Waaree Energies: Seizing the green energy opportunity

In the 1980s, Hitesh Doshi started a small business to reduce his family's financial burden. Today, he is a billionaire

Hitesh Doshi has always known how to move with the tide. That quality has helped the 58-year-old commerce graduate, who started business in the 1980s with a loan of Rs 5,000 from a relative, build India’s largest solar panel manufacturing company by capacity.

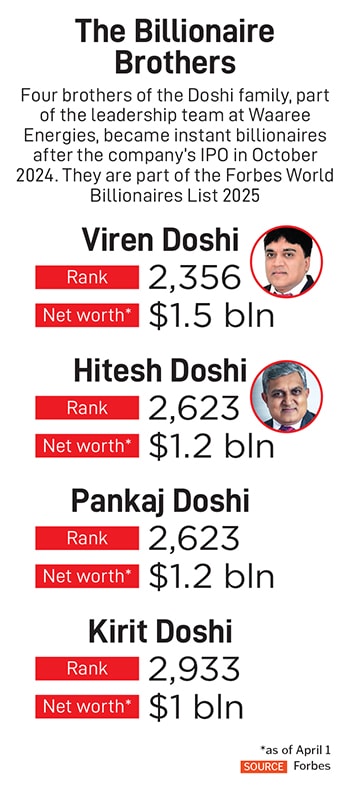

Doshi turned billionaire in October 2024 along with three of his brothers (see box) when his company Waaree Energies listed on the Indian bourses at a 70 percent premium to its initial public offering (IPO) issue price of Rs 1,503. Waaree Energies raised Rs 3,600 crore by issuance of primary shares during its IPO.

“I think this is the happiest moment. If you look at real numbers, there are 97 lakh applications. This shows the confidence on green energy," Doshi told ET Now a few days after the IPO issue close, reflecting on the strong listing. In media interviews during this time, he also outlined his strategy for the company, which included geographical, capacity and product expansions, and becoming a composite energy solutions company.

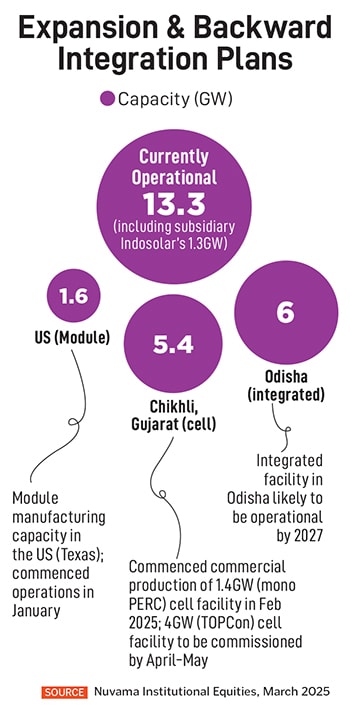

Currently, the Mumbai-based company has a solar photovoltaic (PV) module capacity of 13.3GW in five manufacturing facilities spread across 143 acres in India. “Waaree is currently the only module manufacturer in India with over 5 GW of capacity. Another 12 manufacturers [are expected] to reach this milestone by 2028," Gauri Jauhar, global executive director, energy transitions & clean tech consulting, S&P Global, tells Forbes India. Other module manufacturers in India include Premier Energies, RenewSys India, Reliance New Energy Solar, Adani Green Energy and Goldi Solar.

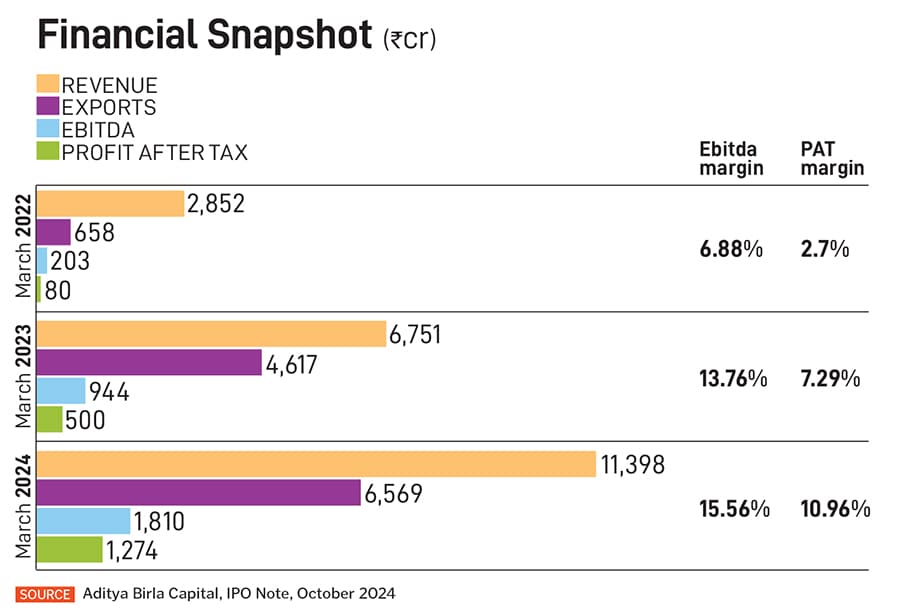

Waaree Energies reported a revenue of Rs 11,398 crore in the fiscal ended March 2024, an increase from Rs 6,751 crore in March 2023, with a profit after tax (PAT of Rs 1,274 crore in FY24 (see box). Their order book stands at 26.5 GW, which translates to Rs 50,000 crore, the company said during their Q3 and 9MFY25 earnings conference call on January 31. This includes orders from Waaree Renewables Technology Limited, a separately listed entity under Waaree Energies.

Nuvama Institutional Equities, which initiated coverage of the company in March, estimates that revenue will cross Rs 25,000 crore in FY27E. “Waaree’s FY24-27E revenue will surge at 30 percent compound annual growth rate (CAGR) and Ebitda at 54 percent CAGR driven by a sizeable order book," the financial services company said in its note. It further stated that the Indian solar PV industry is in the early growth stage of the industry life cycle—much like the Indian IT sector of the early 2000s—and companies in this stage are likely to experience significant growth in revenue and profits as new capacities are announced and utilisation levels of current facilities increase.

India wants to build 500 GW of non-fossil fuel capacity by 2030, and solar is a huge part of that target. India’s total renewable energy capacity as of March 31 is 220.1 GW, of which solar contributes 48 percent, as per government data. A press note by the Ministry of New and Renewable Energy in February also said that solar power, which has crossed the 100 GW capacity milestone, has seen a 3,450 percent increase in the last decade, from 2.82 GW in 2014.

“Investments into solar initially started as a push towards clean energy, but improvements in efficiencies over time, and decrease in the fundamental cost of equipment not only gives it green merit, but also economic merit to compete with conventional sources of power like coal and gas," says Sabyasachi Majumdar, senior director, Care Ratings.

A March 2025 note by Care Ratings on Waaree Energies further states that the prospects for solar cell and module manufacturers remain buoyant considering policies and schemes initiated by the government. This includes basic customs duty, the Approved List of Models and Manufacturers to promote domestically manufactured modules in all solar projects from April 1, 2024, and mandatory use of domestic content requirement (DCR) solar modules in installations under central government-aided schemes such as the rooftop solar scheme and the PM-Kusum scheme for energy security of farmers.

Companies like Waaree Energies, with large existing capacities and planned expansions, are vying for a large piece of this growth pie. “Energy from solar will continue till we search for something that is cheaper, faster and environmentally better than solar. I think not only 2030, this will keep on growing in the coming years," Doshi told ET Now in October 2024.

Doshi has named his company after the famous Wari Hanuman temple near his hometown Tunki in the Buldhana district of Maharashtra, where his father ran a grocery store. He moved to Mumbai, some 600 kilometres from his hometown, and enrolled for a BCom degree in the Shri Chinai College of Commerce and Economics, affiliated to the University of Mumbai, in the mid-80s. While there, he decided to start his own venture to reduce the financial burden of his family.

Waaree Energies" solar cell manufacturing facility in Chikhli, Gujarat, has a total planned capacity of 5.4 GW

Waaree Energies" solar cell manufacturing facility in Chikhli, Gujarat, has a total planned capacity of 5.4 GW

He found that cheaper hardware and electronics goods were available at wholesale prices at Nagdevi street in South Mumbai, and noted that a particular brand of pressure and temperature gauges were in demand. “So, I borrowed Rs 5,000 from a relative on the condition that I would return it in a month. I started taking orders and delivering them to small traders around Mumbai and Thane. I made a profit of Rs 1,000 per month, which took care of my college fees and monthly expenses," he told The Economic Times in 2014.

In 1989, he registered his company Waaree Instruments that sourced and sold gauges. After graduation, in 1992, he took a bank loan of Rs 1.5 lakh to set up a manufacturing unit called Mahaveer Thermo Equipments. By 2010, he was manufacturing nearly 20 products, including pressure gauges, gas station equipment and industrial valves, continues the Economic Times report. By the turn of the millennium, he began trading in solar power equipment—water pumps, water heaters, cookers, home lighting and lanterns.

In 2007 came the turning point. “I had the hunger to grow the business further. During a trip to Germany, I went to a solar exhibition and was spellbound. I talked to people there to understand how solar energy worked, and it convinced me that it would be the next step for not only expanding the business, but also developing India’s solar manufacturing sector," he told YourStory in 2021.

He started Waaree Energies with a module manufacturing facility of 30MW in Surat, Gujarat, investing nearly Rs 9 crore for land and machinery. In February 2011, he sold Waaree Instruments for nearly Rs 85 crore to the Switzerland-based Baumer Group. “From instrumentation trading to manufacturing, expansion and new technologies… and in 2007, came into solar. So, in short, it was always [about] doing something new, better," he told ET Now.

Around 60 percent of the company’s revenue comes from exports, and Waaree Energies is also expanding internationally—it has set up a 1.6 GW module manufacturing facility in Texas, US

Around 60 percent of the company’s revenue comes from exports, and Waaree Energies is also expanding internationally—it has set up a 1.6 GW module manufacturing facility in Texas, US

Doshi has acknowledged how solar has been a competitive business space, particularly in the early days when they faced competition from China that had advantages in terms of economies of scale, infrastructure and government support. The business landscape of today, however, is different. “When I started in the solar business, customers were talking about kilowatts… why? The price when we started was Rs 400. Then it came to Rs 250 a watt of the solar panel. Now, with the price at Rs 15 a watt, down from Rs 250, normal discussion [with customers] starts with ‘our requirement is 1 GW, 2 GW....," Doshi told ET Now.

While there has been a rapid cost decrease of solar PV modules and systems, it remains a capital-intensive business, with large upfront expenditures and returns that could take time to materialise.

The solar manufacturing value chain goes from making polysilicon to ingots to wafers to cell and then the finished modules/panels. For many years, Indian manufacturers had been focusing on the downstream part of this value chain, which includes importing solar cells and assembling them into modules or panels.

Now, the current push by the Indian government, given the criticality of solar in the country’s green energy ambitions, encourages manufacturers to go deeper into the value chain. “The government does not want India to be dependent on Chinese imports. They are supporting domestic manufacturing by putting tariff and non-tariff barriers for imports. As a result, domestic capabilities are getting a fillip," says Majumdar. He adds that India has around 8 GW of cell manufacturing capabilities now, and estimates it to reach around 60 GW by FY27E with a capex of Rs 30,000 crore, supported by schemes and policy incentives. According to Nuvama, domestic solar module manufacturing during this period will increase from 63 GW in FY24 to 123 GW in FY27E.

Apart from the 5.4 GW cell manufacturing that is expected to be operational this fiscal (see box), Waaree Energies has won a production-linked incentive (PLI) project for setting up a 6 GW integrated facility to manufacture wafers, ingots, cells and modules, which will help with its backward integration ambitions.

Around 60 percent of the company’s revenue comes from exports (see box), and Waaree Energies is expanding internationally. It has set up a 1.6 GW module manufacturing facility in Texas, US. Jauhar of S&P Global says the impact of the dynamic tariff situation in the US needs to be watched given the developments over the next three months. She believes that “India will have a unique opportunity to leverage its role in future supply chains in the backdrop of bilateral trade negotiations." A report in Mercom India on April 15 said that Waaree Energies looks to double its Texas manufacturing capacity to 3.2 GW, as part of a broader strategic plan to strengthen its foothold in the American market.

Around 60 percent of the company’s revenue comes from exports (see box), and Waaree Energies is expanding internationally. It has set up a 1.6 GW module manufacturing facility in Texas, US. Jauhar of S&P Global says the impact of the dynamic tariff situation in the US needs to be watched given the developments over the next three months. She believes that “India will have a unique opportunity to leverage its role in future supply chains in the backdrop of bilateral trade negotiations." A report in Mercom India on April 15 said that Waaree Energies looks to double its Texas manufacturing capacity to 3.2 GW, as part of a broader strategic plan to strengthen its foothold in the American market.

In his October 2024 IPO note on the company, analyst Ninad Sarpotdar of Aditya Birla Capital said Waaree imports more than 95 percent of its raw materials, out of which around 80 percent on average is from China. This means that “any change in trade agreements with these countries might disrupt the supply chain management and hence financials of the company", he said. He also pointed out that in the long term, there will be increased competition from larger conglomerates like Adani and Reliance, who are ramping up their PV module capabilities, with operational and planned capacities of 14 GW and 10 GW respectively.

Another potential but necessary business risk is the changing technology in the solar space. Currently, Waaree Energies manufactures its modules using technologies like multi-crystalline cell technology, monocrystalline cell technology and TopCon (tunnel oxide passivised contact) that help to reduce energy loss and improve efficiencies.

Majumdar of Care Ratings says that “quantum jumps" in the technology used in solar manufacturing cannot be ruled out in the future, which means the large manufacturing capacities that companies have set up with a five-or-10-year horizon may face the risk of obsolescence.

Doshi has mentioned in his interactions with the media that he wants Waaree Energies to become a broader green energy player and de-risk by tapping into adjacent businesses. The company is in the process of acquiring a 100 percent stake in Enel Green Power India for Rs 792 crore (subject to statutory approvals at the time of writing this article), as per media reports. The entity is owned by Enel Green Power Development S.r.l, a European renewable energy company that operates a portfolio of solar and wind energy projects in India.

“Our board has approved green hydrogen and electrolyser business with an investment of Rs 551 crore, battery business with an investment of Rs 2,073 crore, and the renewable power infrastructure business with an investment of Rs 650 crore. We are also making an investment of Rs 130 crore in our inverter business," Amit Paithankar, whole-time director and CEO of Waaree Energies, said during the earnings conference call on January 31. He added that the company has been awarded a PLI for a 300 MW electrolyser manufacturing facility, and won a Solar Energy Corporation of India bid for 90,000 tonnes of green hydrogen production.

Doshi, in the ET Now interview, said they could be an energy solutions company three years from now. “The world is changing, and we have to change ourselves continuously," he said, adding that strategies will change as per shifts in customer demand, which is why they are working on areas like storage solutions and hydrogen.

He added that becoming a billionaire has never been important for him. “For us, it is how ahead we are in technology, customer service and how fast we bring each and every electron of the energy we are using, how fast we make it green. That should be the dream, not becoming billionaires."

First Published: May 06, 2025, 10:47

Subscribe Now