Buy then Build: Be an entrepreneur without the start-up

Forget coding in garages--a growing number of entrepreneurs are skipping the start-up grind and buying existing businesses instead

Think entrepreneurship and what comes to mind? A hoodie-clad geek writing code for the next big internet product in their parents’ garage or an engineer tinkering with machines in a workshop? Perhaps go-getters studying spreadsheets and flow charts, looking for the minimum viable product?

How about this: An MBA student poring over databases and financial statements in search of a great business for sale.

This is not the stereotypical entrepreneur who develops the next Amazon and hopes it takes off. This belongs to a growing breed of entrepreneurs taking a different route to business ownership: buying existing companies rather than building them from scratch.

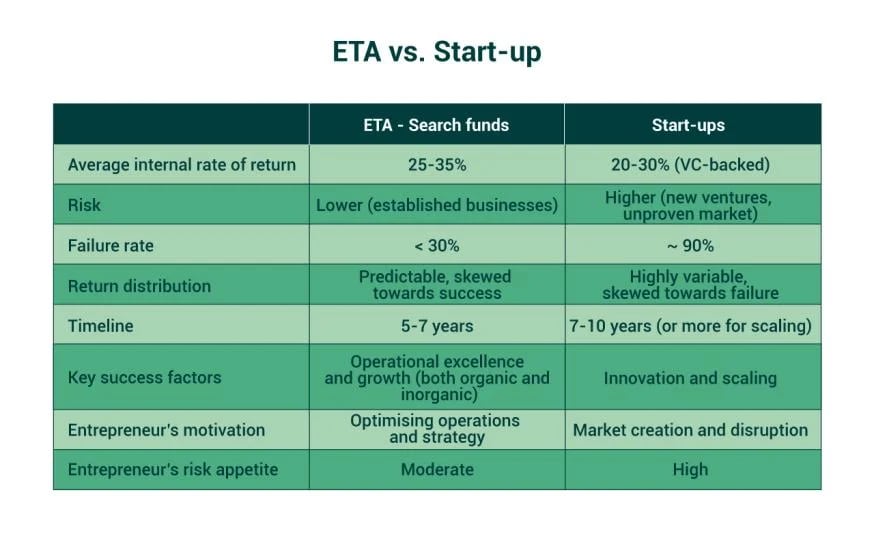

Known as entrepreneurship through acquisition (ETA), this pathway offers lower risk yet often better financial returns than the average start-up. Entrepreneurs, often recent MBA graduates, raise capital from investors to finance their search for an established company to acquire and operate.

A 2024 study by Stanford University shows that search funds formed in the United States and Canada since 1984 have achieved an average return on investment (ROI) of 4.5x. Outside North America, 59 new international search funds were created and a total of 31 companies were acquired in 2023 alone, according to a report by IESE Business School.

At INSEAD, where I (Ivana) have been teaching ETA and search funds for nearly 10 years, we see a growing appetite among our graduates for this rewarding career path. More than 100 search funds and other ETA vehicles have been launched by INSEAD students and alumni in recent years, some of whom pioneered the first search funds in new geographies.

It is therefore timely that INSEAD has launched the ETA and Search Funds Hub to help entrepreneurs with connections, knowledge and resources to succeed in ETA, while supporting investors with access to this high-performing asset class. The Hub will also leverage INSEAD’s global network to advance education, research and value creation on ETA. Our next key event is the INSEAD ETA Conference* on May 10.

My students often ask: I want to be an entrepreneur, but should I do it through a start-up or ETA? The answer isn’t always straightforward, but I’ve noticed a pattern. Those who choose entrepreneurship through start-ups are typically passionate about a specific product or service and are mission-driven those who take the acquisition path are passionate about managing and improving businesses, regardless of industry.

To make an informed decision about which path to take, aspiring entrepreneurs need to understand the rewards and challenges of each route. Here’s a quick roundup.

The traditional start-up model typically emphasises disruptive innovation and rapid scaling, often requiring significant technological advantage and financial capital in its initial phases. It appeals to founders driven by a mission to revolutionise industries and solve problems in the market.

To succeed, founders must not only develop a compelling solution but also convince investors – and eventually customers. Creativity, innovation and product-market fit are crucial.

Start-ups are inherently high-risk ventures. They require patience, resilience and high risk tolerance, often relying on multiple injections of investment capital and guidance from investors. On the flip side, successful start-ups deliver outsized returns, often exceeding 10x, to their investors. Airbnb, for one, overcame regulatory hurdles and scepticism before hitting US$100 billion in market value by 2020, 12 years after it was created.

INSEAD alumnus Tobias Vancura (MBA’06J) is one entrepreneur who has experienced both start-up and acquisition. Vancura co-founded and later successfully exited Nanonis, a nanotechnology venture. “Our start-up was technology-based and came right out of university," Vancura says. “You do something at university technology-wise, you push boundaries, and then you think that could be a market. We established the company, and that worked out well."

Vancura is an outlier: 90 percent of start-ups fail by some estimates. Moreover, true product innovation is increasingly challenging. Even where start-ups have a viable product, they need founders who are versatile and able to pivot to succeed. Perseverance is also a must. “While we were starting to do sales, we were there Saturday, Sunday, everyday…" recalls Vancura.

As long as businesses have existed, there have also been businesses for sale, complete with established management, infrastructure, customers and cash flow. A contemporary version of this practice is the management buy-in (MBI), whereby external managers acquire a controlling interest in a company.

Consider the ETA ecosystem an evolution of the MBI. It has structures that are more accessible and appealing to a new generation of entrepreneurs and investors, not least because there is less uncertainty compared to building from scratch.

However, finding and acquiring a good business involves screening and engaging with hundreds, if not thousands of companies and owners – only to be rewarded with rejection and disappointment more often than not. Convincing a business owner that you are the right person to preserve and advance their legacy demands resilience, meticulous due diligence, a strategic approach to identifying viable opportunities, and, importantly, empathy and humility.

But to Vancura, ETA is well worth the effort. After successfully selling Nanonis and spending some time in the technology industry, Vancura decided to become an entrepreneur through acquisition. He bought CO2 Bà¶rse, a Swiss car import services and carbon emissions trading firm in a self-funded acquisition. “The risks involved with a start-up are much higher than when you buy a cash-generating business," he says.

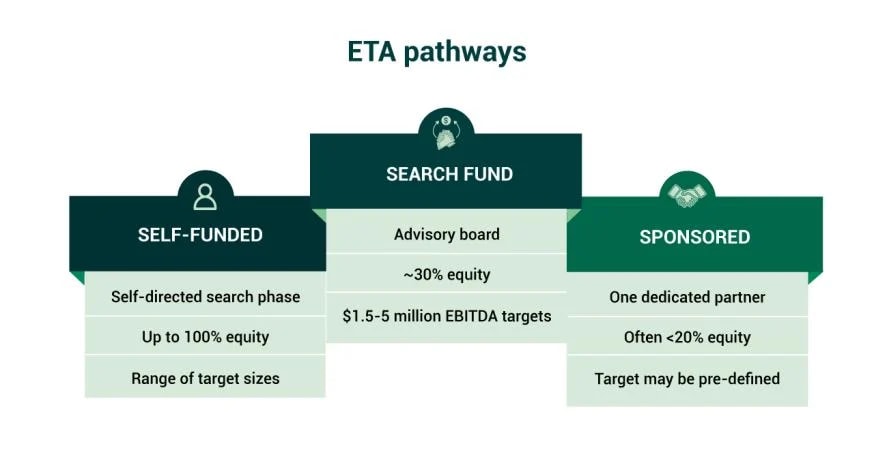

There are numerous approaches to ETA, some more established than others, with more still emerging. Let’s focus on the three foundational types:

Searchers use their own savings or pursue the search part-time while holding a job. INSEAD alumni have succeeded with both approaches. However, part-time searchers usually have less success finding and acquiring a business.

Businesses acquired through self-funded searches are typically smaller – below US$500,000 in EBITDA (earnings before interest, taxes, depreciation and amortisation). This approach attracts entrepreneurs who prefer not to be bound by the criteria imposed by traditional ETA investors. However, this comes at the cost of "smart money": investors who bring not only financial resources but also expertise and guidance throughout the search, acquisition, operation and exit phases.

A searcher raises a fund of around US$500,000 (US$800,000 if there are two searchers) from multiple investors (typically 8-20) to finance the search for a target. The search phase typically lasts one to three years. Searchers look for targets that are ripe for succession, align with their skills, and have potential for growth and operational improvements. These targets also need to meet the well-defined criteria of search fund investors.

Businesses acquired by a search fund tend to be larger than those targeted by self-funded searchers, with around US$1.5-5 million EBITDA. The investors that finance the search phase have right of first refusal – they hold an option that gives them the right but not an obligation to invest in the target proposed by the searchers.

In a sponsored search, the entrepreneur partners with a single primary investor – often a family office, an accelerator or a PE fund – that provides capital for the search and eventual acquisition. The sponsor, who holds an option, not only contributes financially but often proactively participates in the search and subsequent operations compared to the search fund model, which involves a more fragmented investor base. The characteristics of the target business can vary – what matters most is the fit between the target and the investor. Some investors prefer businesses that align closely with traditional search fund criteria, while others are open to distressed businesses.

Sponsored searches suit entrepreneurs who value having a dedicated financial partner with substantial resources, even if it comes at the expense of some autonomy.

Among the three approaches, the search fund model is the most popular among aspiring entrepreneurs straight out of their MBA for its balance of support and decision-making control. The mentorship and operational guidance provided by investors enhance both the probability of acquisition success and post-acquisition performance.

At the INSEAD ETA and Search Funds Hub, we don’t believe any approach is better than the rest. The best approach depends on the preferences of the entrepreneur, as well as market opportunities and constraints.

Here are the key ingredients necessary for ETA success:

First Published: May 12, 2025, 12:10

Subscribe Now