The future is AI-ready

The founders of Fluid AI, brothers Abhinav and Raghav Aggarwal, are deploying Artificial Intelligence to make, among other things, banking fun for customers. Of course, they have a more serious intent

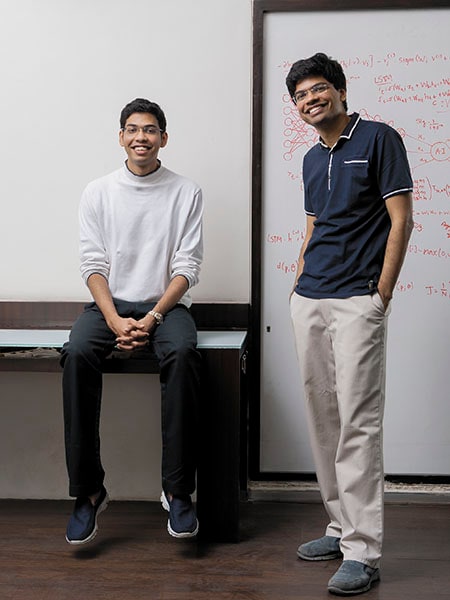

Abhinav (left) and Raghav Aggarwal see a future where people can’t distinguish whether they are talking to fellow humans or to machines

Abhinav (left) and Raghav Aggarwal see a future where people can’t distinguish whether they are talking to fellow humans or to machines

Image: Mexy XavierAbhinav Aggarwal fondly recounts a favourite bit of fiction about a set of scientists who built the first intelligent computer decades ago. The first question they asked the machine was: ‘Is there a God?’ The reply: ‘There is now.’ The lanky, bespectacled twenty-six-year-old flashes a toothy grin as he delivers the punch line.

It isn’t difficult to fathom why this tale tickles Abhinav’s funny bone. He is, after all, in the business of creating God-like machines as CEO of Fluid AI, a startup that draws on Artificial Intelligence (AI) to offer businesses intuitive user experiences and data analytics. Started in 2012 along with Raghav (29)—Abhinav’s elder brother who is managing director—Fluid AI wants to reshape how machines talk to humans.

The combination of recent advances in AI and related areas such as speech and image recognition, and the availability of virtually infinite amounts of computing power and storage has heralded the advent of a world in which machines will take over many human functions (see boxes).

Take the case of RBL Bank. Walk into their Nepean Sea Road branch in Mumbai and instead of being greeted by a receptionist, a smart-screen says, “Hello, welcome”, as it detects a customer using its motion sensors.

Applying for a loan, assessing credit card options or getting the latest rate on various deposits: All these tasks can be done without touching the screen. Gesture with the hand, hover over a virtual button and it’s done. All the while, with a camera mounted on the kiosk, Fluid AI’s software is working away, studying your face to gauge your level of interest. If it senses that you’re keen on a home loan, it’ll suggest options and plans suited to you. Talking back to the screen is also possible. As is taking a selfie. Gesture over a button on the screen, smile, say cheese, and voila, you have a picture of yourself in the bank. Call a toll-free number and get the photograph WhatsApp-ed to yourself. “This is to engage millennials,” says Abhinav, as he picks up a Rubik’s cube lying on the conference table of his Mumbai-based office and plays with it absentmindedly. A customer uses Fluid AI’s AI-powered, gesture-recognition technology at an RBL Bank branch

A customer uses Fluid AI’s AI-powered, gesture-recognition technology at an RBL Bank branch

Image: Mexy Xavier

In the coming months, RBL plans to deploy Fluid AI’s experience-based, smart-screen solutions across other metros in India. Besides engaging customers, the solution also gathers the data gleaned from them, crunches it and presents the analysis to RBL. The bank in turn is better able to woo customers with products most tailored to their preferences.

What started off as an endeavour to build a “hard-core techie product” by two self-taught, code-loving brothers is today a 50-person strong, profit-making company. Headquartered in Mumbai, with outposts in Charlotte, North Carolina in the US, the Netherlands and Mauritius, Fluid AI counts heavyweight financial institutions such as Barclays Plc in Britain, Emirates NBD in the Middle East, and one of the largest banks in the US, which the Indian venture isn’t allowed to name, as clients. Other customers include Axis Bank, Vodafone India, chip maker Intel, IT consulting companies Accenture and Capgemini, automakers Rolls Royce, Toyota and Hero Group, as well as Intelenet, a large back-office outsourcing company.

If that doesn’t put them in the ranks of the big boys, consider this: The founders pitched just one part of their tech, involving the gesture-driven solution, in a televised Shark Tank-like show called The Vault that aired on television in October last year, but walked away from a funding deal that valued that part of their business at around Rs 15 crore. Today, the Aggarwal brothers claim to be receiving acquisition offers for the entire company in the $100 million (around Rs 645 crore) valuation range. (Left to right) SigTuple co-founders Apurv Anand, who serves as CTO Tathagato Rai Dastidar, the chief scientific officer and Rohit Kumar Pandey, CEO started the company in 2015

(Left to right) SigTuple co-founders Apurv Anand, who serves as CTO Tathagato Rai Dastidar, the chief scientific officer and Rohit Kumar Pandey, CEO started the company in 2015

Back in 2008 when Abhinav was still in school and Raghav in college, the two developed an online learning management system for schools and colleges. It was their first entrepreneurial venture. At that time, storing software and data “on premises”, meaning on a computer server located on the premises of whoever used the software and data, was the norm. Even Amazon Web Services, today the world’s largest cloud services vendor, was a nascent business then.

Yet, the brothers built their learning management system, under the name TruTech, as a cloud-based platform. It allowed students, teachers and parents to access relevant information, including attendance, progress and class notes, from any location. The software proved popular with 300,000 students from schools and colleges across the country accessing the B2B platform (business-to-business because, typically, the educational institution would buy the system and the students would use it for free). “It gave us good profits,” smiles Abhinav, holding on to his now-completed Rubik’s cube.

As the boys juggled this work alongside their studies, they realised the software they had built was easily replicable. It was 2012 and a chance holiday to New York alerted them to the ensuing TechCrunch Disrupt Hackathon—billed the world’s largest coding competition. They signed up for it, coded for 24 relentless hours and emerged as one of the winners. The competition gave them a boost of confidence. They realised they had the capabilities to “build more advanced technologies” which would provide “differentiated services”, explains Abhinav. “That’s when we started building AI-based solutions.”

Over the next couple of years they immersed themselves in developing the software and started building Fluid AI, under the parent company TruTech.

All through, the learning management platform generated healthy profits for them, which the boys invested into Fluid AI. “It was like our first funding revenue,” Abhinav says. (Today too, the platform chugs along, under the same parent company as Fluid AI, with a 95 percent retention rate of annual-licence-fee-paying schools and colleges.)

As Fluid AI started scaling and customers started taking note, Raghav got admitted into the Indian Institute of Management, Ahmedabad (IIM-A), and Abhinav into the Indian School of Business (ISB), Hyderabad. They enrolled in their respective programmes but decided to drop out after a month. They had amassed plenty of business experience, having started out so young, and several of their B-school teachers told them that it didn’t make sense to spend two years pursuing an MBA, and then returning to the same business. “Plus, in technology, two years is a long time,” quips Raghav, adjusting his spectacles, “So we dropped out and decided to pursue Fluid AI full time.” Atul Jalan, founder & CEO, Manthan

Atul Jalan, founder & CEO, Manthan Fluid AI offers customers two distinct solutions. One is on the experience side, where customers like RBL Bank install a smart-screen based kiosk to better engage and interact with customers. Computer vision built into the technology recognises customers, speaks to them, hears them and understands their gestures. The tech can do a lot more than what RBL is currently using: For instance, the screen prompts the customer to display an identity card. On doing so, the machine reads the required data off that, creates a passport-size photo and matches the photo in the ID with the customer’s face in real time. “With that you can open a bank account in 30-40 seconds,” says Abhinav. Video calls with advisors, in real time, are also possible, as is face recognition. So the next time the customer walks into the bank, the machine will remember her by name, know the products she previously browsed and the relationship she has with the bank.

Fluid AI offers customers two distinct solutions. One is on the experience side, where customers like RBL Bank install a smart-screen based kiosk to better engage and interact with customers. Computer vision built into the technology recognises customers, speaks to them, hears them and understands their gestures. The tech can do a lot more than what RBL is currently using: For instance, the screen prompts the customer to display an identity card. On doing so, the machine reads the required data off that, creates a passport-size photo and matches the photo in the ID with the customer’s face in real time. “With that you can open a bank account in 30-40 seconds,” says Abhinav. Video calls with advisors, in real time, are also possible, as is face recognition. So the next time the customer walks into the bank, the machine will remember her by name, know the products she previously browsed and the relationship she has with the bank.

The second piece of technology that Fluid AI offers is on the data side. Their software sits atop companies’ data and makes sense of it, thereby helping companies make better decisions and even predictions. A retailer, for instance, would know from Fluid AI’s analysis of its data that a particular customer is going to churn, and how best to counter that move. “We would be able to predict which product to upsell or cross-sell to that customer to retain him and what’s the best time to do so,” says Raghav. Accenture is among Fluid AI’s many clients on the backend, data side. “Through our Open Innovation programme, we connect our clients to enterprise-relevant technology innovators to find solutions to their complex business problems. We are collaborating with leading Indian AI startups like Fluid AI to bring the best of innovations to our clients,” says Avnish Sabharwal, managing director of Accenture Ventures and Open Innovation in India. The consulting company has deployed Fluid AI’s data solution at a client location, he says, without revealing further details.

But use cases are plenty. When the demonetisation of high value currency notes hit in November last year, the banks that used Fluid AI’s data solutions were better off, explains Abhinav. “Our system learnt on its own that withdrawal patterns have changed and automatically adapted to it. Whereas, a lot of the traditional guys using analytics-based solutions had to come in and recode the backend.”

What propels this advanced feature is Fluid AI’s use of AI and deep learning. Simply put, AI refers to a technique that enables computers to think, understand and communicate like humans do. Traditionally, code writing entailed programming computers and telling them what to do. However, with machine learning, which is a subset of AI, computers are taught to do things themselves and learn from experience. Within machine learning is a further subset called deep learning, which enables computers to perform tasks like speech, image and voice recognition.

“We’re replicating human intelligence at a fundamental level,” explains Raghav. Both their solutions are powered by “genetically evolving networks”, he says, which involves adding a layer of “genetic evolution” on top of deep learning. The technique borrows from human evolution, wherein 100,000 “species” are built out on a computer, with each species built to carry out an end goal, such as understanding the customer’s emotions better or figuring out what product to upsell. “Our algorithms build these 100,000 species very similar to human evolution. The ones that do well are propagated further. The ones that do not do well are savagely killed off in the cycle,” explains Abhinav. This allows their software to learn in real time and have “very high levels of accuracy and prediction” on both the data and experience side.

Add to this the fact that the company follows a plug-and-play model, allowing customers to set up Fluid AI’s solutions as seamlessly as possible. The solutions are on-premise ones, that sit atop client data, doing away with the need to push data onto the cloud. “Most of our clients, especially those in the BFSI sector, don’t want to push their data onto the cloud for regulatory reasons. Also, because they have so much data, taking it to the cloud will take months. Instead, our solution is deployed in their environment,” says Raghav.

“Getting entrenched with enterprise and SMB customers, and offering them an end-to-end solution which is easy to adopt will help [AI-based] companies create sticky and sustainable businesses,” says Sumit Jain, partner at venture capital firm Kalaari Capital. It also helps that Fluid AI has been able to shrink its sales cycle to one month from about six earlier. Even “big, complicated clients can be up and running almost instantly, allowing them to stay nimble,” points out Abhinav. Their technology has been validated independently: Forrester Research, which advises large corporate clients on their technology decisions and purchases, recognised Fluid AI as one of the top deep-learning vendors in its recent Global AI Report. Consultancy Frost & Sullivan has also recognised the startup’s work, as has card seller Mastercard, which included Fluid AI in its Start Path Global—an initiative to support innovative later-stage startups who are reshaping the future of commerce.

While convincing their first big customer—Vodafone India—to come on board was trying, conversations have now shifted gears. “It’s not a nice-to-have, it’s a must-have now,” says Abhinav. When they started out in 2012 developing their AI-based solutions, nobody used to talk about AI. Then there was an inflexion point, driven by an increase in available computing power, low-cost data storage and huge amounts of annotated data.

Vodafone for its part has been “very happy” with Fluid AI’s smart-screen based experience solution, which the telecom major has deployed across its Customer Experience Centers (CEC) in Mumbai, Gurugram and Pune to better engage with clients. “The challenge sometimes is that customers don’t intuitively know that they need to use their gestures to talk to the screen,” says Rutvij Gupte, senior manager, new products and CEC. “Abhinav and Raghav are working on this, so that our customers just know what to do,” he adds.

The idea of fully automated machine-driven interactions sufficing for offline interactions is a clear challenge. “Most offline use cases are driven by the customer’s need to interact with a real human. Customer behaviour may take a while to change. Some of these debates can only be settled with pilot deployments and data about customer adoption and engagement,” says Jain.

Raghav, however, points out that for their clients who have a physical presence, ensuring that every customer gets the same quality experience in each store is a challenge. “You need a scalable quality experience,” he says. Moreover, with rising manpower costs and short attention spans of customers, Raghav believes that Fluid AI’s experience solution engages customers on a more “dynamic level”. Customers like Vodafone, while aware of the challenges, are also clear about the benefits. “Our customers find this engaging. It’s a great way to get across information,” Gupte says.

In the CEC, next to Fluid AI’s solution, there are other interactive systems that Vodafone has installed, like touch screen tables (from other vendors) that also help in conveying information in a fun manner. “On the experience side, we consider competition as the guys who do interactive touchscreens, projection based stuff and voice-only systems like Amazon’s Alexa. But no one is really doing a combination of gesture, voice and face recognition like us,” says Abhinav. On the data side, however, he cites Watson, IBM’s cognitive AI platform, as competition but adds that the two have found niches within the same space. “Watson is great if you ask it to read law or research papers, whereas we are better at sitting on top of a lot of data, making micro decisions and then genetically evolving and learning from that in real time,” he explains.

Today AI has become a hot sector. Globally, $2.5 billion of private capital has been invested into AI startups since 2014 and the number is expected to grow significantly in the coming years, according to Kalaari Capital. In India, a little over $50 million has gone into AI investments since 2014, says Jain.

Fluid AI’s revenues (and profits) have followed suit. Since setting up their first learning management platform in 2008, the Aggarwal boys have not taken any investor money. “We’ve been profitable from day one,” says Abhinav. Their business model is straightforward: On the data side, their clients pay them an annual licence fee, and for larger contracts they structure in a profit share in the savings Fluid AI generates for the client. This means if a large international bank deploys Fluid AI’s solutions across its ATMs, and is then able to better predict cash flows, the bank can lighten its float by, say, 10 percent. Assuming the bank maintains $200 million in its ATM network, that’s a $20 million saving Fluid AI charges about 10-15 per cent of that. “This is of course linked to the performance of our system, so that allows our customers to be confident that we will hit the desired metrics, making it worthwhile for them to invest in our licence,” explains Raghav.

This profit share comprises the lion’s share of Fluid AI’s revenues.

On the experience side, along with the annual licence that customers pay, they get a full hardware unit with a kiosk integrated. Customers pay for each location they deploy the unit in. A 50 percent advance is taken when they sign contracts, so cash flow is never an issue, says Abhinav.

The company’s founders won’t reveal its revenues, but say Fluid AI clocked a 300 percent growth in FY17 over the previous fiscal. “Over the last few months we’ve scaled rapidly, closing deals with several international clients. We’re already having conversations with five other American banks,” Abhinav says. For the current fiscal, revenue growth projections are pegged at 250 percent, on the conservative side. Going forward, the Aggarwals have their eyes set on a future where people will be unable to distinguish whether they are talking to fellow humans or to machines. “We want to be the plug and play AI engine for the world,” they say, eyes twinkling through their thick glasses.

First Published: Jun 09, 2017, 08:04

Subscribe Now