The Misadventure of the Apollo-Cooper Merger

Assets that look good on paper usually fail because mergers involve an attempt to marry two cultures and employees with a different outlook

If two plus two can sometimes equal five, the rationale for global mergers and acquisitions would have some justification. If the result is at least a four, as the math indicates, the risks are worth it. But if the chances are that two and two will end up as three, no deal makes sense.

The Apollo Tyres-Cooper Tire merger that would have created the world’s seventh largest tyre company, with a presence in all the critical markets of North America, Europe, China, India and Africa, came unstuck last month when Cooper cancelled the deal. Faced with the belligerence of its own unions, and the local partner of its Chinese subsidiary—who bridled at the thought of an Indian company owning them—the deal ultimately did not make sense even to Apollo. To be financed with $2.5 billion in debt—something that had the markets fretting—the M&A had all the looks of a potential loser that would destroy shareholder value rather than grow it. The world over, the vast majority of mergers fail to achieve their potential revenue or market share targets for two simple reasons: People and culture. Assets that look good on paper and on the Excel sheets of corporate match-makers usually fail because mergers involve an attempt to marry two cultures and employees with a different outlook.

Quite apart from the Chinese balking at the idea of having an Indian shareholder as boss, it was an open question whether even the India-US cultural mish-mash would have been easy to absorb. Apollo is probably well out of it – though there is still a messy court battle ahead.

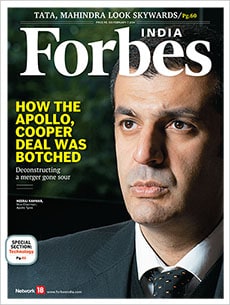

Our auto industry watcher, Ashish K Mishra, who has recently been moaning and groaning about the lack of action in the slowing Indian auto market, suddenly sprang to life as the Apollo-Cooper engagement broke off before the wedding. Divorces always make for good stories, as Mishra’s blow-by-blow account of how this deal fell apart shows. Don’t miss it.

Best,

R Jagannathan

Editor-in-Chief, Forbes India

Email: r.jagannathan@network18online.com

Twitter id: @TheJaggi

(This story appears in the 07 February, 2014 issue of Forbes India. To visit our Archives, click here.)

X