Six out of 10 stocks held mostly by high net-worth individuals (HNIs) or super rich investors in the three-month period ending March have sunk, slipping as much as 67 percent, shows a Forbes India analysis of all stocks listed on the NSE, based on data sourced from Prime Database. To be fair, stock markets were in a major turbulence in the January to March quarter, with the Nifty falling 4 percent in the period.

However, this is not a one-off where HNIs’ top bets have missed the bus of making a fortune in the stock market. A review of the past four quarters shows that a majority of the top 10 stocks where HNIs increased their holdings have underperformed the respective benchmarks. According to markets regulator Securities and Exchange Board of India (Sebi), any individual investor with more than Rs 2 lakh investment in a single stock is defined as an HNI in India.

This phenomenon of losing money in top bet stocks gets pronounced as we sieve through more data. For instance, among Nifty 500 companies, seven of the top 10 bet stocks have fallen in the January to March period. Similarly, in Nifty Midcap, six out of the top 10 have fallen while seven out of 10 among Nifty Smallcap companies have slipped.

“This is their greed and overconfidence," says Mayank Joshipura, associate dean-research and professor (finance), School of Business Management, NMIMS. He adds that an unrealistic, high opinion about their own decision-making skills often blindsides the rational thinking and judgement of this category of investors.

“There is a bit of show-off too. This category of investors has a habit of attention-grabbing and wants to show to the world that they do not follow the herd when it comes to stock picking. They will always prefer contra-bets on stocks, but tend to forget that all stocks that appear lucrative may not be profitable always," Joshipura adds.

Joshipura explains that since this category of investors (HNIs) may have done exceptionally well in their respective fields, they have a lesser tendency to accept mistakes. “They keep justifying their calls. At times, they do not even accept their mistake and will continue adding to their portfolio of stocks even at the cost of loss, just to justify their stance," he adds.

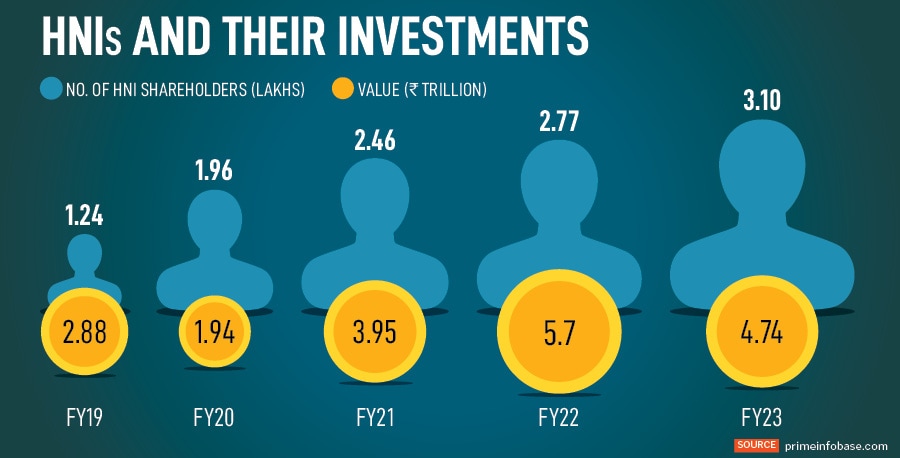

The number of affluent investors has been rapidly growing in the country as equity trading became an obsession following the lockdowns during Covid. There were 3.1 lakh HNIs in India in the financial year ending March 2023, up from 2.77 lakh in FY22, according to Prime Database. The number of affluent investors or HNIs has been steadily increasing in India, with just 1.24 HNIs in fiscal year 2019, implying a massive 150 percent rise in just five years.

However, their value in the shares held has fallen, understandably, as the overall market capitalisation has also eroded in the last one year. In FY23, HNIs’ total holdings in all shares was at Rs 4.74 trillion, lower than Rs 5.7 trillion in the previous year. In FY19, it was Rs 2.89 trillion but had fallen to 1.94 trillion by the end of FY20.

Affluent investors" top calls

In the January to March period, HNIs increased their stakes in 812 companies, the average stock price of which fell 12.56 percent. On the4 other hand, institutional investors like domestic institutional investors (DIIs) upped their stakes in only 529 stocks and foreign institutional investors (FIIs) raised their stake in 609 stocks in the same period.

HNI share by value in all companies listed on the NSE fell to 1.88 percent at the end of March from 1.89 percent in the previous quarter and 2.21 percent in the year-ago period. In value terms, HNI holding was at Rs 4.74 trillion by end of March, a decrease of 9.24 percent over the last quarter.

![]()

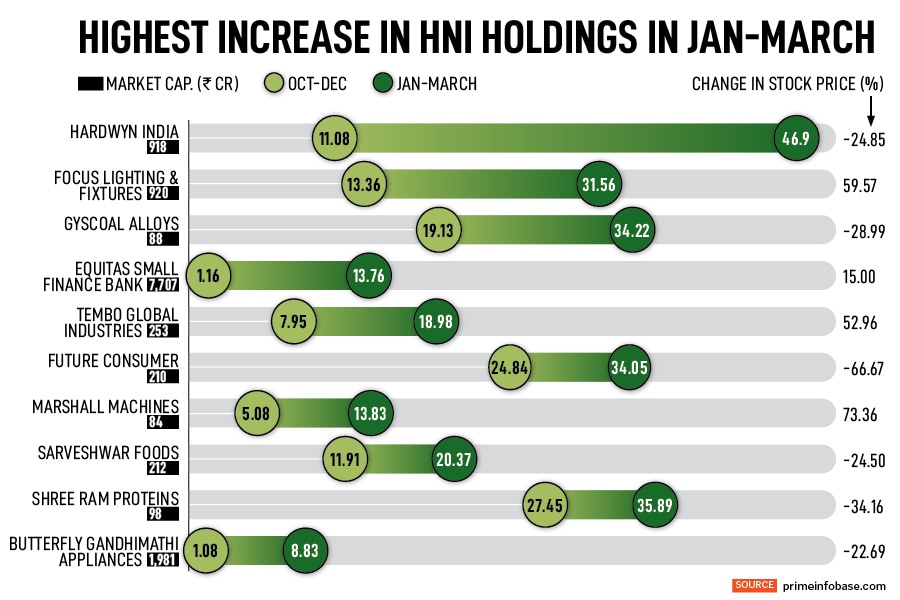

The top 10 stocks (all listed on NSE) that HNIs increased their holdings in were Hardwyn India, Focus Lighting and Fixtures, Gyscoal Alloys, Equitas Small Finance Bank, Tempo Global Industries, Future Consumer, Marshall Machines, Sarveshwar Foods, Shree Ram Proteins and Butterfly Gandhimathi Appliances.

Listen: Active vs Passive: Which investment strategy can deliver better long-term returns?

“It is surprising to see HNIs bet on Future Consumer, a company with practically no business operations," says Deepak Jasani, retail research head, HDFC Securities. Future Consumer, once a jewel of the Kishore Biyani empire, is a beaten down penny stock. In the last six months, the stock has been hovering around Rs 1-1.50 per piece.

Jasani says that HNIs, at times, fall in love with their stock calls, ignoring the rationale or recent developments. They keep hoping for better times in their invested companies. Perhaps that explains HNIs increasing their holdings in Future Consumer.

“An HNI may not necessarily be a smart investor. They tend to fall in love with their stock calls and often hold them for long justifying their stance. This beats any rationale investment or objective research. If they ignore adverse business impact, these calls will definitely lead to monetary losses," Jasani adds.

Among Nifty Midcaps, HNIs have increased holdings in Zee Entertainment Enterprises, Aditya Birla Capital, Astral, Tube Investments of India, Patanjali Foods, Yes Bank, Oil India, Aditya Birla Fashion & Retail, Voltas and One 97 Communications.

“HNIs, at times, average on the downside, which could be the reason for them adding on these low value stocks. A lot of these stocks are also part of PMS (portfolio management service) schemes, so they get added as a part of the portfolio. Some of these investors have conviction that the stocks they picked are sector leaders and may potentially rise in future," Jasani says. Average on the downside means piling on or adding on more volume of stocks as share prices fall.

![]()

Based on the shareholding pattern of all listed stocks on the NSE in Q4FY23, HNIs have the highest exposure to healthcare (2.95 percent), followed by industrials (2.48 percent), consumer discretionary (2.41 percent), services (2.04 percent) and commodities (1.94 percent). They have the least exposure to the energy sector (0.88 percent).

Other shareholders’ exposure

Meanwhile, the share of retail investors in all listed companies on the NSE increased to an all-time high of 7.48 percent in the January to March period from 7.23 percent in the preceding three months. This compares to 7.42 percent in the March quarter of the previous year. In value terms, retail holding was at Rs 18.87 lakh crore in March, a fall of 5.4 percent over the last quarter.

Despite net selling by FIIs of Rs 26,211 crore in January-March, FIIs’ exposure to Indian stocks increased marginally to 20.56 percent, up by 32 basis points from 20.24 percent in the previous quarter. FIIs sold shares worth Rs 35,048 crore from oil, gas & consumable fuels and financial services sectors during the quarter while investing Rs 12,994 crore in the services and capital goods sectors.

DIIs including mutual funds, banks, pension funds and insurance companies pumped in Rs 83,200 crore in equities in January to March. The share of DIIs as a whole also increased to an all-time high of 16.35 percent by end of March, rising from 15.32 percent in the previous quarter.

The share of insurance companies jumped to a six-year high of 5.87 percent by the end of March. Life Insurance Corporation of India (LIC’s) share (across 273 companies where its holding is more than 1 percent), increased to 3.99 percent as of March from 3.95 percent in the preceding three months.

Experts attribute psychological and behavioural biases for such pitfall investment strategies by HNIs.

Experts attribute psychological and behavioural biases for such pitfall investment strategies by HNIs.