything else has a risk premium attached to it. Equities have the highest risk premium as the cash flows accruing to equity holders are after all interest payments and government dues are paid. Equity risk premium over the long term does not change materially and has seen to be in the range of 4 to 5 percent. The second variable into the cost of equity is the risk-free rate. A good reference point is the 10-year government security of the country. The change in this over the long term has been significant and this has impacted the overall cost of equity. The US has seen long term yields go down to 1.5 percent now from 4 percent in 2002 and 12 percent in 1980. In India, yields have dropped to 6 percent now from 14 percent in the mid-1990s.

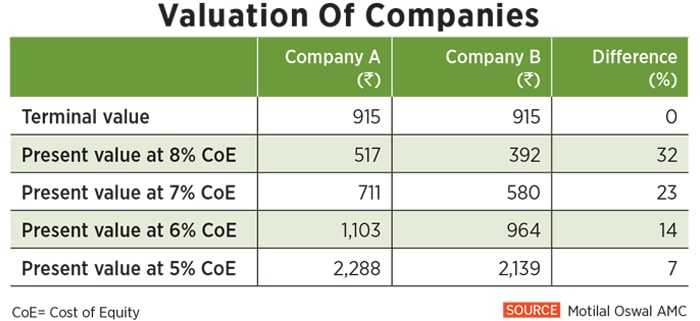

To understand the impact of the fall in risk-free rate and subsequently overall cost of equity, we take up a simple valuation exercise We have two companies, A and B. Company A generates cash flows every year and grows them at 15 percent every year. At the end of 10 years, we assume a simple terminal value to get the value of the stock.

On the other hand, Company B does not generate any cash flow, but is busy creating a unique business with a promise of a large terminal value. For arguments sake, we assume the terminal value to be same as Company A.

Assuming an 8 percent cost of equity and a 4 percent terminal growth, the difference in valuation of companies A and B is A being higher by around 30 percent, but if the cost of equity drops to 5 percent, the difference shrinks to 7 percent (see table).This math is the key to understanding why companies that are cash guzzlers now, but have the promise of a bright future are getting priced at levels similar to or maybe even more than that of companies which are already established and delivering cash flows. In a low interest rate regime, higher growth (expectation) not only gets handsomely rewarded but delayed cash flows get a lower penalty as well.

There is an interesting pro-cyclicality that plays out with non-cash flow-generating companies in a low interest rate environment. If a growing company does not generate enough cash flows to fund its growth, it would have to borrow, which is much easier to do in a low-rate environment. Conversely, not only does valuation get impacted as rates go up, but the path of growth also starts looking more uphill than before. When things turn (which is when interest rates go up) for such companies, it has an effect of a snowball down a steep hill.

[qt]In a low interest rate regime, higher growth [expectation] not only gets handsomely rewarded, but delayed cash flows also get a lower penalty.”[/qt]

If one believes that interest rates have bottomed out, why are valuations still going up? I am reminded of what Warren Buffet said: What the wise do in the beginning, fools do in the end. Advise caution.

The intriguing aspect about talking of value that will be created 10 years down the line is that it has more to do with imagination than reality. The victorious claim visionary status while the fallen are termed dinosaurs. There are many alternate histories that could have played out but like in most uncertain decision-making situations, the deterministic results decide the correctness of probabilistic decision-making.

I should submit that this is a simplification of the much-touted current advancement led by technology that is underway (probably comparable to the industrial revolution and/or the invention of the wheel) and I may not have the “vision” to look into the future. But it is important to not get carried away when valuing businesses.

Until the fundamental reason which is that value of company is the sum of all the cash flows that it would generate changes, it will be unwise to ignore cash flows for eternity.

â— The author is fund manager, portfolio management services at Motilal Oswal Asset Management Company

Disclaimer: This article has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. It should not be construed as investment advice to any party. The recipient should exercise due caution and/ or seek professional advice before making any decision or entering into any financial obligation based on information, statement or opinion which is expressed herein

First Published: Apr 07, 2021, 11:05

Subscribe Now