Suddenly, the ugly elephant in the room became visible. “I don"t sell bread. I don’t have biscuits. I don’t make edible oil. I don’t even sell salt and atta…" Mohit Malhotra felt miserable. A month into the national lockdown triggered by Covid-19, life had come to a screeching halt for everybody, including the chief executive officer of Dabur who happened to be at the corporate headquarters in Kaushambi, Uttar Pradesh, on a blustery Friday.

Businesses had paused, shops were shuttered, and only essential goods and services were allowed. Essentially, the business of essentials meant a silver lining for every FMCG player. ITC started pushing its food portfolio on a war footing Britannia got busy with an aggressive blueprint for breads, biscuits and other edibles Marico and HUL too got into the act.

The maker of the biggest Chyawanprash and honey brand in India found itself in a fix. Consumers don’t see Chyawanprash as a medicine, and ayurvedic medicines that Dabur sells through chemist stores only contribute a fraction to its revenues. To add salt to the wounds, the grocery outlets—which contribute around 70 percent to the business—didn’t have any Dabur product. For a consumer packaged goods company, the glaring gaps in its portfolio became an eyesore. “Are we actually treading on the right track?" Malhotra wondered. A sense of brutal self-assessment gripped him. The chinks were exposed, and the big task for the CEO was not to mask the gaps but load the armoury with new weapons. The eight domestic power brands—Chyawanprash, Dabur Honey, Honitus, Pudin Hara, Lal Tail, Dabur Amla, Red Paste and Réal—needed booster doses.

![]()

A year later—April 2021—Malhotra was in the midst of an urgent huddle with his team. The ‘war room’, as the CEO prefers to call it, had members from across business verticals who were summoned early on a bustling Monday morning to discuss a new product—malted food drink—for kids. “How about Immono Vita," asked one. “Can we call it Chyawan Vita," quizzed another official. Malhotra instantly shot down the Chyawan idea. Kids, he underlined, don’t want to have anything to do with Chyawan. The reason was simple. Back in 2007, Dabur forayed into the MFD segment with a chocolate-flavoured variant dubbed as Chyawan Junior. It bombed. “They want Peter, David, Harry or even Potter. But they don’t want Chyawan," he says in an exclusive interaction with Forbes India.

Malhotra’s observation matched the takeaway of a study conducted by BCG last year. While the global consulting firm encouraged Dabur to make an entry into the MFD segment, the team sounded a word of caution. This time Dabur was looking at MFD products as an extension of Chyawanprash, which had a market size of Rs 1,000 crore and a 4 percent penetration before the onset of Covid-19. Dabur, with a staggering 65 percent market share, was keen to increase the addressable market for Chyawanprash. BCG, though, suggested a twin strategy. First was to have a different and tasty product for kids, along with a stern warning: no Chyawan in the name. The second was to roll out Chyawanprash in different formats so as to make it attractive to youth.

![]()

Fast forward to December. Dabur rolls out Vita, a malted food drink for kids which pits it against the likes of Bournvita, Horlicks and Complan. With Vita, Malhotra reckons, Dabur has taken a differentiated approach in the MFD category as it offers immunity and growth. “Vita offers us a right to win," he says. Meanwhile, to expand the market for power brand Chyawanprash, it has launched the product in tablet and powder forms.

What the new launches—Vita plus the new formats of Chyawanprash—have done is that in one go, they have inflated the addressable market for Chyawanprash from Rs 1,000 crore in March 2020 to a staggering Rs 10,000 crore. Though the pandemic almost doubled the penetration of Chyawanprash, the brand is now wooing a new set of consumers and looking to ramp up volumes. “From power brands, we are moving towards a power platform," says Malhotra, alluding to Dabur’s new marketing strategy to increase the scope, size and play of all its eight power brands by making them enter into adjacent categories.

![]()

Take, for instance, Honitus, another power brand which always existed in the form of cough syrup and lozenges. A few months back, Dabur rolled out sugar-free cough syrup and hot sip kadha, a traditional home remedy for the common cold and flu. The category play for Honitus ballooned from Rs 400 crore to Rs 4,000 crore. Then there is Dabur Lal Tail, massage oil for babies which is just a Rs 550-crore market and that Dabur rules with a 30 percent share. By rolling out an entire babycare range such as wash, cream, shampoo, moisturising lotion, wipes, soap, and diapers this year, the market opportunity for Dabur zooms to Rs 10,000 crore.

Covid is transforming Dabur from a legacy company to a brand that is in sync with a new set of ground realities, bigger market opportunities and a sea of young customers. “The thinking earlier was to enter into niche and profitable markets and dominate them," says 50-year-old Malhotra who joined Dabur in 1994 and handled key assignments in marketing and sales. In 2001, he took over as the business head of European Union. Seven years later, he became CEO of Dabur International, and in 2019 was elevated as CEO of Dabur India.

![]()

Within a year of his India assignment, the pandemic came knocking and Malhotra nudged Dabur to take an aggressive approach. “We are trying to establish a fearless culture in the company," he says. What this means is ramping up volume play, pushing power brands into adjacent categories which stay rooted to Dabur’s core of ayurveda, natural and herbal, refusing to get deterred if some launches bomb, and continuously testing the waters in new categories.

Take, for instance, the move to enter into value-added edibles and cooking oil with tea, ghee, cold-pressed mustard and sesame oil, and spices and pickles. “If a new product fails, then it doesn"t matter. We"ll try harder next time," he says. Within every power brand, he adds, Dabur intends to increase the addressable market. “That’s where the theme of ghar ghar Dabur comes into play. Every house should have a Dabur product," he says.

![]() Dabur, reckon FMCG analysts, is finally waking up to the new realities and is tapping into its hidden potential. The transformation is not easy for a company that has always been fixated with margins and profits. For ages, what Dabur did was to either identify a niche or create a small segment and rule it. By virtue of being the market leader, it would make a profit. Now it wants to make profit by ramping up scale. “They have a right to win in most of the adjacent categories they are entering," says Ronak Soni, analyst at Equirus Securities.

Dabur, reckon FMCG analysts, is finally waking up to the new realities and is tapping into its hidden potential. The transformation is not easy for a company that has always been fixated with margins and profits. For ages, what Dabur did was to either identify a niche or create a small segment and rule it. By virtue of being the market leader, it would make a profit. Now it wants to make profit by ramping up scale. “They have a right to win in most of the adjacent categories they are entering," says Ronak Soni, analyst at Equirus Securities.

Look at Odomos, a mosquito repellent cream brand. Dabur has a 62 percent market share in this segment which has a size of Rs 300 crore. “They could have easily entered into liquid vaporisers (LVP), sprays and other sub-segments of repellents a long time back," says Soni. Now Dabur has got into sprays, LVPs, mosquito nets and electric racquets.

Then there is Odonil, the air freshener brand that came in a blocks format. Again, Dabur has been a market leader in a category which is just Rs 600 crore. So how does one increase the size? Simple. Extend Odonil into gels, aerosols and all kinds of air freshener formats and the addressable market gets expanded to Rs 6,000 crore! “It’s not just about entering into new spaces. It’s about finding the right fit," he says, pointing out another example. Real, the juice and nectar brand which has been under the Dabur stable for over two decades, was extended into the drinks market with a mango drink, and then into fizzy carbonated drinks, milk shakes and now into healthy snacks. From being a leader in the Rs 1,400 crore juice category, the Real category play balloons to Rs 40,000 crore.

![]()

Marketers reckon that Dabur is resizing its business by expanding the size of the market. “From small the opportunity is now XXL," says Ashita Aggarwal, marketing professor at SP Jain Institute of Management and Research. What is helping Dabur in crafting a new marketing strategy, she points out, is shunning the mindset of staying as leader. “Either one build a small country and lead it or become a massive state and keep expanding," she says. The company has also gone deep into the hinterland with the new strategy and a new basket of products. Last October, Dabur started appointing ‘yoddhas’ (warriors) in Uttar Pradesh, Madhya Pradesh and Bihar.

Village-level entrepreneurs, yoddhas act as a stocking point, and as the business ramps up, they are converted into sub-stockists and become an integral part of the sales mechanism. “Look at the way they have scaled this," she says, alluding to 7,000 yoddhas appointed in a little over a year and the move to appoint such village entrepreneurs in Maharashtra, Gujarat and West Bengal. For a company which already has a direct village coverage of over 83,000, yoddhas are set to broaden and deepen its rural contribution, which now stands at around 47 percent.

Though yoddhas might have added more ammunition, Dabur’s new aggressive play comes with a flip side. “They are waging war on multiple fronts now," says Aggarwal. Have a look. Real is now pitted against Slice and Maaza Vita takes on Bournvita, Horlicks and Complan cold-pressed edible oils make them fight heavyweights such as ITC and Marico diapers find formidable rivals in Pampers and Huggies activated charcoal toothpaste now locks horns with Colgate and ghee and tea have Goliaths in their respective segments like Amul and HUL. “Now you are fighting all of them," she says.

![]()

Malhotra, for his part, insists that he has not opened multiple fronts. “We are sticking to Dabur’s knitting, which is herbal, ayurvedic and natural," he stresses. If entry into adjacent or new categories, he explains, results in locking horns with somebody, then it’s okay. “If there are no skirmishes, then honestly there’s no fun," he says with a smile, as he takes a swig of vedic suraksha tea and walks out of his war room. “We are warriors," he says, explaining how his approach is realistic and not opportunistic. “It’s like hedgehog versus fox," he says, explaining his analogy. A few big boys, much like a clever fox, are getting into big categories which have not been their core. “I am like a hedgehog that knows its realm of play," he says. And if in the process of expanding the size of the addressable market, some people find it intrusive, then let it be.

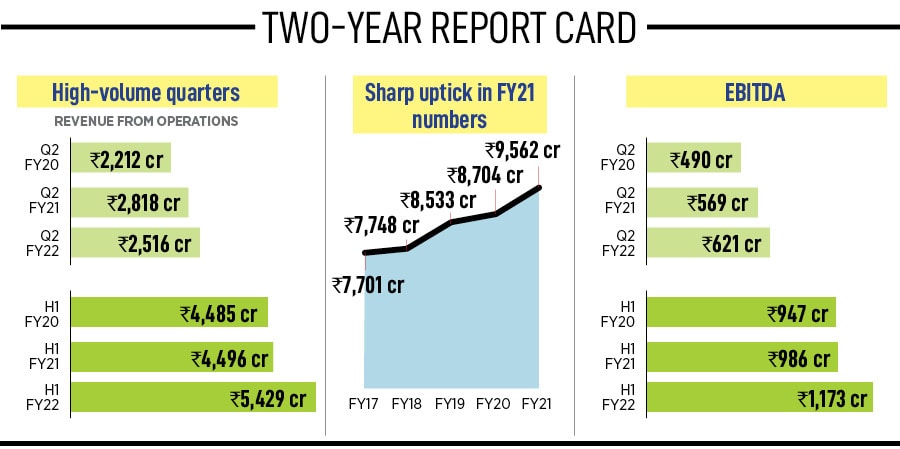

Tell him that some of the new products might cannibalise the existing ones, and the CEO acknowledges the possibility. “It will cannibalise but that’s a conscious cannibalisation," says Malhotra. It will be a weeding and feeding, and the more you feed, the more you grow. “That’s the way we look at it," he adds. And what if others enter into Dabur’s territory? Marico, for one, has rolled out Chyawanprash and honey and has boldly taken on Dabur. Malhotra reckons Dabur is better prepared this time to ensure that the competition doesn’t eat from its plate. A few years back, he recalls, Patanjali grabbed a meaty market share in honey. It’s past. “Now we are aggressive," he says. “We won’t let anybody come and push us," says Malhotra, as the CEO busy pushing the frontier for Dabur. “I want to double my turnover in three years," he asserts, adding that the target can be met only when the market size is increased. “We want our bus to be full of drivers and not passengers," he says, as he keeps his foot firmly on the accelerator.

Mohit Malhotra, CEO, Dabur

Mohit Malhotra, CEO, Dabur

Dabur, reckon FMCG analysts, is finally waking up to the new realities and is tapping into its hidden potential. The transformation is not easy for a company that has always been fixated with margins and profits. For ages, what Dabur did was to either identify a niche or create a small segment and rule it. By virtue of being the market leader, it would make a profit. Now it wants to make profit by ramping up scale. “They have a right to win in most of the adjacent categories they are entering," says Ronak Soni, analyst at Equirus Securities.

Dabur, reckon FMCG analysts, is finally waking up to the new realities and is tapping into its hidden potential. The transformation is not easy for a company that has always been fixated with margins and profits. For ages, what Dabur did was to either identify a niche or create a small segment and rule it. By virtue of being the market leader, it would make a profit. Now it wants to make profit by ramping up scale. “They have a right to win in most of the adjacent categories they are entering," says Ronak Soni, analyst at Equirus Securities.