Inside Marico's pandemic plan

How Marico planned early to prepare for a changed consumer and business reality in the post-virus world

Saugata Gupta, managing director, Marico

Saugata Gupta, managing director, Marico

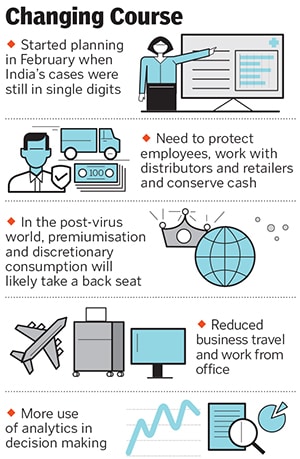

Image: Mexy XavierThe first time Marico started making contingency plans for Sars Cov2-related disruptions was in mid-February. At that point, India’s infection numbers were still in single digits and news headlines were focussed on an impending visit by US President Donald Trump.

Marico, however, was more focussed on the goings-on in China. What was needed was a plan for a situation if India too were to shut down. “As a company, we did not have a ready template,” admits Saugata Gupta, managing director at Marico. “So we used established frameworks.”

As India’s shutdown enters its ninth week, it has laid bare the importance of having a business continuity plan in place. Managing operations during that time can make a difference between a company staying alive and thriving in the post-lockdown world or withering away on account of the new business reality.

The early moves that Marico made gave it a fighting chance in a world that gets gradually used to living with the virus.

The effects of slowing sales are already visible. Net profit for the fourth quarter of the financial year ended March 2020 fell by 3 percent (excluding an exceptional item) from ₹204 crore a year ago. Sales were down by 7 percent to ₹1,496 crore and volumes declined by 4 percent.

In an interview with Forbes India, Gupta speaks about Marico’s early start in dealing with what was to turn into a multifaceted disordering of the company’s operations. Managing factory operations, consumer preferences, supply chain and distribution, and the workspace are all likely to undergo change. Gupta is acutely aware that business rules in the post-Sars Cov2 world are on track to change and the company needs to play by them. There may be less demand for its premium products. Distributors may want to stock less and make sure they get a higher return on capital employed. Employees may prefer to work from home. For now, the annual planning exercise goes out of the window. “We have to live quarter to quarter and even within the quarter have a Plan B,” he says. Marico has put sanitisation and social distancing protocols in place at its factories

Marico has put sanitisation and social distancing protocols in place at its factories

Image: Photo Courtesy MaricoBusiness Planning

Preparing for a pandemic is something few Indian companies had done before. In Marico’s favour was the fact that its supply chain was not dependent on China. Against it was that its business was heavily reliant on distribution and boots on the ground. A contagious virus would require special care.

In early February, Marico began engaging an external agency to come up with a framework to deal with the crisis. What stood out was that the world over, consumers had been reacting similarly: Health and wellness was among the top internet searches. This would lead to the company launching a vegetable sanitiser.

On the business front, a plan was prepared to keep employees safe. Marico realised that this was not just restricted to white-collar workers commuting to office. The company instituted steps to protect employees of distributors and farmers. Insurance plans were rolled out for them. In March, farmers were given a ₹2,000 cash handout to tide over their loss in income. An early plan to transition to working from home worked out as an abrupt national lockdown was announced on the night of March 24.

The announcement came as a bolt from the blue and it took the company seven to 10 days to get its factories running again. There was a lot of liasioning between them and industry associations and state governments to agree to a set of protocols before they got permission.

“Among the things that surprised us was the ease with which we could migrate to working from home,” says Gupta. Laptops were arranged, software loaded and work from home protocols agreed to. The top management convenes daily via a morning call to take stock of the business, and also to discuss how consumer needs and preferences are changing. Among the trends Gupta points out is that once restrictions are lifted, there is a flurry of buying by consumers. In China, luxury goods purchases went through the roof, while in India there was significant buying of alcohol.

Another important realisation was the need to conserve cash. Several businesses have realised that the lack of sales and payments from customers results in an elongated working capital cycle for which they don’t have ready credit lines. Some like Hero MotoCorp have invoked force majeure, a legal clause that allows them to suspend payments during a number of specified circumstances, including a natural calamity. The lack of cash may also prove a hindrance in restarting operations once the restrictions on production are lifted.

In Marico’s case, the need for cash wasn’t as dire as it was still selling and had cash coming in, but the company focussed more on managing its costs. According to Gupta, this is likely to prove crucial in the post-virus world as there would be a lot of stress on the disposable income of its consumers requiring the business to relook at its offerings and how it sells to customers.

Business Retooling

While the immediate production challenge has been addressed, Gupta is also spending time understanding the changing business environment. Three things stand out—the consumer, the distribution chain, and factories and employees.

While it is still early days, the psychological scars on consumer sentiment are evident. They have to contend with social isolation, a loss in income and an uncertain job market. A survey carried out by the Boston Consulting Group (BCG) in late March, mid-April and late April mapped changing consumer sentiment. “My sense is there has been a deep impact on the psyche of the consumer who was driving incremental growth for these companies. They may downtrade as affordability would be a serious challenge,” says Amit Khurana, head of equities and research at Dolat Capital, while pointing out that it remains to be seen whether the salary cuts are temporary or permanent.

As the lockdown was extended, respondents to the BCG survey spoke about how they planned to reduce spends. While restaurants, cinemas and travel are obvious targets, even categories like toys and games, personal care products and apparel are not on consumers’ spending priority. At the same time, there is willingness to spend more on wellness and staples.

For the time being, premiumisation—selling higher priced variants of a similar product—is dead. While consumers may stick to premium products in certain categories—for instance, Saffola on account of increased eating at home—in skin care, they may downtrade. Gupta is unsure how the company would change advertising strategies and budgets for premium products whose purchases are discretionary.

Marico is keeping a close eye on these trends that directly impact its core portfolio. “About 85 percent of our products are for everyday use and so we need to keep ammunition ready to offer more value to consumers,” Gupta says. This could come through rationalisation in pricing and pack sizes as well as spends on increasing direct distribution reach. A key learning of the lockdown has been the need for the product to be available on the shelf. Kiranas and chemists have contributed significantly to sales as consumers are loath to drive 5-6 km to a modern trade outlet and walk down aisles. From a low base, ecommerce has also proved to be a significant driver of sales and should contribute more to growth in the coming months. (Marico launched its vegetable sanitiser only through modern trade and the ecommerce channel.)

On the distribution front, Marico has seen that its channel has been depleted of inventory. Under normal circumstances, restocking happens when normalcy returns, but the experience of demonetisation and the implementation of GST has shown that dealers don’t necessarily stock the same amount. Brands that are stronger and sell faster win as distributors want a higher and quicker return on their investment. “The stronger brands win,” says Gupta, as he points to increased investments in direct distribution. In the interim, the company has extended credit terms across the channel.

The third change is in factories. A consequence of social distancing would be the need for more spacing between workers and increased automation. The net result could be fewer workers needed for the same amount of production. The pandemic may have willy-nilly made future jobs harder to come by. For now, Marico has made arrangements to either house or transport workers to get its factories running. There are myriad rules and regulations to deal with. While goods can move freely across districts, personnel movement is restricted, meaning that factories are working at 60 percent capacity. Future-Proof Strategy

Future-Proof Strategy

While Marico wasn’t dependent on China for its supplies, the international markets the company is present in added another layer of complexity. Infection rates and lockdown rules varied from country to country. Key markets like Vietnam that account for 25 percent of overseas sales have stayed open for business and the Middle East and South Africa are also seeing an easing of lockdown rules. Bangladesh is the only country where business is running at a lower capacity.

In managing business in a disparate set of countries, Gupta foresees a reduction in business travel. “While the last-minute huddle in office always helps”, he says he does see the number of business trips taken reducing. Working from home has also resulted in challenges in terms of data integrity and those will have to be worked on if the company will have employees working from home on a more permanent basis.

There’s also plenty of scope for using analytics to arrive at conclusions. The lockdown has resulted in no physical checks for internal audits. This is being done by mining data and looking for inconsistencies. Even in a post-virus environment, the scope for adopting more analytics is immense.

As of now, Gupta says the infection rates across India are not alarming, but a few cities are showing rising rates of infection, which is a cause for concern. He says the next 20 days are crucial to decide how soon the country can open up for business. He believes Marico is positioned to thrive once markets open and consumers come to their trusted brands. (This is likely to be more pronounced in food products where buyers would want to be sure that they are manufactured with proper hygiene standards in place.) “A lot of growth happens when people move from unbranded to branded,” he says. For Marico, getting to that customer will mean making sure the product is available at a fair price.

First Published: May 26, 2020, 16:20

Subscribe Now