Revealed: India Inc's expectations from Budget 2017

GST, streamlining of tax policies, the war against black money and ease of doing business are the top concerns for India Inc, according to the Forbes India-BMR Advisors pre-budget poll

Finance Minister, Arun Jaitley

Finance Minister, Arun Jaitley

(Image: Udit Kulshrestha/Bloomberg via Getty Images)The Forbes India-BMR Advisors pre-budget poll of select CEOs and CFOs was conducted between November 24 and December 12, 2016, to ascertain the expectations of India Inc from Budget 2017. This was the time when Prime Minister Narendra Modi surprised India by demonetising high-value currency notes.

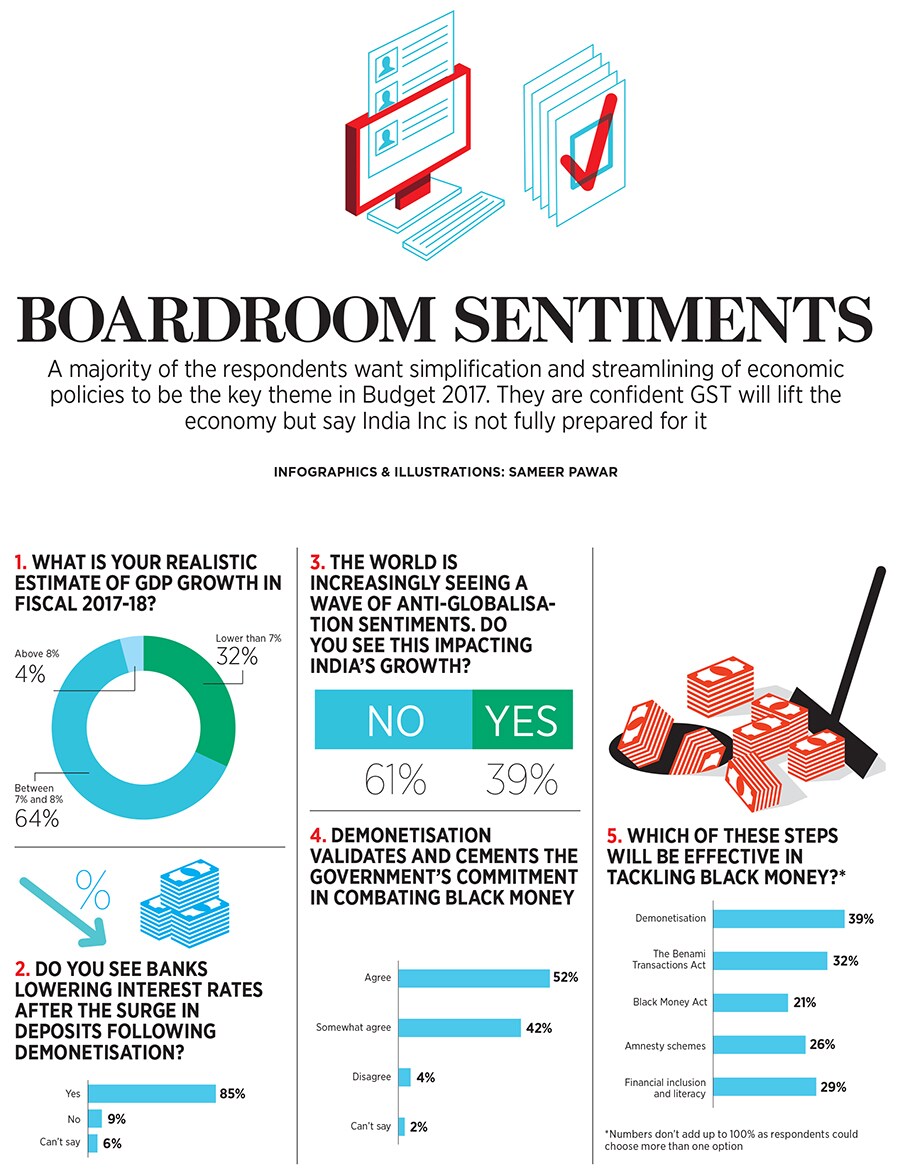

India continues to grow

In the economic survey tabled in Parliament in February 2016, the GDP growth for fiscal year 2016-17 was estimated at 7.6 percent this was lowered to 7.1 percent by the Reserve Bank of India in its latest estimates. In our survey, on the question of expected growth rate in fiscal 2017-18, the respondents were optimistic and consistent: Around two-thirds of them feel the growth rate will be around 7-8 percent and 4 percent believe it will be above 8 percent.

Sixty-one percent of the respondents believe anti-globalisation sentiments in the developed world—such as the Brexit vote and Donald Trump’s victory in the US presidential elections—will not have any impact on India’s growth.

Around 85 percent of the respondents expect interest rates to be cut on account of easing inflation and an increase in bank deposits post demonetisation. Over half of them agree that demonetisation validates the government’s commitment towards curbing black money.

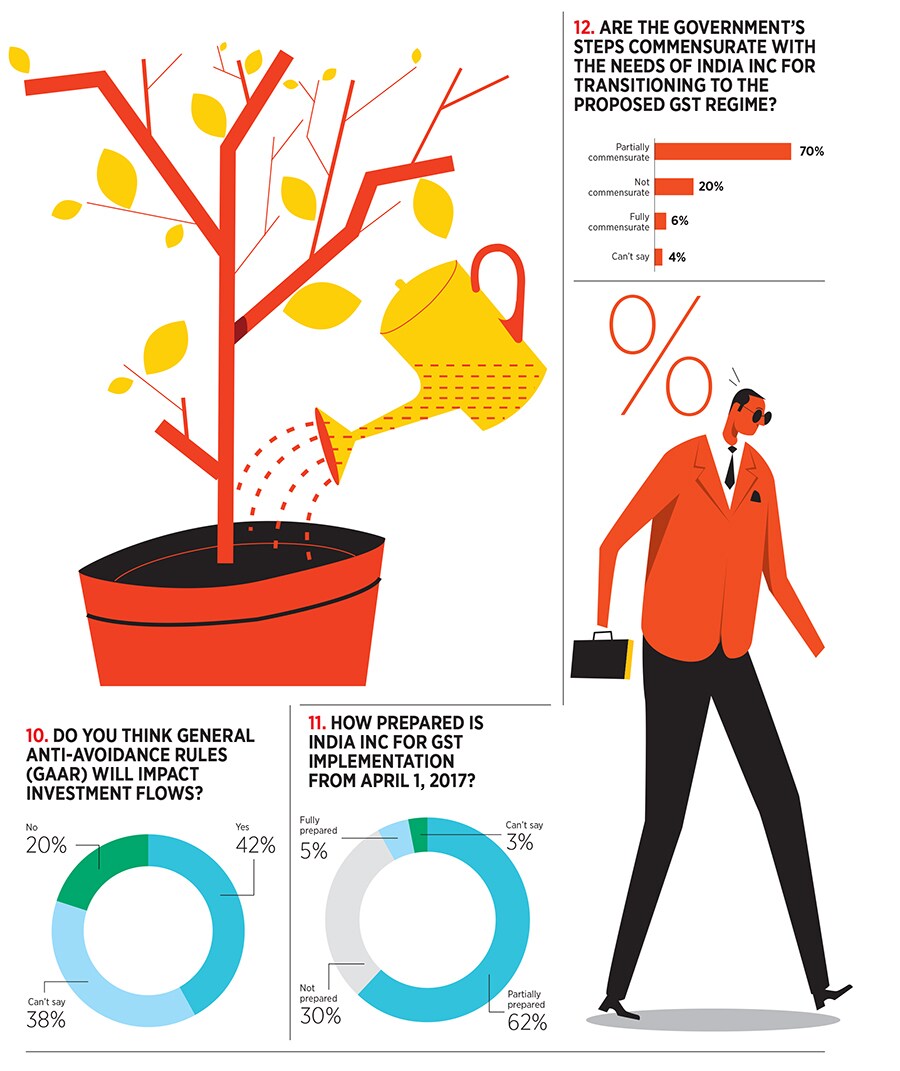

On the tax front, both general anti-avoidance rules (GAAR)—an anti-tax avoidance regulation—and the Goods and Services Tax (GST) are expected to be effective and rolled out in the next fiscal. When asked if GAAR will impact investment flows to India, 42 percent felt it may adversely impact investment flows while 20 percent said it will not have any impact.

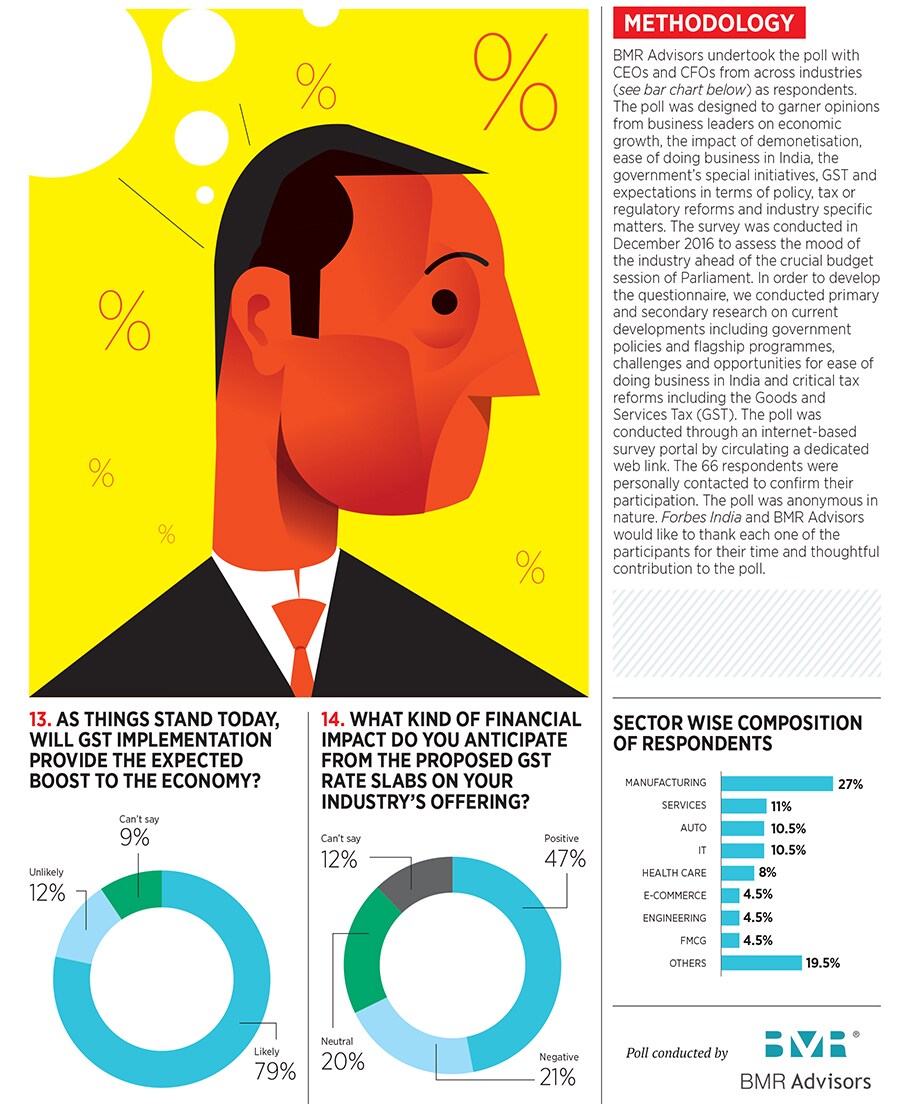

However, consensus seems to exist on the question of whether GST will provide an expected boost to the economy, with 79 percent believing that it is likely to do so.

In order to demonstrate its commitment to curb black money, the government has launched a number of measures. Thirty-nine percent of the respondents rank demonetisation as the most effective move to curb black money over other measures such as amnesty under the Income Declaration Scheme.

On the proposed GST law, while the government has been able to cross the hurdle of passing the Constitution Amendment Bill, only 5 percent believe corporate India is fully prepared for its implementation with effect from April 1, 2017 62 percent feel it is partially prepared.

Similarly, only 6 percent of the respondents say the measures taken by the government and the GST Council are fully commensurate with the needs of corporate India for a seamless transition to the GST regime nearly 70 percent believe that such measures are partially commensurate. On the proposed GST rates, around half of the respondents believe the financial impact will be positive while around two-fifths think that it will either have a negative impact or none at all.

Simplification still an expectation

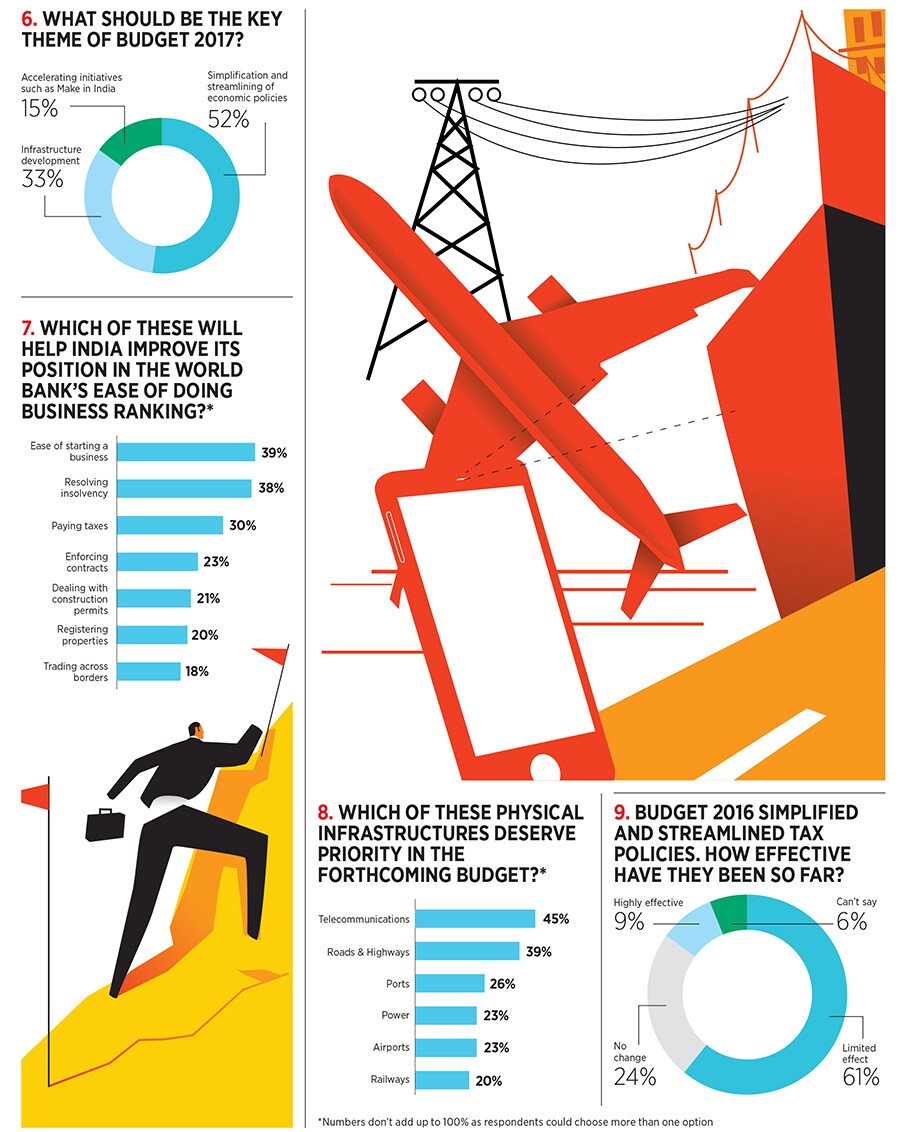

The key theme of Budget 2016 was simplification and streamlining of tax policies. However, just 9 percent feel measures taken in this direction have been highly effective 61 percent think these have had limited effect.

More than half the respondents suggested that simplification and streamlining of economic policies should be the key theme for Budget 2017 as well. One of the key agendas of the government has been to improve India’s ranking on the World Bank’s ease of doing business index. When asked about crucial factors for improving the ranking, 39 percent state ‘ease of starting a business’ as the most crucial factor.

The participants were picked from diverse sectors of the economy. This diversity did not deter the broad consistency in how CEOs and CFOs view economic trends, growth opportunities and challenges.

First Published: Jan 23, 2017, 17:13

Subscribe Now