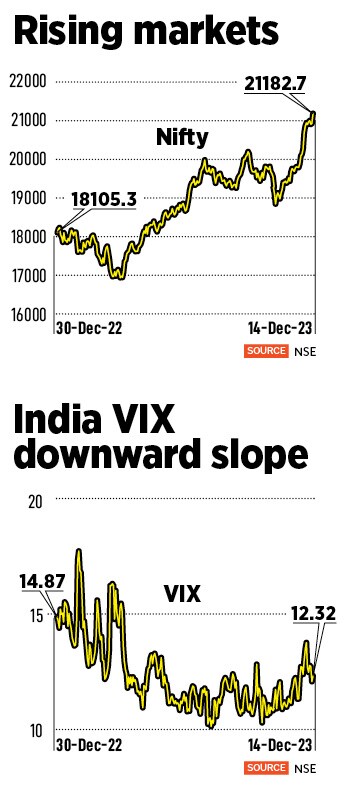

The India volatility index (VIX), often referred to as a fear gauge or fear index, is tumbling, an indication that investors are increasingly betting that a downside risk is a distant possibility. The volatility index typically has an inverse correlation with the benchmark index. The India VIX has slipped 17 percent from the beginning of January to 12.32 levels.

“Tumbling VIX should be interpreted as an increase in confidence by the market participants for the equity markets," Jay Thakkar, head-alternate research, capital market strategy, Sharekhan by BNP Paribas, says. He feels that as of now there are no major domestic risks apart from performance risk.

Thakkar explains that low VIX means market participants are ready to take risks in equity. ““It’s a ‘risk-on’ approach as of now. So, where the VIX is falling it means less uncertainties in near term. A very sharp rise in VIX is considered risk-off mode and small bounces are just due to profit booking," he adds.," he adds.

![]()

The India VIX, which gauges the anticipated volatility in Nifty over the next 30 days, has been trading considerably low over the last several quarters, ranging between 8 and 14 during the previous few months. With the expectation that there is not much likelihood of any big negative surprises in the markets in the foreseeable future, investors" overall positive and bullish sentiments are reflected in the sharp decline in the India VIX, says Aamar Deo Singh, Senior VP Research, Angel One.

“Global economic worries and rising geopolitical tensions notwithstanding, the VIX"s low level suggests that these risks are not currently regarded as serious. One aspect that contributes to investor confidence is the fact that India"s economy is relatively in a sweet spot when compared to most others," Singh adds.

From the highest levels that the India VIX had reached on 30 January, when markets were marred with uncertainties due to the Adani sell-off and Union Budget-related jittery, India VIX has fallen 30 percent. However, currently, India VIX isn’t at the lowest level of the year. It has heated up 4 percent from November when overall markets have started to climb with Nifty increasing over 5 percent in the month. In 2023 India VIX had hit its lowest on July 28, at 10.14, and risen over 21 percent since then.

“The VIX has an inverse correlation with equity markets, so during the start of the year post-Budget there was an increase in volatility due to Adani-related news, thereafter it cooled off and Nifty made a new life-time high. Then Israel-Palestine war led to a little volatility in markets and later due to the cease fire, volatility cooled off. Inflation worries have also dropped as the central bankers have paused an increase in rate hikes, hence markets are forming higher and life-time highs, so VIX cooled off. The five state elections are also well in favour of the incumbent government, so that too led to cooling of VIX. Now there are fewer uncertainties so VIX is falling and equity market is rising," Thakkar says.

Boosted by institutional money flow, Indian markets had started to show signs of recovery in the beginning of November itself. Foreign institutional investors (FIIs) gradually shifted their focus to India equities, pumping in $2.3 billion in November as fear of consecutive interest rate hikes ebbed. In October and September, FIIs were net sellers of Indian stocks worth $5 billion. So far in this year till November, FIIs have invested $14.4 billion into India shares while domestic institutional investors (DII) were net buyers of $20.8 billion. In November, DIIs invested $1.7 billion into stocks. Markets have been on a roll since then.

The 50-share index Nifty hit fresh record highs in December, breaching the 21000-levels while overall market capitalisation of India’s listed companies hit a cumulative $4 trillion for the first time ever.

“The Indian stock markets saw a spectacular run in 2023 with rallies in many industries and multi-caps. Index heavyweights like HDFC Bank and Reliance Industries, which together account for almost 20 percent of the Nifty50 weightage, have recently started to cash in on the momentum," says Singh.

Singh elaborates that falling VIX should be interpreted by investors as a positive indication that a major market correction is unlikely to occur anytime soon. “Furthermore, since VIX is also referred to as the fear index, a notable rise in VIX indicates a bear market, while a notable fall in VIX indicates either a status quo or a sign of confidence in the markets. Since the India VIX typically stays above 20 levels for a longer amount of time in bear markets and stays below 20 levels during bull markets. It"s also important to remember that option premiums typically decrease when VIX is low because investors anticipate less volatility in the markets, and the opposite is true when VIX is high," Singh adds.

However, declining VIX is not an India phenomenon alone. Wall Street"s so-called "fear gauge" is plunging to a four-year low which shows stock market investors have become overconfident, according to UBS. “The VIX index of implied US equity market volatility, a popular measure of fear in markets, is close to historical lows—pointing to a degree of overconfidence, in our view," UBS analysts say.

Turbulence ahead?

Not that the markets are rallying without any risks. Election results in five states in December calmed anxious investors about continuing government policies and political stability, but the Lok Sabha elections may be a different ball game altogether. Adding to it is inflation, which has begun to spike again. Urban consumption after significant growth in 2022 is also slowing due to impact of inflation and interest rates. In contrast, rural consumption is picking up, gradually.

“The markets will be closely watching the Lok Sabha elections, which are predicted to have a big impact on the markets, making the first half of 2024 an extremely exciting and eventful period for the markets," according to Singh.

![]()

Additionally, in the upcoming months, the direction of crude oil prices, inflationary patterns, prospective rate cuts, and FII inflows will be crucial factors influencing Indian markets. “Future volatility is probably going to increase, so investors should definitely tighten their seat belts and be prepared for a roller-coaster ride in times to come," Singh cautions.

Then there is a risk about the macro-economy. Private consumption growth faltered in the second quarter of financial year 2024 to 3.1 percent from 6 percent growth in Q1FY24. Services sector growth in Q2 moderated to 5.8 percent from 10.3 percent a quarter ago partly due to base effect and dilution in discretionary demand. The agriculture sector expanded at a slower pace of 1.2 percent in Q2FY24 compared with 3.5 percent a quarter ago. Wholesale price-based inflation rose for the first time in nine months, driven higher by elevated vegetable prices while volatility in vegetable prices may continue to impact retail inflation.

“The biggest risk to the market of crude prices has eased as chances of the spreading of the conflict in the Middle East appears less. This could sustain India’s valuation premium," say analysts at Tata Mutual Fund.

Crude prices remain critical for India as they directly affect the country"s macro parameters much more than the other emerging markets. Meanwhile, Indian rupee depreciated to its lowest level in 2023 amidst a narrowing yield differential with the US, slowing FII flows and a rise in oil prices.