Ossus Biorenewables has devised a technique that uses proprietary bioreactors to convert the organic carbon content in industrial effluents to so-called “green" hydrogen—a light, colourless gas that doesn’t produce carbon dioxide when burnt.

A large steel manufacturer was the first customer. Half a kilometre away from its plant, where the steel maker’s wastewater was otherwise treated and disposed, Ossus has installed its cylindrical-shaped bioreactors that draw out the organic matter from the effluents and convert it to green hydrogen. It has the twin benefit of eliminating the need to compress, store and transport hydrogen—seen as a stumbling block—besides recycling the wastewater.

Ossus currently produces 30 kg of green hydrogen per day for the steel maker from 6,000 litres of their effluent, at a fraction of the cost it paid to Linde, an Irish supplier of green hydrogen.

Ossus has since been working with companies across industries from oil refineries to cement makers, sugar mills to textile factories, as well as food and beverage. Nikhil Kamath’s Gruhas and Rainmatter Climate are investors having put in $2.4 million in Pre-Series A funding in April.

Green hydrogen uses renewable power like solar or wind to produce hydrogen from water via electrolysis with devices called electrolysers. It’s better than the more dirty “grey hydrogen" that is produced using fossil fuels like natural gas and coal. Even better is what Ossus is doing, albeit on a small scale.

“For a country where 500 million people go without access to drinking water, we don’t see how it is acceptable to use 18 litres of high-quality desalinated water to produce 1 kg of hydrogen," says Suruchi Rao, co-founder and CEO, Ossus Bio.

![]() Interest in the production of green hydrogen has grown, especially over the last year, since the government announced the National Green Hydrogen Mission in Budget 2022 with an allocation of ₹19,700 crore in order to produce five million metric tonnes of the gas by 2030. Companies big and small have been making investments to set up plants, produce new technologies and pilot projects.

Interest in the production of green hydrogen has grown, especially over the last year, since the government announced the National Green Hydrogen Mission in Budget 2022 with an allocation of ₹19,700 crore in order to produce five million metric tonnes of the gas by 2030. Companies big and small have been making investments to set up plants, produce new technologies and pilot projects.

Take the case of Indian Oil Corporation (IOC). The PSU has been “doing extensive research" on green hydrogen and recently announced it will set up two production units on a pilot basis in Tamil Nadu and Kerala. “We see it as the fuel of the future," said VC Ashokan, executive director and state head, IOC, at a press conference in Chennai in July.

IOC’s research and development centre in Haryana’s Faridabad already has an up-and-running hydrogen dispensing station—much like a petrol pump—and it has purchased 15 fuel cell electric buses from Tata Motors for undertaking pilots. Unlike regular electric vehicles (EVs) that draw on electricity from a battery, fuel cell electric vehicles (FCEVs) use a fuel cell powered by hydrogen. Elsewhere, public sector ship builder Cochin Shipyard is experimenting with a hydrogen fuel cell-powered catamaran to take travellers on voyages across the Ganges in Varanasi.

IOC also plans to direct wind power from its wind farm project in Rajasthan to its Mathura refinery and use it to produce green hydrogen. Eventually green hydrogen will replace carbon-emitting fuels that are used in the refinery to process crude oil into value-added products such as petrol and diesel, Ashokan added.

“Currently no industries are off-taking green hydrogen," says Pranav Master, senior practice director-consulting, Crisil Market Intelligence and Analytics. However, India is prioritising green hydrogen as a potential solution to decarbonise hard-to-abate sectors such as refineries, iron and steel, cement, fertilisers and heavy-duty trucking. The last two years have seen a surge in companies unveiling pilot schemes, such as IOC’s, aimed at proving the potential of the green gas to transform industry.

Reliance, for example, has embarked on a “full spectrum" green hydrogen strategy, as Morgan Stanley notes—from the manufacture of solar panels and batteries to the development of electrolysers to make green hydrogen. The Mukesh Ambani-run conglomerate has partnered with Danish clean-technology firm Stiesdal to manufacture electrolysers at its factory in Jamnagar. These devices will use clean electricity from Reliance’s solar farms, which are also being built in Jamnagar, to manufacture green hydrogen.

Ambani believes these investments will make India the first country to produce green hydrogen for $1 per kilogram within a decade. It’s a bullish estimate as the current cost is $3.6 to $5.8 per kg. According to Sanford C Bernstein, an American investment bank, “under $2/kg seems achievable towards the end of the decade".

“Just as India has the world’s most affordable wireless broadband today, we will have the world’s most affordable green energy within this decade. And these solutions will then be exported to other countries, helping them contain carbon emissions," Ambani noted in Reliance’s 2021-2022 annual report.

Similarly, JSW Energy is setting up a 3,800-tonne hydrogen plant at its Vijayanagar plant with 25 megawatts of round-the-clock renewable power. The plant will be up and ready before March 2025. “It will help us decarbonise the steel-making process to produce green steel, the demand for which is strong in domestic and international markets," says Prashant Jain, joint managing director and CEO, JSW Energy.

Engineering and construction giant Larsen & Toubro (L&T) commissioned its first green hydrogen pilot plant at its Hazira complex in Gujarat in 2022. The plant has been in operation for over a year now and has been producing around 45 kg of green hydrogen daily for captive consumption. The move is integral to its ambition of achieving carbon neutrality by 2040.

L&T has plans to develop projects with capacities of 50-100 kilo-tonnes per annum of green hydrogen for direct use or conversion to derivatives like ammonia and methanol, says Derek Shah, senior vice president and head-Green Energy Business.

Like Reliance, L&T is also eyeing the entire green hydrogen value chain. It has started building a manufacturing unit for 1 GW electrolysers and is also set to acquire land in coastal regions for building solar and wind farms that would feed into its green hydrogen facilities. “In the next five to 10 years, green hydrogen will have a significant contribution in the India energy portfolio. To start with, green hydrogen will support the refinery, fertiliser and city gas distribution sectors and eventually it will contribute to other sectors like power, steel and mobility," says Shah.

Adani New Industries (ANIL) has made the biggest splash thus far announcing that it will invest $50 billion over the next decade to produce green hydrogen and create an ecosystem around it in partnership with France’s Total Energies. The Gautam Adani-run conglomerate plans to develop green hydrogen capacity of one million tonnes per annum before 2030 as part of its initial phase. Total Energies will pick up a 25 percent stake in ANIL. “This allows us to shape market demand," Adani said while announcing the deal in January 2022.

Startups like Ossus and the Poonawalla family-backed H2e Power Systems, which is building a 1,000 MW electrolyser plant, are also making a splash. As are medium-sized outfits like Hyderabad-based Greenko which has partnered with Belgium’s John Cockerill to make electrolysers in India.

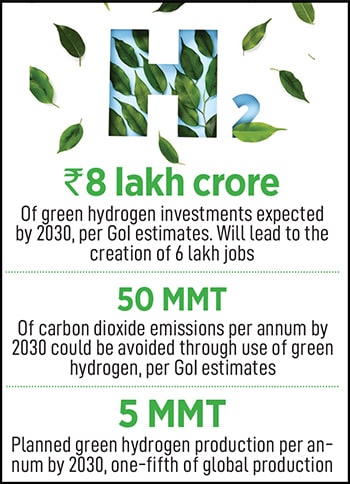

In all, over eight lakh crore of green hydrogen investments are expected by 2030, as per government estimates. Fifty million metric tonnes of carbon dioxide emissions per annum could be avoided through the use of green hydrogen by 2030.

![]()

Demand dynamics

The reason companies are investing in green hydrogen is because of the huge demand they foresee. India’s current hydrogen demand is around six million tonnes per annum, which is expected to reach 12 million tonnes by 2030. The government expects around 40 percent of this demand to be met by green hydrogen, leading to around five million tonnes per annum of domestic demand by 2030.

Additionally, as India is also gearing up to be a major hub for exporting green hydrogen, analysts expect an additional demand of five million tonnes from the export market by 2030.

“I would put the use cases [of green hydrogen] into three large buckets—industry, power generation and vehicles," says Mustafa Wajid, chair, IET Future of Mobility and Transport Panel. While the clean fuel has use cases across industries, adoption depends on bringing the price of green hydrogen down.

“To produce cost competitive green hydrogen, low-cost renewable energy, which accounts for 60 percent of the total cost, and water are two important resources required," says Master. Electrolysers account for 30-35 percent of the cost.

Currently the vast majority of hydrogen is produced from fossil fuels such as natural gas and coal to make what is known as “grey" hydrogen. It costs around ₹160-200/kg, according to KPMG.

Green hydrogen, by comparison, is produced using renewable energy like solar or wind energy, which is by definition intermittent. This means storage costs need to be included to ensure round-the-clock supply of renewable energy when calculating the cost of green hydrogen, which currently hovers around ₹300 per kg. “Because of the intermittent nature of renewables, green hydrogen has not been able to scale yet. The technology is still in its infancy," explains Wajid. According to International Energy Agency, green hydrogen currently accounts for a mere one percent of global hydrogen supply.

The theory, however, is that costs will fall over time as they did for offshore wind and solar power—a shift that made them much more competitive. KPMG expects green hydrogen costs to halve to ₹160-170 per kg by 2030.

Here India is at an advantage given its vast coastline (~7,500 km) with access to sea water and ample sunlight and wind, “as well as rivers, which provide a source of water for the electrolysis process," says Master. Also, India’s large industrial base gives green hydrogen producers a captive market, while its proximity to key global markets and large ports gives it an advantage in the export markets.

The consumption and demand of green hydrogen are also stunted by problems relating to the storage, compression and transportation of the gas. “India lacks the necessary infrastructure such as pipelines and storage facilities to transport and store green hydrogen. The entire market and ecosystem need to be built out, as is the case with every new technology. We saw a similar pattern play out with renewables and EVs." says JSW Energy’s Jain.

He adds, “The transition [to green hydrogen] cannot happen overnight, but it will happen sooner than most people think." And it may well be a historic opportunity for India to not just reduce its own emissions but also create a robust export-led industry.

Interest in the production of green hydrogen has grown, especially over the last year, since the government announced the National Green Hydrogen Mission in Budget 2022 with an allocation of ₹19,700 crore in order to produce five million metric tonnes of the gas by 2030. Companies big and small have been making investments to set up plants, produce new technologies and pilot projects.

Interest in the production of green hydrogen has grown, especially over the last year, since the government announced the National Green Hydrogen Mission in Budget 2022 with an allocation of ₹19,700 crore in order to produce five million metric tonnes of the gas by 2030. Companies big and small have been making investments to set up plants, produce new technologies and pilot projects.