After eight long years of being a voice for hemp in India, Elston Menezes, 31, one of the founders of B.E Hemp, decided to shut the shop last year before the pandemic due to miniscule returns and very limited market reach.

“We were the only people delivering rolling paper pan-India during the lockdown, and news spreads quickly in a country of 1.38 billion people stuck inside their homes. Our popularity grew over the course of three months, leading us to build our website, and we decided to contact the other hemp companies in India to help them gain traction during the pandemic as well,” he adds. The startup now has nearly 20 hemp vendors on their platform.

According to a report published by Grand View Research in February 2020, the global industrial hemp market is expected to grow at a compounded annual rate of 15.8 percent from 2020 to 2027 to reach $15.26 billion in 2027. As of now, India only contributes less than 0.1 percent to the global hemp market. Yet, the Asia Pacific dominated the industrial hemp market with a share of 32.6 percent in 2019. China has a significant tradition of hemp production and exports. The key factors driving the industrial hemp market growth include the growing demand for hemp oil and fibres in the automotive, construction, food and beverage, personal care, and textile industries.

Hemp and marijuana both come from Cannabis sativa plant family. The main factor that differentiates them is the amount of THC (tetrahydrocannabinol) content. THC is the psychoactive component that gets one high, while the cannabidiol (CBD) largely neutralises the intoxicating effects of the THC, apart from having other health benefits. Hemp strains have minimal THC and a lot of CBD (if grown to flower) and they do not lead to intoxication when consumed.

Marijuana and hemp can also be differentiated on the basis of their usages. Hemp is mostly used for industrial purposes (textiles, clothing, shoes, food, paper, biofuel) while cannabis or weed is useful for medicinal (treating cancer, arthritis, chronic pain, epilepsy) and recreational purposes.

Amit Vaidya, 43, who is a cancer survivor, has been using hemp products for over 10 years. During his cancer treatment, one of the side effects was increased body heat. He started wearing hemp t-shirts and trousers at a friend’s suggestion. “I couldn’t believe the difference the hemp fabric made in terms of breathability. That’s when I started researching about hemp and its many other uses. I’ve now been using food products such as hemp seed oil, hemp hearts and hemp tea,” he says.

Many Indian cannabis startups have emerged in the recent years and are focusing on medicines, textiles, foods, cosmetics and accessories. According to media reports, there are currently over 30 hemp startups in the country.

One of the oldest in the market, Bombay Hemp Company (Boheco), is backed by investors like Ratan Tata and Sequoia Capital MD Rajan Anandan. Boheco, which is an agro-based startup trying to make hemp mainstream in agriculture and sustainable living, has played a big role in the ongoing evolution of the hemp industry in the country.

It is also a major supplier of raw material to other hemp startups, working with close to 100 farmers in Uttarakhand and Uttar Pradesh. Most of the company’s revenue is generated from their health and wellness products, while the rest comes from hemp-blended apparels and accessories. The company is over eight years old and still faces a lot of challenges ranging from marketing their products on ecommerce platforms and creating awareness to changing consumer perception.

“Third party ecommerce platforms like 1mg, Amazon etc, have a very restricted outlook on this plant, though all the licenses are available for one to conduct trade in this business. We use tools and products through these platforms, but at least in the last three months, they have just put a blanket ban saying they don"t want to work with hemp and cannabis because it is illegal. We face this challenge even after carrying all kinds of letters from the concerned regulators,” explains Yash Kotak, one of the seven co-founders of Boheco.

Many regions like Manipur, Madhya Pradesh, and Jammu & Kashmir are looking at developing a hemp industry at a local level, but that same kind of push needs to come at the central government level, according to Kotak, who adds that this global trillion dollar industry could create many jobs, and help with local development. “The central government needs to set up a small committee within the group that looks at developing this industry. We"re at it for over eight years now. We"re doing everything by the book, but then these things happen and suddenly you take four steps forward and six steps behind.”

![boheco yash_bg boheco yash_bg]() (From L-R) Siddarath Ahuja, one of the investors in Boheco Chirag Tekchandaney and Yash Kotak, two of the seven co-founders of Bombay Hemp Company (Boheco)

(From L-R) Siddarath Ahuja, one of the investors in Boheco Chirag Tekchandaney and Yash Kotak, two of the seven co-founders of Bombay Hemp Company (Boheco)

According to Ram Vishwakarma, ex-director of CSIR-Indian Institute of Integrative Medicine, Jammu, the startups, research institutions and the industry at large will continue to face these problems unless “the central Narcotic Drugs and Psychotropic Substances Act [NDPS Act] is not amended and respective state governments do not frame appropriate rules within the NDPS Act regarding licensed cultivation, processing, research, inter-state transport and export of crops and value added products”. He adds that a few states have recently taken progressive steps in this direction. “Hemp/cannabis hold great promise in India in several industry sectors, particularly pharma, nutraceutical, fibre and construction industry. Currently global cannabis/hemp driven industry is multi-billion dollar industry [globally], and unfortunately, India"s share in this sector is close to nil.”

Boheco along with CSIR institutes have institutionalised first of its kind Cannabis breeding projects for both industrial and medicinal purposes. The trials are conducted in two different states Uttarakhand (Almora) and Uttar Pradesh (Lucknow) initiated in September, 2018. "The aim is to standardize the genetics and have approved varieties for cultivation of the crop in India. This is going to be a major step in the direction towards the acceptance of the crop by the state and central regulators and going to positively impact the industry," says Kotak. The revenue of the company stood at Rs3.4 crore in FY20.

Another startup Hemp Horizons recently raised Rs2 crore in seed funding from Mumbai Angels Network and AngelList. Founded in 2017 by Rohit Shah, Kartikey Dadoo, and Kanishk Yadav, it is a seed-processing company registered with the US Food and Drug Administration (FDA) and is certified for Good Manufacturing Practices (GMP).

The founders faced many hiccups while setting up. “Even today, Facebook, Instagram and other social media channels don’t allow the word ‘hemp, cannabis’ or the leaf photo to be used via paid promotions. A lot of people initially would ask ‘will I get high eating cannabis / hemp seeds, oil or powder?’ The answer is no. It is a nutritional powerhouse which doesn’t contain the psychoactive compound THC. We were hit with major roadblocks almost everywhere, and still do,” describes Shah.

Hemp Horizons also struggled with finding and creating a stable supply chain. The founders took many trips to Uttarakhand, met with farmers and agricultural co-operatives. “In the initial months, it was tough to maintain the quality, and we had to do quality checks on a lot of raw materials before processing them,” says Shah. “Things have improved now. In fact, we are happy to see FSSAI soon regulating hemp seeds, which will be a big step towards a mass acceptance of the plant,” he adds. The company’s year-on-year growth since 2017 has been over 35 percent.

Indian investors are also showing interest in the green plant. “The last few years have seen global acceptance of the wellness benefits of hemp and we in India, too, are rediscovering a lot of these benefits. As more people find positive use cases of hemp products, investors will also identify the potential in the space and get active,” says Abhishek Nag, director of business development, India and South Asia, at Netflix, and a recent angel at Hemp Horizons.

The global industrial hemp market stood at $4.6 billion in 2019 and the Indian industrial hemp market stood at an estimated $1 million, explains Nag. “I am optimistic about us reclaiming our roots with this miracle plant and becoming the global centre for excellence and trade in all hemp products. The opportunity for investors and entrepreneurs is clear,” he adds.

![hempstreet founder abhishek mohan hempstreet founder abhishek mohan]() Abhishek Mohan, co-founder, HempStreet Image: Olena Mazur

Abhishek Mohan, co-founder, HempStreet Image: Olena Mazur

Another Delhi-based startup, HempStreet, founded in 2019, raised $1 million from international investors in its pre-Series A funding round last year. The company, founded by Abhishek Mohan, Aradhna Rai and Shrey Jain, provides ayurveda doctors with high quality and standardised cannabis-based medicines. They primarily want to tackle chronic pain. “We wanted to address this mass ailment that has been affecting a large part of our population, for which less than 8 percent received any relief or care. We saw that cannabis-based medication as a solution to this. We took quite a bit of time to understand the regulatory framework in India and that was probably the longest activity in terms of starting up,” says Mohan.

The startup claims to have gone from 0 to 850 clinics across 22 states in less than four months between November 2020 and March. “Our first product is Trailokya Vijaya Vati, primarily aimed at menstrual cramps. We purchase all our raw material from the excise department since farming of cannabis is illegal in India. Our products are dispensed via our network of ayurvedic doctors,” he adds.

At present in India, the NDPS Act, 1985, illegalises any mixture with or without any neutral material, of any of the two forms of cannabis– charas and ganja —or any drink prepared from it. Cannabis was termed illegal in India only after the Single Convention on Narcotic Drugs in 1961, which scheduled cannabis as a drug. India finally implemented the NDPS Act in 1985, banning parts of the cannabis plant.

Currently, it is only allowed to grow hemp plants with a chemical composition of THC that is below 0.3 percent. According to the Act, only the seeds, leaves, and stalks of the hemp plant are permitted to be used for industrial or medical purposes, and the fruiting tops are banned.

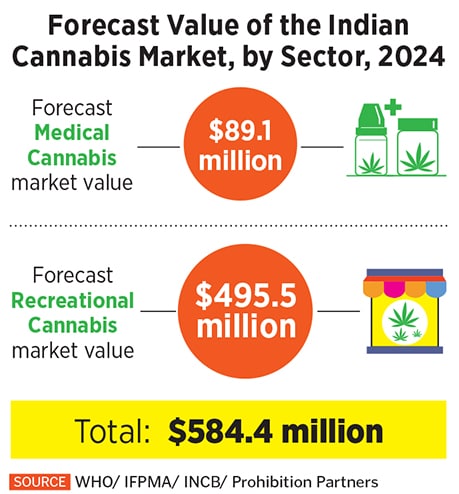

![indian cannabis market indian cannabis market]()

According to experts, the current THC limit set for hemp cultivation policy seems to be less since native Indian hemp strains have more than 0.3 percent THC. Unfortunately, India has adopted this from the West, without any rationale or domestic research. This leads to importing seeds from other countries even when India has the capability to dominate and contribute largely to the global market.

Last December, the United Nations Commission on Narcotic Drugs (CND), voted to remove cannabis and cannabis resin from Schedule IV of the 1961 Single Convention on Narcotic Drugs, decades after they were first placed on the list. This decision could influence the global use of medicinal marijuana. India’s backing on this has sparked hopes that the country will join the new global movement towards using the medicinal and commercial potential of cannabis. This will result in the opening up of policies around cannabis and will contribute greatly to easing out several regulations that are currently imposed on the plant.

In July 2016, Uttarakhand became the first Indian state to permit large-scale commercial cultivation of industrial hemp. The license was awarded to the Indian Industrial Hemp Association (IIHA) to plant cannabis on 1,000 hectares. The IIHA is also developing a seed bank, aiming to cultivate hemp across 10,000 hectares within five years for textile fibre. IIHA is a non-profit organisation was founded in 2011 by Rohit Sharma who works closely with the government to support the cultivation, processing, and use of industrial hemp in India.

According to Sharma, many startups in India lack in terms of giving quality products because a lot of them do not follow quality parameters. “To increase the customer retention rate, giving a good quality product is very important. If the quality is good, the product will move faster. So this is a big problem. The prices are also obnoxiously high. People can"t afford if it is more like a luxury product rather than a day to day consumer product.” IIHA also assists startups to set up their business and currently they’re getting maximum queries from the age group between 18 and 30 years. “The next generation wave is higher on hemp and cannabis,” adds Sharma.

![namratahempco namratahempco]() Harshaavardhan Reddy Sirupa founded Namrata Hemp Company in 2016, along with his wife after whom the company is named Image: Selvaprakash Lakshmanan for Forbes India

Harshaavardhan Reddy Sirupa founded Namrata Hemp Company in 2016, along with his wife after whom the company is named Image: Selvaprakash Lakshmanan for Forbes India

Founders of Namrata Hemp Company are also on a spree to develop their own seed strains. “We are extensively doing research to develop a seed bank. Currently, there is no commercial cultivation happening, even though there is a huge demand nationally and internationally. The reason is, if any farmer has to cultivate they need to have approved seeds, the agriculture department has to approve those seeds. So, in India there is no genetics approved by the Government of India. There is no research that has been done. So we are developing it in association with the state universities, agricultural and horticulture universities,” explains Harshaavardhan Reddy Sirupa who founded Namrata Hemp Company in 2016, along with his wife after whom the company is named. After five years of research on the benefits and effects of hemp, the duo launched their products under the brand—Satliva. They are into creating soaps, creams and oils with a hemp seed oil as base. All the raw materials and the hemp seeds are sourced from local farmers from the foothills of the Himalayas. With 83 percent customer retention rate, the company clocks in Rs50 lakh per annum.

![india hemp and co india hemp and co]() Shalini and Jayanti Bhattacharya, co-founders, India Hemp & Co, recently launched a new pet vertical, starting with hemp seed oil for pets

Shalini and Jayanti Bhattacharya, co-founders, India Hemp & Co, recently launched a new pet vertical, starting with hemp seed oil for pets

A few months before the Covid-19 pandemic, Shalini and Jayanti Bhattacharya set up India Hemp & Co in November 2019. Keeping sustainability at fore, the Bengaluru-based startup sells hemp hearts, protein powder, seed trail mix, and hemp oil—on their website. Recently they also launched a new pet vertical, starting with hemp seed oil for pets—which prevents inflammation (internal and external), promotes joint, heart and brain health.

“We’re currently present in over 25 stores, three cafes and also launched a hemp-concept kitchen called SoulStir with our partners in Jaipur,” says Shalini. Yet, the Bhattacharya sisters had to put some great opportunities on hold due to hiccups.

“Online retailers such as Amazon, BigBasket and so on, require FSSAI licenses which hemp doesn’t have as yet. This limits our ability to meet the customer, where they already are. And since hemp is still relatively new, there are a lot of misconceptions which require constant education and ‘unlearning’. We have seen the conversation evolve but we still dedicate a lot of effort to educating new customers,” she adds. Their online store saw 2.5x growth in Q2 2020 when people began experimenting more in their kitchens and as of Q1 of 2021, they have seen over 20 percent growth from the last quarter in online sales.

![loveena rohit iho loveena rohit iho]() Loveena Sirohi and Rohit Kamath, co-founders of India Hemp Organics

Loveena Sirohi and Rohit Kamath, co-founders of India Hemp Organics

Another startup that launched right before the pandemic in February 2020 is India Hemp Organics founded by Rohit Kamath and Loveena Sirohi. They manufacture and retail ayurvedic proprietary medicines using hemp seeds and leaves, particularly in categories like medicine, nutrition, and personal care.

“We launched our products right before the pandemic hit. Due to a shift in consumer behaviour, and as health started to become a prime priority, our products fit the bracket perfectly and we had a great start in the financial year 2020-2021. This year, with our growth plans, we see the revenue multiplying by 3-4x from the last,” says Kamath. The startup is primarily retailing its products on their website and is present in several modern trade physical outlets and other online marketplaces across India that fit their niche. Apart from that, they also have their own experience store in Bengaluru where customers can walk into to learn more about the benefits of the products and purchase them.

Cannabis has been an ingredient in ayurvedic formulations for ages now, and hence the ministry of AYUSH promotes indigenous alternative medicinal systems, allows ayurvedic products to include cannabis, and ayurvedic doctors to prescribe such medicines. The manufacturers have to bank on leaves to avoid falling under the purview of narcotics.

The lack of awareness is one major problem faced by all hemp startups in India. “The common perception of cannabis is primarily associated with narcotic properties. Inadequate awareness is hardly surprising considering how India is yet to come on par with global hemp markets such as Israel, Netherlands or China, both from a knowledge and mind-set perspective,” says Shailesh Ganeriwala, who founded OG Hemp with Animesh Kumar and Sarabjeet Rattan in May 2019.

OG Hemp sells paper that is not manufactured using wood pulp, but hemp plants. “Our need for raw hemp, for producing paper and derivatives, is satiated by hemp grown and processed in India. But there is a shortage at times that makes it hard to find the grade of fibres required for consistent paper quality. We are importing different grades of raw hemp bast fibers, which facilitate paper production from North America and Spain,” says Ganeriwala, who struggles with supply as the Indian production is not enough for his business to scale up the operations. The bootstrapped startup currently has clients over 18 countries.

![tarun jami_greenjams_bg tarun jami_greenjams_bg]() Tarun Jami, co-founder of GreenJams

Tarun Jami, co-founder of GreenJams

Some hemp startups are also addressing the climate change crisis using hemp products. In 2017, Tarun along with his brother Varun Jami founded GreenJams to eliminate the emissions from the construction industry. They came up with hempcrete, also known as hemp concrete or lime hemp concrete, and agrocrete (made from crop residues). Hempcrete is carbon negative, and can absorb emissions (up to 250 kg of carbon dioxide per meter cube), plus it is light-weight too. Yet, the limited domestic supply of hemp has made hempcrete about six times the cost of cement-based concrete, destructing its commercial potential.

“Cost is a really important factor. And the only thing that drives up the cost of hempcrete is the cost of hemp shivs. Currently, we source our hemp from the hills of Uttarakhand where there are tribal groups and self-help groups that extract hemp fibres to make bags, clothes, and other textiles,” says Tarun, who, along with his brother, featured in 2019 Forbes 30 Under 30 list. He explains that it is a completely manual process and the high cost of transportation, labour and so on drives up the cost of hemp hurds to almost Rs 70-80 per kg.

"‹“We put approximately 2 kg of hemp hurds in a block of hempcrete, which lands up at a price of Rs. 180-200 per block. A concrete block of the same size costs somewhere around Rs. 30-35. We find it difficult to justify the 6x higher price when the product is supposed to be used in such large volumes in a home. The higher thermal insulation does help lower the operational costs of the building, but the payback period is almost 100 years,” explains Tarun.

The solution to this problem, according to Tarun, is that the cultivation of hemp must be made easy and the THC content must be relaxed to make it easier for farmers to cultivate it at a large scale.

Before it is too late, India should join the party to unlock the full potential that legalisation of cannabis would bring. Vaidya, the cancer survivor, says, “In a country trying so hard to praise its own land for its many natural remedies, I hope hemp becomes another bonafide star because it is as amazing and healing as turmeric, tulsi, jackfruit or moringa.”

Rohit Sharma, President, Indian Industrial Hemp Association (IIHA) Image: Madhu Kapparath

Rohit Sharma, President, Indian Industrial Hemp Association (IIHA) Image: Madhu Kapparath  (From L-R) Siddarath Ahuja, one of the investors in Boheco Chirag Tekchandaney and Yash Kotak, two of the seven co-founders of Bombay Hemp Company (Boheco)

(From L-R) Siddarath Ahuja, one of the investors in Boheco Chirag Tekchandaney and Yash Kotak, two of the seven co-founders of Bombay Hemp Company (Boheco) Abhishek Mohan, co-founder, HempStreet Image: Olena Mazur

Abhishek Mohan, co-founder, HempStreet Image: Olena Mazur

Harshaavardhan Reddy Sirupa founded Namrata Hemp Company in 2016, along with his wife after whom the company is named Image: Selvaprakash Lakshmanan for Forbes India

Harshaavardhan Reddy Sirupa founded Namrata Hemp Company in 2016, along with his wife after whom the company is named Image: Selvaprakash Lakshmanan for Forbes India Shalini and Jayanti Bhattacharya, co-founders, India Hemp & Co, recently launched a new pet vertical, starting with hemp seed oil for pets

Shalini and Jayanti Bhattacharya, co-founders, India Hemp & Co, recently launched a new pet vertical, starting with hemp seed oil for pets Loveena Sirohi and Rohit Kamath, co-founders of India Hemp Organics

Loveena Sirohi and Rohit Kamath, co-founders of India Hemp Organics  Tarun Jami, co-founder of GreenJams

Tarun Jami, co-founder of GreenJams