Vikram Solar's moment under the green energy sun

Kolkata-headquartered Vikram Solar is among the new crop of solar module makers that are in a sweet spot

Being in the right space at the right time is half the job done. That’s the position Vikram Solar finds itself in. The Kolkata-headquartered two-decade-old business is having its place in the sun.

The reason: Solar panel manufacturing has caught the fancy of investors. Recent market flotations in the sector—Waaree Energies and Premier Energies—have more than doubled from their IPO allotment price. Expect more listings from this space.

These businesses are seen as a three-fold opportunity. First, they are at the forefront of clean energy transition with wind, solar and hydro on track to displace fossil fuels as a primary energy source in the next two decades. Second, they are import substitution plays. Solar panels that were imported from China are now made locally (although about 60 to 75 percent of the components are still imported). India’s module manufacturing capacity is expected to double from 63 GW by the end of fiscal 2024 to 120 to 125 GW by 2030, according to Crisil.

Third, the export market for solar panels, particularly to the US, is large. Exports of solar panels and cells to the US from India were $1.8 billion in 2023 compared to $250 million in 2022, according to BloombergNEF.

Leading Vikram Solar has been chairman and MD Gyanesh Chaudhary. He started in the business in 2005, “when there was next to zero solar module manufacturing capacity and no installations". Neatly dividing his 20-year journey into five-year chunks, he puts the periods down as education, growth, stability and the current period as blitzkrieg. The business is now on track to scale rapidly.

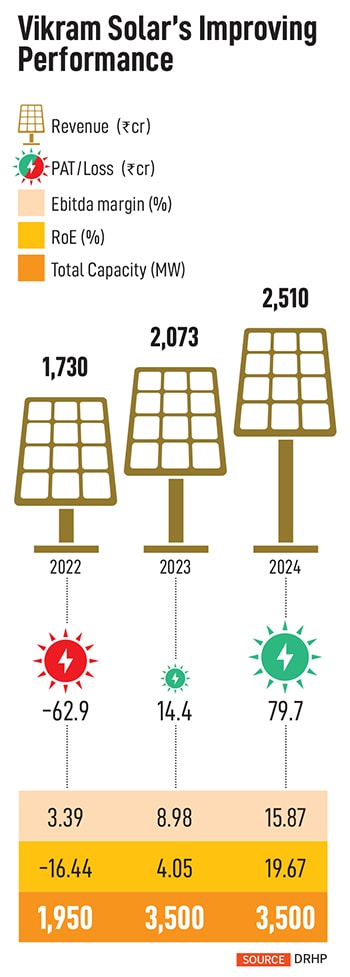

In 2022 installed capacity for Vikram Solar moved from 1,950 MW to 3,500 MW in 2023. In the same period, the outstanding order book increased from 1,789 MW to 2,786 MW. Growth in the outstanding order book accelerated to 4,376 MW in 2024. In the financial year ended March 2024, revenue stood at ₹2,510 crore and profit at ₹79 crore. (As a result, the company has recently revived its listing plans that had been shelved in 2022.)

While the industry has done well to set up manufacturing capacity in India, a significant part of its business case has come from an imposition of duties on Chinese imports. In April 2022, India imposed a 40 percent tax on solar panel imports and 25 percent on solar cells to discourage Chinese imports, prompting some to ask if the growth in Indian solar panel manufacturing has come solely on account of the imposition of tariffs. Chaudhary believes this imposition of duty is fair and that this has to be seen in the context of Chinese dumping and the fact that Indian manufacturing had suffered on account of the Covid-19 pandemic.

In addition, solar module manufacturing is also eligible for production-linked incentives (PLI), something Vikram Solar plans to take advantage of. “As of now, import percentage of all raw materials stands at 61.49% in period ended FY24 as opposed to 79.83% in period ended FY22" says Chaudhary. Upstream components (polysilicon to cells) will be driven by PLI incentives, but module capacity additions will be a mix of PLI and non-PLI, according to Sehul Bhatt, director, research at Crisil Market Intelligence and Analytics.

In addition, solar module manufacturing is also eligible for production-linked incentives (PLI), something Vikram Solar plans to take advantage of. “As of now, import percentage of all raw materials stands at 61.49% in period ended FY24 as opposed to 79.83% in period ended FY22" says Chaudhary. Upstream components (polysilicon to cells) will be driven by PLI incentives, but module capacity additions will be a mix of PLI and non-PLI, according to Sehul Bhatt, director, research at Crisil Market Intelligence and Analytics.

As of now, there are at least two dozen companies operating in the solar module space. The business model is based on engineering, procurement, construction (EPC) contracts where bids are invited, and solar companies quote prices. For public sector companies like NTPC Green and SJVN, it is usually the lowest bid that works but for private sector bids—Sterling and Wilson, JSW, Azure, Acme Power—it is a mix of cost as well as performance guarantees on the panels that result in companies being selected. Customer concentration is a risk for Vikram Solar and its top 10 customers account for 89 percent of revenues, according to its Draft Red Herring Prospectus (DRHP).

Over the last year, an increase in solar installations has powered margins for the likes of Vikram Solar. As Vikram Solar swung from a ₹62.9 crore loss in 2022 to a ₹79 crore profit in 2024, Ebitda margins improved from 3.39 percent to 15.87 percent in the same period. Chaudhary believes that Vikram Solar can grow threefold in the next three years, pointing to more operating leverage kicking in. Recently listed peer Premier Energies also saw Ebitda margins rise from 4.01 percent to 15.11 percent between 2022 and 2024.

A point of concern for the industry has been the large build up in capacity, which has grown from 8 GW in 2021 to 67 GW in 2024. Another 48 GW is being set up with the aid of PLI, according to the Ministry of New and Renewable Energy. Compare this to a domestic demand of 20.4 GW in 2024 primarily on account of the Pradhan Mantri Suryodaya Yojana, which provides free electricity of 300 units a month and it is clear that there is excess supply in the domestic market. As of now, it is not clear how far domestic demand can grow to absorb this capacity.

Vikram Solar’s exports to the US market have provided it with an avenue to make use of its excess capacity. Chaudhary says that about half of its revenues come from the US market and they have a plan to start making modules there. In 2022, the passing of the Inflation Reduction Act in the US provided a further fillip to exports to the US. The Act mandates the reduction of carbon emissions by 40 percent by 2030 through the combination of grants, loans, tax provisions and other incentives.

But it’s not clear how long this increase in exports can last. Analysts argue that Indian companies are too dependent on the US market for exports. “The share of the US in India’s export basket increased to over 95 percent in the first quarter this fiscal, from 66 percent in 2022," says Bhatt of Crisil. With the Inflation Reduction Act resulting in an increase in domestic manufacturing in the US, it is possible that this window would close soon. India’s exports to other key importing nations—Brazil, the Netherlands, Spain and Germany that make up 28 percent of global imports—remains low.

As Vikram Solar expands, its low leverage levels will go in its favour. As of now, its debt equity ratio is 1.8 times. As the business has a lot of operational leverage, an increase in sales should flow substantially to the bottom line, giving it the cash flows it needs to expand. It has also filed a DRHP in October that is awaiting approval from the Securities and Exchange Board of India. Its listing would allow it to spend on a 6 GW module manufacturing facility in Chennai of which 3GW will be backward integrated to cell manufacturing".

After two decades in the business, Vikram Solar has managed to get the operational and profitability metrics to be accepted by public market investors who see this as a sunrise growth sector. For now, competitors like recent listings Waaree Energies or Premier Energies are being priced like growth stocks with price earnings multiples of between 90 and 200 times due to healthy order books and execution. What remains to be seen is how long this run continues. Chaudhary believes that the industry will inevitably consolidate and only the fittest will survive. Focusing on the product and de-risking from the US market would allow the company to differentiate itself from its peers.

First Published: Nov 26, 2024, 15:18

Subscribe Now