Deepak Fertilisers: On fertile ground

Several setbacks and a failed acquisition attempt have only made Sailesh Mehta better equipped to take his company, Deepak Fertilisers, to the next level—from being a commodity-oriented firm to a cons

Aided by a restructuring and massive capacity expansion, Sailesh Mehta expects DFPCL to double its turnover in five years

Aided by a restructuring and massive capacity expansion, Sailesh Mehta expects DFPCL to double its turnover in five years

Image: Mexy Xavier

There is no place for ego in business. That is how Sailesh Chimanlal Mehta, the 59-year-old chairman of Deepak Fertilisers and Petrochemicals Corporation Ltd (DFPCL), explains his backing off from a much-publicised bid to acquire a rival company, Mangalore Chemicals & Fertilizers (MCF), after fighting to gain control of it for two years.

Mehta, who keeps a low profile, shot into the limelight when DFPCL attempted to acquire MCF by buying a chunk of shares from another investor. MCF was part of the beleaguered former liquor and aviation baron Vijay Mallya’s UB Group. But Mehta’s competitor, Zuari Fertilisers and Chemicals, part of the Kolkata-based Adventz Group, held the upper hand in the fight for control of MCF. After several rounds of a price war, Zuari, led by Saroj Poddar, who enjoyed Mallya’s support, outbid Mehta. By 2015, DFPCL sold off its entire 31.25 percent holding in MCF at a price of

322.82 crore, pocketing a profit of 63 crore.“It was never our intention to get into a fistfight with anyone. We were interested in MCF since it was a wonderful asset and we were given to understand that Mallya wanted to divest,” says Mehta. “But it became a peculiar contest. I believe everything has an appropriate value and we were constantly evaluating MCF’s business model to ensure we didn’t go overboard. It doesn’t help anyone if business is transacted from the standpoint of a person’s ego.”It’s a pragmatic approach and one that has held Mehta in good stead through the several hardships his company, which reported revenues of

4,257 crore in FY2017, has experienced over the years.From the failed takeover attempt to the abrupt discontinuation of gas supply to his firm, a factor critical for DFPCL’s operations, Mehta has emerged stronger from each crisis. He is now bringing this pragmatism and experience into play as his company, one of the major fertiliser producers in the country, goes in for a massive restructuring. One that would see a sharpened focus on each business vertical and the transformation of a commodity-led business into a consumer-focussed one, even as he reinvents his company as a more resilient entity.

The first step the second-generation business leader (DFPCL was founded by his father Chimanlal Mehta in 1979) took towards this end was to get global consulting firm McKinsey & Company on board in September 2016. “We thought about what DFPCL should look like 10 years from now and, after some soul-searching, concluded that we cannot remain a mere commodity player,” Mehta says.

The idea was that DFPCL, which makes NPK (nitrogen, phosphorous and potassium) fertiliser, TAN (technical ammonium nitrate used to make explosives) and industrial chemicals, should be able to price its products in a manner that would help protect its margins, despite uncertainty with regard to raw material costs or increased competition from imports.

To enable this shift, McKinsey suggested a corporate rejig. The company’s NPK and TAN businesses are being moved into an entity called Smartchem Technologies, which will be a wholly-owned subsidiary of DFPCL. The two businesses have been housed under a single entity since they have common raw material requirements and select manufacturing processes. The parent company will continue to house the remaining businesses, which are industrial chemicals and real estate (DFPCL owns a mall called Ishanya in Pune).

Mehta expects DFPCL’s new initiatives, as well as a massive capacity expansion programme, to help his company double its turnover over the next five years. DFPCL recently completed a

750-crore expansion of its NPK fertiliser manufacturing capacity at Taloja, near Mumbai. It also plans to invest 500 crore for establishing a nitric acid manufacturing complex at Dahej in Gujarat and another 1,000 crore to expand its TAN-making capacity.Though it lost the battle for control of MCF, in the process, his company gained valuable knowledge on the norms governing mergers and acquisitions, Mehta says.

“Shifting from being a bulk producer of fertilisers to a farmer-centric consumer company needs an organisational ethos different from that needed to sell chemicals to other companies,” Mehta explains. “So we thought we can effectively achieve this by spinning off the verticals into standalone businesses.”

In its fertilisers business, the company’s thrust is going to be on making specialty grades, such as water-soluble fertilisers, which have greater efficacy, and fertilisers tailored for specific crops like sugarcane, cotton, fruits and vegetables.

“Till now, the marginal cost-benefit ratio for fertilisers was calculated based on yield. But there was no value given to size, colour, shelf life or taste. This is going to be a big differentiator in the future,” says Mehta. “So we are thinking about the farmer when we make our fertilisers, and not just the dealer to whom we directly sell.”Similarly, in its TAN business, the focus will shift towards devising solutions for drilling and blasting services that can help improve productivity at mines. DFPCL has a joint venture in Australia that offers similar services to companies and that technical know-how will be imported to India.

Mehta claims this revamped product strategy, along with an effort to educate farmers on the benefits of contemporary farming techniques, appears to be working as there is robust demand for these new fertilisers, despite them being sold without subsidy support and at three to five times the price of regular fertilisers.

This has also helped reduce dependence on subsidy support from the government. “Earlier, our total pricing strategy for NPK fertiliser was 80 percent dependent on subsidy support. That has now come down to 25-30 percent,” Mehta says. Delayed receipt of subsidy payments from the government is a major cause of concern for fertiliser sector companies, stretching their working capital cycle.

Bharat Banka, founder of FideliMent Ventures, an investment banking and management consulting firm, says DFPCL’s migration towards becoming a consumer-focussed, branded player is a natural outcome of the way in which the market has evolved over the years. “It is not a regulated market any longer, like it was three decades ago when the government used to issue licences. To cater to consumer demand in a free market, it is important to build a brand and get closer to the consumer,” says Banka, the former chief of Aditya Birla Private Equity.

Even a single phase of adversity can spell an entrepreneur’s doom. Mehta has faced no less than three. First was in the 1990s, when the prices of non-urea fertilisers like NPK were decontrolled by the government, while urea-based fertilisers continued to enjoy subsidy support, leading to soaring prices of NPK and a demand shift in favour of urea. Then, in 2005, DFPCL’s fertiliser manufacturing facility in Taloja was completely submerged due to a flood.

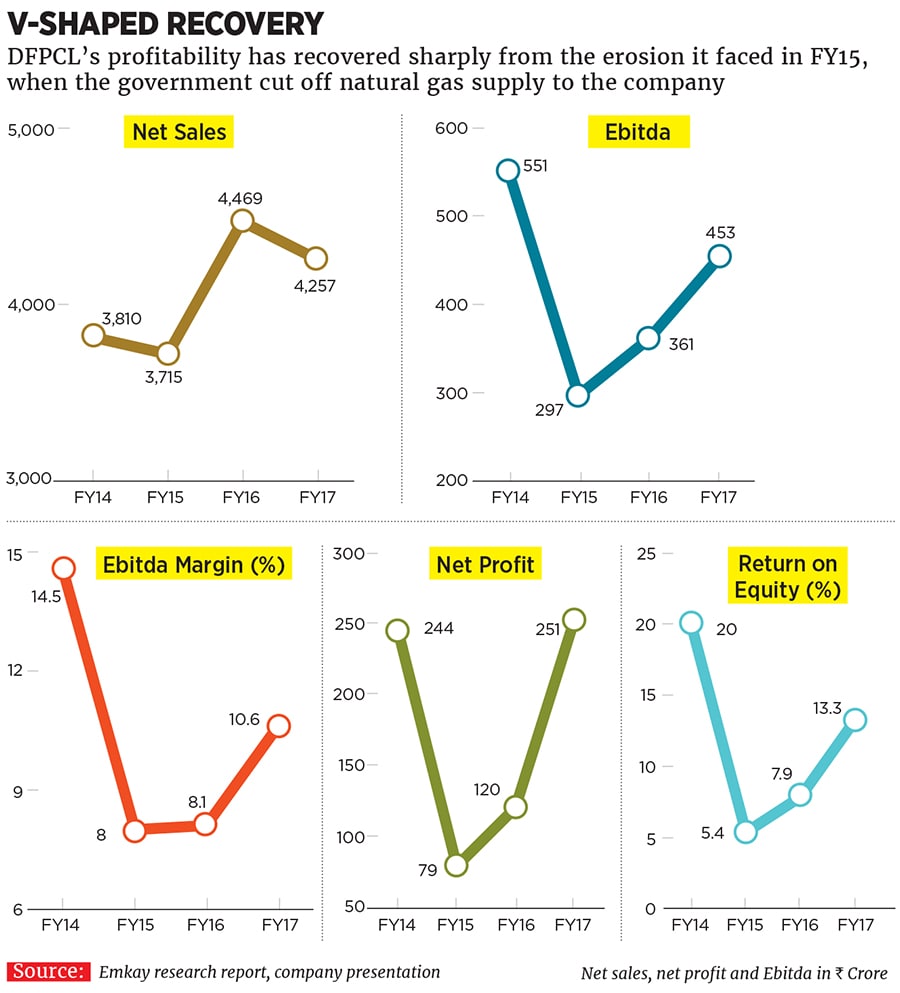

But perhaps no other crisis was graver than the one DFPCL faced in 2014 when a shortage of domestic gas production led the government to arbitrarily cut off natural gas supply to DFPCL, despite the company being entitled to it. Domestic gas was the main fuel on which DFPCL’s fertiliser units used to run.

Though, supported by its other businesses, DFPCL’s overall revenues during the troubled period didn’t decline much, the company took a substantial hit on its profitability (see chart V-shaped Recovery).

DFPCL moved various courts challenging the government’s decision and received four high court judgments in its favour. But Mehta couldn’t afford to wait endlessly for gas supply to resume. Fertiliser manufacturing operations had completely stalled at their Taloja plant between May 2014 and June 2015, and the management decided to change the plant’s configuration to allow it to use imported coal and liquefied natural gas (LNG) as fuel.

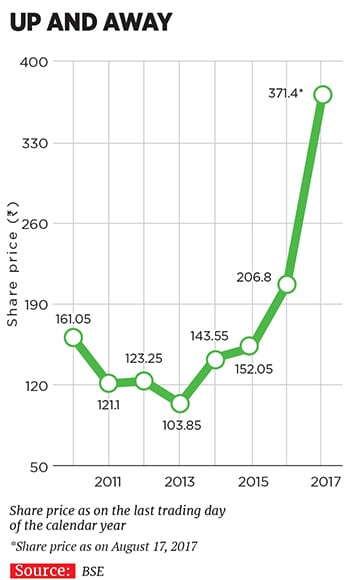

The stitch in time saw DFPCL’s fortunes revive with its financial performance and market value improving sharply.

Banka describes Mehta, who joined the family business in 1985, as a resilient entrepreneur. “He has a fighting spirit in his genes and takes setbacks in his stride,” says Banka. “He doesn’t overanalyse lost causes and moves on with life quickly.”

Helping Mehta move ahead with his ambitions for DFPCL is his son Yeshil. An MBA from Harvard Business School, Yeshil, 29, spent a year as a consultant with Bain & Company and then joined DFPCL as associate vice president—corporate strategy. In July, Yeshil was appointed an executive director on Smartchem’s board, signalling that the next generation of the Mehta family is taking up a bigger role in operations.

“I lucked out that DFPCL is looking at this kind of a transformation organically at this time. This has helped me get an end-to-end comparison of all the businesses quickly by meeting people and analysing data minutely,” says Yeshil.

Going forward, his role will also involve leveraging technology in DFPCL’s transformation journey by utilising analytics and big data to connect better with the consumer, and to drive research into aspects including soil analysis and crop requirements. Together, the father and son duo hope to reap rich dividends from their new strategy for DFPCL.

First Published: Sep 07, 2017, 08:41

Subscribe Now

Mehta’s son Yeshil is associate VP—corporate strategy and is leveraging technology in DFPCL’s transformation

Mehta’s son Yeshil is associate VP—corporate strategy and is leveraging technology in DFPCL’s transformation