Flipsters @ work to stay ahead of Amazon

It is game on at Flipkart. India's most-valued startup is out to prove its critics wrong and stay ahead of the deep-pocketed global giant Amazon. And its leaders, and 8,000-plus team, believe they can

Flipkart CEO Kalyan Krishnamurthy gives credit to his agile team and says his confidence comes from their ability to successfully turn things around even in pressure situations

Image: Mallikarjun Katkol for Forbes India

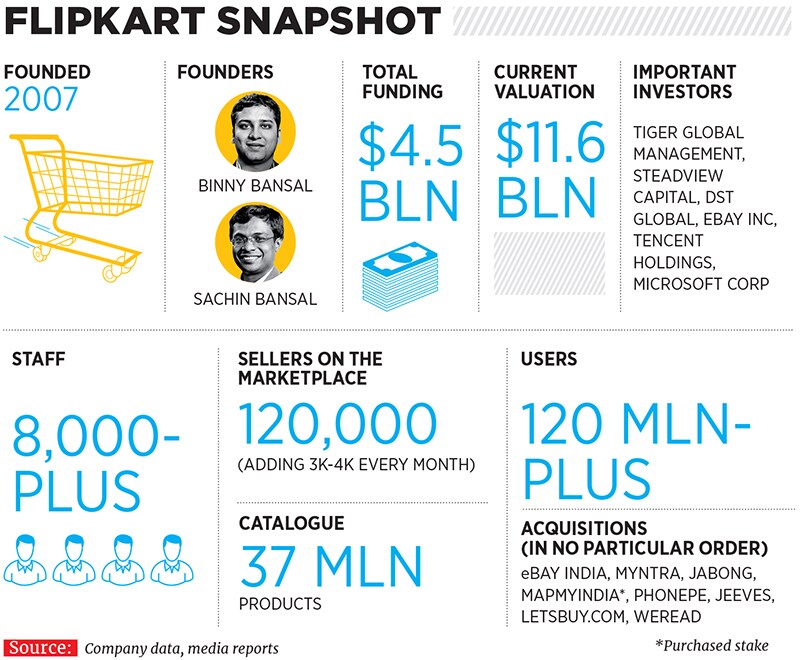

The year 2014 was eventful for Flipkart, India’s biggest online shopping company. It was the year when founders Sachin Bansal and Binny Bansal (no relation) catapulted to global fame on the back of their biggest funding at the time—a billion dollars. It was the year they launched their mobile app. It was also the year Flipkart’s Big Billion Day (BBD) sale was born.

Flipsters, as staff at Flipkart call themselves, take pride in pulling many all-nighters ahead of a “BBD” to ensure consumers access the best deals without any glitches. That first BBD in 2014, however, was a bit of a disaster, even though the company did reach the Rs 600 crore, or $100 million, target it had set itself.

By late evening that day, “we had to shut down our site and tell people that the sale was over”, recalls Smrithi Ravichandran, a senior director at Flipkart, and orchestrator-in-chief of the BBDs. “The surge in traffic was phenomenal. We didn’t expect that kind of scale. If things had been good that day, we could have probably done Rs 1,200 crore or Rs 1,500 crore, probably,” Ravichandran still rues during her interview with Forbes India. Two years on, she got her chance at redemption.

Two years on, she got her chance at redemption.

The sale is always organised around Diwali which sees the country’s biggest shopping frenzy every year. The one in 2016 ran for five full days. On the second day alone, the biggest of the five, Flipkart saw Rs 1,400 crore in sales. Ravichandran, 32, declined to reveal the take at the end of the five days, but clearly it was a triumph.

“You know, 2016 was a tough year for us, but that quarter [ended December 31] was one of the best,” COO Nitin Seth, 42, tells Forbes India. “We had a phenomenal Diwali period with sales growing by 60 percent that time [over the previous Diwali’s sales], we brought our cash burn down significantly, and we got our customer experience back up at a historic high. Competition was intense—Amazon had been chasing us quite aggressively—and [in] the last two months, we were happy that we were able to rebuild our lead in a significant way.”

The resurgence was underscored three months down the line when, in its 10th year, the company announced its biggest funding round to date. In total, Flipkart is getting $1.4 billion in investments in a transaction that values the company at $11.6 billion—still shy of its 2015 peak, but higher than recent markdowns suggested. The funding highlights Flipkart as the de facto front behind which all non-Amazon forces have begun to align in the Indian ecommerce market.

As part of the deal, eBay Inc is selling its Indian unit to Flipkart and investing $500 million in the Indian ecommerce company. In return, it gets stock in Flipkart. Two other large strategic investors have come on board —China’s Tencent Holdings Ltd and US tech giant Microsoft Corp—Flipkart said in a press release on April 10.

CEO Kalyan Krishnamurthy, 45, whose career includes seven years at eBay, sees the funding as a “very big compliment that the company and the brand Flipkart has received”. “These are companies that share our philosophy. Brands of the stature of eBay, Tencent and Microsoft backing us is what is unique about the latest round,” he tells Forbes India. “It feels great to be in this position.”Not only is it a “compliment” but investor confidence is also a validation of Flipkart’s stature as India’s most-valued startup and global force Amazon’s only real homegrown competition, famously started by two former Amazon employees.

The Bansals, both Indian Institute of Technology-Delhi graduates, worked in Bengaluru at the US company’s Amazon Web Services division before starting Flipkart in 2007, with around Rs 4 lakh that they came up with together. Flipkart’s origin, like Amazon’s, too was in books, and true to startup-style life, the duo did many things on their own, including hand-deliver the books.

More things succeeded than failed, including funding, and in a few years, Flipkart’s roster of investors included Accel Partners (now called Accel), which invested $1 million in a series A round in 2009, South Africa’s Naspers, Steadview Capital, DST Global and Tiger Global Management, which was to become the company’s biggest investor, starting with a $10 million investment in 2010.After a $700 million investment in July 2015, led by Steadview, Flipkart saw its value rise to $15.2 billion, and the Bansals, with around 7 percent stake each, made their debut as Forbes billionaires—only to be bumped off the list in 2016 as the euphoria of 2014 had begun to run its course. Investors too were grumbling about the viability of India’s ecommerce story.

Morgan Stanley even reduced the value of its holdings in Flipkart commensurate with its marked down valuations of Flipkart—it was down to $5.37 billion in March this year, the fifth successive quarter in which the financial major had reduced Flipkart’s valuation. The $11.6 billion, therefore, shines in comparison, although, technically, from the high of its 2015 value, the latest investment at Flipkart is a ‘down round’, as it values the company lower than at a previous funding round. That said, the reality is, Flipkart has pretty much become the rallying point for any investor who wants a meaningful part in India’s ecommerce story.

“Flipkart has emerged as the de facto leader, and it has the money now to put in all the elements it needs to consolidate its lead,” Ankur Bisen, senior vice president of the retail and consumer products division at Technopak, a leading consultancy in the retail and ecommerce sectors, says. “We will clearly now see two ecosystems evolving, one led by Amazon and the other by Flipkart.”

And the biggest force to align behind Flipkart may yet do so, if Japan’s SoftBank Group Corp succeeds in brokering a deal to sell or merge the Delhi-based Snapdeal with Flipkart. In return, SoftBank will likely own a stake in Flipkart that could include a chunk it will purchase from Tiger Global Management.

Also, SoftBank, in the bargain, could become another bulwark for Flipkart to lean on after the likely three years the current funding process will take. And at that point, an exit, via an international IPO, could well be on the cards for Flipkart—an event which could be a milestone in India’s startup history. Krishnamurthy declined to comment on talks with SoftBank, which are reportedly in advanced stages.

That is a space the investing/startup ecosystem is watching closely. As Bisen points out, “This proves the conviction of the investors in the Flipkart story.”

The $1.4 billion-funding had been contingent upon several elements coming together some of those have fallen into place and the others will evolve as the Flipkart versus Amazon dynamic unfolds, Bisen says. What is clear, he adds, is that the market is all but closed for others. “The time for the small guys is now over. I don’t think anyone else will come in and say, ‘I will take on Flipkart and Amazon and build a marketplace’.”

For instance, if SoftBank does enter into a deal with Flipkart and its largest investor Tiger Global, it could set itself up to do with Flipkart what it did with Alibaba in China—defeat Amazon and list the rival (Alibaba) for a superb return on its investment. There is one difference though. Amazon India has already set itself up to garner a big share of the Indian market, even as it lags Flipkart on sales volume. In China, it didn’t take off at all.

Sanjay Mehta, a Mumbai-based investor in multiple ecommerce startups, including OYO Rooms from which he made a hugely profitable exit, isn’t quite as dismissive of the others’ chances. “The businesses which will survive and thrive are going to be the ones that will come out with disruptive models,” Mehta says. “And there are examples even in the offline world, such as DMart.” By 2020, Mehta expects that India will clearly see a number one, two and maybe a third large horizontal player in ecommerce, but the opportunity to do something innovative within niche, yet large-enough, categories will remain, he says. A Myntra could dominate, but a Limeroad will also thrive, he says.

He also believes that SoftBank is still only testing the waters as far as investing in India is concerned, given the Japanese group’s size. “If they see value, they will open up a larger purse. My sense is, for another couple of years, SoftBank will try multiple models, multiple investments, and possibly after 2020, they will bring a larger bet,” he says. “Clearly Amazon is here to stay, but Flipkart will continue to grow and attract investments.”

The freshly-minted CEO is certainly optimistic. “I am confident of what we are doing,” Krishnamurthy, also a former Tiger Global executive, says. “It’s entirely due to the team that we have.” Together the members of that team bring to Flipkart “a very deep understanding of technology, of the Indian consumer, of the landscape… it is actually a very agile team, and that’s where the confidence comes in.”For this story, interviews were scheduled on the sidelines of a leadership offsite for some of Flipkart’s senior executives. Outside, it was a hot Bengaluru day, with rain threatening but not quite delivering. Moving a kilometre in a car takes close to 10 minutes along some stretches of Marathahalli road— among Bengaluru’s tech corridors. One of Flipkart’s large centres is just further along the road, and has other Indian unicorns for neighbours—InMobi, for instance—and some of America’s biggest tech companies, including Cisco, as well.

The meeting was at Park Plaza hotel’s banquet hall. Some art wouldn’t have been out of place at the hall that was largely bare. Chai, cookies, pakoras and sandwiches and unobtrusive hotel staff helped move the conversations along.

What also worked was the camaraderie—a joke was thrown at one, and banter was returned in a quick comeback as executives posed for photographs and headed into their Forbes India interviews in succession.

These executives had previously worked in companies ranging from McKinsey & Company to Microsoft. Some, like Anil Goteti, 35, a general manager who heads all-things sellers at the marketplace, had even built their own startups. He says he had launched GrooveBug in Chicago, a sort of a Rolling Stones magazine for bands.

Goteti’s current job is to ensure that Flipkart’s 120,000 sellers (and counting) keep their side of the marketplace populated. For that, he’s constantly churning out ideas on how to make the company’s own 26 or so warehouses, and around 160 mini warehouses that Flipkart has helped its larger sellers put up, more accessible. In one successful experiment, Goteti and his team figured out a way to completely bypass a “mother hub”, and cut down delivery time by a day, he says. The software coding and the supply-chain reorganisation was done in a matter of weeks, he recalls.

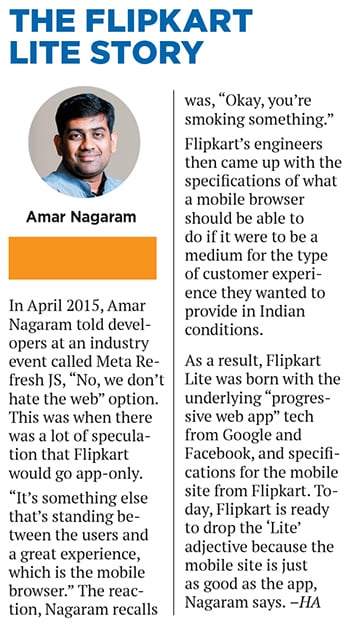

Flipkart Lite, the mobile website that the company released in November 2015, which for all practical purposes works like a smartphone app, was built in 45 days by five engineers, says Amar Nagaram, vice president of engineering.

The underlying tech comes from Google and Facebook, says Ram Papatla, 43, vice president of product development, who had previously spent 15 years at Microsoft. “We built a framework on top of it,” he says. In fact, Flipkart’s effort of building that mobile website, in close collaboration with engineers at Google Chrome, has become a sort of a global benchmark.

Going ahead, Artificial Intelligence and machine learning will be integral to how Flipkart builds its technology to support its many new forays, says Ravi Garikipati, Flipkart’s CTO and head of engineering. While personalised experience is the Holy Grail of ecommerce, Garikipati expects Flipkart’s experiments will succeed in serving the multiple mini Indias, as the company chases its next phase of growth which will primarily come from small-town and eventually rural India.Consider this example of how Flipkart solved multiple problems with one answer. It re-engineered its app in such a way that a user’s homescreen would become increasingly personalised, based on the petabytes of data it has on its over-120 million users. It also stripped the screen down to its building blocks, with the logic for how the blocks should arrange themselves sent on-the-go to the user’s phone from Flipkart’s cloud. Next, the app was built in such a way that the number of updates were reduced. And by the time the 2016 BBD had arrived, “we stopped spending dollars on promoting updates. We stopped asking users to update. If you have the app, it will work”, Nagaram says.

In the process, they figured out several other engineering processes around app development and were able to reduce the number of core Android developers needed down to a handful. What followed was maintenance—which is accomplished by all of nine engineers. The app has been downloaded over 50 million times so far.

More than the tech, the challenge today is that while the user base at the macro level is large, the transacting user base is still small—only about 5 million households from the top socioeconomic strata of those earn around Rs 10-15 lakh a year 60 million to 70 million households are in the next couple of rungs below.

“The onus of expanding the market and solving for difficult categories is what we have taken on as our responsibility,” Krishnamurthy says. Discerning what is required to be present in the consumer’s household on a very regular basis is a herculean ask, he points out. “You have to cover, very deeply, categories which are related to their home what they wear, which is the middle-of-the-market-fashion, the unbranded fashion market what they eat, which is the groceries business.”

After all, Flipkart wants to touch households not just in their living rooms, but in the bedroom, in the kitchen, the kids, the parents and everyone else in the family. And the only way to do this is by using data and technology. It has to have repetitive transactions and that’s another big metric, Krishnamurthy says. “It is a multi-year thing and it goes back to solving for the real middle India. We want to lay the foundation for that this year.”

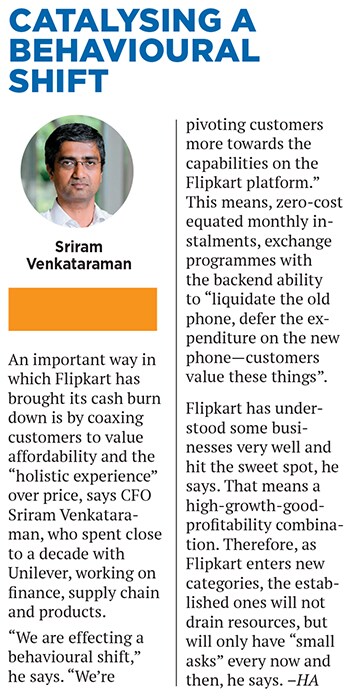

That is the context in which to look at the latest round of funding because from a purely operational perspective, “we are in a very, very healthy position,” CFO Sriram Venkataraman, 42, says. “There are parts of our business which are actually pretty profitable and we reinvest those profits. In the coming years, you will see us continuously reinvest in both capabilities and new categories.”

Flipkart closed the year ended March 2016 with 50 percent higher sales than the previous fiscal year, says Venkataraman. And helped by the surge through the December quarter, the cash burn came down by half, COO Seth adds. That means the company’s net loss for every rupee of revenue was reduced by 50 percent. This is something that he expects Flipkart will be able to sustain and further improve. IIT-Delhi graduates Sachin Bansal (left) and Binny Bansal started Flipkart in 2007 with around Rs 4 lakh

IIT-Delhi graduates Sachin Bansal (left) and Binny Bansal started Flipkart in 2007 with around Rs 4 lakh

Image courtesy: Flipkart

For now, the fund infusion allows Flipkart to experiment boldly, and on multiple fronts. It opens the door to get into payments, new underpenetrated categories or solving for products with lower average selling prices. Fintech is potentially a large play for Flipkart. In lending to both sellers and consumers on its marketplace “it’s a massive, massive opportunity”, Krishnamurthy says.

“This is a company which is growing from being a startup, and being India’s most-celebrated startup, to a larger company. It’s not an easy transition. Not many companies make that, and that to me is the dominant feeling of where we were,” Seth says. “We were going through that process and it’s going to be a difficult process, but if we get this right, there will be no stopping this company.”

And people like Ravichandran are raring to go. “One project that is really close to my heart—that I’m working on—speaks to the idea of affordability,” she says. Take, for instance, the idea of combining the warranty on a high-end smartphone, exchanging an old phone for it and various lease plans.

Therefore, soon, a Flipkart customer would be able to turn in an older phone, and walk away with the latest model with a fairly affordable monthly instalment to be paid, leasing the phone for a pre-set period, rather than paying a larger sum to own it. And Garikipati’s team has already been at work for some six months, building credit-scoring models for Flipkart’s customers.Ravichandran, and everyone else at Flipkart, know that their innovations can be copied. Cash on delivery is a case in point. Flipkart’s secret sauce, they all believe, is its people. “Anything that we do, such as the leasing model, all of it is maybe for a maximum of one year to 18 months of runway before competition has it as well,” Ravichandran says. “It’s really the people and the culture.” For those who see that as a clichéd sentiment, “you need to be here one night at 11 pm ahead of a BBD”, she says. “That killer attitude, that we will do whatever it takes to see this through, that you see from the CEO all the way down to the entry level staffer—I don’t know if it’s because we hire people like that, or if people come here and change.”

It is rare for an effort to rise above the sum of its contributions, and go beyond the goals of its originators. When such a thing does occur, that effort changes lives beyond its immediate stakeholders. An illiterate tribal in a remote village-by-the forest could get access to a portable ECG machine, or a little girl her first Segway from a grandparent a thousand miles away.

Flipkart's mega investment: The five key takeaways

Flipkart is within grasp of such an opportunity. Competition will be fierce as rival Amazon is equally intent on winning this market and has a formidable combination of technology and deep pockets. Flipkart has shown it can hold its own, even under intense pressure and when others perceived its back as against the wall.

But the journey ahead will require sweat, funds and toil to deliver the kind of innovation that will endear middle India to Flipkart, while retaining the loyalty of the company’s premium customers. What might those innovations be, and how will they change the game in Flipkart’s favour—and in a manner that competition won’t be able to replicate easily? Interesting times ahead.

First Published: Apr 28, 2017, 06:30

Subscribe Now