Investing in hidden tech gems

Technology is emerging as one of the favourite sectors for retail and institutional investors in the unlisted, private market space, as they bet on sustained growth

Entrepreneur Yash Poddar, looking to add an unlisted technology company to the investments of his family office, bought stock in hyperlocal delivery startup Dunzo

Entrepreneur Yash Poddar, looking to add an unlisted technology company to the investments of his family office, bought stock in hyperlocal delivery startup Dunzo

Image: Nishant Ratnakar for Forbes India[br]For a year, second-generation entrepreneur Yash Poddar had been looking to add a new-age unlisted technology-led company to the basket of investments of their family office. Flush with funds after the family had exited a joint venture in their Bengaluru-headquartered PVC pipe business in 2018, Poddar, 26, wanted to be an early investor in companies that will emerge as builders of India’s growth story in the current decade.

Through his business network, he met private wealth manager Krishna Raghavan, deputy CEO of UnlistedKart, a market maker for unlisted stocks. Raghavan offered Dunzo—the Google-funded, hyperlocal delivery—stock to Poddar who seized the opportunity.

The dunzo investment

Growing up in Bengaluru, Poddar was no stranger to Dunzo and its business.

Founded in 2015, Dunzo provides delivery from meat-to-medicines across Bengaluru, Delhi, Gurugram, Pune, Chennai, Jaipur, Mumbai and Hyderabad. Like most startups, Dunzo’s topline has seen impressrive growth—₹27 crore in FY20 against ₹1.27 lakh in FY17. Its losses, too, have been ballooning—₹338.4 crore in FY20 against ₹10.79 crore in FY17. The Ebitda (earnings before interest, taxes, depreciation, and amortisation) burn per order has improved to ₹162.18 in FY20 from ₹217 a year ago while the number of orders surged to 20.3 million from 6.54 million in the same period.

Dunzo, armed with a fresh Series-E funding from Google, Lightbox, Evolvence and other investors, aims to build a massive logistics network, strengthened by a large number of delivery partners.Poddar is not too worried about its rising expenses or cash burn. “The pandemic gave us a snapshot that the world is dependent heavily on technology,” says Poddar, who is chief investment officer at the Vikas Poddar Family Office. Customer stickiness to Dunzo was seen during the pandemic. Poddar will look more closely at the gross merchandise value, sales, additional margins above transaction value, free cash flows, geographical expansion, revenue streams coming in and future rounds of funding to decide how to treat his upwards-of-₹3 crore Dunzo investment.

The challenge is that since they are in the unlisted space, authentic research and a steady stream of data on these stocks may not be easily available. It is a Catch-22 situation even for savvy investors like Poddar.

Unlistedkart is among the few companies that offers a balanced research report to its clients, listing out director holdings, profit and loss, and balance sheet statements, financial ratios, comparative competition, compliance and news about the company.

Poddar was clear that he did not want to wait till the startup lists at the markets. “By the time something lists, the juice has already gone,” he says. Dunzo’s co-founder and CEO Kabeer Biswas is yet to disclose the startup’s listing plans, and Poddar is confident that getting in early—and staying invested for at least five years—will ensure that the rewards will be higher.

Poddar’s assessment has some merit, particularly seen from experiences across international markets. Technology Matters

Technology Matters

The pandemic disrupted businesses big and small. Internationally, the companies that reported the greatest gains in market capitalisation in 2020 were largely technology-led, including Amazon, Microsoft, Alphabet, Apple, Facebook, online gaming giant Tencent and graphic chip maker Nvidia. Several of these are top components of the S&P 500 index.

In India, too, the pandemic, accentuated growth and valuations, but most of them were privately held startups. Around 11 startups turned unicorns last year, including Unacademy (edtech), Razorpay (fintech) and Zenoti, the software-as-a-service-based service provider to the wellness space.

Globally, while public market opportunities are arguably expensive, valuations in private markets still remain attractive. “Data from Pitchbook and Bloomberg show that the 2021 estimated median EV/Ebitda multiple for private markets is 13.9x. This is notably lower than the 15.5x multiple for technology companies in the Nasdaq 100,” says Narayan Shroff, director (investments), India, at Barclays Private Bank.

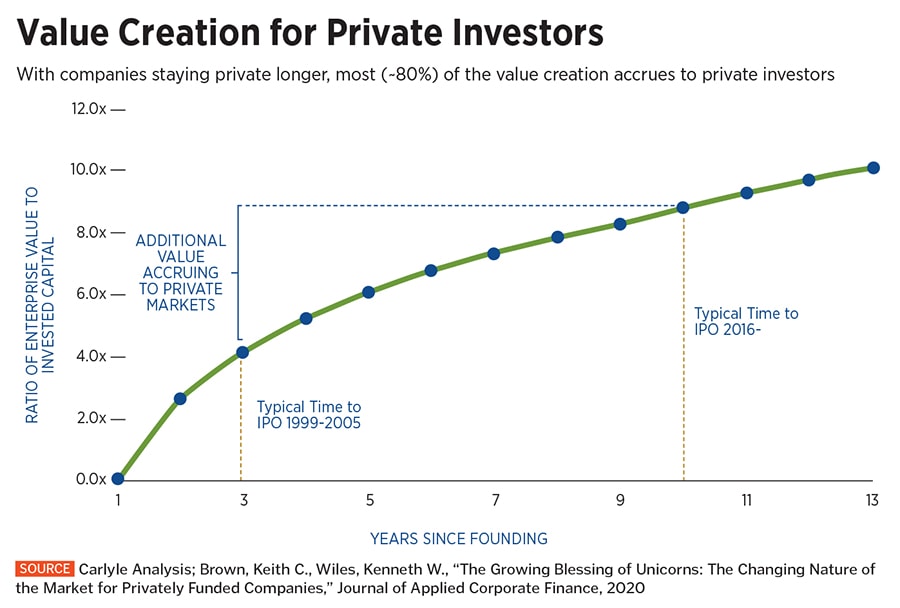

It has been seen that the benefits of value creation often go to private investors. Researchers Keith Brown and Kenneth Wiles in their 2020 paper ‘The Growing Blessing of Unicorns: The Changing Nature of the Market for Privately Funded Companies’ for the Journal of Applied Corporate Finance have noted that as companies stay private longer (see graph), nearly 80 percent of the value creation accrues to private investors.

This also indicates that disruptive innovation tends to take place at an early stage of a company’s formation and slows once companies are public. All of this calls for early entries into technology companies.

“A solution could accommodate getting access to innovation and technology in a more disruptive fashion and at an earlier stage in private markets,” says Shroff. Barclays offers private market investments to its clients, in India and overseas, through the Structured Solutions Group, in the form of curated and researched funds besides direct investment opportunities across seed- and venture capital and private equity, in the country and globally.

Companies also seem to be staying private longer. In fact, globally the average median age of technology companies filling for initial public offerings (IPOs) has grown to 12 years from about five years a decade earlier, and valuations at the IPO stage have consistently been higher. Mudit Gupta, 31, a strategic consultant with Accenture who also runs a family office, invested in Nazara Technologies, a diversified gaming and sports media company, a few months ago

Mudit Gupta, 31, a strategic consultant with Accenture who also runs a family office, invested in Nazara Technologies, a diversified gaming and sports media company, a few months ago

Image: Raghav Sharma for Forbes India[br]Serious business: Gaming

The diversified gaming and sports media company Nazara Technologies, backed by Rakesh Jhunjhunwala, is on the cusp of listing through an IPO, but continues to find interest in the unlisted market. Mudit Gupta, 31, a strategic consultant at Accenture, who also runs a family office, is one such investor, who has bought Nazara a few months back.

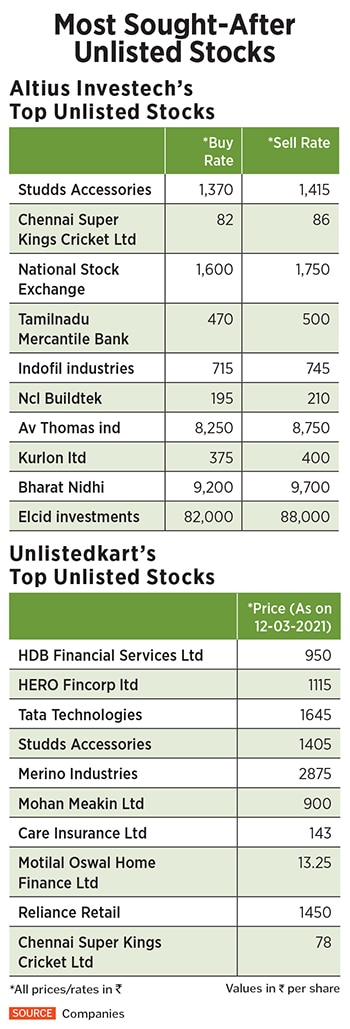

Nazara attracts a buy rate of ₹1,370 and a sell rate of ₹1,500, quoted by Altius Investech, one of the oldest market makers for unlisted securities in India. Gupta, who has been investing in unlisted stocks since 2019, approached Altius CEO Sandip Ginodia to help identify fast-growing public companies, which have yet to go public.

With an issue price fixed at between ₹1,100 to ₹1,101 a share, its interest and rates in the unlisted space remain unchanged, with a buy rate of about ₹1,380 and a sell rate of ₹1,450. In the grey market, Nazara is quoting at near ₹1,900, a premium of ₹850. The company has raised a little over ₹260 crore from anchor investors.

Nazara Technologies gets over 40 percent of its revenue from India and an equal amount from North America. With listing around the corner, an investor who has invested in Nazara through the unlisted space, will be viewed as more loyal and discerning than the one applying for shares through the IPO, expecting a premium on listing.

Being a pre-IPO stock, there is a lock-in period of one year placed by a company, which means that the selling date cannot be one year before the IPO. Nazara in the unlisted space will get locked in now.

This has hardly dampened the buzz factor for Nazara. The same goes for other unlisted stocks such as Studds Accessories, Chennai Super Kings, National Stock Exchange and Tamilnad Mercantile Bank, all of which are in Altius’s top ten stocks (see table).Gupta has an 80:20 investment strategy, where 80 percent of funds go towards equities. This is split equally between listed and unlisted stocks. “Having a family office makes investment options easier,” says Gupta, whose size is of around ₹10 crore between 18 family members.

But his portfolio is well-diversified with “not more than 15 percent investment in any one stock”, says Gupta. Discipline and the ability to move on [if strategies go wrong] are a must while investing privately, he says.

Market Making

Gupta was lucky to find Ginodia, whose proprietary-run firm Altius is one of the oldest in the business and offers market making for the past 17 years in over 60 private companies, including about 29 startups such as Meesho, Speedlabs and Navars (an astronomy edtech firm).

Altius serves over 5,000 clients, several of them high net-worth individuals. Altius Investech, which claims to have found several multibaggers for its clients, reported a share trading profit of ₹2.15 crore for the period between April 2020 and February 2021. With interest in unlisted securities growing and 40 percent of revenues coming from non-resident Indians, Ginodia plans for an overseas expansion next year, by offering offshore funds and alternative investment funds to its clients. A listing of Altius at the stock exchanges is also not ruled out.

Ginodia sees huge interest from both retail and institutional investors, considering “there are several triggers left for investors before a company lists”. Altius keeps inventory of all stocks, which includes sourcing startup stocks through the Employee Stock Ownership Plan [ESOP] route. The seller drives prices, which are determined largely by demand/supply, last valuation price and peers’ listing price.

Raghavan formed Unlistedkart after in his previous venture, Astute Advisors, he created a market to help professionals liquidate their positions that were locked in close-ended funds, before the tenure of the fund got over.

Unlike Ginodia’s Altius that is a bootstrapped B2C company, Unlistedkart is a bootstrapped B2B2C firm, which has most of India’s leading private banks and wealth advisory firms as its clients. Inventory is sourced either directly from the company or these wealth advisory firms. Unlistedkart deals mainly with institutional investors who have a mandate to buy/sell in large deals. Raghavan claims Unlistedkart to be the fastest-growing market maker in the unlisted space in the past 30 months, reporting a profit before tax of ₹1.94 crore, on a topline of ₹170 crore, as of December 2020.

As seen with Poddar and Gupta, investment decisions into unlisted startups are not necessarily based on ratios. “They look at the growth story, potential multi-year cash flows, the ability to raise capital and management quality,” says Raghavan.

Both Gupta and Poddar have more to add to their bucket list of unlisted stocks. Gupta is keen to eye SaaS-based companies and startups and fintech firms. Poddar is looking to add more technology stocks to his portfolio, including investor favourites Zomato and Dream 11. Being savvy and disciplined investors who keep an eye for detail, both Poddar and Gupta will neither chase prices, nor just a short-term goal when investing privately. These attributes will work well in technology stocks, which will continue to be a driver for growth in the coming decade.

First Published: Apr 06, 2021, 10:04

Subscribe Now