Fiscal health: Oil up, Rupee down, foreign money fleeing

Image: Reuters

Image: Reuters

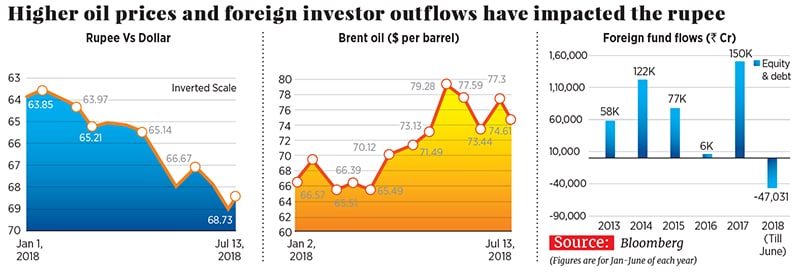

As 2018 rolls on, the clouds gathering on India’s economic horizon continue to darken. It is becoming increasingly clear that our prospects are directly dependent on an interplay of three factors—oil prices, foreign investor outflows and the impact they have on the rupee. Queering the pitch further are the recently announced increases in the minimum support price for farmers and Act 1 of Donald Trump’s trade war.

First, oil. The broad consensus is that oil above $80-85 per barrel is a significant headwind. The fact that it is not being subsidised (except in the case of kerosene and cooking gas) means that any increase would directly add to inflation, which would in time translate to higher interest rates. “This time the increase is a lesser threat to government finances and a greater threat to consumer finances,” says Abheek Barua, chief economist at HDFC Bank.

The increase in oil prices comes at a time when rising US interest rates have led to emerging market outflows. Foreign investors have sold a total of ₹47,000 crore debt and equity in the first six months of 2018. Higher payments for oil imports coupled with FII outflows have resulted in a ballooning current account deficit—up 42 percent to $160 billion in 2017-18. Not surprisingly, the rupee has fallen around 8 percent to ₹68.73 as on July 13.While it is evident that irrespective of where oil prices settle, India’s import bill will be higher than last year, FII outflows are also unlikely to abate as investors lighten their bets ahead of the 2019 election. Hence, the pressure on the rupee is likely to continue.

Last, the recent announcement of higher minimum support prices for farmers is expected to be inflationary. Industry body Ficci estimates this would result in a transfer of ₹13,000-35,000 crore to the rural economy. This could be the final nail in the inflation coffin.

To mitigate inflation the government plans to make changes to the procurement mechanism and come up with an export policy for agricultural produce.

The announcements will be keenly awaited as last time it took India nearly five years to arrest a combination of inflation, high interest rates and low growth.

First Published: Jul 15, 2018, 08:04

Subscribe Now