Why the most valuable companies bring women to boards

If a board doesn't have any female directors, it is missing some critical skills that would improve its advisory capacity

Daehyun Kim is an Assistant Professor of Accounting at the Rotman School of ManagementQ. Describe the current state of ‘women on boards of directors’.

Daehyun Kim is an Assistant Professor of Accounting at the Rotman School of ManagementQ. Describe the current state of ‘women on boards of directors’.

The average proportion of women directors on the boards of S&P 1500 firms has steadily increased from 7% in 1998 to 16% in 2015. Nevertheless, women are still significantly underrepresented, given that 47% of the U.S. work force consists of women. As of 2015, about 17% of S&P 1500 boards still have no women directors and 35% have only one woman director. The lack of gender diversity becomes more severe in smaller firms.

A number of OECD countries are addressing this issue through various forms of regulations. Some countries have either mandated or established voluntary women director quotas for corporate boards others, including Canada, require disclosure explaining the reason for the lack of gender diversity in boards. These global efforts to promote more women directors on corporate boards is based on an argument that gender-diverse boards improve firm value.

However, whether gender diversity actually leads to higher firm value has been actively debated and the literature documents mixed empirical evidence. One important aspect of understanding the relation between board gender diversity and firm value is identifying the mechanisms through which gender diversity impacts firm value. This was the goal of my research with Professor Laura Starks.

Q. Based on your findings, what does a company lose if it doesn’t have any women on its board of directors?

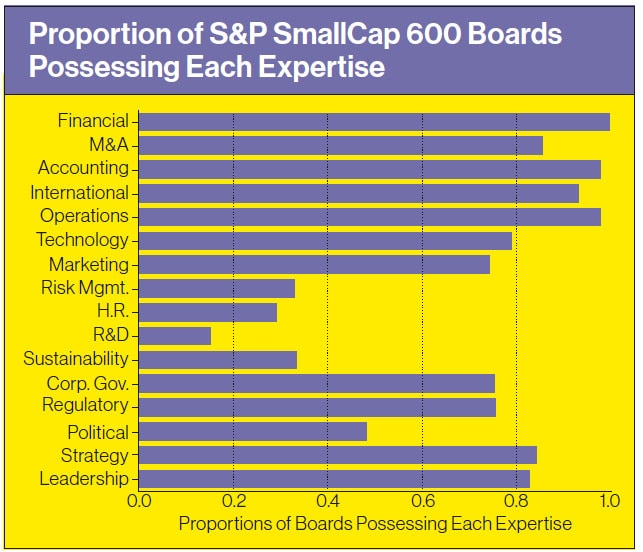

A board of directors without any women is more likely to be missing some key skill sets that could improve the board’s advisory effectiveness. Less effective advisory board, in turn, is associated with lower firm value. Based on industry publications, we identify 16 skill sets deemed critical for corporate boards to effectively advise the management. When we examine the relation between these skill sets and individual directors, we find that some types of skills are much more likely to be possessed by women, while others are more often found in men. More importantly, we find that most of the current cohort of corporate boards already possesses skill sets that tend to be male-dominant however, not many boards have the skill sets that are more likely to be offered by women. Therefore, if a company doesn’t have any female directors on its board, it may be missing some critical skills that could improve the board’s advisory capabilities.

Q. Describe which skill sets women tend to excel in.

The skill categories that women are more likely to possess include Risk Management, Human Resources, Sustainability, Corporate Governance, Regulatory/Legal/Compliance, and Political/Government. As I mentioned earlier, these skill sets are currently lacking on most boards, particularly at smaller firms: less than half of the S&P SmallCap 600 boards have a director with expertise in Risk Management, Human Resources, Sustainability, or Political/Government. By contrast, all of the four male-dominated skill categories—Finance, Mergers & Acquisitions, Operations, and Technology—can be found in the majority of those boards.

Q. You have made the observation that smaller firms are even worse off than bigger firms. Is there a particular reason why smaller firms struggle more with this issue?

This is perhaps because investors don’t put as much pressure on these firms: the smaller a firm, the less scrutiny it receives from the public. Also, from an investor’s point of view, the same governance change will have a much greater valuation impact when the change takes place at a larger firm. That is why corporate governance improvements usually start with the big firms. The effort to diversify boards in terms of gender, hasn’t reached all the way down to the smaller [S&P SmallCap 600] firms yet—at least, not in the U.S.

That said, the situation isn’t much better for bigger [S&P 500] firms. Even though many S&P 500 firms now have one or more women on the board, an average S&P 500 board consists of only 20% female directors as of 2015. Clearly, we can’t call this statistic as “diverse,” as this figure is nowhere near 47%, the proportion of the total women in the U.S. labour force.

Q. What barriers and biases are preventing gender parity—or anything close to it—on these boards?

The primary barrier is the belief that women don’t have the required knowledge or experience to serve on corporate boards however, this “belief” is sometimes disseminated by incumbent directors with no supporting evidence backing up such a claim. In fact, there is already a significant and growing number of women in senior management with required experience and skills. Knowing this through data, I find it difficult to accept the claim that there aren’t enough qualified women to become board members.

Since corporate directorships can enhance one’s status and reputation in the business community, it is understandable how the existing directors can be very protective of their “turf.” Informally, this so-called the “old boys’ club,” consists of members of a specific gender and race. Unless you resemble the other members of the club in terms of these traits, which, by the way, had been determined at birth, it will be extremely difficult to penetrate into this exclusive club.

Q. Broadly speaking, your research finds that heterogeneity tends to increase firm value. Is this widely accepted in business circles?

The organizational behaviour studies document that heterogeneity in opinions and perspectives among group members improves the group’s decision making the corporate directors, in general, tend to agree with this argument and believe such heterogeneity increases firm value. However, to my knowledge, no prior studies have empirically examined whether heterogeneity in opinions among board members actually improves firm value. Prof. Starks and I have been working on another study that attempts to answer this question using a novel data set which allows us to empirically test this hypothesis. In that study, we find that heterogeneity of board members’ skills—the source for their opinions at board meetings—does indeed improve firm value, as measured by Tobin’s q [the ratio of the market value of a company's assets divided by the replacement cost of its assets (book value)].  Q. Do you think your findings would be similar if you explored other types of diversity, such as ethnic or racial diversity? Would you expect similar results?

Q. Do you think your findings would be similar if you explored other types of diversity, such as ethnic or racial diversity? Would you expect similar results?

I haven’t examined the valuation effect in terms of other diversity categories as of yet, but that is something I am interested in doing to provide evidence which could broaden the current board diversity debate. The reason we first examined gender diversity is because that is currently the primary focus of the board diversity debate not only in North America but worldwide.

Q. Faced with this resistance, what can proponents of diversity do to convince boards that this is not just a moral argument—but a newly established benchmark that will improve the health of the business?

That’s an important question, because as indicated, one of the reasons that the gender diversity proponents have been struggling with, is the lack of causal evidence in prior studies. We try to address this issue by showing a mechanism through which women directors could contribute to corporate boards.

The corporate laws in the U.S. require the board of directors to act in the best long-term interest of the corporation. Based on the directors’ duty as provided in the law, the corporate boards have been vehemently opposing the push for gender diversity when it was presented as a moral or social argument. Oftentimes, the primary argument against board gender diversity is that the board must seek diversity not in terms of gender, but rather with respect to expertise, opinions, and perspectives, since it is heterogeneity in these traits—not gender diversity per se—that improves the firm’s long-term value.

The premise of our study is consistent with the argument that heterogeneity in expertise is what matters. That said, our results show that female directors are more likely to possess specific types of expertise that are often missing in incumbent boards, and that when added, the women directors broaden and diversify opinions and perspectives in the boardroom. These results, coupled with the results from the other working paper I mentioned earlier, suggests that appointing more women to corporate boards makes financial sense: women directors are more likely to bring new perspectives, hence improving the board’s strategic discussions this, in turn, is associated with a higher firm value.

undefinedHeterogeneity in opinions among group members improves a group’s decision making.[/bq]

Q. Let’s circle back to the 16 skill sets you mentioned earlier. Is it possible that men simply don’t value the particular skill sets that women tend to hold? That they, for example, prioritize Finance over Human Resources, and therefore, they might employ women in these areas but they don’t think they’re necessarily fit for the board?

I can’t answer whether men do not value certain skill sets or not because I don’t have data on that. I also cannot say why men or women tend to be more dominant on a certain set of skills. As you said, I think it stems from differences in career paths they may have taken, but again, I have no data to back that claim up.

What I can say is that corporate boards do not perceive female-dominant skill sets unimportant. Some of publications that we identify the 16 critical skill sets are published by organizations that represent and advocate for corporate boards, such as the Conference Board and the National Association of Corporate Directors. In the U.S., these are organizations who recommend best practices from the corporate boards’ point of view.

In fact, I think it will be difficult to argue that these women-dominant skills are not crucial for corporate boards. Take, for example, Risk Management: most boards want to have a risk management expert, but argue that it is difficult to find qualified director candidates with such expertise. If the boards expand their search to include more women, I think they will be able to find risk management experts more easily. Arguably, expertise in Human Resources is one of the most crucial needs for any corporate boards: all boards have governance or nominating committees that nominate or appoint directors as well as CEOs, and compensation committees that set executive compensation. Sustainability is becoming a very important issue, gaining immense traction. Many firms nowadays are very focused on their corporate social responsibility activities: having a director with Sustainability expertise would enhance the firms’ long-term strategic directions on corporate social responsibility.

Q.Whenever there are discussions about the importance of embracing diversity, there is an implicit debate about whether the issue is a pipeline problem or a recruitment problem. Is it simply that there aren’t enough women or minorities to draw from? So, it’s not that companies don’t want them they just can’t find them? Or, is it a recruitment issue, whereby people are only looking within their pre-existing networks, which tend to be homogenous—i.e. ‘white men recruit more white men’? Which is it?

I think it’s both. The results of our study suggest that there exists a recruitment problem, where incumbent corporate boards fail to tap into potential female director candidates. That said, even though my expertise is in corporate boards, I know that there is also an imbalance of gender in senior management roles. In that case, it is mostly about the pipeline. Then the implicit question becomes: should we take a top-down or a bottom-up approach to add more women on boards?

If we take the bottom-up approach, we are trying to solve the problem with the proposition that pipeline is the main problem. To solve this problem, we have to increase the proportion of female employees along the corporate hierarchy, including senior executives and then, hope such a change will lead to more women serving on corporate boards. Alternatively, we can take the top-down approach by, for example, implementing a quota that increases the number of female corporate directors, with the hopes that diversity at the top will trickle down to the entire firm.

I, personally, think the bottom-up approach is very difficult to achieve. I make such a claim based on a historical fact on labour statistics: in the U.S., the proportion of women in the total labour force has gradually grown from 38% in 1974 to 46% in 1997 since then, this number has stayed constant at 46-47%. If the bottom-up approach were effective, we would have expected a convergence between the proportion of women on boards and in the labour market. After a 40+ years of experiment, we know ex post that this convergence did not happen naturally, without the current board diversity movement.

In my view, it’s better to focus on achieving diversity the other way around—from the top-down—by starting to add more women on corporate boards. That sends a clear signal, not only to employees, but to the next generation of business leaders. If they see diversity at the very top of the most successful corporations, our next generation will grow up believing that diversity in the corporate leadership is the norm.

Daehyun Kim is an Assistant Professor of Accounting at the Rotman School of Management. His paper “Gender Diversity on Corporate Boards: Do Women Contribute Unique Skills?”, co-written with Laura T. Starks of the McCombs School of Business at the University of Texas at Austin, was published in the American Economic Review and can be downloaded online.

Rotman faculty research is ranked #3 globally by the Financial Times.

First Published: Jan 18, 2018, 08:58

Subscribe Now