How Bihar's Flat-Tax Scheme for Small Businessmen is a Success

Bihar shows how a gentle touch can improve tax revenues even in backward states

Rajul Awasthi, IFC-World Bank’s senior private sector development specialist in Washington, remembers a workshop in Bhagalpur, Bihar, two years ago where he was speaking to a hall of about 100 people on tax compliance. At the end of the workshop four people walked up to him. Going by their clothes and manner Awasthi figured they were small merchants. “One of them said, ‘we are very scared to go to the offices though we want to be part of the scheme’,” he says. “They said they didn’t want to do business like thieves.”

What they were referring to was the sales tax system that existed in Bihar, as in many other states.

Much has changed since 2009 when Bihar introduced a flat-tax scheme for small businessmen. The scheme did away with quarterly filings with the tax department and scrutiny by officials, instead accepting the businessmen’s assessment of their business in good faith. In short, a small businessman did not have to meet a tax official on any occasion. Awasthi, who was one of the key advisors to the state government, says many people do not pay tax simply because the compliance cost was too high.

Experience worldwide and now in India shows that an easy way to improve tax payments is to reduce the cost of compliance. Many Indian states such as Kerala, Gujarat and Maharashtra have improved tax collections by simply making it easier for people to pay their taxes. The commercial tax reform project in Bihar, which borrows elements from good practices in other states, proves that even regions that are far behind in economic activity can scale up their revenues with some simple measures, especially for small taxpayers. Some of these lessons are finding their way into the national Goods and Services Tax regime being designed by an empowered committee chaired by Sushil Kumar Modi, Bihar’s finance minister.

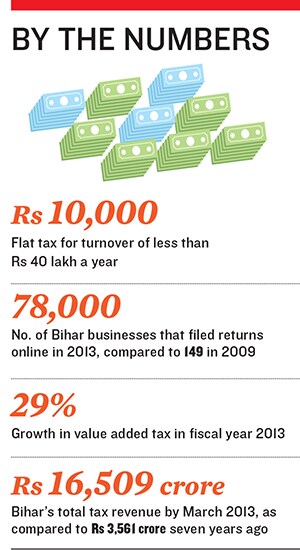

Only 149 businessmen in Bihar filed tax returns electronically in 2009 when the project started. In February 2013, 78,000 businesses filed returns online. Value added tax grew 29 percent in fiscal year 2013, says Modi. The state ended the year with a total tax revenue of Rs 16,509 crore compared to just Rs 3,561 crore seven years ago.

What Changed

Sitting in the first class compartment of the speeding Patna-bound Rajdhani Express, Delhi-based businessman RK Gupta is carefully filling up a ‘C’ form on his laptop. The ‘C’ form is a mandatory filing made by businessmen who have inter-state trade in India. Gupta imports polymer bags to Bihar from his factory near Delhi. Earlier, a businessman in Bihar (it is still the case in many states) had to physically file the form in triplicate at the sales tax office and wait for the officials to issue an acknowledgement which had to be shown at the checkpoints on borders and verified by tax officials. The form would have a declaration of the goods and their value. Now Gupta can fill it online and get a token number which his trucker can quote at the state border where tax officials look it up online. Officials at the checkpoint have also been asked to take the declaration of value in good faith and not harass the truckers.

Amit Mitra, finance minister of neighbouring West Bengal told Forbes India in an earlier interview that his state had eased inter-state movement of goods. “The way bill is generated online and importers have to pay only 1 percent of the value of the goods which they declare,” Mitra had said adding that it has practically eliminated the need for sales tax check posts at borders. Such rationalisation smoothens movement of goods, saving time and money for businesses and reducing petty corruption.

Bihar has moved many of its tax processes online, including payments. More than 90 percent of tax payments were made online in fiscal year 2013, Modi says.

When Bihar approached IFC seeking help in reforming its tax regime, Awasthi first commissioned a survey of businesses in the state. “We found that there was a significantly high compliance burden on many tax payers,” he says. Businesses had to hire accountants and spend time and effort which was not justified by the turnover and amount of tax they were expected to pay. Awasthi advised the state to introduce a flat tax scheme for small businessmen.

Following the advice, Bihar launched a scheme under which businesses with a turnover of less than Rs 40 lakh a year could pay a flat tax of Rs 10,000, that too in two instalments if they like. It also replaced quarterly statements with a single, yearly statement. To remove the fear of the taxman, the state decided to exempt all such businesses from scrutiny. “We have not done a single tax raid this year,” says Modi. He has found other ways to check evasion. The government has asked 1,500 large companies for data on goods supplied to Bihar. Modi reasons that a television maker, for example, will have meta data of sets sold in the state and once that is available, it is easy to find out who sold what and where and cross check whether revenue flowed to government coffers or not. Electronic markers are easier and efficient than sending a pack of taxmen to raid offices and homes to chase paper trails.

Manoj Kumar, a watch-shop owner in Patna, says that the new regime saves him a lot of hassles and costs. He says he has a turnover of approximately Rs 30 lakh. If he were to calculate his tax burden at the earlier rate, it would have worked out to about Rs 9,000. “I deposit Rs 10,000 in the bank now and there are no hassles,” says Kumar. He, however, feels that he would have had to pay much less when business is slow and turnover falls to, say, Rs 20 lakh. “I wish there was one more slab with a lower tax rate.”

The Larger Picture

Modi says it did not make sense for the state to spend its energy on small taxpayers. “Ninety-eight percent of our tax revenues come from 2 percent of tax payers. So we are focusing only on the biggies,” he says, adding that what Bihar did was not original but largely copied from the successful model of Kerala which reformed its tax regime some years ago. In Kerala businesses with a turnover of less than Rs 5 lakh do not need to register or pay any tax. Those with a turnover between Rs 5 lakh and Rs 10 lakh have to register but pay no tax. Those with a turnover of Rs 10 lakh and up to Rs 40 lakh pay 0.5 percent of their turnover as tax. When Bihar was implementing the project, it invited officials from other states such as Kerala, Maharashtra, Karnataka and Gujarat to hold workshops to share good practices.

Many of these practices could also find their way into the GST regime as and when it is rolled out. One of the key subjects that the empowered committee on GST headed by Modi is currently discussing is the tax regime for small businessmen. The success of the model even in Bihar shows that it can be implemented nationally. Modi says one of the three sub-committees is working on it. An issue they are grappling with is setting the threshold for Central excise. Modi feels businesses could be exempted up to a turnover threshold of Rs 1.5 crore. That could be a boon for millions of small businesses across the country.

First Published: May 02, 2013, 07:12

Subscribe Now