Wealth wizards: Follow the 'keep it simple' policy for investments

Believe in the idea? Then run with it, say some of India's smartest investors

“The truly big investment idea can usually be explained in a short paragraph.” – Warren Buffett, chairman’s letter, 1994

Investing is best when kept simple. And nobody understands this better than Warren Buffett. The iconic American investor has shown a distinct preference for ideas that are easy to understand and for businesses that don’t require extraordinary managerial skills. In the real world, though, the number of alert people who can take this straightforward advice to its necessary conclusion is limited. Not only does this need a sharp mind, but it also requires extraordinary observation skills to spot a good business to buy at the right price.

The pages that follow showcase 18 such individuals in Forbes India’s 2015 edition of Wealth Wizards who have stayed true to this idea of wealth creation. They may not be the largest investors but they are among the most incisive: Many of them have been around for the long haul and have ridden the markets roller coaster—from the lows of the turn-of-the-century dotcom bust and the 2008 financial crisis to unprecedented bull runs. Their astuteness is evidenced in how they were able to protect their portfolios during periods of turbulence.

And in their stories, a common theme has emerged, a la Buffett: Their truly big investment ideas have not been complicated. In fact, many of these individual investors have not concerned themselves with the macro factors. Take businessman and investor Rajiv Khanna, who draws on his personal experiences to unearth good companies. He doesn’t meet promoters, instead using basic parameters to understand valuation. Often, he considers the market capitalisation of the company and sees how far it is away from being the leader in that sector. This gives him a sense of the size of the opportunity and he then invests on the basis of growth prospects.

Similarly, Mohnish Pabrai only looks at businesses he understands and those that have sound management and a competitive moat. Porinju Valiyath, a successful value investor, bought into Geojit Securities (where he had also worked earlier) in single digits and saw the price go up to Rs 2,500 in 17 years.

Probably the simplest of all is Sanjiv Shah’s business of an exchange traded fund through which, he says, investors could make good returns by just parking their money in diversified indexes like the Nifty 50 or BSE 30. These are low-cost products and, in many ways, no-brainers.

These individuals have also shown the patience in holding on to their convictions in a volatile market—and emerged successful.

Investing is simple. But then simplicity is not easy to achieve. Just for that, these wizards earn their place in the investing firmament.  Ajit Dayal

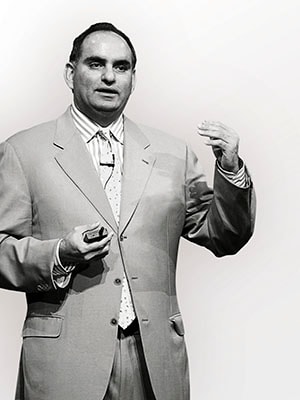

Ajit Dayal

54

Chairman, Quantum Asset Management Company

When the BJP came to power, the markets were euphoric. But over the last one year, Ajit Dayal, as a long-term value investor, has been sceptical about the earnings growth in the Indian economy. In the absence of any major policies to that end, Dayal decided to increase his cash allotment by over 25 percent of his portfolio. His philosophy has been vindicated as the markets have started to slip over the last few months.

In a previous job, Dayal had worked with Tom Hansberger, a value investment maven. He had been the deputy chief investment officer for the global fund of Hansberger Investments between 1997 and 2004. “There are many ways to become a value investor. You can re-theorise and read a lot of value investment books or you can attend the annual general meeting of Warren Buffett. But here I was living day-to-day effectively with an original value investor during my seven years with Hansberger,” says Dayal.

Dayal likes stocks with good managements. They include Infosys and Titan. “But at some price points, even good companies are not great buys,” he says.

His advice to investors? “Equities are a wonderful place to make money in the long run, but if your buying price is wrong, you will never make money. You have to be extremely careful about the quality of management, which is the key to the performance of a good company.”

-Pravin Palande

Image : Joshua Navalkar Anup Maheshwari

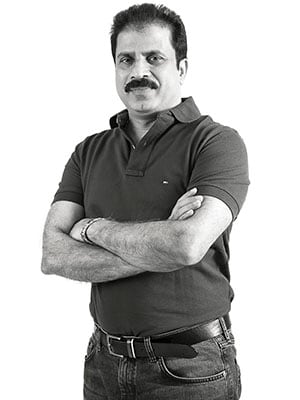

Anup Maheshwari

44

Executive vice president, head-equities & corporate strategy, DSP BlackRock Investment Managers

For Anup Maheshwari, the key to making money is asset allocation. The fund manager argues that like bank deposits, equities are investments, but acknowledges that most retail investors don’t see it that way. “Over time, equities outperform banks. People should realise that, and allocate capital to equities,” he says. He speaks from experience. In 1995, when he was 24, Maheshwari bought Blue Dart shares worth Rs 50,000. The stock price has risen over a hundred times now. “I haven’t touched it. I hold (stocks) for years,” he says.

Maheshwari has been managing DSP BlackRock’s domestic funds since May 2001. The first step towards asset allocation is to make a list. “Keep your list simple,” he says, pointing to three categories of companies one should invest in: Defensives like pharma or the consumer sector, which are characteristically RoE (return on equity) stable and should be bought and held onto for a longer period. Then there are cyclical firms (their RoE tends to go through variations and can be volatile) followed by companies that have high growth.

“How do you compartmentalise these categories? We look at a mix and manage them in the best way,” he says. According to Maheshwari, fund managers don’t define the time horizon for an investor. It’s about an investor’s need for liquidity.

He advises retail investors to remain loyal to one mutual fund for a longer time instead of juggling across various funds: “Stick to funds. Sit through them for the longer term and chances are you will do better.”

-Deepti Chaudhary

Image : Mexy Xavier Chetan Parikh

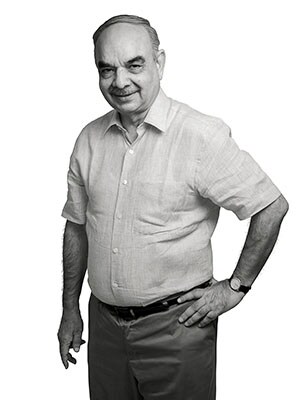

Chetan Parikh

58

Investor and portfolio manager

When Chetan Parikh returned to Mumbai in 1980, having completed his MBA in finance from the Wharton School of Business, he inherited a struggling pharmaceutical company. The sale of this firm was his first lesson. “It was our first experience in practical valuation,” recalls Parikh.

Life back home was a far cry from Wharton, where Parikh was influenced by the efficient market theory that stock prices reflect all available information at any point in time. But in India, he found many instances where stocks were mispriced. His views on investing altered further after Professor Russi Taraporevala, a family friend, suggested he read Benjamin Graham’s Security Analysis and The Intelligent Investor. “I had to unlearn everything and believe that markets are inefficient, mispricings common and you can make impressive returns when great mispricings happen,” he says.

Parikh’s preferred style is to buy moat companies with a bulk of his personal portfolio. He likes companies with high entry barriers, free cash-flow generation, low capital requirement and good R&D. This is despite the fact that he believes moats are becoming less relevant in this age of disruption.

He has had Nestle India and 3M India for over 15 years in his personal portfolio. Through his portfolio management service at Jeetay Investments, which he founded with brother Vinay in 2003, he has invested in companies like Sundram Fasteners, Kennametal India, United Spirits and Elecon Engineering.

Parikh’s advice to investors is, “Know your limitations, decide what returns you will be satisfied with and what risk levels you’re going to be comfortable with.” And then, you can sleep easy.

-Angad Singh Thakur

Image : Joshua Navalkar Donald Francis & Ayush Mittal

Donald Francis & Ayush Mittal

45 & 31

Co-founders, Valuepickr

Ask Donald Francis (left) and Ayush Mittal whether this is the right time to invest (the markets have fallen in recent weeks) and pat comes the reply, “Index levels do not matter. What matters is the consistency of the business performance.”

Like true value investors, the duo would rather analyse the business thoroughly and enter only if the business model is niche and durable. Together, they have picked many winners—Atul Auto, Balkrishna Industries and Mayur Uniquoters, to name a few.

Five years ago, for individual value investors like them, there were few research options. It was this roadblock in good quality research and discussion that led them to found Valuepickr. “We were surprised that there is no place [online] where you could go and read about a business lots of places where numbers are put up and discussed, but what’s behind the fantastic numbers, no one cared to tell you. [That was the] genesis for our structured pieces, to chronicle the struggle of a business to reach where it is today,” says Francis.

Contributors to the forum have had several successes using their domain knowledge. Mittal explains how it was a doctor who spotted Ajanta Pharma, which went on to become a multi-bagger.

Given how they look at businesses it is no surprise that many of their picks have gone on to create a lot of wealth. The model? “Focus on emerging businesses that dominate a niche, where one can see a long operating runway,” says Mittal. These companies should be hard to dislodge from their perch, leading to a sustainable competitive advantage over long periods.

-Samar Srivastava

Image : Joshua Navalkar Ekansh Mittal

Ekansh Mittal

27

Individual investor Founder, Katalyst Wealth

Ekansh Mittal has been reading The Economic Times since he was 12. Reason: His father, a stockbroker and a member of the Uttar Pradesh Stock Exchange, wanted him to identify stocks that gave high returns on equity and a low P/E ratio. One of his early learnings: “Picking up a stock is like solving an algebra equation. The fewer the variables, the easier it is to solve.”

While pursing his BTech at JSS Academy of Technical Education in Noida, Mittal bought micro-cap stocks with his pocket money. He also read books on investors Peter Lynch and Warren Buffett. His philosophy has emerged as straightforward: “I look at simple companies with one or two product lines. I don’t invest in a stock if I don’t understand a company’s business and the sustainability of its earnings.”

Mittal started his equity research firm Katalyst Wealth in 2011 and focuses on small- and mid-cap stocks of reasonable valuations, of companies with strong fundamentals, high-quality products, and minimal debt businesses growing at over 20 percent annually. He cites Cera Sanitaryware, Wim Plast Ltd, Acrysil Ltd, and DFM Foods Ltd as examples. “I’m still holding most of the stocks I picked in 2010-11. It is important to be patient when you are dealing with stocks.”

Stick to the basics is his advice. “Don’t try very high market-cap companies as they have multiple variables that are difficult to follow. Also, look for companies in a space you understand,” he says.

But, before anything, he suggests a thorough read of a Class 12 commerce book to understand the fundamentals of a company’s financial statements. Simple is right.

-Debojyoti Ghosh

Image: Amit Verma Harsha Upadhyaya

Harsha Upadhyaya

43

Chief investment officer (Equity), Kotak Mahindra Asset Management

Soft-spokenness and reticence are not characteristics associated with an equity fund manager. But Harsha Upadhyaya is that and more. He has a shrewd financial brain and for all his successes over the past 15 years—managing funds previously at Unit Trust of India and DSP BlackRock, and now Kotak—he is grounded, too.

This can be seen from the books he reads: Nassim Nicholas Taleb’s Fooled by Randomness (about the hidden role of luck in life and markets) and Antifragile, which discusses how some things benefit and thrive from disorder, shock and volatility. “In the field that we are in, we often feel that we are successful… but it could be due to randomness,” says Upadhyaya.

While at UTI between 2006 and 2011, he was instrumental in making its Opportunities Fund among the top performing funds of its type. He found success by investing in firms such as Titan Company and ITC. At Kotak, he identified companies like Britannia Industries (for changing its growth strategy, improving margins and market share) and Bajaj Finance (niche focus with strong risk management and quality profile). He hints that despite the recent correction, the markets could bottom out over the next 3 to 6 months.

Upadhyaya has a clear investing mantra. “The company must have a proven business model, the ability to generate steady cash flows, show good return ratios and a capital allocation policy,” he says. He wants investors to follow a well-known but often ignored rule: “Invest by buying into a business, not a stock. And don’t get influenced by short-term volatility.”

-Salil Panchal

Image: Mexy Xavier Jinesh Gopani

Jinesh Gopani

37

Fund Manager, Axis Mutual Fund

A conversation with Jinesh Gopani will leave you with the impression that investing in equities is about keeping things simple. Invest for the long term, identify potential leaders, recognise the risk profile of a business model and watch the stock’s performance before betting big, says the fund manager of one of India’s best performing mutual funds.

“Start with a small investment review the performance on a quarterly basis. Once you’re okay with a model and the price, buy big stakes,” he says. “Take concentrated bets and wait for a full cycle before you exit.” Another bit of advice: Pump capital into companies that have innovative products or services and the ability to generate steady high cash flows and RoEs (return on equity) over a longer period.

The soft-spoken fund manager knows what he’s talking about. His Axis Long Term Equity Fund gave over 21 percent returns, compared with the stock market’s nine percent in the last five years. But Gopani is familiar with loss and the fact that things can go very wrong. When that happens, cut your losses as soon as possible. Gopani started investing in equities at the age of 19. He and his two friends invested Rs 5,000 each in a natural resources company. They invested without any research and lost their money. “It humbled me. Since then, I have never gone by [stock] tips. Ho jaayega, no analysis… doesn’t work,” he says.

He has another simple rule: Have a solid reason for buying a company’s stock. “In the first year, you are a star. In the second, you can be a flop star. No one is above the market.”

-Deepti Chaudhary

Image: Mexy Xavier

Jonathan Garner

Jonathan Garner

50

Chief Asian and EM equity strategist, Morgan Stanley

Jonathan garner looks at macro data to understand emerging economies. He focuses on the trajectories of GDPs to assess the equity map of a country.

In his latest report on emerging markets, Garner is bullish on Japan, talks favourably about India but has downrated Brazil. He would know. Over the last 20 years, Garner has seen Portugal, Israel and Greece transition from emerging to developed markets, and Greece slipping back to its erstwhile status after the financial crisis.

When Garner began working on the emerging markets in 1996, the concept was in its infancy. “When I started, it was difficult to even get basic economic data, let alone corporate earnings data to aggregate it,” he says.

Today access to data is no longer a problem in many emerging economies. However, Garner believes that a macroeconomic perspective on emerging markets is still necessary. While a good stock normally has a positive country factor, sector factor and even factors specific to the stock, the sector’s significance is often reduced in emerging markets due to the impact of macroeconomic factors.

Garner’s advice to investors: “An investor should try and understand the economic cycle in a country. He should understand the political economy of a country and most importantly where he is in the valuation cycle at that point in time.”

-Pravin Palande and Angad Singh Thakur

Image: Mexy Xavier Madhusudan Kela

Madhusudan Kela

46

Chief investment strategist, Reliance Capital

Madhusudan Kela made a name for himself in the midcap space in 2005 when he was a fund manager with Reliance Mutual Fund. At the time, he invested in small- and mid-cap companies that were primed for high growth. He invested in the likes of BEML, Kirloskar Brothers and Jaiprakash Associates. They were all multi-baggers with attractive valuations and a potential for huge returns.

Kela feels that investors need to first identify companies that have excellent managements in favourable sectors. In 2005, the macroeconomic conditions were favourable as inflation and interest rates were low, he says. Then in 2009, he began focusing on the pharmaceutical sector, and took disproportionately large bets. He believed that there could be a meaningful medium-term opportunity at hand. He was right.

It isn’t easy pinning down Kela’s investment philosophy. “You need to be in control of your emotions when you are doing long-term investments. The rest of it can be learnt from many different places,” he says.

Kela credits investor Rakesh Jhunjhunwala for shaping his investment acumen, and is inspired by investment guru George Soros. “I was also influenced by Peter Bregman’s book, 18 Minutes. It provides actionable insights to improve efficiency in different aspects of your life,” he says.

He advises investors to have a proper asset allocation plan for the long term. “Volatility can be your friend. It provides an opportunity to build positions in otherwise great companies. Lastly, identify good asset managers and invest through them as this is their full-time job.”

-Salil Panchal

Image: Mexy Xavier

Mohnish Pabrai

Mohnish Pabrai

51

Founder and Managing Partner, Pabrai Investment Funds

“The idea that someone else does your research for you is antithetical to good investing,” says Mohnish Pabrai. The industry with its teams of research analysts may operate that way and yet, on an average, it has not managed to beat the market over a 20-year period. Just to make his argument crystal clear, he explains that it would be akin to writing an article based on someone else’s interview.

Pabrai, who manages $900 million across Pabrai Investment Funds and Dhandho Holdings, got his start in 1994 when he read about American billionaire Warren Buffett. What amazed him was that no one in the industry was copying Buffett even though, by then, he had emerged as the world’s most successful investor, compounding money at over 30 percent. He decided to take up a challenge: If he could compound $1 million at 26 percent for 30 years, he’d get to a billion dollars. In the 20 years since, he has managed to do exactly that.

Individual investors would do well to invest in a few low-cost index funds, he says. “It is very hard to pick a successful investment manager over a 10-year horizon. The pick can only be made with hindsight,” says Pabrai, who lives in California. He advises people in the US to invest in Berkshire Hathaway stock. While there is nothing similar in India, investors here should put their money in something like Tata Sons, if it was to be listed, he says. “And most importantly, cut out noise.”

-Samar Srivastava

Image: Getty Images Neelkanth Mishra

Neelkanth Mishra

39

India Equity Strategist, Credit Suisse

In 2011, before the Indian economy had slowed down, the rupee was at 48 to the dollar. Capital flows were robust. Still, the soft-spoken Neelkanth Mishra downgraded the outlook on the rupee. With a high current account deficit, he only saw a downward trajectory. By the end of the year, the rupee was at 55. It soon came back to 50, but Mishra stuck to his call. By August 2013, the rupee breached 68 for a few hours.

And then, when everyone was bearish, he made another contrarian call—that the rupee was likely to stay in the 62-63 range. Again, he’s been proved right.

Unlike his peers, Mishra doesn’t share the current pessimism on Indian growth. “I’m hugely positive on India,” he says. Sure, the pick-up in the investment cycle is still some time away. “But, there is little a change in government can do. What is happening, though, is a set of reforms at the state level that will propel the next level of growth,” he explains.

“Think of India’s states as countries. UP would then be Brazil and Maharashtra would be Japan,” he says. For instance, UP is separating lines that supply power for agricultural users that will lead to huge productivity increases.

Mishra, who was among the first to spot the opportunity in consumption stocks, is still bullish about the sector. “It still has a long way to go,” he says. What’s a strict no-no? Metals and mining. Be prepared to see some of those stocks in single digits in a couple of years.

-Samar Srivastava

Image: Mexy Xavier

Porinju Veliyath

Porinju Veliyath

53

Founder, Equity Intelligence India

Porinju Veliyath likes to tell the world that he is a farmer who takes active interest in equity investing. “Value investing is a passion but I enjoy farming and I live in my farmhouse three days a week,” says Veliyath, who has been running a portfolio management scheme (PMS) out of Kochi, in Kerala, for the last 12 years. But staying away from the cities, especially Mumbai, helps him avoid all the noise generated in the markets. And take concerted calls.

Veliyath started his career as a floor trader with Kotak Securities in 1990 and then worked with Parag Parikh Securities in the mid-’90s as an institutional dealer and a fund manager. He moved back to Kochi in 1998—his hometown, he says, bought him closer to nature. There he worked with Geojit Securities till 2002 and then started Equity Intelligence, a PMS rooted in value investing.

Veliyath likes to identify the future bluechips—stocks that are not fancied currently. For instance, he chose Geojit Securities as his first value pick and acquired 5 percent of the company at a single digit price the company had a market cap of around Rs 3 crore at the time. The share price has gone up to Rs 2,500 in the last 17 years. His other success was Shreyas Shipping which he identified at Rs 30 in 2012 and is quoted at Rs 700 today.

“The Indian market today is a goldmine if you look beyond Nifty and the fancied stocks. I can clearly see hundreds of multi-baggers, even after the big rally of the last two years. There is a big opportunity if you can identify these positive changes early.”

-Pravin Palande

Image: Amit Verma

Rajiv Khanna

Rajiv Khanna

67

Businessman and Investor

Rajiv Khanna started investing at 52, an unusual age to enter the equity market. This happened after he and his wife Dolly sold their Kwality ice cream business to Hindustan Unilever. He invested his wife’s share into the stock market while using his own money to a run a milk business.

“I follow the Peter Lynch philosophy of investing in what you know,” Khanna says, adding that being a businessman has helped him understand how companies/businesses are run and what will work. His stock picks are related to his own experiences and observations on consumption patterns. Take Unitech, which he purchased in 2003 after chancing upon one of their properties in Delhi while buying a flat. His investment appreciated 300 times in the next five years. Then, once, seeing his wife purchase Nutralite, a butter alternative, he studied Carnation Nutra, the company manufacturing it, and bought a stake in it. It was later acquired by Zydus Wellness. On another occasion, while looking for bottle manufacturers for ghee for his milk business, he came across Manjushree Technopack and invested in the company.

He also advises investors to stay in equities. “Running a business is very difficult as compared to investing. But we have an option to choose from 5,000 businesses of which some of them are going to be big companies. Investors should not miss this opportunity,” he says.

Advice to investors: “You have to ask if you would like to buy the entire company. If the answer is yes, then invest in it. Look for companies which have low market cap to sales ratios, low P/E ratios and companies that have a greater potential to grow.”

-Pravin Palande and Nimesh Shah

Image: Manikandan for Forbes India

Sanjiv Shah

Sanjiv Shah

49

Managing director and chief executive officer, Goldman Sachs Asset Management (India)

“Don’t try to time the market or attempt to beat it many have miserably failed at it. Just bet on the index,” says Sanjiv Shah, the first person in India to start an exchange traded fund (ETF) and a Gold ETF. He believes that an index-focussed fund is the only game in town. “It’s not just safe play, but the only play,” he says.

He built his formidable reputation by punting on low tracking error index funds. After a 14-year stint with DSP Merrill Lynch, Shah partnered with a colleague to launch Benchmark Asset Management Company (BAMC) in 2001 with the sole mandate of focusing on index funds. In doing so, he disrupted the market and rattled fund managers who did not take indexing seriously. BAMC was managing funds to the tune of Rs 3,000 crore when it was bought out by Goldman Sachs AMC.

Shah advises against sector-focussed funds. “Avoid them if you can,” he says. But if an investor is keen on such funds, he recommends infrastructure, FMCG, IT and pharmaceuticals.

On asset allocation, he believes gold in a portfolio shouldn’t be more than 15 percent, while real estate is a no-no. “Buy a house to live in, don’t invest for returns.” In the long-run, real estate returns are equal to or less than equities. “If you really love it, then buy real estate stocks.”

His mantra for wealth creation: “Start a systematic investment plan (SIP) with the index. In the long run, you’ll never get it wrong.”

-Deepak Ajwani

Image: Joshua Navalkar

Shankar Sharma

Shankar Sharma

52

Vice chairman and joint managing director, First Global Stockbroking

“There is money to be made in junk and mispriced opportunities.” This philosophy has held Shankar Sharma in good stead as he built his investment portfolio over a span of more than three decades. He got his first experience of how “junk can turn to gold” during the bull run of 1991-92 when a bunch of worthless stocks that accidently landed in his portfolio appreciated overnight. He used the proceeds from those investments to buy his BSE membership.

“Those were the days of physical trading and the confusion on the exchange floor often meant that you ended up with stocks that you didn’t intend to buy,” says Sharma in a telephonic interview from Dubai. (He divides his time between Mumbai and Dubai.)

Sharma is proud of his investment in Tata Motors. He picked up its shares in 2008 after its stock price slumped following the company’s acquisition of Jaguar Land Rover (JLR). “Everyone had written off JLR due to its debt and lack of profitability. But on one of my trips to London, I saw the new JLR models and instantly knew that they would be successful,” Sharma says. “I did the math and figured that if JLR could improve its market share from 0.6 percent to 1 percent of the global luxury car market, it would lead to a billion dollars of profit. Eventually, JLR made a profit far in excess of that.”

Never underestimate the importance of pragmatism, he says. “Don’t get emotional about investments. It’s all about timing enter and exit an investment at the appropriate time.”

- Aveek Datta

Image: Prasad Gori for Forbes India Sukumar Rajah

Sukumar Rajah

50

Managing Director & CIO Asian Equity, Local Asset Management, Templeton Asset Management Ltd, Singapore

Even as his IIM Bangalore classmates sought out lucrative jobs in consumer banking, Sukumar Rajah, an IIT-Roorkee grad, chose a path less trodden. It was the early 1990s and Rajah had decided to plunge into the nascent field of equity investments in India. “Most of the [other] career options that were available were fairly restrictive in the use of creative capabilities and depth/width of knowledge,” says Rajah. And he saw a career in the field of investments differently: “To be a successful equity investor, one has to have a deep knowledge of various businesses, corporate governance, market psychology and macro-economics before one can pick the right stock.”

Twenty-five years on, Rajah’s record validates his decision. The Franklin India Bluechip Fund that he oversees has grown 85 times since inception (in 1993) even as the benchmark index grew by just 8.5 times Franklin India Prima Fund has grown 66 times since inception (again in 1993) as against 8.2 times by the benchmark index Franklin India Prima Plus launched in 1994 has grown 44 times (the benchmark index grew by 6.4 times).

Rajah’s investment philosophy defies traditional wisdom which stipulates that cheaper stocks give maximum returns. “I try to unearth value looking at a holistic perspective of a company,” he says. When he bought Infosys stocks in 1994, it was a mid-cap company and its P/E was twice that of similar mid-caps. But the company’s market cap has since grown 300 times. The moral of this story: People who take short-term view of their investments make quick money. That gives them a false sense of confidence leading to costly mistakes. And this is advice he follows himself.

-N Madhavan

Sumeet Nagar

43

Managing Director, Malabar Investments

Serendipity describes investment advisor Sumeet Nagar’s life best. A childhood fascination for dismantling toys to understand how they work was a precursor to an education in mechanical engineering at IIT-Bombay. He later joined oilfield services provider Baker Hughes in Italy, where an engineer friend (who was an avid investor) kindled Nagar’s interest in equities and investing. So much so that he left Baker Hughes to pursue an MBA in finance from Wharton in 1999 thereafter, he worked with McKinsey & Co, where he advised fund managers on investment opportunities across countries.

Nagar set up Malabar Investments in 2008—just prior to the global slowdown—which specialises in mid- and small-cap investment opportunities for private equity players, hedge funds and institutional investors. “Go where the fish are, not the fishermen,” Nagar says, regarding investment opportunities in India. Nagar and his team manage a total of $250 million worth of investments at Malabar.

His investment philosophy: “Look for the highest quality mid- and small companies—which have outstanding fundamentals, a terrific management team—these would be less volatile and less risky [to external shocks], than some blue-chip stocks.”

He cites India’s largest synthetic leather maker Mayur Uniquoters (which grows faster than its clients in auto and footwear industries) and cookware industry giants Hawkins Cookers and Prestige TTK as companies they identified early, invested in and booked profit at different points since 2011.

Managing money is a “huge responsibility” but, he says, ensuring returns to investors is an “opportunity to repay faith which investors put in you and a yardstick to measure your performance”.

-Salil Panchal

Image: Joshua Navalkar

First Published: Jul 06, 2015, 07:51

Subscribe Now