Health insurance: Decoding the Corona Kavach and Corona Rakshak policies

The coronavirus has led to a rise in demand for health insurance plans. A Covid-specific product can be used to supplement existing coverage—here's how it works

As treatment and hospitalisation costs of contracting Covid-19 became apparent, so did the necessity of having appropriate health insurance coverage

As treatment and hospitalisation costs of contracting Covid-19 became apparent, so did the necessity of having appropriate health insurance coverage

Image: Atish Patel / AFP Via Getty Images[br]Insurance startup Toffee Insurance had been working on an insurance product for the past couple of quarters, and when the pandemic came along, they tweaked it, keeping in mind both the health and economic consequences of Covid-19.

The plan, which starts at ₹600, is “a sort of Netflix-style subscription plan for insurance, where you pay one monthly EMI and we give you cover for your life, health and home”, says Rohan Kumar, CEO and co-founder of Toffee Insurance.

The plan has seen demand, he says, because of its affordability and simplicity. “Someone who’s earning in the bracket of ₹3 to 6 lakh right now, who has a lot of uncertainties in terms of his employment, can still manage to afford paying ₹600-700 a month,” he says. The plan includes life insurance of up to ₹75 lakh and health and household insurance of up to ₹5 lakh each, the logic behind home insurance being that the risk might arise post-Covid. “We felt that as Covid-19 starts to spread, and we were seeing this in other geographies, as unemployment grows, you will start to see an increase in crime, in robberies and theft. So why don’t you cover that as well?” he says.

As March turned to April and the medical costs of contracting Covid-19 became apparent, so did the necessity of having appropriate health insurance coverage. While insurance usually covers hospitalisation charges, the fact that coronavirus can also rack up the charges with consumables like personal protection equipment (PPE) as well as be treated at home meant additions and tweaking of products by insurers. The launch of an Insurance Regulatory and Development Authority of India (IRDAI)-mandated Covid-specific policy is the latest tool in the pandemic insurance arsenal.

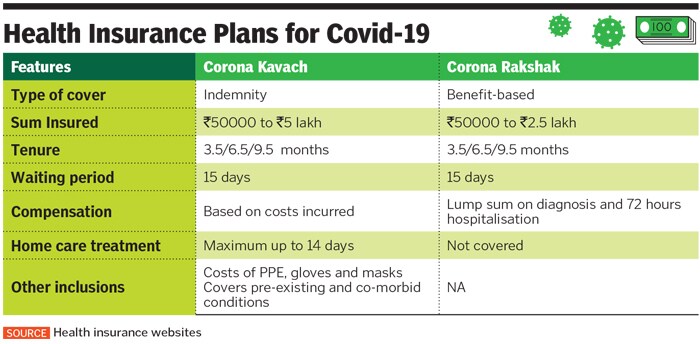

According to the guidelines issued by the regulator, insurers are to offer Covid-19 standard indemnity (Corona Kavach) and benefit-based (Corona Rakshak) plans with tenures of 3.5, 6.5 and 9.5 months. While the Kavach is mandatory, the Rakshak policy is optional. Under the indemnity policy, hospitalisation expenses incurred will be reimbursed to the extent of the sum insured while in the benefit-based policy, the sum insured will be paid in a lump sum on positive diagnosis of Covid-19 that requires hospitalisation for a minimum period of three days (see box).Covid-19 is covered under several comprehensive health plans, including the recently mandated standard Arogya Sanjeevni policy that was launched in April, so experts advise a comprehensive plan rather than a disease-specific one. However, it may make sense to get a Covid-specific policy for a few reasons.

“The situation is that anyone who has insurance today already has that coverage for Covid-19. But over and above that, because of the lack of infrastructure and no pricing cap, and the cost of the treatment, most people are realising that they are either not insured or underinsured,” says Kumar.

Think of it as a supplemental top-up to an existing comprehensive health insurance policy. “The fixed benefit plan somewhat makes sense because if you get Covid-19 and are hospitalised, a certain amount will be paid out to you. That is a good add-on to your policy because it gives you a certain fixed amount which can be used for anything,” says Amit Chhabra, head—health insurance, Policybazaar.com. The policy might come in handy if there is loss of income due to someone getting Covid and not being able to work for an extended time. The indemnity one, he says, is not really needed if one already has a decent comprehensive health insurance plan.

But existing plans may vary on the coverage for home treatment and cost of PPEs. “Where it makes sense is that in the standard plan there are some costs that are outside the plan like the PPE costs, home quarantine etc so this is a way to make sure that cost gets covered,” says Kapil Mehta, co-founder, SecureNow Insurance Broker.

For those who do not have any cover at all, experts still advise a comprehensive health insurance plan since health insurance is a long-term risk mitigation measure. “A disease-specific product makes sense to those who are already insured and want to cover for an extra risk of a condition. For a first-time buyer, a disease-specific product may not be the right choice,” says Bhabatosh Mishra, director—underwriting, products and claims, Max Bupa Health Insurance, though he adds that it has its uses. “At least it would protect them against Covid if not anything else.”

Considering these are affordable options, it might also be a good entry point in cases where there is a liquidity problem or people are taking time to decide on buying a health insurance cover. “So in the interim they can quickly buy a Covid product while they decide on a more comprehensive cover,” adds Mayank Bathwal, CEO, Aditya Birla Health Insurance.

For now it may help tide over a crisis, and later it might act as a nudge to buying a comprehensive cover once the pandemic dies down. “We don’t know how it will shape up tomorrow. But because they had coverage they may actually go and buy a new health insurance coverage. By that time they will have time and funds to be able to afford it,” says Sanjay Datta, chief —claims, underwriting and reinsurance, ICICI Lombard General Insurance.

But whether one is buying a comprehensive plan or a Covid-specific plan, the basic advice remains—comparing features and checking claim settlement ratios. Mehta of SecureNow advises 40 percent weightage to product features, with maximum weightage within that to the number of years pre-existing conditions are excluded and the room rent cap. Another 30 percent would be on the premium and the remaining to the insurer’s settlement claim ratios. “On the Covid side, I would look for plans that have a longer tenure and can be renewed, and plans that cover home treatment and PPE expenses. And which also cover co-morbidities without any ambiguity,” he says.

Financial planners also recommend having a high sum insured. Medical inflation doubles every seven years and medical conditions in early years might lead to exclusions in the policy, making it difficult to increase the sum insured. “Savings and financial planning could then go for a toss since you would have to build a corpus just for health emergencies,” says Viral Kothari, an independent financial intermediary.

In fact, Chhabra says it is a clear trend they are seeing. “Before Covid-19 and the lockdown, last year we used to sell a lot of ₹5 lakh to ₹10 lakh policies. Right now, one crore has become the new norm and almost 50-60 percent of our business is one crore,” he says.

With health being on everyone’s mind, and the fact that insurance is a factor of fear, insurers have, expectedly, also seen a huge surge in demand. Aditya Birla Health Insurance, for instance, says Bathwal, has seen a year-on-year growth of 71 percent in business for April and May, while Max Bupa has seen a 22 percent overall growth over the last one year, including new business and renewals. Policybazaar has seen an almost 150 percent year-on-year growth for June.

“It’s almost as if two or three decades later, insurance is being seen as a pull product rather than a push product,” says Kumar of Toffee. As claims rise, he also sees the possibility of premiums going up by 25 to 30 percent. While for now deferred and avoided claims like postponed surgeries like hip and knee replacements as well as reduced accident claims due to the lockdown have in a way compensated for the claims arising due to Covid-19, “if the claim issue becomes adverse, insurers have no choice but to revise premiums upwards”, says Mishra. He, however, adds that keeping insurance affordable is in the interest of the industry.

“At the moment we will have to see how it plays out. If we think it’s a one-time burden we may not increase premiums going forward. Because we also want health insurance penetration,” says Datta.

First Published: Jul 20, 2020, 17:01

Subscribe Now