Buyofuel: Making biofuel connections

There is a government push for biofuels adoption, but companies will not transition away from fossil fuels until they have a clear visibility on biofuel supply, which is currently fragmented. Buyofuel

Kishan Karunakaran says that his entry into the biofuels space was purely coincidental. In 2007-08, cultivation of a crop called Jatropha curcas was becoming famous in India for production of biodiesels, advocated even by former President of India Dr APJ Abdul Kalam. The grandson of a farmer, Kishan decided to cultivate the crop. The idea was to sell it to biofuel manufacturers, but there was no demand. They decided to get into manufacturing themselves. “I set up one of India’s earliest commercial scale biodiesel plant, and ran my own manufacturing unit till 2014," he says. They had to soon shut shop for various reasons: They realised that the crop Jatropha curcas was not a viable option for biofuels, and both demand and supply was extremely fragmented. “Clients were big but the supply was small," he says.

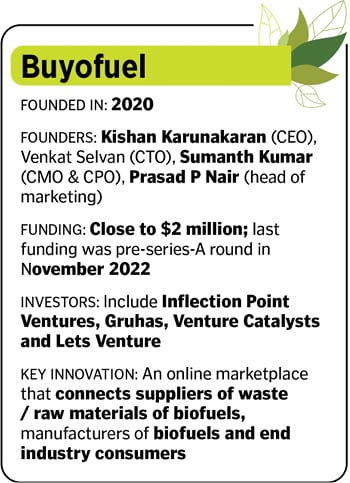

In 2018, the Indian government launched the National Policy of Biofuels to reduce India’s dependence on imports and improve local manufacturing of biofuels. This time around, Kishan, along with friends Venkat Selvan, Sumanth Kumar and Prasad P Nair, decided to plug the gaps across the value chain using technology and a mobile platform. “We wanted the platform to help fragmented suppliers of waste [that can be used as raw materials for biofuels] to connect with biofuel manufacturers easily, and also supply these biofuels to large fuel consumers," says Kishan. They launched Buyofuel in 2020, which they call India’s first B2B marketplace for buying and selling both biofuels and raw materials to make biofuels.

There are three main stakeholders that Buyofuel seeks to connect: First, suppliers of waste like used cooking oil, tyre/rubber waste, agro waste, wet organic waste, saw dust and plastic waste that can be used as raw materials to make biofuels. Second, manufacturers of solid, liquid and gaseous biofuel. Third, end consumers like factories or industries that can replace their petrol, diesel and coal requirements with bio-alternatives.

There are three main stakeholders that Buyofuel seeks to connect: First, suppliers of waste like used cooking oil, tyre/rubber waste, agro waste, wet organic waste, saw dust and plastic waste that can be used as raw materials to make biofuels. Second, manufacturers of solid, liquid and gaseous biofuel. Third, end consumers like factories or industries that can replace their petrol, diesel and coal requirements with bio-alternatives.

Examples of solid biofuels—typically used by industrial boilers as an alternative to coal—available on the platform include loose biomass, biomass briquettes and pellets. Liquid biofuels, a prospective replacement for fossil fuels based on petroleum, on the platform include biodiesel, bio LDO (plastic oil), bio ethanol and bio-FO (tyre oil). Gaseous biofuels available on the platform include bio CNG and green hydrogen.

It is easier for companies to source fossil fuels since the supply is more consistent and organised, there is an assurance of quality, and transactions are transparent and simple, Kishan says, adding that Buyofuel is trying to build the same ecosystem for biofuels. “First, we want to aggregate and curate suppliers in terms of quantity. Second, offer a quality assurance. Third, being a tech platform, we want to give an end-to-end visibility from enquiry to doorstep delivery, thereby making it as easy to carry out these transactions as in the case of fossil and conventional fuels." All transactions are done online on the platform. There is no subscription fee, and revenue earned by the startup is through sales.

The Coimbatore-based startup works with 30 large consumers of biofuels across sectors like cement, pharmaceuticals, steel, paper, and food beverage. Their clients include companies like ITC, Aditya Birla Group, Saint Gobain, Hindustan Unilever, Cipla, Ramco Cements and Thermax. “We are doing a monthly revenue rate of Rs 7 crore, with transaction volume of about 12,000 tonnes of biofuels a month," says Kishan, who is the chief executive officer at Buyofuel. “We have ensured that more than 25,000 metric tonnes of carbon emissions are offset by replacement of fossil fuels by biofuels from our platform."

“The challenge in biofuel adoption is supply, because despite government mandates, industry will only make the switch if they see uninterrupted supply," says Ankur Mittal, co-founder, Inflection Point Ventures (IPV). “We wanted to invest in and promote businesses that can solve for this supply problem, and it was clear for us that if Buyofuel can solve for this, their growth can be exponential."

Kishan has deep experience of more than 10 years of working in this space that will be helpful in solving for challenges that come with scale, adds Mittal, whose firm holds around 10 percent equity in Buyofuel. “We are now working with them to turn the business profitable, particularly at the state-level."

With 58 employees, the startup is currently present in Tamil Nadu, Karnataka, Maharashtra, Andhra Pradesh, Telangana, Punjab and NCR. Their path to profitability, Kishan says, includes diversifying across various types of biofuels and waste, and working more closely with the government, which is one of the largest buyers of biofuel. “We want to become an Ebitda-positive company over the next two-three months, and in the next three-five years, we want to target at least 1 percent of India’s fuel sales to be replaced by biofuels through the platform," he says.

First Published: Aug 21, 2023, 11:20

Subscribe Now