Our top reads of the week

From Jungle Ventures' gambit to expert advice on life after layoffs, here are our top reads of the week

1) Laws of the jungle

1) Laws of the jungle

Amit Anand, a founding partner at Jungle Ventures, recalls that their "regular" process of meeting founders had flaws. The realisation came when the promise and the vision didn’t match the execution. Everyone had a cookie-cutter approach—amazing pitches, brilliant stories, and ambitious strategies to conquer the world. Partners at Jungle Ventures changed the course. They now choose to meet the team. “We want to see what they would order for lunch," says Anand. “We also see how they behave in the office."

How does this change and having Ratan Tata as an advisor works to their advantage? Let"s find out. Read more

2) Life after layoffs

2) Life after layoffs

16,000-odd employees working in tech companies in startups have lost their jobs this year as part of mass—and in many cases, sudden—layoffs announced by their respective companies. Many such employees report that they were not given advance notice, and leadership did not hold any town halls to warn them about the situation. There was just an email and a call from HR saying they had been relieved from their duties with a few weeks of severance. What should an employee do after this unceremonious departure? Here"s what experts have to say on the rights employees can exercise and how they can fight back or pick up the pieces. Read more 3) The trap of BNPL

3) The trap of BNPL

The Indian fintech market is filled with entities offering the "buy now pay later" services. LazyPay witnessed a 400 percent growth in the last two years, with 296 merchant partners choosing it as a payment alternative. Amazon Pay Later has over 3.7 million registered users, driven by a faster customer sign-up process and its wider use cases for goods purchases and utility payments. BNPL transactions on ZestMoney surged by 300 percent in 2021. For an investor, these numbers are essential from a business point of view. But the customer"s point of view is not as rosy. Check out this story to understand the darker side of this fintech boom. Read more

1) Understanding the value of choice and time

Sriram Viswanathan, the founding managing partner at Celesta Capital was the guest on this episode of the Startup Fridays podcast. In this conversation, Sriram talks about his long association with technology. He shares insights about investing in deep tech companies and Celesta"s strategic focus on the US-India corridor. He also has some experience to share with deep tech entrepreneurs in areas including product-market fit, growth and scale, the value of strategic investors, and exits. Listen here

2) 5 gems of advice from ace investor Raamdeo Agrawal

In the new episode of Forbes India Pathbreakers, Raamdeo Agrawal, chairman and co-founder of Motilal Oswal Financial Services, says, "This is 30 years journey from zero to thousands of crore of wealth. That is possible only because of compounding and compounding is possible only when you are in one type of work you are doing." There"s a lot more to the conversation, and you will have to watch the episode to learn more about one of India"s ace investors. Watch here

3) Leadership Mantras of CK Ranganathan of CavinKare

What does it take to build a business that is resilient and lives long? How do you learn and unlearn on the job, balancing between telling people what to do and being a team player? And most of all, how do you believe in yourself when the going is tough? CK Ranganathan, chairman and MD of CavinKare, gives us the answers through his personal story in the second episode of Leadership Mantras. Watch here

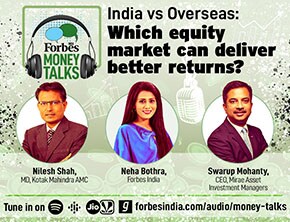

4) Listen: Decoding the finer nuances

4) Listen: Decoding the finer nuances

At a time when Indian equities are seen as richly valued, many analysts say the rise in global commodity prices can directly impact the profitability of around 25-30 percent of Nifty50 companies. In the current backdrop, should HNIs increase allocation to Indian or overseas markets for better returns? Nilesh Shah, MD, Kotak Mahindra AMC and Swarup Mohanty, CEO, Mirae Asset Investment Managers, decode the finer nuances of investing in India and international equity markets and to find out how returns compare in the long-run. Listen here

First Published: Nov 26, 2022, 07:36

Subscribe Now