The phrase ‘crypto winter’ that is being used frequently by market intermediaries, investors, media and columnists is not fallacious even as the summer season pans across the Northern Hemisphere. It describes a bearish phase when prices collapse, with indications that they are likely to remain under pressure for months. It"s a winter that is harsh and brutal.

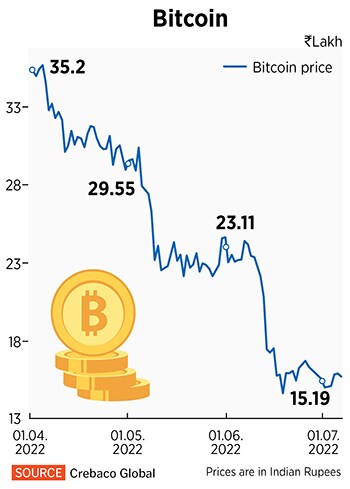

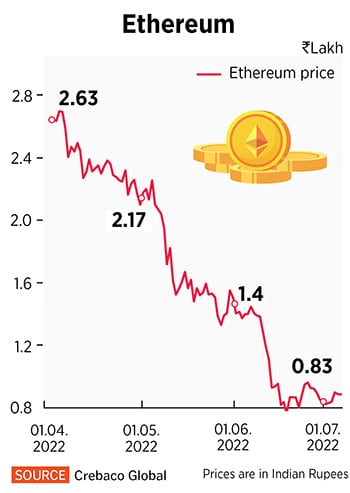

In an interview to CNN in July, US entrepreneur-billionaire Samuel Bankman-Fried, CEO of crypto exchange FTX, warned of some crypto assets being “empty products" and “having a real crash potential". Bankruptcies, restructuring and consolidation have been sharp in recent weeks within the industry, raising fears of a contagion effect. The market cap of global cryptocurrencies is down by a third in value to $0.88 trillion as of July 12 from its November 2021 levels, and bitcoin and ethereum prices have more than halved in 2022.

US-based crypto broker and lender Voyager Digital which filed for bankruptcy has announced a restructuring plan and the promise to compensate its customers. Another crypto lender Celsius Network is exploring strategic transactions and restructuring of its debt to stay afloat, while lender Nexo has offered to buyout troubled crypto exchange Vauld, after the latter’s business was suspended due to financial challenges recently.

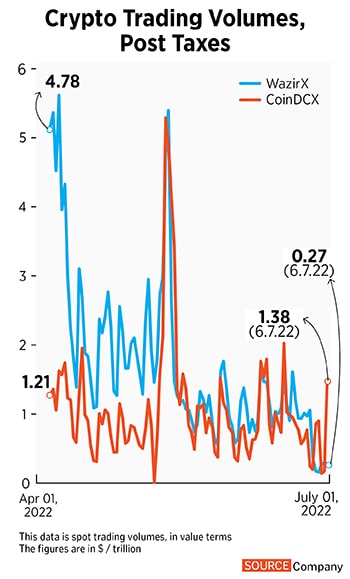

In India, trading volumes at some crypto exchanges have fallen between 70 percent and 90 percent in spot trade (see chart) after the government imposed stringent taxes and duties in FY23 to discourage such trade. Two crypto exchanges, CoinSwitch Kuber and CoinDCX, both unicorns, are now being probed by government agencies for possible foreign exchange violations.

Says CoinDCX co-founder & CEO Sumit Gupta: "This is not the first crypto winter for CoinDCX. The cyclical nature of the market and its downturn are part of the journey. However, amidst all this news plaguing the crypto market, the positives often get overlooked. We think this is a great opportunity for us to build innovative long-term products. And we are confident that India will soon become the bedrock for Web3 and Defi ecosystem."

The plunge in digital asset prices is the impact of classic investor behaviour: Turning risk-averse in a bear market and exiting cryptocurrencies, as inflation continues to surge across large economies. Central banks worldwide have been sucking out liquidity and raising interest rates to battle inflation, which makes capital costlier for investors. Cryptos, thus, are no more one of the favoured asset classes. At least not until inflation subsides and confidence resurfaces to reinvest into equities and then riskier assets such as cryptos.

![]() A winter till September?

A winter till September?

Like any other bear phase, the positive developments are sidelined and negative news excessively analysed. Hemant Mohapatra, partner at global venture capital Lightspeed, says, “This [crypto] winter feels lighter compared to prior winters. The fear and uncertainty about the whole sector going bust or getting regulated out completely are no longer part of the conversation."

“The crypto sector—much like many others the last few years—was clearly overheated. Crypto has a habit of getting ahead of itself, driven usually by outside interest and FOMO… lots of tourists deploying capital, many who aren"t too deep in the technology. Some outright bad actors and a combination of negligence and greed led to huge mistakes being made. Other big players also got themselves in trouble with excessive leverage and poor risk management," Mohapatra tells Forbes India, talking about why cryptos are losing favour.

Mohapatra says if people focus on things that aren"t often in the media narratives, such as developer interest, blockchain throughput, consumer, sovereign and institutional education, they will see that the adoption of crypto is at an all-time high. “The next wave will be the most impactful yet, moving beyond speculation to actual sustained utility. Those that have managed risk well will come out of this cycle really strong," he says. Lightspeed has backed a range of crypto firms that include crypto exchange FTX, UK startup Blockchain.com, crypto infrastructure startup Alchemy and lender Aave.

Rajagopal Menon, vice president of crypto exchange WazirX, says: “It has been a hard crypto winter, no doubt. We are seeing high inflation and resultant interest rate hikes a war rage in Europe and concerns of an impending recession. These have led to a fall in crypto prices and bitcoin is close to half of what it was at the start of the year.

In India, the crypto tax, TDS, inability for traders to set off losses and inaccessibility to banking partners have all been “added dampeners". “Overall, we are going through a difficult period. But in hindsight, crypto markets, like other financial markets, have matured. We had a bull cycle last year and this year, we are crawling through a bear cycle," he says.

![]() Menon is confident of a bounce-back. “If we look at the past trends, bitcoin has lost more than 50 percent of its value seven times before and 80 percent thrice. Regardless, it has always bounced back," he tells Forbes India. “Historically, you can’t put a finger on a specific time by which we can see situations improve. Global factors have majorly impacted us and it will take some time to improve to see the crypto winter waning. The last bear phase lasted between 2018 and 2020, and 2021 was welcomed by a bull run where bitcoin touched its all-time high. We will have to wait and watch, but like PB Shelley said, ‘If winter comes, can spring be far behind?’"

Menon is confident of a bounce-back. “If we look at the past trends, bitcoin has lost more than 50 percent of its value seven times before and 80 percent thrice. Regardless, it has always bounced back," he tells Forbes India. “Historically, you can’t put a finger on a specific time by which we can see situations improve. Global factors have majorly impacted us and it will take some time to improve to see the crypto winter waning. The last bear phase lasted between 2018 and 2020, and 2021 was welcomed by a bull run where bitcoin touched its all-time high. We will have to wait and watch, but like PB Shelley said, ‘If winter comes, can spring be far behind?’"

Sidharth Sogani, founder and CEO of Crebaco, a rating, research and intelligence firm focussed on blockchain and cryptos, is more bearish. He calls this phase “the toughest crypto winter ever". “We are seeing the impact of the Ukraine war, post-pandemic stress and recession-like situation," Sogani says.

“It"s a tough time for all asset classes. We will see a lot of layoffs, companies shutting down, going beyond crypto. Further pain is expected," he adds, saying he expects the crypto winter to last at least till September. “Post that, we will see some stability in the market, but even if we"re out of the crypto winter, we"re not going to see a bull market till the start of Q3 of 2023 or the first quarter of 2024."

Crypto prices could remain range-bound for the next one year, he adds. CoinSwitch Kuber’s co-founder and CEO Ashish Singhal expects market sentiment to change when inflation is under control and capital becomes less costly.

![]()

Crypto exchanges under scanner

Even while the government and the Reserve Bank of India (RBI) continue to maintain a broad anti-cryptocurrency stance, the scanner is on two of India’s crypto exchange unicorns, CoinDCX and CoinSwitch Kuber. The Enforcement Directorate (ED) has asked both the exchanges to submit some documents, seeking further clarity. The probe is to ascertain if there have been any foreign exchange violations, under FEMA (Foreign Exchange Management Act).

![]() A CoinSwitch spokesperson says: “We receive queries from various government agencies. Our approach has always been that of transparency." CoinDCX declined to comment on the matter.

A CoinSwitch spokesperson says: “We receive queries from various government agencies. Our approach has always been that of transparency." CoinDCX declined to comment on the matter.

In 2021, rivals ZebPay and WazirX were also pulled up by the ED for possible FEMA violations. In WazirX’s case, the matter is still sub judice, so the exchange did not directly comment on the matter. “WazirX has consistently implemented systems to ensure compliance with various laws and statutes. It also diligently follows stringent KYC procedures while onboarding customers. Wazirx endeavours to promptly provide information to law enforcement agencies as and when demanded. Even in the present matter, the information sought by the authorities has been provided," it said in an emailed response.

Last year, Union Minister of State for Finance Pankaj Chaudhary had in written reply to the Lok Sabha (lower house) in Parliament said that the government “does not collect any data on cryptocurrency exchanges. Few cases of evasion of Goods & Services Tax (GST) by cryptocurrency exchanges have been detected by the central GST formations". The data revealed total GST evasion of Rs81.5 crore and a recovery of Rs95.86 crore from 11 crypto exchanges, which included CoinDCX, CoinSwitch, Unocoin, WazirX and ZebPay.

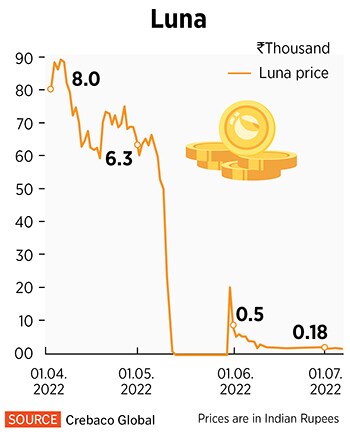

Prudent investing

The weakening sentiment across the crypto markets has meant deep cuts in portfolio values for most, but investors such as Ahmedabad-based Akash Jain are not fleeing. “I have experienced the crypto winter in 2018. Expert views are not affecting me anymore because now I am investing for the long-term," he says. Jain’s crypto portfolio—comprising ethereum, XRP and luna (before it crashed)—is down by 60 percent in value to Rs12 lakh.

![]() “I’m not selling any of my crypto as of now... just buying more on every dip," he says. Jain is unfazed by the high taxes, which could hurt short-term trading more. The 34-year-old crypto miner says he is likely to hold on to this investment till 2024, forecasting a major bull run at that time.

“I’m not selling any of my crypto as of now... just buying more on every dip," he says. Jain is unfazed by the high taxes, which could hurt short-term trading more. The 34-year-old crypto miner says he is likely to hold on to this investment till 2024, forecasting a major bull run at that time.

Investors with a short-term trading horizon have been particularly hurt by the GST of 18 percent on the services provided by crypto exchanges. The government is contemplating raising this to 28 percent. India, since July 1, also imposes an additional 1 percent TDS (tax deducted at source) on transactions carried out, to bring it under the radar of tax authorities.

Chartered accountant Rishabh Parakh, who is the founder-mentor of NRP Capitals, explains that the liability for the seller is much higher. “A person transacting in bitcoin, for example, which he bought for Rs1 lakh and sold for Rs3 lakh... he will pay a 30 percent tax on the Rs2 lakh gain. But if this person were to transfer the Rs3 lakh worth of bitcoin to another person, that new buyer has to deduct a one percent TDS before transferring that entire Rs3 lakh," he explains.

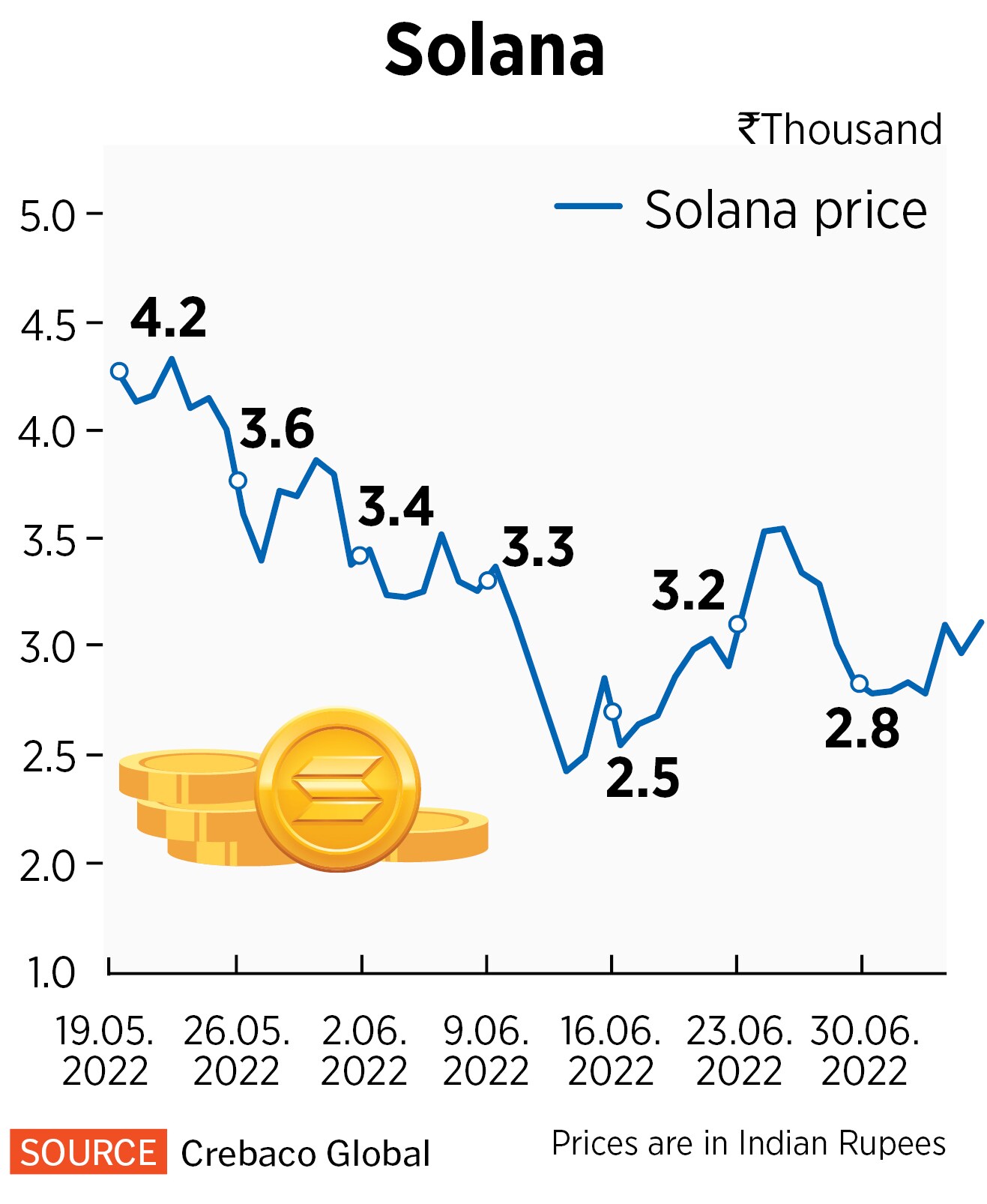

Other investors such as Vedant Jogani, a 21-year-old student, who in May bought into and exited from luna just before it got delisted, is a little prudent. “He suggests buying into those coins which have a hold on the market—such as bitcoin, ethereum, solana, BNB and tether/USDT—and are the primary coins. “They might give your portfolio some pain, but will never become zero value," he says.

Jogani, who has been investing in cryptos since September 2021 at WazirX and CoinSwitch Kuber, is confident of “staying invested in the crypto markets for at least another two years".

WazirX’s Menon corroborates this investing behaviour. “To survive the present conditions, we have seen investors flock to blue-chip cryptos like bitcoin and ethereum. In addition, we are witnessing a definite shift from meme coins toward stablecoins. This behaviour exhibits that investors have become more informed over time and their investments have become information-driven instead of being entirely led by sentiments."

Innovations before regulations

There have been enough signals from the RBI to indicate its dislike for trading in cryptocurrencies and, being unregulated, the risk that cryptocurrencies pose to a country’s financial system. But keeping cryptocurrency volatility aside, market intermediaries and investors in India’s crypto ecosystem remain bullish.

![]() “Innovations have always come before regulations. You cannot second-guess innovation. But regulations have to follow and keep pace with innovation to protect users and enable legitimate businesses," says CoinSwitch’s Singhal. “India has the potential to lead the technological shift unleashed by cryptos, and it is my belief that the government recognises this. Today, there may be challenges with regards to certain regulations and provisions, but crypto is here to stay," he adds. Singhal is confident that CoinSwitch is “on track" to evolve into a one-stop wealth tech destination for India. It is working on non-crypto offerings which are likely to be announced soon.

“Innovations have always come before regulations. You cannot second-guess innovation. But regulations have to follow and keep pace with innovation to protect users and enable legitimate businesses," says CoinSwitch’s Singhal. “India has the potential to lead the technological shift unleashed by cryptos, and it is my belief that the government recognises this. Today, there may be challenges with regards to certain regulations and provisions, but crypto is here to stay," he adds. Singhal is confident that CoinSwitch is “on track" to evolve into a one-stop wealth tech destination for India. It is working on non-crypto offerings which are likely to be announced soon.

WazirX’s Menon says a few projects are in the pipeline to make investing in crypto easy. “Until now, the teams were occupied with implementing TDS on our platforms so that investors can easily transact while understanding that the TDS will be deducted upfront. Now that it is deployed, we will go back to concentrating on other projects and we intend to launch them soon."

Avinash Shekhar, CEO of ZebPay says the crypto industry is at a very nascent stage in India. “We hope to see an end to regulatory uncertainty soon. India has been at the forefront of both adoption and innovation in crypto, and I believe this will sustain in the long-term."

Rameesh Kailasam, CEO of IndiaTech.org, says the crypto markets may recover, depending on the broader macro environment for investing. “Retail investors will continue to figure out means to trade. The craze to invest will not stop, the sheen will be back when the other markets go up."

![]()

There is yet lack of clarity on the cryptocurrency bill to regulate such trade in coming years. Top RBI officials had, in May, warned the parliamentary committee of finance about the dollarisation of part of the Indian economy as trading in cryptocurrencies increases. The majority of cryptocurrencies are dollar-denominated and against the country’s sovereign interest. This is due to the initial trade where stablecoin USDT is bought to help purchase cryptocurrencies.

Retail investors like Jain say macroeconomic data affects equities and cryptocurrencies alike, signalling an interconnection. “When this acceptance is there in other countries, why isn’t the Indian government accepting it too?" he asks. The coming months will determine how much financial muscle and fortitude various crypto intermediaries have to face uncertainties in the future. They will be hoping that the current meltdown is just a healthy shakeout and nothing worse.

A winter till September?

A winter till September? Menon is confident of a bounce-back. “If we look at the past trends, bitcoin has lost more than 50 percent of its value seven times before and 80 percent thrice. Regardless, it has always bounced back," he tells Forbes India. “Historically, you can’t put a finger on a specific time by which we can see situations improve. Global factors have majorly impacted us and it will take some time to improve to see the crypto winter waning. The last bear phase lasted between 2018 and 2020, and 2021 was welcomed by a bull run where bitcoin touched its all-time high. We will have to wait and watch, but like PB Shelley said, ‘If winter comes, can spring be far behind?’"

Menon is confident of a bounce-back. “If we look at the past trends, bitcoin has lost more than 50 percent of its value seven times before and 80 percent thrice. Regardless, it has always bounced back," he tells Forbes India. “Historically, you can’t put a finger on a specific time by which we can see situations improve. Global factors have majorly impacted us and it will take some time to improve to see the crypto winter waning. The last bear phase lasted between 2018 and 2020, and 2021 was welcomed by a bull run where bitcoin touched its all-time high. We will have to wait and watch, but like PB Shelley said, ‘If winter comes, can spring be far behind?’"

A CoinSwitch spokesperson says: “We receive queries from various government agencies. Our approach has always been that of transparency." CoinDCX declined to comment on the matter.

A CoinSwitch spokesperson says: “We receive queries from various government agencies. Our approach has always been that of transparency." CoinDCX declined to comment on the matter. “I’m not selling any of my crypto as of now... just buying more on every dip," he says. Jain is unfazed by the high taxes, which could hurt short-term trading more. The 34-year-old crypto miner says he is likely to hold on to this investment till 2024, forecasting a major bull run at that time.

“I’m not selling any of my crypto as of now... just buying more on every dip," he says. Jain is unfazed by the high taxes, which could hurt short-term trading more. The 34-year-old crypto miner says he is likely to hold on to this investment till 2024, forecasting a major bull run at that time. “Innovations have always come before regulations. You cannot second-guess innovation. But regulations have to follow and keep pace with innovation to protect users and enable legitimate businesses," says CoinSwitch’s Singhal. “India has the potential to lead the technological shift unleashed by cryptos, and it is my belief that the government recognises this. Today, there may be challenges with regards to certain regulations and provisions, but crypto is here to stay," he adds. Singhal is confident that CoinSwitch is “on track" to evolve into a one-stop wealth tech destination for India. It is working on non-crypto offerings which are likely to be announced soon.

“Innovations have always come before regulations. You cannot second-guess innovation. But regulations have to follow and keep pace with innovation to protect users and enable legitimate businesses," says CoinSwitch’s Singhal. “India has the potential to lead the technological shift unleashed by cryptos, and it is my belief that the government recognises this. Today, there may be challenges with regards to certain regulations and provisions, but crypto is here to stay," he adds. Singhal is confident that CoinSwitch is “on track" to evolve into a one-stop wealth tech destination for India. It is working on non-crypto offerings which are likely to be announced soon.