“We seek clarity on the rationale behind retaining 40 percent stake in the new entity, the royalty structure, any tax implications and the key criteria for a strategic investor, partner or collaborations in the business," says Nitin Gupta, analyst, Emkay Global Financial Services. However, Gupta maintains a positive outlook and sees a K-Shaped recovery in ITC’s ‘other FMCG’ business.

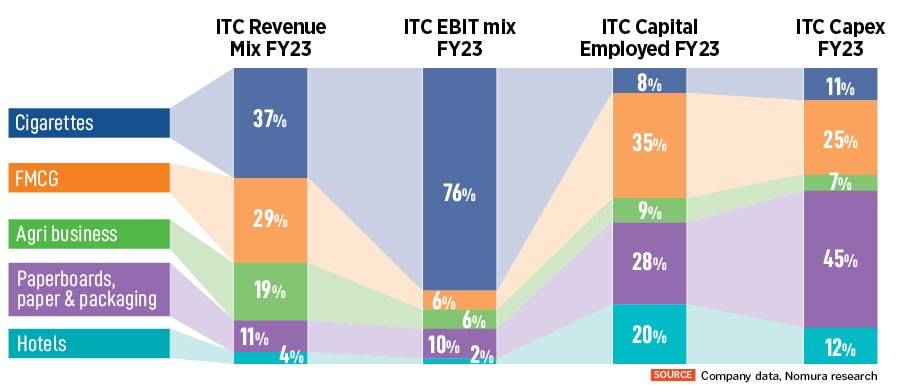

Others concur the demerger will create value-unlocking and improve the balance sheet of ITC, along with capital allocation and return on capital employed (RoCE). The hotel business share in revenue and EBIT was 4 percent and 2 percent in FY23 respectively, accounting for 20 percent and 12 percent of the overall capital employed and capex in FY23.

“In the financial year 2023, hotels segment RoCE stood at 9.6 percent while ITC"s total segment RoCE was at 34.5 percent. Excluding the hotel business, its total segment RoCE improves to 37 percent," says Mihir P Shah, analyst, Nomura. The financial term RoCE is used to typically assess a company"s profitability and capital efficiency and helps to understand how well a company is generating profits from its capital as it is put to use.

ITC’s hotels business’ average annual capex pre-Covid was Rs 600-700 crore, while capex over FY21-23 moderated to Rs 200 crore as it moved to an asset-right model.

Shah believes the demerger will free-up the earmarked annual capex of Rs 200-300 crore. “On the demerger of the hotels business, there could be surplus cash-saving and could result in higher dividend payout for shareholders over the medium term, in our view. Management control in hotels in the new entity can aid in securing management control in case any large shareholder intends to exit, avoiding hostile takeover," Shah explains. Currently, British American Tobacco or BAT’s hold of 29 percent in ITC will become 17.4 percent in ITC Hotels.

According to Abneesh Roy, executive director, Nuvama Institutional Equities, investors need to watch out what happens to BAT’s holding in ITC Hotels over medium or long term given BAT does not hold interest in hotels globally. The proposed structure shall ensure lower stamp duty costs and continued synergies (with agri business in terms of sourcing, tapping into R&D capabilities of FMCG, cross-branding, etc).

“If it were a zero percent stake, then hotels business would have become a takeover candidate with no possibility of synergies. But the structure of the ‘demerged’ entity implies a balance between sufficient decision-making capabilities and stability. Post-demerger, the hotels entity shall become an associate company accordingly, the profit/loss will only be considered on a pro rata basis," Roy explains.

Currently, Indian Hotels (IHCL) has a market cap of Rs 55,000 crore. ITC Hotels is roughly half the size of IHCL as Roy feels ITC Hotels will be of a reasonable size and if it were listed currently, he estimates ITC Hotels could have a market cap of about Rs 250,00 crore.

“In light of the proposed demerger of the hotels business, we are raising the target valuation for the cigarettes business to 22 times (from 20 times) and for the FMCG business to six times from five since the demerger of the hotels business (less than 5 percent each of overall sales and profits, but guzzling 20 percent of capital and generating only a single digit returns ratio) would remove a big overhang on ITC," Roy elaborates.

Concerns

Shirish Pardeshi, research analyst, consumer, Centrum Broking, points out to three unknowns. First, what will be the swap ratio for the existing shareholders second, why ITC decided to pick up only 40 percent stake in in the new entity and third, in the alternate structure (separate listing), if ITC would pick up strategic investor, at what valuations.

“We expect post-listing ITC may buy out BAT’s stake to ramp up to 51 percent in ‘ITC Hotels Limited’," he says.

ITC’s proposal to demerge its hotels business is not exactly a gamechanger, but definitely points towards a sharper capital allocation strategy, says Richard Liu, analyst, JM Financial Research.

“The principle," Liu adds, “is that the hotels business should not be starved of capital simply because ITC’s shareholders at large are unhappy with the cash and RoCE drag from its presence in the sector."

However, there are concerns. ITC’s residual shareholding in the hotels business could get subjected to a ‘holdco’ or holding company discount. Holdco is a company that exercises control over one or more additional firms and may influence shareholders.

![]()

“This is not exactly a big issue," says Liu, given that the hotels business’ valuation comprises sub-5 percent of ITC’s overall value.

Once the new entity ITC Hotels is listed, Vivek Maheshwari, analyst, Jefferies, sees a risk as there could potentially be some supply pressure from existing shareholders in the case of ITC Hotels, especially from shareholders like BAT. “We also note that most analysts currently do not apply a hold-co discount which could potentially be the case once ITC Hotels is separately listed," he says.

High capex intensity and weak return ratios in the hotel business have been a key concern for ITC in the past. Hotel business accounted for nearly a quarter of ITC"s capex over FY10-20 with 5 percent RoCEs.

“Metrics, however, have improved in the last few years, a trend we expect to continue. With ITC pursing an ‘asset-right’ strategy, capex for the hotel business has moderated. At the same time, profitability has improved sharply. Put together, after seeing negative cash flows, the business generated a positive free cash flow for the first time in nearly 15 years. This would enable ITC"s plans to look at an alternate structure for the hotel business," Vivek Maheshwari says.

Stock reaction

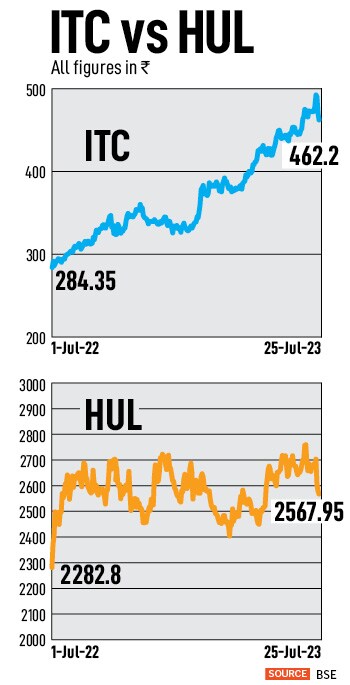

The shares of ITC have been on fire in last one year. From the beginning of January, stock rose over 45 percent, after slipping nearly 6 percent in last two days following the demerger news. The stock hit a record high at Rs 499.6 on July 24, before hitting a low of Rs 300.50 on July 26.

![]() On July 20, ITC market capitalisation had hit a milestone of Rs 6 lakh crore, rising over 50 percent in a year. With a market cap of Rs 6.22 lakh crore, ITC had moved ahead of HUL at Rs 6.12 lakh crore. However, at current levels, ITC’s market cap stands at Rs 5.89 lakh crore while HUL is still above Rs 6 lakh crore.

On July 20, ITC market capitalisation had hit a milestone of Rs 6 lakh crore, rising over 50 percent in a year. With a market cap of Rs 6.22 lakh crore, ITC had moved ahead of HUL at Rs 6.12 lakh crore. However, at current levels, ITC’s market cap stands at Rs 5.89 lakh crore while HUL is still above Rs 6 lakh crore.

“High incidence of taxation and strict regulatory norms on cigarette usage in public and packaging poses threat to cigarette volume growth. The growing contraband market of cigarettes also poses a significant threat for the cigarettes business. The slowdown in macro-economic environment is a major threat to the hotels business. SUUTI stake sale is a likely overhang on the stock," says Roy. The government via SUUTI (Specified Undertaking of Unit Trust of India) holds 7.84 percent in ITC as of June.

The story so far

The board of ITC has given an in-principal approval to demerge the hotels business into a wholly-owned subsidiary. The new entity is proposed to be called ITC Hotels Limited or other similar names, as per approvals by the ministry of corporate affairs, which will be listed on the exchanges separately. However, further details of the proposed re-organisation and scheme of arrangements will be known only after the final board approval, which is scheduled on August 14.

What is known so far is that existing shareholders will hold 60 percent direct stake in the new entity, while the remaining 40 percent will be held by the parent entity and there will be no change in the economic interest held by ITC’s shareholders. Once approved by the board, the hotel business will require further approvals from shareholders, creditors, stock exchanges, Securities and Exchange Board of India (Sebi), National Company Law Tribunal (NCLT) and other regulatory bodies.

According to ITC, the demerger will help the new entity in attracting appropriate investors and strategic partners and collaborations whose investment strategies and risk profiles are aligned more sharply with the hospitality industry. “In addition, it will unlock value of the hotels business for the company’s shareholders by providing them a direct stake in the new entity along with an independent market driven valuation thereof," ITC says in a statement to BSE.

This move by the company also reinforces the sharper capital allocation strategy put in place in recent years, manifest in the pivot to ‘asset-right’ strategy in the hotels business, ITC adds.

In 2004, ITC’s hotel business had merged with the company. During this period, the company has expanded room keys by 2.6 times—of the over 120 hotel properties, located across more than 70 destinations, the company has more than 11,600 room keys while 54 percent is under management contract.

Prior to 2004, the ownership of the hotels business was split between ITC and ITC Hotels & subsidiaries, which was later merged into ITC to obtain fiscal efficiencies, rationalise operating cost and scale up the business with sustained growth prospects.

ITC’s hotels business run several brands, like ITC Hotels that caters to the luxury segment, Welcomhotel that targets the premium segment, Fortune catering to the mid-market to upper upscale segment, and WelcomHeritage in the leisure and heritage segment. It has further expanded into two new brands—Mementos in the luxury lifestyle segment and Storii in the premium segment.

ITC is one of the largest consumer companies in India with diversified presence in FMCG hotels, packaging, paperboards & specialty papers, and agri-business. Its FMCG brands include Aashirvaad, Sunfeast, Yippee!, Bingo!, B Natural, ITC Master Chef, Fabelle, Sunbean, Fiama, Engage, Vivel, Savlon, Classmate, Paperkraft, Mangaldeep and Aim.

On July 20, ITC market capitalisation had hit a milestone of Rs 6 lakh crore, rising over 50 percent in a year. With a market cap of Rs 6.22 lakh crore, ITC had moved ahead of HUL at Rs 6.12 lakh crore. However, at current levels, ITC’s market cap stands at Rs 5.89 lakh crore while HUL is still above Rs 6 lakh crore.

On July 20, ITC market capitalisation had hit a milestone of Rs 6 lakh crore, rising over 50 percent in a year. With a market cap of Rs 6.22 lakh crore, ITC had moved ahead of HUL at Rs 6.12 lakh crore. However, at current levels, ITC’s market cap stands at Rs 5.89 lakh crore while HUL is still above Rs 6 lakh crore.