As Krishnakumar Natarajan, popularly known as KK, walks into the headquarters of Mindtree in Bangalore, he greets everyone with a humility that colleagues and clients across 14 countries have come to recognise him for. The former chairman of Nasscom, and the CEO and MD of Mindtree, the $500 million IT services firm he co-founded and helped build from ground up, is never too busy for his staff, be it to answer questions, address complaints or extend a warm handshake.

The other CXOs of Mindtree have a similar ethos: A flat hierarchy and an approach that is far less uptight than many industry peers. Natarajan insists that this down-to-earth attitude is what has got his company this far.

Ironically, as Mindtree began to lose its way after an explosive start, industry experts pointed to this very attitude as having morphed into a glass ceiling for the Bangalore-based firm. Mindtree was the good boy in class, with its highly-planned and execution-centric work ethic. But it didn’t have enough fire in its belly to stand out as a disruptor. A lack of risk appetite and aggressive intent has prevented its leapfrog into the league of the behemoths. What else can explain the sudden break in the accelerated growth for the company, set up in 1999, that ballooned to $100 million revenue in just six years?

Why did Mindtree fail to come of age despite storming off the blocks? Because, analysts say, it was still thinking “mid-tier”. If you want the big fish—the $100-million-kind-of catch—you have to venture out into the deep sea.

The good thing about a company that runs without rockstars is that the people in charge are not arrogant enough to ignore the shortcomings. Natarajan is the first to accept them. “Mindtree was perceived as the best mid-sized company in its space, but that positioning itself had certain inherent limitations,” he says. “When customers thought of us, it was only for work of a certain nature and size. Though we had good traction with our customers, for a $50-100 million project they preferred expert players in that area.”

That leads to the million-dollar question: How do you change that?

Course correction

Natarajan, along with nine co-founders from Wipro, Cambridge Technology Partners and Lucent, had set up Mindtree as one of the first venture capitalist-backed software services companies in India. (As of March 2014, the promoter and promoter group holding in the company stood at 16.57 percent. Founder of Cafe Coffee Day VG Siddhartha, along with his two group companies—Global Technology Ventures (GTV) and Coffee Day Resorts—is the single-largest shareholder in the company.) By 2005, Mindtree crossed $100 million in revenue and witnessed rapid growth till the Lehman crisis sank the markets in 2008.

In 2009, the company acquired the India R&D unit of Kyocera Wireless to make mobile handsets, which it exited the following year due to diminishing profitability. Mindtree lost an estimated $3.5 million in restructuring costs and also saw the exit of some key people.

In 2011, executive chairman and co-founder Ashok Soota quit the firm to start his own venture. It took a year for Mindtree to name one of its founders, Subroto Bagchi, its new chairman as the company looked to consolidate its strengths in a troubled economic environment. “Not everybody left under pleasant circumstances. Adversity can either ruin you or bring out the best in you. It’s a question of how you look at it and work around it,” says Rostow Ravanan, CFO, Mindtree.

Over the last 18 months though, the company has embarked on a transformational drive to reposition its brand in a highly commoditised industry where players clone each other’s offerings. Throughout 2013, global management consulting major Bain and Company worked on a single-line question posed by the Mindtree board. “Are we playing in the right spaces?” Not just an answer, Bain came back with a roadmap for the future.

Based on the assessment of Mindtree’s internal capabilities and headroom for growth, Bain chalked out a list of specific areas across business segments that the IT firm needed to target. Within the banking, financial services and insurance (BFSI) verticals, the suggestion was to focus services in the insurance space and dig deeper into areas such as property and casualty insurance. “They suggested packages we should offer, aligning with the market as customers are more comfortable using packaged applications rather than building software solutions,” says Natarajan, who put in place a team of 10 to 12 people with experience in selling packaged software applications in the financial services space. The team was non-existent earlier as the company was addressing insurance as an overall vertical.

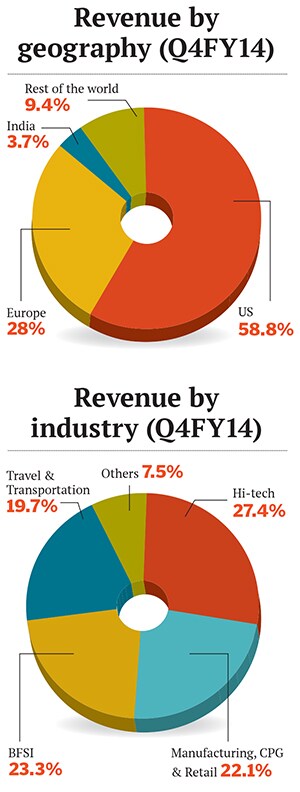

Similar suggestions were made for the high-tech business (semiconductors, consumer electronics, office automation, mobile, and gaming), which contributes over 27 percent, the largest chunk, to the company’s total revenue of $501.5 million in FY2014. Other major verticals of the company include BFSI (23.3 percent), manufacturing, consumer packaged goods and retail (22.1 percent) and travel and transportation (19.7 percent).

Working on the Brand

Even as its operational strategy was changing gears, Mindtree had already shifted its focus to another key concept that keeps companies ahead of the curve: Branding. As with Bain, Mindtree gave a single-line problem statement to Siegel+Gale, a global strategic branding firm: “If we need to take the next big leap, how should customers see us?” In order to break free from the ‘mid-tier’ image, and gain more visibility, the company gave Siegel+Gale leeway to make big changes. “We were fairly open in terms of changing things which were hitherto sacrosanct,” says Natarajan.

The branding firm surveyed the company’s existing and prospective clients, employees, analysts and even people who were exploring Mindtree as a possible career option. “Everybody loved the culture of the company, and they wanted us to keep that intact. But if we wanted to be expertise led, we needed to project a brighter, active and more confident side to customers,” adds Natarajan. With that in mind, Mindtree launched its new corporate branding towards the end of 2012.

TR Madan Mohan, managing partner, Browne & Mohan, a management consulting firm, says, “Mindtree had an early branding advantage in the tier II space compared to other companies like Hexaware, KPIT, which were largely seen around engineering.”

Plans in motion

To reposition a brand is a job only half done Siegel+Gale suggested a realignment of Mindtree’s organisational values which, so far, only looked within. From ‘caring, learning, achieving, sharing and being socially responsible’, Mindtree now had to look outward for a more ‘collaborative’ approach—with the customers, the partners as well as the investors.

The company began with the most visible change to its facade: Its logo. Its earlier one (a tree symbolising imagination, action and joy) was no longer seen as capturing the company’s future ambitions the iconography evolved to depict a globe comprising ‘strands of collaboration’, pointing skyward.

As part of its organisational restructuring, in 2013 Mindtree discontinued two key positions—CEOs of its IT business and product and engineering segment—to streamline services across verticals and make it more agile. This led to the exit of founding partner Anjan Lahiri, the CEO of the IT business division.

The structural change was augmented by a renewed vigour to channelise resources towards the growth drivers—the sales and marketing teams. Natarajan brought on board people who will not only present a refurbished face of the company to the world, but also make it future-ready.

Last year, in October, Mindtree roped in Paul Gottsegen, former chief marketing officer of Infosys, to spearhead its and marketing, strategy and alliances division. A month later, it appointed Ramesh Pillai from HCL Technologies and Mark Wilsdon from Cognizant as the global head of its hi-tech vertical and the sales for the UK and EU operations, respectively. This May, the IT firm hired Ralf Reich from Wipro to head its operations in Germany, Austria and Switzerland as it looks to ramp up its client base and tap into the European market. To boost its sales, founding partner Scott Staples, president Americas at Mindtree, took on an additional role of the global sales head.

Natarajan adds that a lot of investments the company made last year were in the marketing space, primarily directed at the US market. To support this, Mindtree built a dedicated 18-member sales force in the US, doubling the team size in one year.

As part of its global expansion plans, Mindtree has launched its newest delivery centre in the US in April. The 13,000-square foot facility in Redmond, Washington, located next to Microsoft’s corporate campus, will focus on mobility, infrastructure management and testing solutions. The company’s other facility in Gainesville, Florida, currently caters to over 15 clients across businesses. (The US accounts for the largest chunk of Mindtree’s revenues at 58.8 percent as of March, 2014, followed by Europe at 28 percent and India at 3.7 percent.)

![mg_75970_mindtree_280x210.jpg mg_75970_mindtree_280x210.jpg]() In for the long haul

In for the long haul

Once the expansion plans were firmed up, Mindtree started re-evaluating its client base. The sales force was divided between teams servicing existing clients and those who would win new accounts across industries. The effort paid off. Ankita Somani, a Mumbai-based IT analyst, says, “The company has expanded its client mining focus to top 30 clients from top 10 earlier and has appointed an additional sales team. We expect Mindtree to stay ahead of its peers in terms of revenue growth, keeping in notice strong growth in its top accounts, ability to cross-sell services, its diversified portfolio mix and consistent wins against stronger players.”

The company’s specialty focus will help it mine more businesses across segments from existing key clients, adding to its top-line and bottom-line. During the January-March stretch, Mindtree’s top 10 client contribution to revenue stood at 49.2 percent compared to 45.7 percent during the same period last year.

Before Mindtree started its restructuring exercise about two years ago, it had 336 customers. During the recently-concluded March quarter, the company added 15 clients as against five in the corresponding quarter a year ago, but dropped its total client list to 207. This distillation has helped Mindtree focus its efforts on creating long-lasting, high-engagement relationships with key clients.

“Clients didn’t leave us, but there were certain segments which we discontinued and exited those accounts. The impact on the revenues was mostly last year. In the future, we do anticipate that this focus will help us post industry-leading growth,” says Natarajan.

For FY2014, Mindtree posted a net profit of $74.6 million, up 19.3 percent year-on-year, while revenue during the period rose 15.1 percent to $501.5 million from $435.7 million in FY2013, ahead of the industry growth rate of 13 percent projected by Nasscom for the period.

However, Mohan of Browne & Mohan feels that Mindtree still needs to strengthen its client mining strategy and benchmark itself against market leaders like TCS. “The reason why TCS is growing much higher than its peers is because of strong mining of its existing clients. This is an area where Mindtree can do exceedingly well because they have a good reference list of clients,” he says.

People policies

Along with its strategy, Mindtree has also evolved the fabric of its organisational character. Ravi Shankar, chief people officer, Mindtree, says, “We revamped the entire performance appraisal process about nine months ago to be more relevant to our employees.”

Over the last six months, Mindtree has also developed a new, five-level leadership programme, partnering with US-headquartered Korn Ferry, one of the world’s largest executive search firms, to ensure a strong leadership pipeline. “We start with about 6,000 people and then scan it down to 25 employees in the final stage. It’s a programme which runs for three years at every level. At any given point of time, about 25 people are trained to be the future leaders of the company,” says Shankar.

The company has invested $5 million in two business ideas as part of its ‘5 by 50 intrapreneurship programme’. Under the scheme, Mindtree will identify five business ideas that have the potential to generate $50 million in revenue over five years. Till now, it has invested in two ideas in the cloud space and the video management and analytics platform. The IT firm has also created a Mindtree intellectual property portal to support employees in the patent filing process. At present, it has filed about 22 patents.

The way ahead

With a market capitalisation of approximately $1 billion (Rs 6,028 crore), the listed mid-cap IT firm saw its shares hit a 52-week high of Rs 1,724.95 apiece in late February this year.

“The changes are paying off. You can see the reflection in the financial results, customer satisfaction and market capitalisation. These changes have brought some predictable churn we like it. The board has attracted some outstanding people like Ramesh Ramanathan, Pankaj Chandra, Apurva Purohit—this by itself indicates optimism and confidence for the strategic view of the future that the management is taking,” says Subroto Bagchi, chairman.

In 2009, the company had declared its intent to be a $1-billion IT giant by 2014 (in revenues). It isn’t there yet, but its tectonic shift in strategies has given it a much-needed start.

In for the long haul

In for the long haul