Mahindra's highly profitable car business

The automaker's steady dominance of the SUV space in India has given it the highest profit margins in the industry even as it seeks to move beyond automobiles

In the year gone by, Mahindra & Mahindra (M&M) sold more SUVs, made a splash in the EV (electric vehicles) space and unveiled growth plans across a host of businesses—from renewable energy to real estate and financial services to logistics and hospitality. All this has kept its profit meter ticking at higher margins.

The results come in the backdrop of Mahindra becoming the second largest automaker in India owing to its dominance of the SUV space. Not one to take its lead lightly, it plans to unveil a new vehicle platform on August 15.

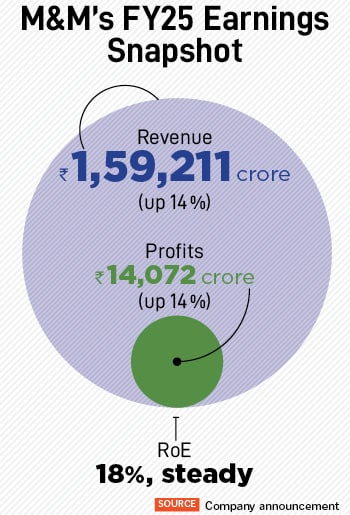

The fiscal year ended March 2025 saw M&M deliver a top line of Rs159,211 crore, up 14 percent from the previous year. In the same period, profits stood at Rs14,073 crore, also up 14 percent. For its core automotive business, the revenue market share went up to 25.3 percent, a growth of 210 bps. Every rupee put in by shareholders in the business delivered 18 paisa of return or two-and-a-half times what a 10-year risk-free government bond would give an investor. Mahindra hopes to do better in the years to come.

The key to maintaining and growing its 18 percent return on equity would be to maintain its stranglehold on the SUV market. “We want our growth to be driven by the quality of our products," says Rajesh Jejurikar, chief executive of the auto business at Mahindra & Mahindra. He’s working on growing revenue market share, increasing capacity and putting out a pipeline of products by 2030. By then, the company would have launched seven ICE SUVs and five electric SUVs.

The key to maintaining and growing its 18 percent return on equity would be to maintain its stranglehold on the SUV market. “We want our growth to be driven by the quality of our products," says Rajesh Jejurikar, chief executive of the auto business at Mahindra & Mahindra. He’s working on growing revenue market share, increasing capacity and putting out a pipeline of products by 2030. By then, the company would have launched seven ICE SUVs and five electric SUVs.

Two months after launching two eSUV products, the numbers have been encouraging. The company has delivered 6,800 products and has a four-to-five-month waiting period. Here Jejurikar and his team are clear that they want to scale cautiously and chase revenue market share, and not volumes.

A key learning for the company: When a customer comes to the showroom to take delivery of an ICE vehicle, they drive of immediately, but for an EV, the time taken to explain all the features is two to three hours. The company is putting in a lot of thought into the handover experience as that can make or break the experience in the long term.

After several years of stagnant market share, the farm equipment business saw market share rise to 43.3 percent. The performance earned Hemant Sikka, its chief executive, a promotion to head the Mahindra Logistics business. He leaves a business with 20.8 percent margins, its highest since FY22.

It"s the new businesses like Logistics that has Anish Shah, chief executive officer, Mahindra & Mahindra, spending a lot of his mind space on. “We want the group to have multiple large businesses in the years to come," says Shah. He knows that he must shift focus to businesses that can provide incremental growth in the years to come.

Some are starting to show signs of promise. For instance, Mahindra Holidays plans to more than double the number of available rooms by 2030 to over 12,000 rooms per night. Mahindra Lifespaces aims to have Rs10,000 crore in residential pre-sales by 2030 and is raising money through a rights issue. Mahindra Logistics aims to see a three-fold rise in revenue to Rs18,000 crore. If these plans play out, they would add a meaningful chunk to Mahindra’s profitability.

Others like Mahindra Finance and Tech Mahindra still have some way to go. “We have a lot more to do," acknowledges Shah, while pointing out that Mahindra Finance had managed to get its gross stage three loans down to 4 percent. The business course-corrected by lending to borrowers with higher credit scores. Tech Mahindra margins have risen 320 bps last fiscal to 10.5 percent. This is still below TCS’s 19 percent margins.

Lastly, there are a set of businesses—Accelo, Classic Legends, Car&Bike and Aerostructure—where the group is targeting a $1 billion valuation in the short term. Just as it managed to do with hospitality and real estate. if it manages to scale up here, it would put growth on a firm (and more diversified) footing in the years to come.

First Published: May 05, 2025, 17:48

Subscribe Now