How GE HealthCare wants to tap India for the next 10 years

A look inside how GE believes India is poised to play a global role in healthcare supply chains beyond generic drugs

The last time Peter J Arduini came to Bengaluru was almost 20 years ago, but the chief executive of GE HealthCare Technologies is no stranger to India. Previous visits had taken him more to Hyderabad and Delhi through his first 15 years or so at what was GE then, where he’d started in 1990.

After those 15 years, Arduini had left to take on mainly two assignments, including the role of president and CEO of Integra LifeSciences, another, smaller, med-tech company, until he came back in 2022. He’d been tapped the previous year to lead the healthcare business as part of its planned spinoff from GE.

This time in Bengaluru, “What struck me with our team is just the technology evolution of what we’re doing," Arduini said in an interview with Forbes India on March 27. He and Azim Premji, chairman of Wipro Enterprises, had just announced a plan to invest a billion dollars over the next five years to increase local manufacturing in India—through their almost 35-year-old joint venture, Wipro GE HealthCare.

“We have so far served 300 million people across India and now, we aspire to serve 3 billion people across the world with medical technology, which is touched by our engineers, manufactured by dedicated people in factories in India," Premji said in a short speech at the Bengaluru event to announce the new investment plan.

“We’re going to go many X folds larger just on the equipment side than we are today," Arduini told Forbes India. In an interview with CNBCTV18, he added: “I think it’s going to be one of our top three biggest opportunities really around the globe for us to continue to expand."

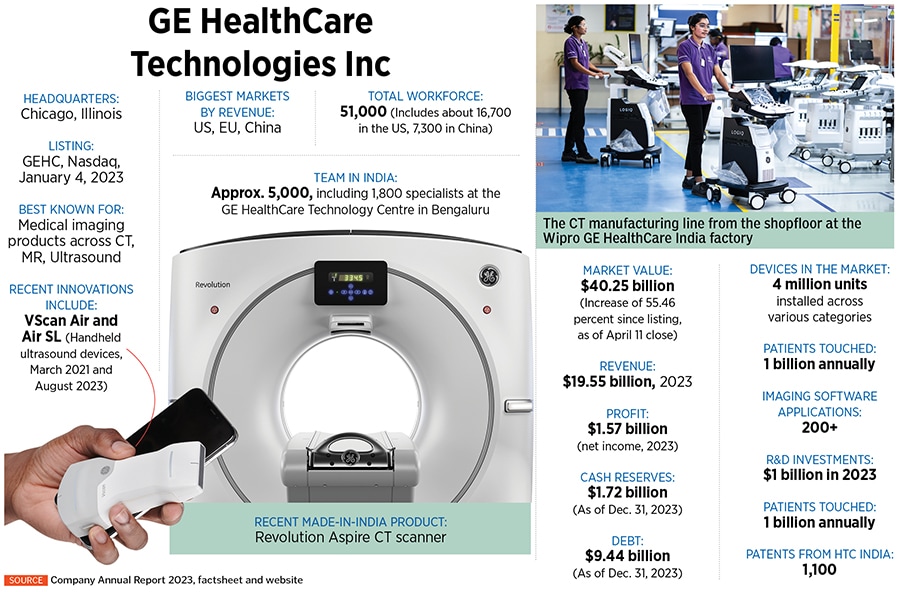

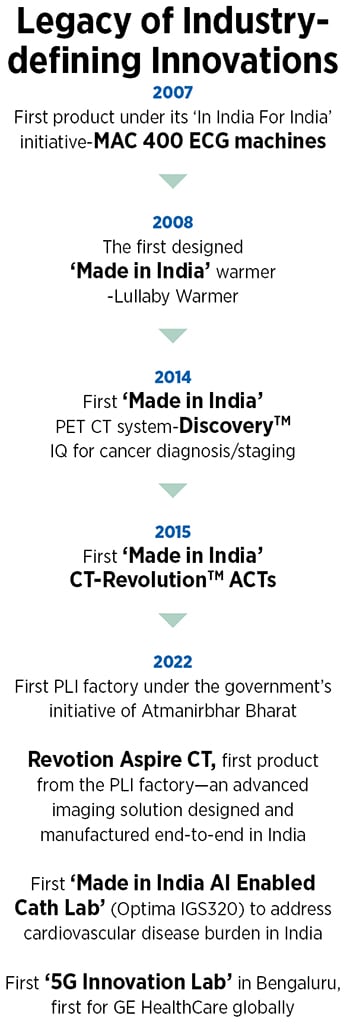

In addition to local manufacturing, GE HealthCare Technologies, which became an independent, Nasdaq-listed company on January 4, 2023, is looking at significantly ramping up R&D in India. Part of its approximately 5,000-member total workforce in India is an 1,800-strong multidisciplinary team of specialists in Bengaluru—its biggest outside the US—now called the GE HealthCare Technology Centre India, within the campus of the John F Welch Technology Centre that turns 25 next year.

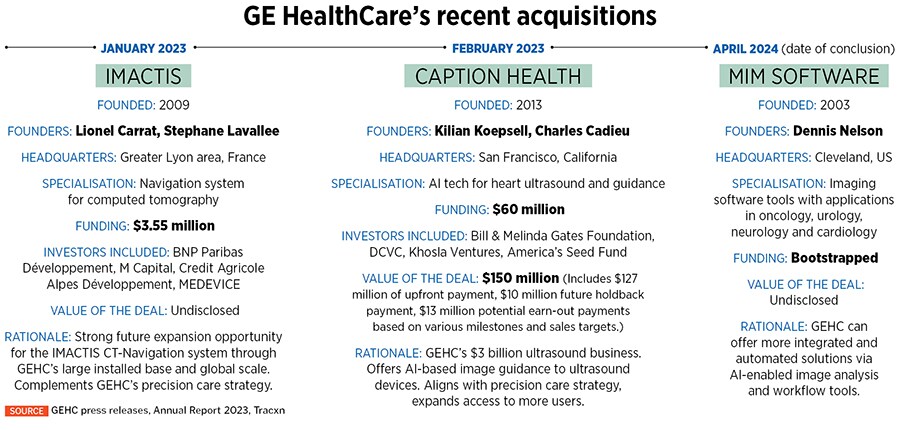

What started out with basic ultrasound work back then has grown into a team developing some of the company’s most sophisticated CT (computed tomography) system and molecular imaging tech, for example, out of Bengaluru, Arduini says. Work is now being ramped up in digital solutions, and of course, artificial intelligence.

During this visit, Arduini was accompanied by CTO Taha Kass-Hout, a medical doctor and statistician who was previously VP and distinguished engineer, machine learning, and chief medical officer at Amazon Web Services, signalling the CEO’s intent that the India team should do much more on AI.

“For artificial intelligence, some of the most sophisticated foundational modelling work we’re doing anywhere in the world, we’re doing here in Bengaluru," he says.

A sort of a trifecta comprising strong government support, a growing and youthful local market, and geopolitical considerations—including the West seeking to reduce dependence on China—has made India the top contender to take over from China as the world’s number one economic growth engine. This could happen as early as 2028, according to a Bloomberg Economics projection.

Such considerations have prompted Arduini to join the growing list of multinational tech CEOs, including Apple’s Tim Cook, Nvidia’s Jensen Huang, AMD’s Lisa Su and Bernard Charlà¨s of Dassault Systà¨mes to commit to large expansions in India.

What’s it about India at this juncture that makes it strategic to GE HealthCare, and in general to investors in the healthcare sector? The answer is in the first half of the slogan that businesses and tech industry lobbies across sectors are tom-tomming these days: ‘India for India and India for the world.’

On the one hand, some 400 million people in India have no health insurance, according to a December 2023 report from the National Insurance Academy. On the other, health insurance penetration is significantly better than it was five years ago and continues to gradually expand, because of government-backed programmes such as Ayushman Bharat and private insurers’ push as well.

The share of government health expenditure in total health expenditure has increased from 28.6 percent in FY14 to 40.6 percent in FY19, according to a January 2023 statement from India’s finance ministry, which cites the government’s economic survey for the year 2022-23. There’s also been a concomitant decline in out-of-pocket expenditure as a percentage of total health expenditure from 64.2 percent in FY14 to 48.2 percent in FY19, according to the statement.

A more granular look will reveal that “insurance is always playing catch-up with innovation", says Saurabh Arora, co-founder and CTO at Plum Benefits Insurance Brokers, a new-age insurer in Bengaluru. Arora is a computer scientist and engineer who’s seen innovation ecosystems from Berlin to Sydney and Singapore to now Bengaluru.

For example, a new innovation might make hospital stay for a certain procedure unnecessary, but the insurance policies might be still stuck in the era of paying only for hospitalisation. Or, say a new robotics-based knee surgery might make the procedure more effective, but it may also be costlier because of the upfront expenditure the hospital has to make in purchasing the robot, and the insurer might decline to meet the full cost of the surgery for the patient.

Such things will change for the better, Arora says, but over time. One very important driver of that change is that “what we’re realising is that the early screenings and health check-ups are super critical", he says. This not only improves an individual’s quality of care and life, but also reduces the cost to the payer (the insurance provider).

Therefore, insurers are now thinking about how to incentivise people to get into early screening—at population scale.

As more people are able to pay for better care, which. in turn, has the potential for raising the demand for modern technology, “there’s so much opportunity", Arduini says, to bring much more of GE HealthCare’s products and tech to India.

Making more of them locally is the next logical step versus shipping them from China, for example.

What’s also encouraging to Arduini is how more of the second and third-tier electromechanical component supply base is beginning to build up in India, he says. Certainly, this pick-up isn’t mature, but significant enough for the CEO to say this ecosystem can broaden and deepen, because the government backing is there now.

Now, consider the second half of the slogan, which is ‘India for the world’. GE HealthCare had already been doing software development here for many years. Therefore, when one thinks about where tech companies are going with artificial intelligence, they are building products that are deeply integrated with machine learning, and eventually artificial intelligence.

“So, the more we have certain products here, the more full-system integration and development will take place," Arduini says.

Add in the geopolitical imperative to reduce dependence on China: “The days when you could have single-source countries or single-source products, if Covid taught us anything, it’s just not a practice that’s sustainable," the CEO says.

Dovetailing with GE HealthCare’s need for “distributed capabilities", is a world where India is on track to becoming the third largest economy. So, “it deserves to have the capabilities to do complete products and systems."

“We’ve been here for 35 years, and I think as far as having the infrastructural capability to do it, I feel very good about doing that in India," he says.

Arduini won’t be drawn into quantifying what this can mean for output from India. India “has always been big" for GE HealthCare, he says, alongside China and Mexico, apart from products designed or made in Europe or the US.

What has happened, however, is that India has transitioned from a location for cost savings to one that can deliver high-end innovation. In considering such locations, “I would say India is high on the list, if not on the top of the list because of the software capabilities," he says.

Broadly, “we do three things: High-end digital work, product development where we add a lot of value, and as an organisation how do we get (multidisciplinary) teams to work together," says Girish Raghavan, vice president of engineering and head of the Healthcare Tech Centre India, with its 1,800 specialists.

“For example, if you have a CT system, and you want to work with the ultrasound system, there’s no other place in the world we can do that except from India, because there’s no other place today where you have all the technology organisations on the same campus."

Developments outside the walls of the tech centre also gives us a sense of how the med-tech ecosystem is changing in India.

“What happened in pharmaceuticals 10-15 years ago is now going to happen in med-tech," Dhruv Sukhrani, a partner in Mumbai at Bain & Company and part of the consultancy’s private equity and healthcare and life sciences practices, tells Forbes India in an interview.

And the money is coming into the local market to support this because “there’s also a lot of private equity interest in India’s healthcare ecosystem across providers, pharma, diagnostics, IVD (in-vitro diagnostics), med-tech, you see the deals happening", Sukhrani says. “There’s a lot of support now with these folks bringing targeted ability to invest into taking India outside," he adds.

And startups are beginning to mature in India, designing sophisticated products here that are relevant for markets around the world. SigTuple, which developed an in-vitro diagnostic device to automate manual microscopy, now exports to Southeast Asia. SMT, the market leader in India for minimally invasive cardiovascular devices, exports to EU, according to a March 6 Bain report, Healthcare Innovation in India.

Molbio Diagnostics offers a portable battery-based RT-PCR, Meril Life has developed the world’s first 100µm fully biodegradable vascular stent, and Niramai offers an AI-based breast cancer detection tool.

“India is at a turning point globally… healthcare tech going global from here, that’s the big change coming," Anand Madanagopal, founder and CEO of Cardiac Design Labs in Bengaluru, says. In January, Anand struck a partnership with Medtronic to distribute Padma Rhythms, a cardiac monitoring patch developed by his company. “It’s only a matter of progression for us to go global via this partnership," he says.

In May last year, Medtronic, the world’s biggest med-tech company, bigger than GE HealthCare by roughly half as much—with 2023 revenue of more than $31 billion—announced a follow-on investment of $300 million to expand its engineering centre in Hyderabad. It had previously announced an investment of $160 million in the Medtronic Engineering and Innovation Center in 2020.

Medtronic aims to double its MEIC team to 1,500 by 2028, which is one example of how GE HealthCare is also in a race to defend its talent in India even as it seeks to expand in the country. In April 2022, Wipro GE HealthCare released the next-generation version of a CT (computed tomography) scanner with the brand name Revolution Aspire, made in India, at the company’s new medical devices manufacturing factory in Bengaluru that qualified for India’s production-linked incentives. The company had invested some `100 crore in the plant.

The greenfield factory is a 35,000 sq. ft. facility, set up for 24/7 operations for manufacturing CT machines, cathlab equipment, ultrasound scanners, patient monitoring solutions, ECG machines and ventilators. It is equipped with automated testers to assess performance of the medical devices. Today it has 35 employees on the shopfloor, most of them women.

Lean concepts at work at the Wipro GE HealthCare ultrasound manufacturing line

Arduini is encouraged by a convergence of capabilities, existence of different manufacturing locations and top-notch local leaders who understand the global big picture, he says. And “it’s actually easier to bring the hardware to a country where you have deep (applied) AI and software capabilities than it is the other way around," he says.

Certainly, a critical ingredient that India will have to ensure it won’t botch up is to build the local ecosystem for the components that go into the hi-tech end products—like the PET CT scanners, in the case of GE HealthCare. About 70 percent of the components of the products that the company manufactures in India today still need to be imported, according to the CEO.

Today India would probably be the company’s fifth largest market.

At Wipro GE HealthCare, “from a manufacturing standpoint, roughly about 25 percent is consumed in India. The remaining is exported," Chaitanya Sarawate, MD of Wipro GE HealthCare and president and CEO of GE HealthCare South Asia, told Deccan Herald in an interview published on March 4. GE HealthCare also has a second joint venture in India, with Bharat Electronics Ltd, called GE BEL, which started in 1997, making X-Ray tubes.

Therefore, manufacturing in India will be the sum total of Wipro GE HealthCare’s output and that of GE BEL. As to sales in India, about “40 percent of sales is driven from India", according to a company fact sheet about its India operations.

That means, of the total sales done in India for GE HealthCare, about 40 percent is fulfilled by the company’s India manufacturing sites. Most of the rest is dependent on imports.

Med-tech in India is an approximately $11 billion market overall, dominated by imports, which account for 75 percent to 80 percent of the market, according to Bain’s report. Indian med-tech players accounted for about $2.5 billion in FY23, up from approximately $1.8 billion in FY20, the consultancy estimates.

At GE HealthCare, while hardware manufacturing will remain important, “the real value over time is this combination of advanced R&D and (all the other) capabilities together. And I think that’s one of the unique opportunities for India," Arduini says.

That India also offers a billion-person scale market, where demand and propensity to pay for quality care will only go up, is, of course, the clincher.

Throw the story forward and India offers a “multi-decade opportunity", says Sarawate.

In that context, “There is no other market which is as important as the Indian market from our perspective and no other market which provides the diversity of customer segments, diversity of needs, diversity of patients, diversity of clinical capabilities," he adds.

The billion-person scale also means that India becomes the natural test bed for most new innovations that the company wants to commercialise and “we are thinking of the global south as well", he says.

“In recent years, we have focussed a lot on digital capabilities. There was a big rise of AI starting to become relevant for healthcare about 6-7 years ago and we were one of the first (healthcare) companies to embrace artificial intelligence," Roland Rott, president and CEO of GE HealthCare’s ultrasound business, said in an interview with Forbes India, during a visit to Bengaluru in September 2023.

“We’ve created software solutions to make our medical devices smarter and help users to be more efficient. A lot of these AI developments today are rooted and developed right here in India for the world in fact," Rott added.

In, say, 10 years, “the big picture would be the digital solutions that GE HealthCare would offer are going to be a more prominent driver of value and capabilities than even the equipment," Arduini says. “That’s the first part which gets back to development and capabilities in Bengaluru… I mean that would be a critical role."

Similarly, he expects GE HealthCare India to play a bigger role in advancing its cutting-edge technologies such as theranostics (a term that comes from combining therapeutics and diagnostics), and building generative AI applications.

“We’re thinking very big," CTO Taha Kass-Hout told Forbes India in an interview on March 27, during his first visit to India and Bengaluru. The context for that ambition is that, globally, 40 percent of the world’s population doesn’t have access to any care. Not quality care, but any care at all, he says.

The aim is to meaningfully contribute to making high-quality care accessible and affordable to billions of people. “So, if you consider that as the 1.4 billion population experiment, the next 3 billion is really where this can go," the CTO says.

The Bengaluru teams have delivered some 125 technologies and solutions over the last 30 years, Kass-Hout says. In the future, “AI is going to be front and centre" in solving these problems of access, affordability, making the tech ever more user-friendly and reliable, raising the effectiveness of frontline technicians as well as productivity of expensive specialists in urban centres and so on.Therefore, R&D investments in India will “fast track this path", he says. In the long run, the way to look at India’s strategic value will be less about how many pieces of hardware came out from here and more about the value generated here from R&D and intellectual property, CEO Arduini says. Manufacturing will remain important, but software will be more valuable, even at the GE HealthCare level itself, as the world embraces cloud computing, software-as-a-service and AI.

GE HealthCare has invested some $4 billion over the last 30 years or so in India. The next $1 billion is “really the minimum of where we are". What will determine where the company will go from there will depend on sustained government support, and how quickly the overall local ecosystem can mature.

First Published: May 14, 2024, 11:20

Subscribe Now