There are huge internal challenges on the merger which we will overcome: Arundha

State Bank of India Chairman Arundhati Bhattacharya talks about the bank's mega merger, non-performing assets, digitisation and much more

Arundhati Bhattacharya, Chairman, State Bank of India

Arundhati Bhattacharya, Chairman, State Bank of India

Image: Vikas Khot

The country’s largest lender, the State Bank of India (SBI), is in the midst of completing a historic merger with five of its erstwhile associate banks and the Bharatiya Mahila Bank (BMB) with itself. The merger will result in the creation of a banking behemoth with more than

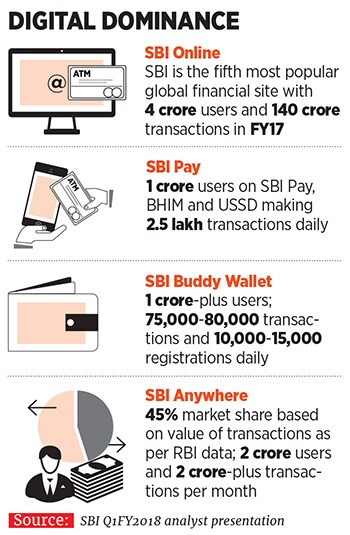

Bhattacharya, 61, is widely credited for being at the forefront of the banking sector’s war on NPAs, and also for driving deep-rooted cultural and process changes at SBI. One of the key areas she has focussed on is technology and the spread of digital platforms. The results are healthy: The SBI group saw

5.83 lakh crore worth of mobile transactions (with a market share of 44.5 percent) during FY17. Its consolidated net profits stood at 2,006 crore in the quarter ended June 2017. However, gross NPAs of the merged entity stood at 9.97 percent of gross advances during the quarter, indicating the battle against bad loans is far from over.In a freewheeling interview with Forbes India before the results were declared, Bhattacharya speaks about the economy, the changes she sought to drive at SBI and how far she thinks she has succeeded. Excerpts:

Q: India’s economy has witnessed major reforms with the implementation of GST. There will be an impact on government revenue. How do you see it playing out?

A: It is difficult to say at this point of time what is happening there are obviously a lot of concerns relating to GST. Some say they have got the hang of it, most large companies seem to be dealing with it well, but I am not sure of how it is panning out at the grassroots. There are still some people who believe that [GST] will make their model non-viable and obviously that should not be the case, because ultimately you are just replacing one tax with another.

The fact remains that you are getting sufficient amount of input credit, so the incremental tax rate is not that huge. Maybe it is a question of understanding it better, or IT-preparedness we have to watch the unorganised sector to see how they can be helped. We are doing a number of SME meetings across India to propagate what we think is the right way to go about it.

On the other side, personal demand [for consumption] is pretty good the monsoons have been positive, though there has been flooding in parts of East and West India, so issues relating to re-sowing of crops have to be tackled. There are a number of imponderables in the economy still, and there is no direction that we are seeing. It is a time to hunker down and wait, and allow things to mature.

Q: Do you see an increase in the credit offtake?

A: Not much really. If you look at investments, the offtake is mainly only retail credit and there is some amount of refinancing taking place. Fresh investment credit is still not very visible.

Q: Isn’t the SME sector facing worries on the GST front?

A: That is what I am concerned about because we need to understand their awareness, their ability to put together processes and access IT systems maybe it is still less. There is a feeling of unpreparedness that they need to get past. Just a month has gone by since GST came in, it seems to have gone smoother than anticipated. People are making purchases and paying their taxes. In the cases of foodstuff, there are a lot of hybrid items, which makes classification difficult to understand [for the consumer].

If the tax base goes up and if there are more official transactions going through the formal channels, then it would be beneficial to the country. I hope that happens because people have got used to operating in a certain manner, it is not easy to change customs… they have got used to handling cash.

Q: There is a view that with demonetisation a huge reform came in, followed by GST. Is the government bringing about too many reforms too quickly?

A: We cannot complain… first we say there are no big-bang reforms. Now when we are getting the reforms, we say there is too much of a bang. We cannot do that. We have to be fair. We need to get a lot of things done in our country the quicker they are done the better it will be. And no matter when they are introduced, there will be some degree of unpreparedness amongst people.

Q: Private sector investments are still not picking up as needed. Much has been tried by pushing up public investment too…

A: Even today the capacity utilisation is just 70 to 72 percent investment comes in when this crosses 80 percent. Then you know that if you have to put up a project in two or three years’ time, demand will start to kick in by the time the project is up. Today, with demand being far lower than capacity, it is difficult to envisage anybody wanting to put in capital. [qt] We have neither a shortage of capital nor of liquidity. What we have is a shortage of well-conceived projects.[/qt] Q: Is the difficulty of banks to lend also a critical factor?

A: This is not the case for everybody, it is just a certain segment… because whenever we lend today we have to ensure that your risk-weighted assets have enough capital backing them. The bigger banks have huge liquidity today we have neither a shortage of capital nor of liquidity. What we have is a shortage of well-conceived projects. You should know where the deal is coming from, there should be genuine equity. Whenever we do an assessment these days, these are the things we are very careful about. We don’t want to repeat mistakes. The projects have to be done with more than a shoestring equity, there should be clarity on where equity is coming from, what the contingency plans are, or what if there are delays. These have to be dealt with.

Q: When you last met Forbes India you had spoken about the battle against NPAs and also helping industrialists—such as Tulsi Tanti of Suzlon—turn their business around. How is the whole NPA problem being addressed at the bank?

A: The main thing that has happened is the reference to NCLT [National Company Law Tribunal]. These cases will be closely watched. [The government recently amended the Reserve Bank of India Act, giving the central bank powers to direct banks to take punitive action against companies, and referring them to the NCLT, which takes up bankruptcy and insolvency cases under the government's revamped bankruptcy code.]

If these cases are resolved in a time-bound and efficient manner, it will go a long way in restoring confidence in the system. If that happens, more cases will go the NCLT at an earlier stage, and that is where I am a little concerned.

There are reports that the RBI will ask banks to set aside additional amounts—a 50 percent provisioning—against stressed assets that are referred to the NCLT. That may not be conducive we would like to take a case to the NCLT the moment we see stress, but if immediate provisioning needs to be made, it would be difficult. So far, we are allowed three years to make up to a 40 percent provisioning.

I hope that the RBI will try and align rules with today’s requirements of NPA provisioning. Then we can ensure a good pipeline of cases. We need a framework that is flexible and practical, and the NCLT provides both, along with transparency.

Q: How are the early warning signals—which you spoke about earlier—working at SBI?

A: Those are working well [Bhattacharya, soon after taking charge, had set up a full-fledged analytics team for intelligent data crunching]. The portfolio creation in the last three years has been well thought out. We have taken steps to improve risk management for smaller accounts also several tools, which are more like black box underwriting, are there with the bank in some form or the other. Lots of processes and product changes, and training programmes are in place. We have used the period of stress very well when the system is stressed, that is when you see the weaknesses and try and address them quickly we are more than ready for the next [growth] cycle.

Q: But there are other developments that are making your efforts difficult, like farm loan waivers…

A: That will happen. Nobody in the economy can tell you that this period is the end of stress and now begins the golden period. Whoever thought of something like taper tantrums in 2013 and India’s currency being marked as being part of the “fragile five” [besides Brazil, Turkey, South Africa and Indonesia, as those which were likely to be most impacted once the US Fed started to raise interest rates]. We proved how wrong they were, but it happened. These are ‘black swan’ risks.

At this stage, we need to work on the agriculture segment of the economy. We need to do much more to ensure that there is a process to create sustainable livelihoods from the banks. All of these problems arise because over a period of time the country did not take care to ensure that the people who are living on the land have a decent standard of living.

We need to look at the long term, there is no solution in the short term. So whether it be creation of better infrastructure, building better irrigation potential, better management of subsidies and ensuring more amenities in social areas, these have to be provided for, it is a wake-up call.

Q: On the NPA side, what are the steps you would like to see introduced?

A: Demand needs to go up. NPAs occurred because we put capacity into assets but could not create money. We need to bring back growth. Demand is like an incoming tide, it raises all boats. Secondly, there need to be better governance standards, use of technology, and better information analysis to check what could be happening.

We are still working through legacy issues. We should not create more, which could go on for several more years. If we are looking at the working capital cycle, one of the reasons that gets extended is because receivables are not paid on time. These are in the hands of the larger corporations, both in the public and the private sectors. The small boys have little capability, even though there are redressal systems. There are governance standards that larger corporations must start adopting. Also, sanctity of contracts, payment terms and arbitration mechanisms are important, and must operate efficiently. Definitely, we should be better placed on NPAs over the next 18 months or so. I have no doubts.

Q: But public sector banks—SBI aside—have been crumbling under pressure of NPAs.

A: Yes, so they obviously have to be supported to get past this hump. Once they get past the hump they can pick themselves up and do things.

Q: Which means government intervention.

A: Could be. There have to be some ways in which they have to be supported. At this time, I think capital is a very big necessity, given that topline growth is not there. If topline growth was there, you could have paid from your earnings. But if it isn’t there then you don’t have those earnings to pay from.

Q: Do you see mergers as a solution to this problem?

A: See, mergers if you do them… specially our merger, people think there’s no problem at all. It’s not simple. We will see how the difficulties come and how we overcome them. I am still confident we will overcome all difficulties. But there will be difficulties.

Q: What are the main challenges in the merger you’re undertaking?

A: There are so many. The entire organisation changes, the DNA of the organisation needs to be explained to the new people who are coming in. HR issues are very large. Issues of new ways of doing things, products, processes, new screens, new places… because people will get transferred. So lots of dislocations, and things like that.

On our side, all of these accounts need to get allocated differently. Some branches are going out, some are coming in. So all the base level numbers have gone up. With the base level numbers not there you don’t know how to monitor. I monitor when I have a base, and I know where I am supposed to go. Now the base itself is changing so frequently, it becomes a challenge. And without monitoring you cannot get many things done.

So there are huge internal challenges that we will get past. Because these are either IT issues or follow-up issues or HR issues. So all of these issues are understood by us quite well.

Q: It’s a case study like no other.

A: Yes, it’s a huge case study. Actually you should do it one year down the line. Then you really begin to understand what has been done.

So, therefore, if you have to do a merger, it has to be quite deliberate. There has to be positive synergies and it has to be meticulously planned. For instance, we did 62 mock runs before we actually did the IT integration. And, then also, on April 1, the integration happened only for the general ledgers, that is, the toplines. Then every weekend we took one bank and over the next six weeks, every weekend we merged one bank’s granular level data. And we did it on a Saturday so that on Sunday people could actually test it out. So the actual data integration was completed on May 27. And then we started generating individual reports in various areas. So, by the time people got their accounts [in the merged entity], it was already June 10. So there is a lot of work.

Then there were blocks of accounts where the account numbers had to be changed because there were duplicates. So lots of little things. We had to tell them, “Change your account number, let us help you do it,” etc. The logistics is really a nightmare. There are spreadcharts that are that huge.

Q: How long will it be before the whole thing plays out fully?

A: Most of it is done already, but the HR integration is still happening. We needed to do the promotion exercise. That got delayed because there was a case where the judge wanted to see how we were going to do the seniority adjustment. And only after that, just a month ago, we were allowed to start the promotion exercise. We should be through it by July 31. Thereafter the actual transferring will happen. We’ve already done the senior level transfers but all the junior level ones from scale V right down will happen in the next two months. On branch rationalisation, some 94 of them have been done, but it’s a long way to go. Around 1,500 to 1,800 will have to be done.

Q: So what would be the final number of branches of the merged entity?

A: See, what will happen is, while we merge these branches, we are not giving up these licenses. We intend to open them in other places. So that will take time because you will have to determine where you want to open, do an RFP [request for proposal] for the space, set it up and put the staff. And we are also changing the branch formats in various places they are beginning to look different. Whether it goes in the standard format or the InTouch format… lots of things have to be decided. The whole thing will take at least two years. But you should be able to see the results, the synergies by the fourth quarter of this financial year.

Q: But still, you have the Chinese banks at the top of the world’s biggest companies.

Q: But still, you have the Chinese banks at the top of the world’s biggest companies.

A: Yes, but the merger was important. And it was quite inefficient keeping six structures. All this technology I have been doing, I’d like everyone to be on the same platform. I couldn’t do six rollouts… everything had to be done six times. So no matter what the pain for us, it makes sense. If I am the owner and if I am going to provide capital to these units, I would rather like them under my direct control. Board control is not enough. At the end of the day you need management control. So we have done the right thing. It was the right time to do it.

Q: Why do you say it’s the right time?

A: It’s the right time because the difference in technology was becoming too much. The gap between the two was beginning to yawn. We were going very fast, and they were not able to keep up. It was not their fault. It was our fault because I didn’t have the bandwidth to do six rollouts instead of one. So this was absolutely the right time. And frankly, when the economy is not really supportive, that is the time when you should do all of these housekeeping moves instead of trying to do it when everything is booming. Then you focus on the business. This is the right time to set your house in order.

Q: Coming back to the economy, which are the key pain points you’re noticing right now?

A: Pain points are there in some sectors. You are aware of the telecom sector pain points. That is obviously there because of the price competition. There is so much of digital content that is happening. With this kind of spread, both in depth and width, the infrastructure also will obviously need more support. We need to look at that.

With respect to the power sector, we still haven’t seen too many PPAs [power purchase agreements] coming up. That is something that is very important we need to see that happen. The discoms [distribution companies] themselves are still a little on the backfoot. Steel is more or less fine all metals are doing better.

In the road sector, they are doing very well in the allocation of projects but we still have some concerns on the HAM [hybrid annuity model] side. We’ve flagged those. [In] renewable energies also there are some issues because there are delays in payments on contracts. So quite a few areas, actually.

Q: In telecom, what’s your assessment of the road ahead?

A: Difficult to predict. They [older, existing players] need to hang in there. They need to have the staying power to stay the course.

Q: Do you see entrepreneurs more willing to let go in the interest of their companies?

A: That you can see now even in the NCLT… there’s been very little opposition. Most of the things have gone through. If there was a lot of opposition they would have gone to the high courts and the Supreme Court. That has not happened and hopefully we won’t see that happen. Because we do need to see some good implementation of these things [the new bankruptcy laws]. If they happen well, it’ll be good for the economy.

Q: Technology was your big agenda when you took over. How has the bank fared on that front?

A: That has gone very well. In fact, very shortly we should be able to come out with a few very nice offerings. We’ve just got Mr [Bhaskar] Pramanik, the former Microsoft India chairman, on our board. He has great experience in Sun Microsystems, Oracle and then Microsoft.

Q: What is the progress on the wallet side?

A: Our wallet is doing fine. We have, I think, 13 million customers, it’s available in 13 languages the transactions are increasing. The volumes of our digital transactions are also increasing.

Q: Demonetisation would have given a push to that.

A: Oh yes, very much so. It’s a fact that demonetisation has increased these transactions. Only yesterday we were doing a review. We have done about two to three years’ work on digitisation in 60 days. The other thing that has happened is the increased resources in the banking system. That is also a positive [outcome] of demonetisation. The resources are still there in the system. The way the deposits went up then, it hasn’t all got depleted at that rate. Sixty days after all the curbs were removed, it is not as if 100 percent of all that has flowed back. That liquidity is what allowed us to transmit the rate cuts. Otherwise we would never have been able to do that. That’s been a bit of a gamechanger as well. From the banking system side, these are two big positives: The increase of resources, and the growth in digital adoption.

Q: What is your view on the debate around the disruption in financial services by fintech companies?

A: Fintech companies are more than willing to collaborate. We have set up a

At the end of the day, just like telcos give their subscriber numbers, we have more than 400 million with us. That’s not a small number. We need to be able to get a lot of things done with those kinds of numbers.

Q: Is the startup ecosystem something SBI is actively looking at?

A: You see, we are not into venture financing. So we will not be there, that’s not our forte, we don’t have a fund aimed at that. But we do have these branches that provide services. We are considering opening a few more of those. Otherwise, one good thing about the entrepreneurial space is, earlier it would only be ecommerce. Today you’re seeing many different things. The basket is getting more varied, and as it gets varied there are better chances of success. Some of them are in absolutely different areas, such as robotics. I am very hopeful that India will continue to have this entrepreneurial talent.

Q: It’s now been nearly four years for you at the helm of SBI. What are some of the key highs and lows for you?

A: There is so much that has happened… I have been meaning to tell my department to put together a list of all that has been done in this period. But I think when I came in and when I went to RBI for my interview, I had talked of four or five things I meant to accomplish. One was better risk management. The second was collaboration across verticals, organisations and subsidiaries. The third was HR, the fourth was the NPA bit, and the fifth was that I would drive all of this through technology.

I think if you look at all of those, significant progress has been made in every single area. If you look at collaboration, the amount of up-sell and cross-sell we are doing within and outside is humungous. Our risk management has really become dynamic. We have a structure right down to the regional office level, and also up to the board level now. We have the organisation, the tools, the processes. So we have done a lot of work on that.

Similarly, on HR we have come a huge distance. From a place where only 37 percent were measurable goals, we are today up to, I think, some 93 percent. It’s a huge thing because people can now understand where they are and the numbers are now coming on a monthly basis. Postings have been rationalised, succession planning too.

NPA resolution is the one area where we have not been able to do as much. Not every time the stuff is up to us, we need the economy also to be supportive. But I still think we’ve done a lot of work there.

And on technology… I have done every single thing through technology. As I said, it takes time. This is still the beginning. It is still not anywhere close to the half way mark or the end of the journey.

Q: What next for Arundhati Bhattacharya?

A: (Laughs) I don’t know! I have zero understanding of that.

Q: Any regrets?

A: The regret is only that I haven’t been able to finish the NPA job. That’s all. No other regrets.

First Published: Aug 31, 2017, 06:15

Subscribe Now