Wagh Bakri: Brewing a slow and steady growth story

Wagh Bakri has never focussed on growth at breakneck spread, yet it remains the third-largest packaged tea company

On a Saturday afternoon, as we enter the two-storeyed Wagh Bakri tea lounge in Ellis Bridge, Ahmedabad, a houseful of customers are enjoying warm cuppas in the relatively mild winter of January. We sit down for a conversation with the three generations of the family, but something feels incomplete. The most enthusiastic and outspoken member isn’t around. 2023 was a tough year for the Desai family, with the passing of, first, Pankaj and later Parag Desai within six months. In October, 49-year-old Parag met with an accident and succumbed to multiple complications.

A week later, his wife, Vidisha, decided to fill in the shoes and took charge. While she wasn’t involved in the business earlier, things were not new either. “I used to accompany him on most business trips and international fairs where he wanted me to take the lead and speak about our brand and explain business processes," reminisces Vidisha, who is getting hold of the day-to-day operations gradually.

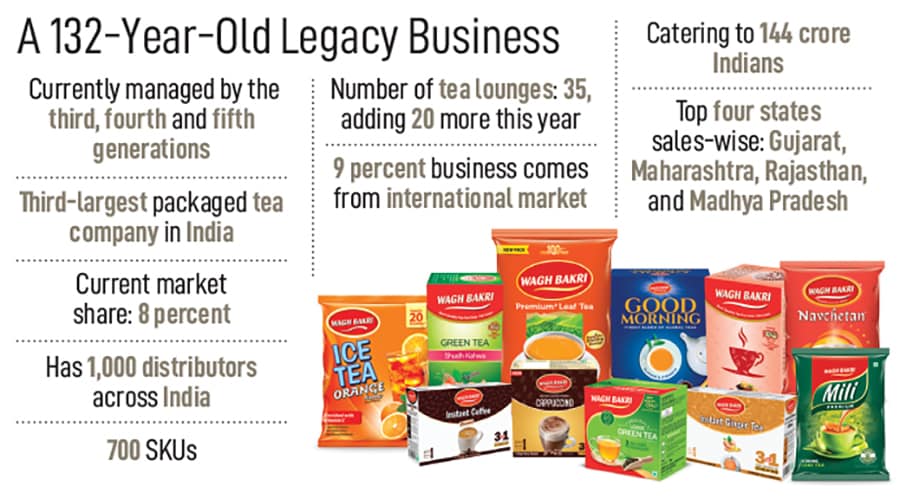

While the world moves at lightning speed, 132-year-old Wagh Bakri Tea Group still believes that slow and steady wins the race. The brand rules the hearts of 144 crore Indian tea drinkers today and has been clear about its business ethos from day one. Quality, customer satisfaction, and brand value have helped it not only earn loyal customers but also the badge of the Regional Goliath.

“We never had this thirst to become a regional or national leader. Our single focus has been our customers," says Paras Desai, executive director of Gujarat Tea Processors and Packers Ltd (the parent company of Wagh Bakri). It was only in 2000 that the Ahmedabad-headquartered company became the leader in Gujarat, after eight decades of its existence in India.

“We never had this thirst to become a regional or national leader. Our single focus has been our customers," says Paras Desai, executive director of Gujarat Tea Processors and Packers Ltd (the parent company of Wagh Bakri). It was only in 2000 that the Ahmedabad-headquartered company became the leader in Gujarat, after eight decades of its existence in India.

Just a day before the interaction, the legacy brand founded by Narandas Desai celebrated its 105th year in India. In 1892, he started the tea business by leasing 500 acres in Durban, South Africa. But racial discrimination forced him to follow his mentor, Mahatma Gandhi, back to India in 1915. He sailed back home with a certificate signed by Gandhi, which read, “I knew Mr Narandas Desai in South Africa, where he was for a number of years a successful tea planter." This served as a token of help to ease migration in the homeland. And there was no turning back thereafter.

Narandas started the Gujarat Tea Depot Co shop in Ahmedabad to sell processed tea. His sons (Ochhavlal, Ramdas, and Kanti) grew the business to seven shops across the city. The third generation—Rasesh, Piyush and Pankaj—moved into the packaged tea business in 1980.

Whether it is launching its bestselling premium tea brand Good Morning in 1944, introducing tea packets in the ’70s, or expanding out of Gujarat in the late ’90s, Wagh Bakri has grown at its own pace, which has worked well for the brand. “I don’t think we were late in moving out of Ahmedabad or even to another state. It’s important to gain confidence first. We mastered the whole thing in Gujarat, and now we are doing the same in Maharashtra, Rajasthan, Madhya Pradesh, and other states where we have presence," says Rasesh, the septuagenarian entrepreneur and managing director.

At the regional level, Wagh Bakri competes with Tulsi Tea and Jivraj Tea. On the national front, it is the third-largest packaged tea company after Tata and HUL. Their overall market share stands at 8 percent. “Local players are our biggest competitors," reckons Rasesh. Wagh Bakri’s art of blending remains its unique selling point as it crafts blends that suit regional tastes. Each director of the company tastes around 400 to 500 samples every day, customising the blends.

With more than 1,000 distributors across India, the brand has over 700 SKUs and products ranging from masala chai, tea bags, green tea, and ice tea to even coffee and tea premix. To keep up with the times, the company also started offering gourmet tea priced between ₹700 and ₹900 for 50 grams, with offerings like tranquil berry tea, milk oolong tea, and matcha tea.

With more than 1,000 distributors across India, the brand has over 700 SKUs and products ranging from masala chai, tea bags, green tea, and ice tea to even coffee and tea premix. To keep up with the times, the company also started offering gourmet tea priced between ₹700 and ₹900 for 50 grams, with offerings like tranquil berry tea, milk oolong tea, and matcha tea.

Parag and Paras from the fourth generation, who joined the business in 1995, took charge of expanding outside Ahmedabad and also introduced the ecommerce platform buytea.com 20 years ago. It has gradually started generating sales, and about 7.5 percent of revenue comes from e-tail. The household brand has a capacity of 50 million kg of tea distribution. Spread across 60,000 square yards of land on the outskirts of Ahmedabad, Wagh Bakri has two composite factories where the material is stored, blended, packed, and dispatched. This also includes NABL-accredited testing laboratories.

What Amul is to butter, Wagh Bakri is to chai in Gujarat, primarily on the strength of its product, says Damodar Mall, chief executive officer of the grocery retail business at Reliance Retail. Its distribution historically has been largely focussed in their strongest areas. “We’ve been working with them to take them to our stores in adjacent markets. They are mainstream in several states beyond Gujarat, in our network. It works for the brand, us and consumers... as a win-win for all."

Wagh Bakri claims to be more economical than the other brands price-wise. The company has also put consistent efforts into educating consumers about how it requires low consumption of fuel and time, and gives high cuppage.

The brand has a presence across 24 states, exports to over 60 countries, and sold 48 million kg of tea last year. It is a brand leader in the US in the Indian ethnic market and also has a strong foothold in Canada, New Zealand and Australia. About 9 percent of business comes from the international market.

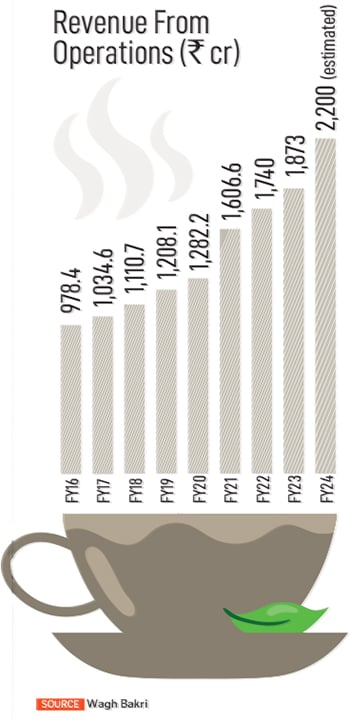

In FY23, the company reported operating revenue of ₹1,873 crore and is eyeing a close of ₹2,200 crore this year. Being a cash-rich company, the promoters don’t wish to take the company to the bourses. “Those who have requirements for funds for quick growth and quick everything go public," says Paras. “Here, we are talking about habit formation, which always happens at a slow pace by design. We’ve seen so many examples in front of us. Even if they had good quality, they had other issues."

Priyam Parikh concedes. For years, the company has primarily focussed on selling, distribution, and expansion. “We’re not your typical FMCG company. We still run in a conservative manner," says the fifth-generation entrepreneur who joined the business in 2009.

The size of the Indian tea market reached $11.1 billion in 2023. It is expected to go up to $14.7 billion by 2032, with a growth rate of 3.18 percent during 2024-2032, according to market research company IMARC Group. The increasing consumer preference for premium and packaged tea brands, the expansion of online retail channels, and awareness regarding the health benefits offered by tea represent some of the key factors driving the market.

In recent years, Wagh Bakri has impressively expanded its product line and established aesthetically pleasing tea lounges in strategic locations, says Abhik Choudhury, founder of brand consultancy firm Salt and Paper. However, the brand faces a pivotal decision regarding its market positioning: whether to align itself with the likes of economical Chai Point or aspire to emulate a more premium Starbucks" model.

"Focusing on authentic and expansive "chai" branding and introducing signature offerings could better position Wagh Bakri to captivate a global audience, rather than merely becoming another venue for casual meetings, which often centers more on the location than the brand itself," he adds.

Hot tea accounts for 60 to 70 percent of the hot beverage market in India. While a large proportion of the players are unorganised, there’s a tilt in organised players either by way of unorganised players losing share or unorganised players becoming organised, explains Nikhil Sethi, partner and national leader, FMCG, KPMG in India. “Commodity challenges continue to affect pricing. Premiumisation and the increasing shift from unbranded to branded products, coupled with innovation in value-added tea products such as flavoured or functional teas, are fuelling growth in this segment."

He adds that given the rapid rise in food services and the growing propensity to experiment in the younger population, tea cafes are expected to gain momentum. Here, product assortments will be key, as tea combinations along with several food items could boost growth. Further, given that convenience continues to be a driver of purchase, pre-mix tea, immunity-based tea, tea concentrates, extracts, and essence could also go a long way.

Wagh Bakri has opened 35 tea lounges and plans to add 20 more this year, amidst the growing trend of tea cafes in India. Most of them are located in Ahmedabad, Mumbai, Delhi, Pune and Goa. The idea is to popularise tea as a preferred beverage. The tea lounge business is growing 12 to 14 percent year over year. The best-performing lounge is the one on the Pune-Mumbai expressway and another in Delhi’s Connaught Place.

The company doesn’t have plans to diversify into new categories. There’s still a lot more to tap into in the tea business, according to them. They don’t even have plans to have their own tea estate. As senior Desai puts it, “We pick good tea from the garden, so we don’t require the garden. We’re blenders and stackers, not growers."

There’s no rush, but eventually becoming the national goliath is the next goal. “We surely want to go national but want to replicate the Gujarat model," concludes Paras.

Lastly, suggests Sethi of KPMG, like no other business, the tea business, too, cannot escape digitisation. To combat the growing demand, tea companies should look to leverage technology across the value chain—such as buying and blending processes, automated brewing for dispensing machines, D2C for their distribution channels, and backend processes such as supply chain and production.

First Published: Mar 20, 2024, 15:56

Subscribe Now