ESG funds losing sheen in India

Despite regulatory push and improved awareness about the green economy and climate risks, investors' interest for ESG-focussed funds is waning. Such schemes are seeing net outflows and low AUMs

The world is leaning towards a greener and cleaner environment, but investors in India are losing interest to bet their bucks on funds focussed on environmental, social and corporate governance (ESG). This is despite widespread emphasis, awareness and concerns about ESG investing, and the government’s regulatory changes to incentivise investors towards low-carbon instruments. The wake-up call post Covid-19 seems to be fading away.

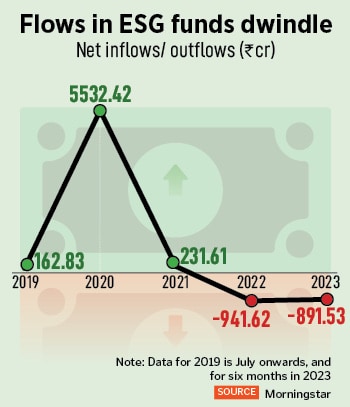

After a rushed approach to ESG mutual funds in India in 2020, those categories of funds are not only seeing consistent outflow of money, but there have been no fresh schemes which is eroding the assets under management (AUM) as well. ESG-focussed funds are steadily seeing net outflow for last 12 months—with the highest outflow of Rs229.99 crore in June, shows a Forbes India analysis based on data provided by Morningstar. In the last one year ending June, ESG mutual funds lost Rs1,684.84 crore, with a net outflow of Rs891.53 crore in 2023 alone. The analysis considers nine ESG-focussed funds in India launched since 2013.

According to Rohit Shimpi, fund manager, and Priyanka Dhingra, ESG analyst, SBI Mutual Fund, ESG-based investing in India is at its ‘infancy’. The category did well globally and domestically during the Covid years of 2020 and 2021.

“Subsequently ESG investing went through a challenging phase. The war in Ukraine sparked a global rally in defence stocks, the spike in energy prices renewed interest in oil and gas, and other fossil fuel companies. Traditionally, both these sectors are not part of an ESG portfolio, resulting in relative underperformance," explain Shimpi and Dhingra.

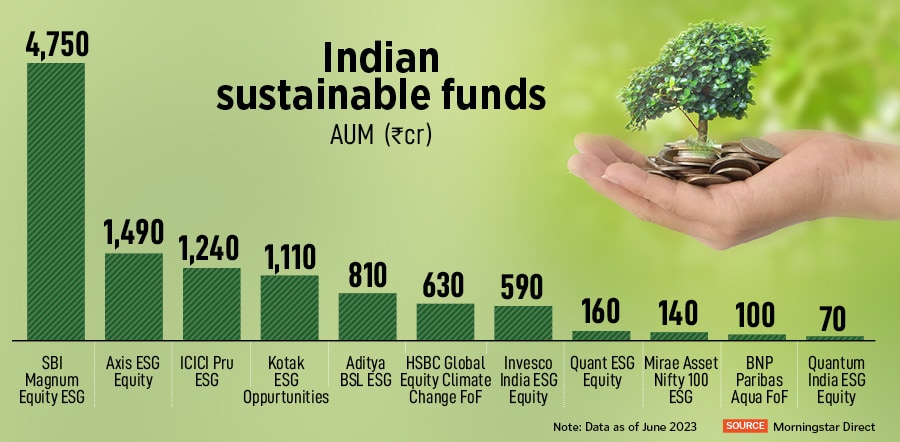

SBI Magnum Equity, the oldest ESG fund launched in 2013, accounts for nearly half of the overall assets of such schemes in India.

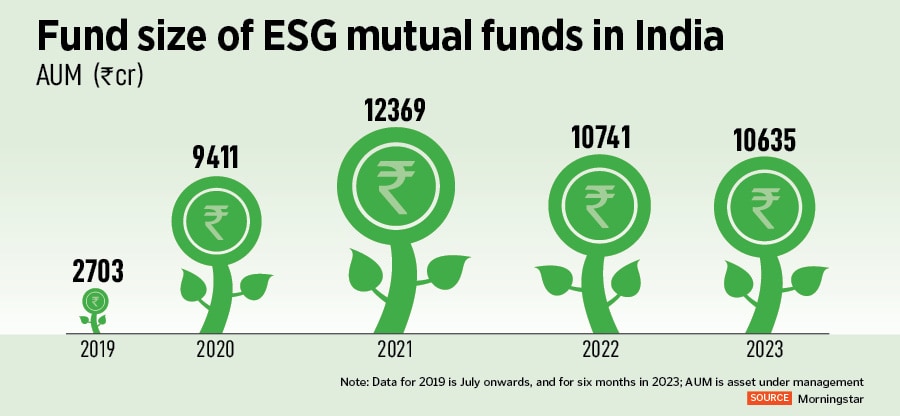

Picture this: Fund size worth a meagre Rs2,703 crore in 2019 more than tripled to Rs9,411 crore in a year, and then rose to Rs12,369 crore in 2021, shows the analysis. However, starting 2022, AUM of ESG-focussed funds started to dwindle—to Rs10,741 crore and it further fell to Rs10,635 crore in the first six months of 2023.

The trend follows a similar script even for flows. ESG -focussed funds have seen the highest outflow ever in 2022 worth Rs941.62 crore. For three consecutive years starting 2019, ESG funds continued to see net inflows peaking at Rs5,532.42 crore in 2020 when six new schemes were launched in the category. In the six months of 2023, ESG schemes have seen a net outflow of Rs891.53 crore.

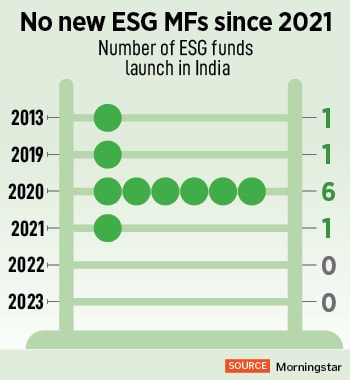

Adding to the woes, there has not been a single ESG fund launch in the two years after 2021. In 2020, as investors grew conscious of climate risks, India saw six additions of ESG schemes, followed by only one the following year and none thereafter.

However, post the onset of the Ukraine/Russia conflict and the resultant rally in defence and energy stocks, there was a subdued interest in ESG funds as a category. This was coincidental to an increase in regulatory measures, primarily due to multiple greenwashing allegations on larger global funds.

According to the Morningstar analysis, sustainable funds saw an outflow of Rs1,060 crore in the first half of 2023. While the initial fund launches attracted significant interest and flows, there aren’t any continuing flows into sustainable funds after the initial fund launch period.

According to the Morningstar analysis, sustainable funds saw an outflow of Rs1,060 crore in the first half of 2023. While the initial fund launches attracted significant interest and flows, there aren’t any continuing flows into sustainable funds after the initial fund launch period.

While still nascent, with only 11 sustainable funds, the market is concentrated as the top five sustainable funds account for 87 percent of overall sustainable fund assets, with the largest fund accounting for 45 percent. Currently there are eight actively managed sustainable funds, one passive environmental, social, and governance exchange-traded fund/fund of funds, and two global sustainable feeder funds. Active funds account for 97 percent of overall sustainable fund assets.

Morningstar defines sustainable funds as open-end funds, exchange-traded funds, feeder funds, and funds of funds which focus on sustainability, impact or environmental, social and governance factors.

Experts and analysts blame it on lack of awareness and teething problems of a nascent industry. “It is still early days for sustainable investing from a retail investors’ perspective. Globally, too, the interest started from asset owners and managers, and then translated into retail interest in sustainable investing. Continuing awareness and focus on sustainable investing by asset managers will eventually translate into retail investor interest in sustainable investing," says Kaustubh Belapurkar, director-manager research, Morningstar India.

Ashwin Patni, head products & alternatives, Axis AMC, feels in India, ESG funds are still at a nascent stage and most retail investors don"t understand how ESG translates into an actual portfolio. Therefore, one cannot expect drastic rise in flows given the limited number of schemes.

“Individual investors may not be able to appreciate what fund managers are attempting to do in the same way that they do with conventional equity funds. Different AMCs have their own individual approach. What we need is awareness and conversations around the theme, and the approach for these products. With the new norms in place, there can be multiple ESG schemes offered by AMCs," adds Patni.

After the Ukraine-Russia conflict and the resultant rally in defence and energy stocks, there was a subdued interest in ESG funds which was coincidental to an increase in regulatory measures, primarily due to multiple greenwashing allegations on larger global funds, elaborate Shimpi and Dhingra.

After the Ukraine-Russia conflict and the resultant rally in defence and energy stocks, there was a subdued interest in ESG funds which was coincidental to an increase in regulatory measures, primarily due to multiple greenwashing allegations on larger global funds, elaborate Shimpi and Dhingra.

“Asset managers took a back seat to evaluate the evolving regulatory framework and the feasibility of complying with the revised regulations. EU SFDR is a classic example. To date, funds are ironing out the classification of their respective funds into article 6, 8 or 9. Closer home, Sebi [Securities and Exchange Board of India] has also tightened the disclosure norms around ESG funds," they add.

What is surprising is ESG funds are losing charm among investors despite the government’s effort to make companies move towards a greener economy, creating opportunities for social-impacting causes, transiting into less climate risk environment and achieving net-zero carbon emission by 2070.

Making further headway in climate action is not just about meeting the earlier commitments, but also entering into swifter and stronger policy and regulatory change. The government and market regulator Sebi have been actively introducing slew of changes in norms for companies to become ESG-compliant to attract more investor interest.

India made its first foray into ESG regulatory frameworks and dislosures by introducing the Business Responsibility and Sustainability Reporting (BRSR) by Sebi in 2021. BRSR guidelines make it mandatory for the top 1,000 listed companies by market capitalisation to make sustainability disclosures. Later, the market regulator added a set of key indicators, also known as BRSR Core, on the top 150 companies—they are expected to provide reasonable assurance as part of their annual reports by FY24.

In July, Sebi allowed mutual funds to introduce new categories under the ESG scheme, which are spreading the net wide. Fund houses were earlier allowed only one ESG scheme under the thematic category of equity schemes.

The new categories are exclusions, integration, best-in-class and positive screening, impact investing and sustainable objectives and transition or transition-related investments.

So far, the most popular ESG strategy in India was exclusion, which means you exclude certain sectors from investments, narrowing your investment universe. Investors who have a strong belief against these sectors due to their negative connotation towards environment or society could choose these funds since there is an exclusion of such sectors.

However, fund managers are enthusiastic that Sebi’s introduction of new ESG categories of schemes will open up more opportunities. “With options to launch integration and best-in-class strategies, fund houses can design funds without any sectoral exclusion. For instance, a specific low carbon fund or a gender diversity fund would fall in this category. A transition category fund would be especially relevant for emerging economies like India which are undergoing a low carbon transition. These opportunities were not available in the market earlier. Investors will now have a bouquet of products to choose from," Simpi and Dhingra add.

Currently, most of the ESG funds" holdings are heavily dominated by banking, financial services, information technology and consumer staples stocks as these companies tend to score better on ESG. “This is because fund houses face a lack of choice, and options are limited as most businesses engaged in the green economy and sustainability are not well represented on the listed market," Patni says.

Sebi has also mandated ESG schemes to invest at least 65 percent of AUM in listed entities, where assurance on the BRSR Core is undertaken. But therein lies a core issue of high concentration of funds in only large cap stocks, while mid and smaller stocks may be ignored. According to Patni, ESG compliance is not mainstream in many mid and small-sized companies in India yet, and hence the universe for the schemes is smaller and more concentrated.

The BRSR Core mandate will be required for 250 companies in FY25 and increase thereafter to cover the top 1,000 listed companies in FY27. ESG as a concept is a longer-term investment strategy and fund managers believe it will gain investor confidence as awareness of ESG products in the market grows. Unlike globally, where asset owners (investors) initiated focus on ESG aspects, in India, the thrust on ESG was initiated largely by asset managers.

“Over the longer term, we do not believe ESG funds will necessarily need to sacrifice returns relative to comparable non-ESG funds in order to achieve their objectives," Shimpi and Dhingra say.

First Published: Aug 21, 2023, 14:50

Subscribe Now