Hyundai Motor IPO: Do valuations justify the price?

Despite stable financials, the auto manufacturer is far from being the industry leader in India's passenger vehicle space, raising valuation concerns of the Rs 27,870 crore-IPO

As investors are vying to grab a share of the world’s third-largest auto manufacturer Hyundai Motor India, the initial public offering (IPO) appears to be richly valued. Though the company has consistently grown and been the first mover in various passenger vehicle categories, the country’s largest IPO is hardly leaving anything on the table for investors.

Hyundai Motor India plans to raise Rs27,870 crore through the IPO with a price band of Rs1,865-1,960. The issue, which is open for subscription from October 15 to 17, has already received anchor investors’ hefty money. A clutch of 225 anchor investors has pumped in Rs8,315.3 crore in the South-Korea based company’s IPO.

Of the total allocation of 4.2 crore shares to anchor investors, 1.46 crore shares were allocated to 21 domestic mutual funds through 83 schemes. Some of the marquee anchor investors include the Government of Singapore, New World Fund Inc, Monetary Authority of Singapore, Fidelity, Government Pension Fund Global, and American Funds Insurance Series New World Fund.

The issue is a complete offer-for-sale in which the promotors are reducing their stake by around 17 percent, and the company will not receive any proceeds from the sale. It plans to utilise the proceeds in research & development (R&D) of new cars.

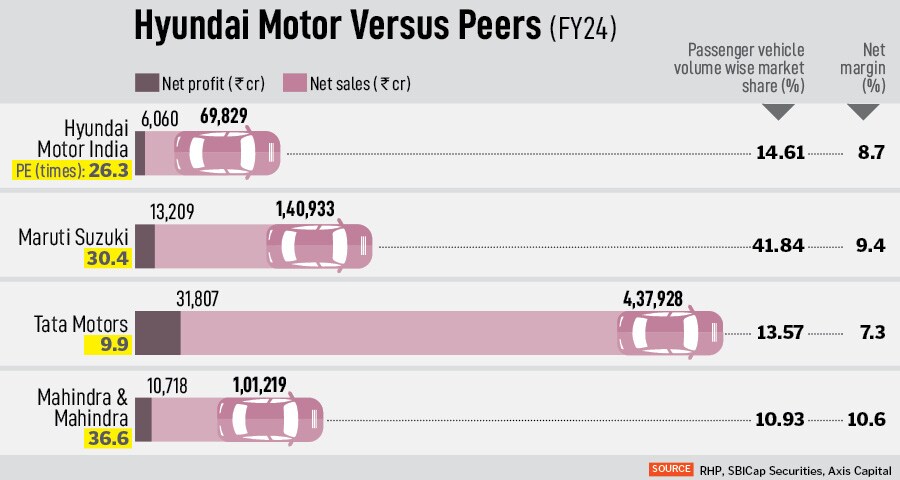

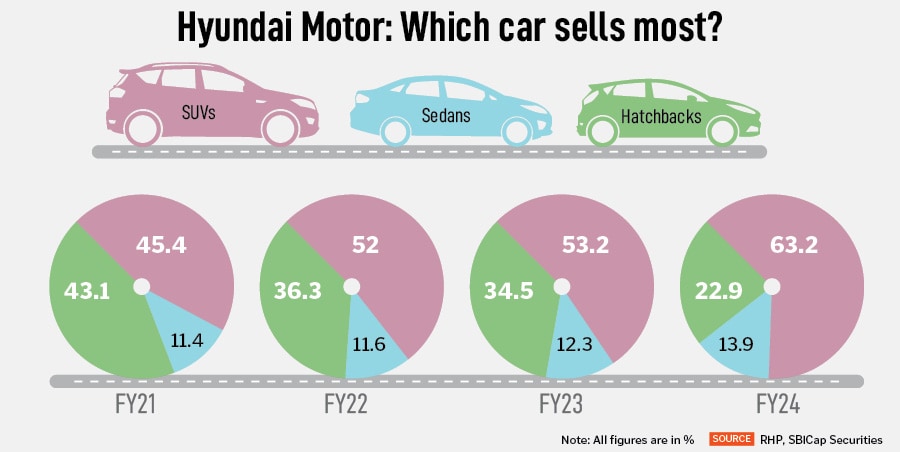

Hyundai has been one of the largest automakers in India garnering a market share of 14.6 percent (second to Maruti) in FY24 despite competition. It has a 24 percent market share in exports—one of the highest in industry. However, Mihir Manek, analyst, Aditya Birla Capital, finds it risky that Hyundai has been unable to increase its market share beyond 20 percent. He points out that there is a slowdown in electric vehicles (EVs) demand with no hybrids on offer and over 67 percent of its volume is derived from the SUV segment, which is not favourable for the company.

“At the upper price band, Hyundai is available at a rich valuation of 26 times its FY24 earnings per share (EPS), leaving little on the table for investors," says Manek. However, he believes that the outlook for Hyundai continues to be strong due to its robust parentage, and for leveraging Hyundai Motor Company (HMC’s) technology and R&D capabilities as well as a strong balance sheet.

Hyundai Motor India is among the top three contributors to Hyundai Motor global sales volumes, with contribution rising to 18.2 percent in 2023 from 15.5 percent in 2018. Its portfolio includes 13 models across major passenger vehicle segments, including Grand i10, Aura, Verna, Exter, Venue, and Creta.

With a strategic focus on the EV market, it aims to launch four new EV models in India with the Creta EV scheduled for launch by the fourth quarter of FY25.

Despite the company"s growth potential and strong market presence, the issue comes with higher valuations, warn analysts at Canara Bank Securities. “The PE ratio of 26.28 times is above the industry average of 24.41 times and far higher than its parent company Hyundai Motor Global’s PE of 5 times," they say.

The company has been reporting steady growth in its financials. In FY24, Hyundai Motor’s total income was Rs71,302.33 crore, earning a net profit of Rs6,060.04 crore in FY24. In the first three months of FY25, it earned a net profit of Rs1,489.65 crore on a total income of Rs17,567.98 crore.

For the last three fiscals, the company has reported an average EPS of Rs62.56, and an average return on net worth (RoNW) of 39.11 percent. The issue is priced at a price to book value of 13.11 based on its NAV of Rs149.52 as of June 30, as well as post-IPO equity capital since this is a secondary issue, say analysts at Bajaj Broking.

“If we attribute FY25 annualised super earnings to its post-IPO fully diluted paid-up equity capital, then the asking price is at a PE of 26.73, and based on FY24 earnings, the PE stands at 26.28. The issue relatively appears fully priced, but the company is poised for bright prospects post the completion of its ongoing expansions," says Bajaj Broking.

Its sales have been bolstered by the rapid expansion of the SUV segment, which accounts for over 60 percent of its total sales. Its flagship model, Creta, led sales in the mid-sized SUV segment, while the Verna dominated the premium sedan segment with 20 percent market share.

Its sales/net profit has grown at a CAGR of 19.4 percent/47.7 percent respectively over FY21-24, led by 11 percent sales volume CAGR and consistent improvement in Ebitda margin profile.

“At the upper end of the price band, it will command a valuation of 26 times PE and 16.5 times EV/Ebitda on FY24 basis which is at a tad discount to industry leader, that is Maruti Suzuki India," says Shashank Kanodia, analyst, ICICI Securities.

Unsoo Kim, Managing Director of Hyundai Motor India Limited, and Tarun Garg, Chief Operating Officer of Hyundai Motor India Limited, pose for pictures during a press conference, ahead of the company"s IPO launch, in Mumbai, India, October 9, 2024.Image: Reuters/Francis Mascarenhas

Unsoo Kim, Managing Director of Hyundai Motor India Limited, and Tarun Garg, Chief Operating Officer of Hyundai Motor India Limited, pose for pictures during a press conference, ahead of the company"s IPO launch, in Mumbai, India, October 9, 2024.Image: Reuters/Francis Mascarenhas

Two of Hyundai Motor’s group companies, Kia Corporation and Kia India, are in a similar line of business which may involve a conflict of interest, and adversely impact their business.

Kanodia adds that the high quantum of related party transactions with presence of sister company Kia in similar segments may lead to a potential conflict of interest.

While exercising their rights as shareholder, Hyundai Motor Company (HMC) may consider the interests of all their subsidiaries and affiliates, which may not align with their interests. “This in turn could give rise to various conflicts of interest between them and HMC and its affiliates, which could impact their operations," says Canara Bank Securities.

Further, HMC, including certain companies in the Hyundai Motor Group, are engaged in businesses that may be similar to other companies. For example, as of June 30, HMC holds a 34.34 percent stake in Kia Corporation which operates in the automobile industry in India through its subsidiary, Kia India Private Limited. “It also supplies engines to Kia for their vehicles. Given the potential product overlaps between their offerings and those of Kia in India, there is no assurance that conflicts of interest will not arise between the two businesses which could negatively impact their business and prospects," explains Canara Bank Securities.

The company plans to further expand its production with a new manufacturing plant in Talegaon, Maharashtra, which will increase its total capacity to 1.074 million units annually once fully operational by FY26.

Hyundai Motor India has outlined an ambitious capex plan of Rs32,000 crore by FY32, which includes not only enhancing its EV production capabilities but also developing the Pune manufacturing plant, increasing its capacity by 30 percent. The Pune plant will be highly automated, further boosting efficiency, and will contribute to driving the company"s capacity utilisation beyond 90 percent.

First Published: Oct 15, 2024, 11:49

Subscribe Now